🕺Vedant Fashion (Manyavar) Business Analysis🕺

India's leading wedding & celebratory wear player is coming up with their IPO.

The IPO is expensive, but the business is beautiful - so I thought I'd write a thread explaining the dhandha!

Please like and RT if this adds value!♻️

India's leading wedding & celebratory wear player is coming up with their IPO.

The IPO is expensive, but the business is beautiful - so I thought I'd write a thread explaining the dhandha!

Please like and RT if this adds value!♻️

Before we dive deeper into the company, lets understand the Indian Ethnic wear market.

The Indian Ethic wear market is a 1,80,000 cr market, with 30-35% branded penetration. The market is expected to grow at 12-14% over the next 5 years.

80% of the Ethnic wear market is women's Ethnic wear, with Men's and Kids at 10% each.

80% of the Ethnic wear market is women's Ethnic wear, with Men's and Kids at 10% each.

A smaller portion of this, the Indian wedding & celebration wear market is 102,000cr and a 15-20% branded penetration. The market is expected to grow at 18-25% over the next 5 years.

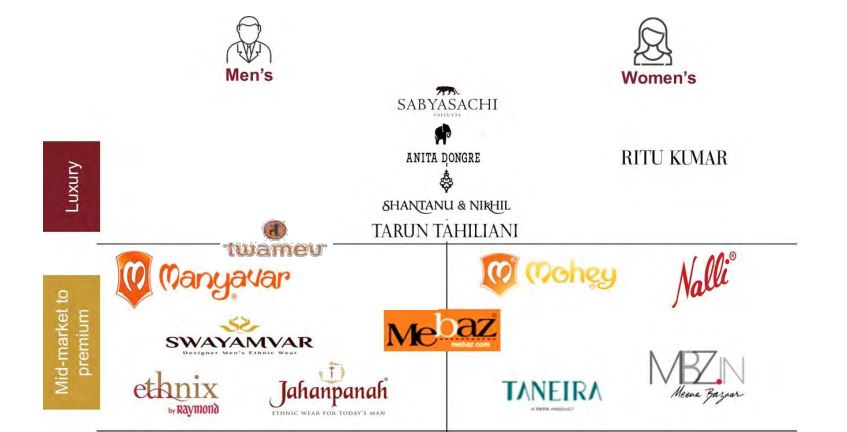

So who are some of the top brands in this market? Here's a list!

Men's wear: Manyavar, Jahanpanah, Mebaz, Manthan, ethnix, Swayamvar, Twamev

Women's wear: Nalli, Sabyasachi, Ritu Kumar, Neeru's, Anita Dongre, Mebaz, Mohez, Taneira, Shantanu & Nikhil

Men's wear: Manyavar, Jahanpanah, Mebaz, Manthan, ethnix, Swayamvar, Twamev

Women's wear: Nalli, Sabyasachi, Ritu Kumar, Neeru's, Anita Dongre, Mebaz, Mohez, Taneira, Shantanu & Nikhil

Now that we have the numbers backing the Indian ethnic wear & wedding, let's understand the qualitative story here!

Indians love to splurge on weddings. We have around 1cr weddings a year. Wedding are generally grand multi-day celebrations, and are often displays of status leading to extraordinary spend.

The average expenditure on an urban wedding is between 10-20 lakhs/day, with bride and groom outfits taking around 5% of that spend.

One of the rare occasions when Indians don't look at the price tag too much makes this an extremely attractive segment.

And we don't use the word attractive loosely - think 70%+ gross margins!

And we don't use the word attractive loosely - think 70%+ gross margins!

Goes without saying, firms that establish a strong brand here will make a tonne of money in a market like India!

With the demand story broadly understood, let's move on to the understanding Vedant Fashion's core business.

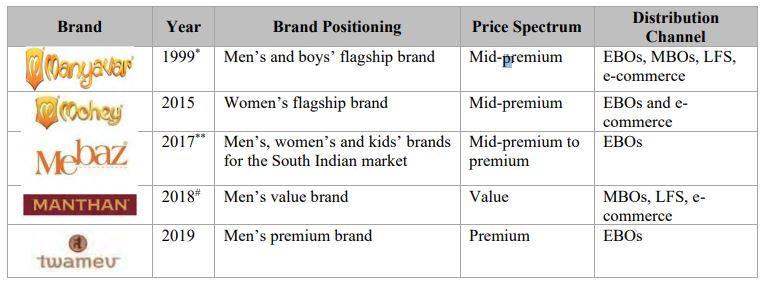

The firm owns 5 brands for various gender/price segments - of which the top 2 drive 90% of the revenue.

