0/This is the first of a series of threads, each based on one of @parkeralewis' 'Gradually, Then Suddenly' essays.

"Education is a critical aspect of #bitcoin. I hope that by distilling my own thoughts I can help others accelerate their path in understanding a complex subject."

"Education is a critical aspect of #bitcoin. I hope that by distilling my own thoughts I can help others accelerate their path in understanding a complex subject."

1/ "I've titled the series Gradually, Then Suddenly.

As Hemingway penned the process of going bankrupt, it’s also the way that government-backed currencies hyper-inflate and often how people come to understand bitcoin (gradually, then suddenly)."

As Hemingway penned the process of going bankrupt, it’s also the way that government-backed currencies hyper-inflate and often how people come to understand bitcoin (gradually, then suddenly)."

2/ "Bitcoin is money. Or rather, Bitcoin has become money (to me).

It was a slow process that involved unlocking a number of mental blocks along the way but it began with asking the question, what is money?

That is the beginning of the real rabbit hole."

It was a slow process that involved unlocking a number of mental blocks along the way but it began with asking the question, what is money?

That is the beginning of the real rabbit hole."

3/ "Why do hundreds of millions of people exchange their hard-earned, real-world value every day for this piece of paper (or digital representation)?

People have to be interested in that question in order to even begin to understand bitcoin."

People have to be interested in that question in order to even begin to understand bitcoin."

4/ "For me, the path involved first understanding why gold was money.

That involved understanding the unique properties which made something a better or worse form of money and what differentiated money as a unique economic good compared to most other types of economic goods."

That involved understanding the unique properties which made something a better or worse form of money and what differentiated money as a unique economic good compared to most other types of economic goods."

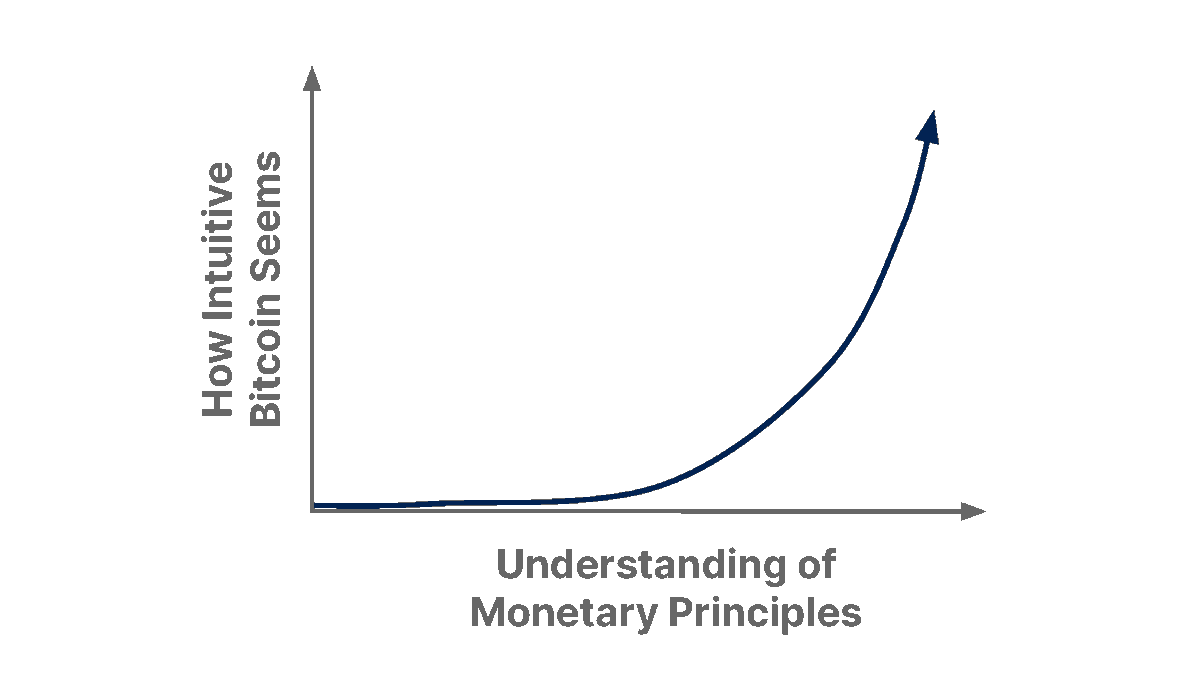

5/ "It’s true that bitcoin is not intuitive. It’s extremely unintuitive.

