🐅Bharat Equity Strategy

👨🎓IIM Cal,Cleared CFA L3,BITS Goa

💼JP Morgan,Goldman Sachs

®️ SEBI Registered RA-INH000008835

3 subscribers

How to get URL link on X (Twitter) App

Speaker 1: @rajeev_agr sir (Doordarshi India Fund) @ias_summit #IAS2025

Speaker 1: @rajeev_agr sir (Doordarshi India Fund) @ias_summit #IAS2025

Read more about the research offering here (ideal for folks with 25L+ in Indian equities):

Read more about the research offering here (ideal for folks with 25L+ in Indian equities):

(1/21) Modi Naturals

(1/21) Modi Naturals

Growth: FY26 guidance of 6.5%

Growth: FY26 guidance of 6.5%

Started the day with Sterling tools, a business in the traditional fastener business, now venturing into MCU (motor control units) for EVs.

Started the day with Sterling tools, a business in the traditional fastener business, now venturing into MCU (motor control units) for EVs.

🇮🇳💹Before we begin - I'm a SEBI Registered RA and share detailed medium and long term research with my clients. If you would be interested in learning more about the service, you can schedule a free call here📞

🇮🇳💹Before we begin - I'm a SEBI Registered RA and share detailed medium and long term research with my clients. If you would be interested in learning more about the service, you can schedule a free call here📞https://twitter.com/bharatbetpf/status/1644722530362556418

Before we begin!

Before we begin!

Before we begin-

Before we begin-

💰Before we begin - You can now read & access 200+ in-depth analysis of businesses under GSN Invest Edge

💰Before we begin - You can now read & access 200+ in-depth analysis of businesses under GSN Invest Edge

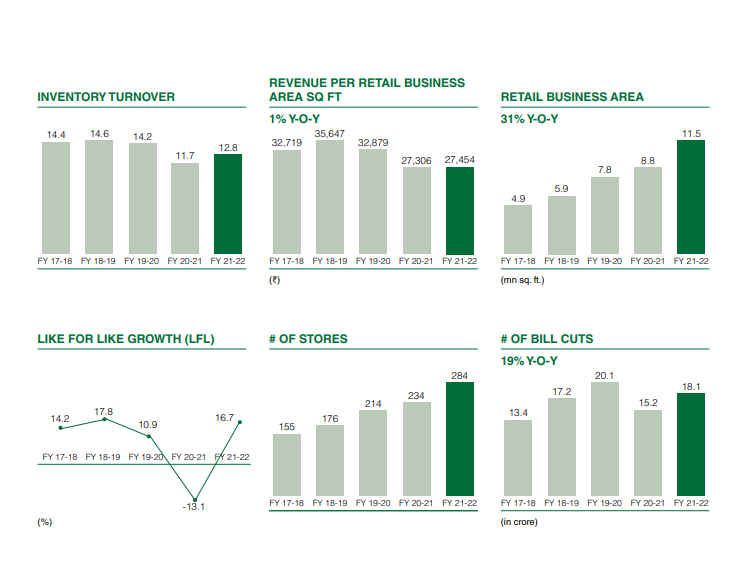

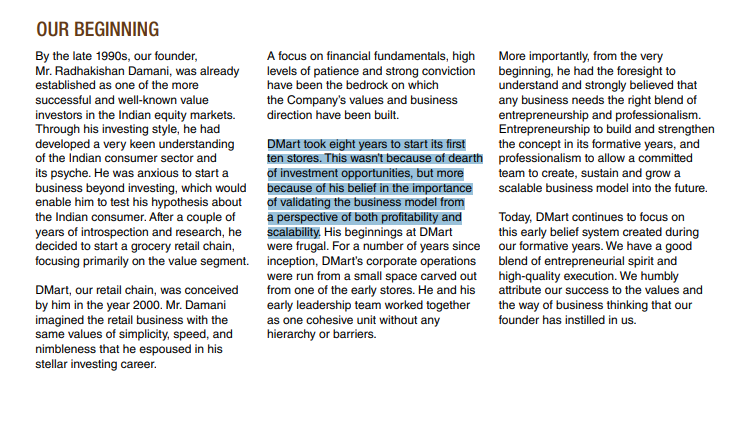

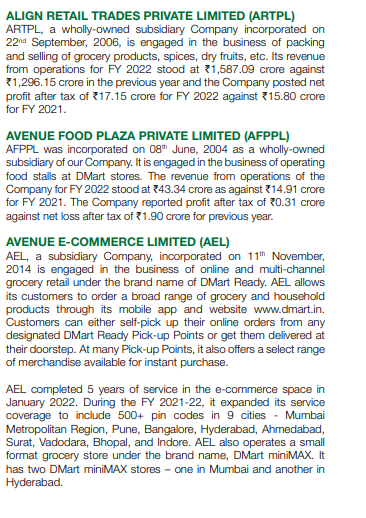

(1/200) DMart

(1/200) DMart