1.Manyavar (Men's midpremium): 83% of Sales

2.Mohey (Women's midpremium): 7% of Sales

3.Mebaz (South Indian mid-premium)

4.Manthan (Men's value)

5.Twamev (Men's premium)

1.Manyavar (Men's midpremium): 83% of Sales

2.Mohey (Women's midpremium): 7% of Sales

3.Mebaz (South Indian mid-premium)

4.Manthan (Men's value)

5.Twamev (Men's premium)

The two main drags on capital for an apparel business are manufacturing costs & the brand outlet costs. Manyavar saves on both by having outsourced manufacturing and franchisee-owned brand outlets.

Let's understand the distribution, branding, and manufacturing of the firm better

Let's understand the distribution, branding, and manufacturing of the firm better

Distribution:

The firm has 300 franchise partners, and through manages 535 exclusive brand outlets (1.2 mm sq ft).

Relationships with franchisee partners are sticky, with 73% having 3+yr relationships.

The firm has 300 franchise partners, and through manages 535 exclusive brand outlets (1.2 mm sq ft).

Relationships with franchisee partners are sticky, with 73% having 3+yr relationships.

Manyavar assists partners in location selection, ad spend driven traffic push, inventory and supply chain management and staff training. Close to 90% of the sales is generated by the Exclusive brand outlets.

Brand:

The firm has built a strong brand in the ethnic wear segment with strong investments in advertisements featuring Virat Kohli, Anushka Sharma, Amitabh Bachchan, Alia Bhat, Ranveer Singh and more. It does all this with a disciplined single digit ad spend intensity.

The firm has built a strong brand in the ethnic wear segment with strong investments in advertisements featuring Virat Kohli, Anushka Sharma, Amitabh Bachchan, Alia Bhat, Ranveer Singh and more. It does all this with a disciplined single digit ad spend intensity.

Manufacturing:

The firm has a diverse pool of 458 vendors that it procures fabrics and other key material from. Third party manufacturers then manufacture the item of clothing that is tracked at an SKU level from material to store dispatch.

The firm has a diverse pool of 458 vendors that it procures fabrics and other key material from. Third party manufacturers then manufacture the item of clothing that is tracked at an SKU level from material to store dispatch.

Financials

The firm's financials are stellar, commanding a 70%+ gross margin, 30%+ operating margin, and ~25% net profit margin - which is best in class in its peer set.

The firm's financials are stellar, commanding a 70%+ gross margin, 30%+ operating margin, and ~25% net profit margin - which is best in class in its peer set.

There is a working capital drag on the business - high inventory and receivables in line with the business cycle, but strong margins ensure and a capital light business ensures that the business still churns out a healthy return on capital.

tl;dr: It's a phenomenal business in a great end market. Is it a good investment - at this price, not for me.

Disc: This is a purely educational post to teach folks about the sector and is not a recommendation.

Wait, If you've come this far you might consider:

Disc: This is a purely educational post to teach folks about the sector and is not a recommendation.

Wait, If you've come this far you might consider:

1. If you're really impressed: Come onboard as a Bharat Bet Portfolio Customer: bit.ly/33bJK9X

(I'm an IIM C grad, a SEBI Registered Research Analyst, and an ex top-rated Goldman Sachs, J.P. Morgan analyst - who will work extremely hard to help you grow your wealth).

(I'm an IIM C grad, a SEBI Registered Research Analyst, and an ex top-rated Goldman Sachs, J.P. Morgan analyst - who will work extremely hard to help you grow your wealth).

2. If you're modestly impressed: Join as a Edu100 Customer: easebuzz.in/link/ZQFFW (Our team analyzes 100 market leading Indian companies - covering governance, growth+margin levers, WC & capex discipline, and moats giving you a 360deg understanding of some of India's top comps

Last but not the least - I've just started on Twitter, as a result of which my hard-work doesn't reach enough people.

Please do Like and RT if this thread added value! ♻️

Please do Like and RT if this thread added value! ♻️

https://twitter.com/bharatbetpf/status/1488104705897029635

• • •

Missing some Tweet in this thread? You can try to

force a refresh