Until it becomes intuitive and then over time it becomes hyper-intuitive."

Until it becomes intuitive and then over time it becomes hyper-intuitive."

6/ "What makes something money is not an absolutism; it is a choice between storing value in one medium vs. another, always involving trade-offs."

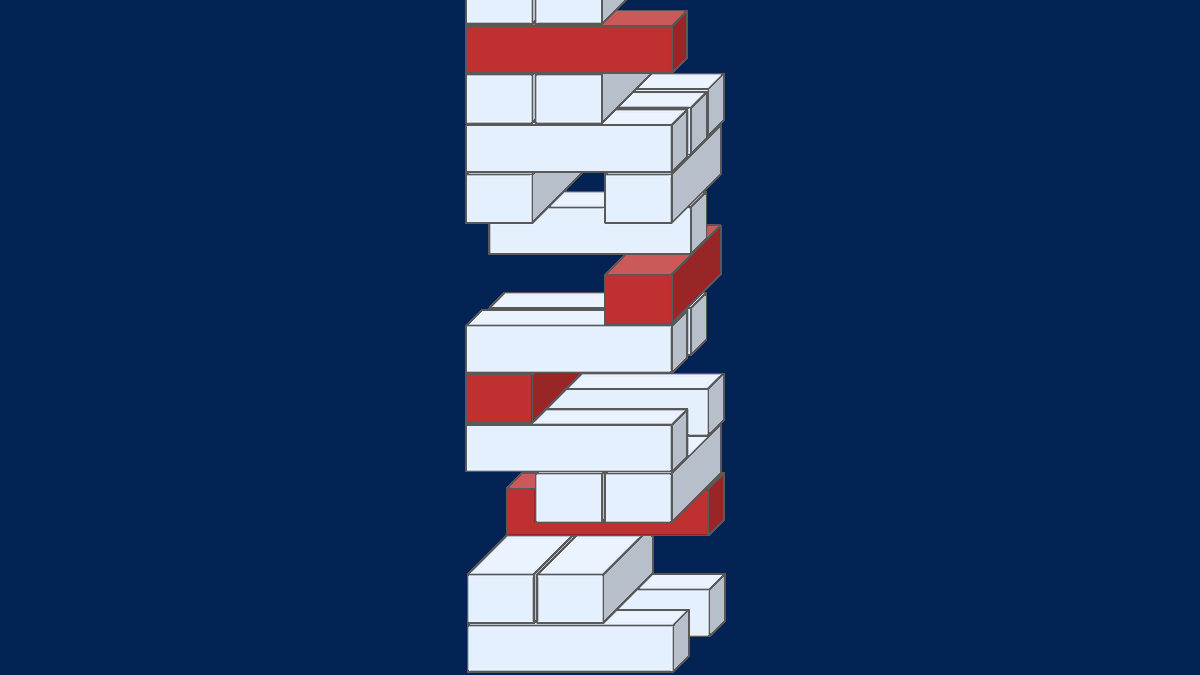

7/ "Through my own research of the great financial crisis, the Fed, and specifically the impact of quantitative easing, I came to the principal conclusion that the root problem was the financial system had been leveraged approximately 150:1.

Too much debt and too few dollars."

Too much debt and too few dollars."

8/ "The insane degree of leverage was only made possible as a function of Fed policy which had consistently prevented system-wide deleveraging over the course of the three decades leading up to the crisis."

9/ "I became convinced that, whether bitcoin survives or not, the existing financial system is working on borrowed time and that one way or another, something other than the status quo will be the inevitable path forward."

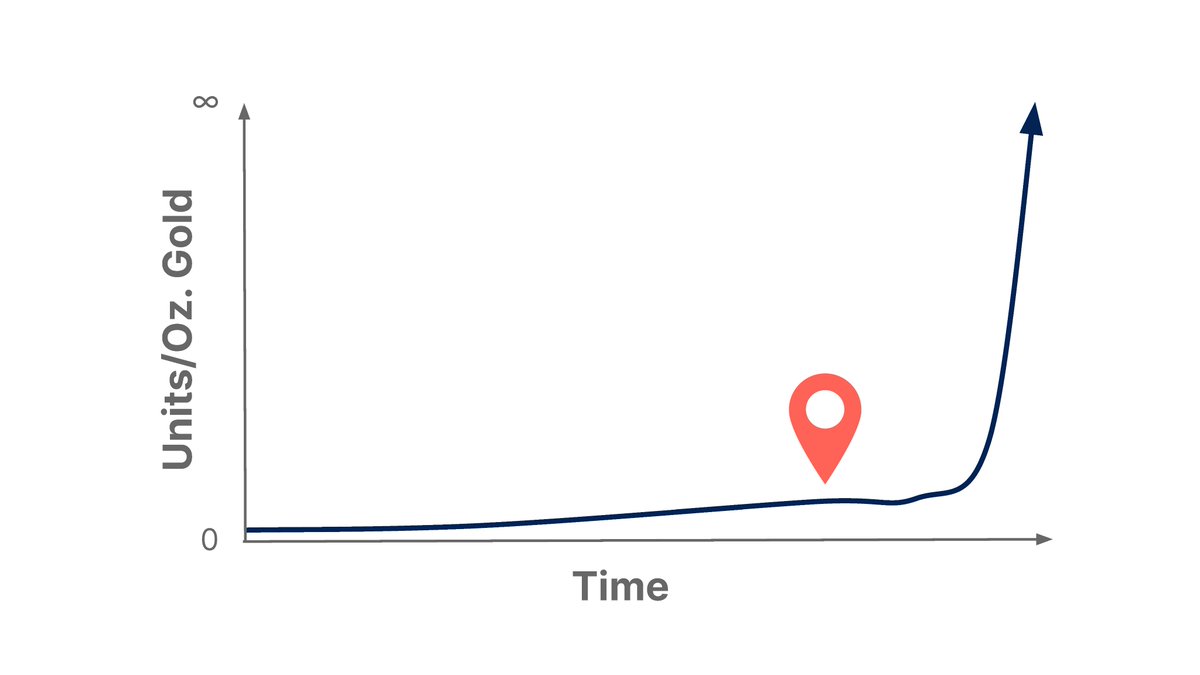

10/ "Then I figured out that bitcoin has a fixed supply. Developing an understanding of how and why that is possible is the basis of understanding bitcoin as money."

11/ "Doing so requires significant personal investment in understanding how economic incentives are woven together with bitcoin’s technical architecture. Incentivizing cooperation, imposing a significant opportunity cost for defection."

12/ "A global network of rational economic actors operating within an opt-in currency system would not form a consensus to debase the currency which they have all independently and voluntarily determined to use as a store of wealth."

13/ "It’s not simply that software code dictates that there will only ever be 21M bitcoin. It’s understanding why that monetary policy is credible and resilient and how bitcoin achieves verifiable scarcity.

Bitcoin exists as a solution to the money problem that is global QE."

Bitcoin exists as a solution to the money problem that is global QE."

14/ "If you believe the deterioration of local currencies in Turkey, Argentina or Venezuela could never happen to the U.S. dollar or to a developed economy, we are merely at a different point on the same curve."

15/ "Hayek writes about the price mechanism as the greatest distribution system of knowledge in the world. When the money supply is manipulated, it distorts global pricing mechanisms which then communicates “bad” information throughout the economic system."

16/ "When that manipulation is sustained over 30-40 years, massive imbalances in underlying economic activity are created, which is where we find ourselves today."

17/ Credit to @anilsaidso for helping compile, edit, and illustrate the thread!

For more Gradually Then Suddenly content, head to our blog: unchained.com/gradually-then…

For more Gradually Then Suddenly content, head to our blog: unchained.com/gradually-then…

• • •

Missing some Tweet in this thread? You can try to

force a refresh