The right DeFi tools can help you find alpha and save you hours each week.

Here's a collection of the best FREE tools in DeFi:

(Some of which you've never heard of before)

🧵

Here's a collection of the best FREE tools in DeFi:

(Some of which you've never heard of before)

🧵

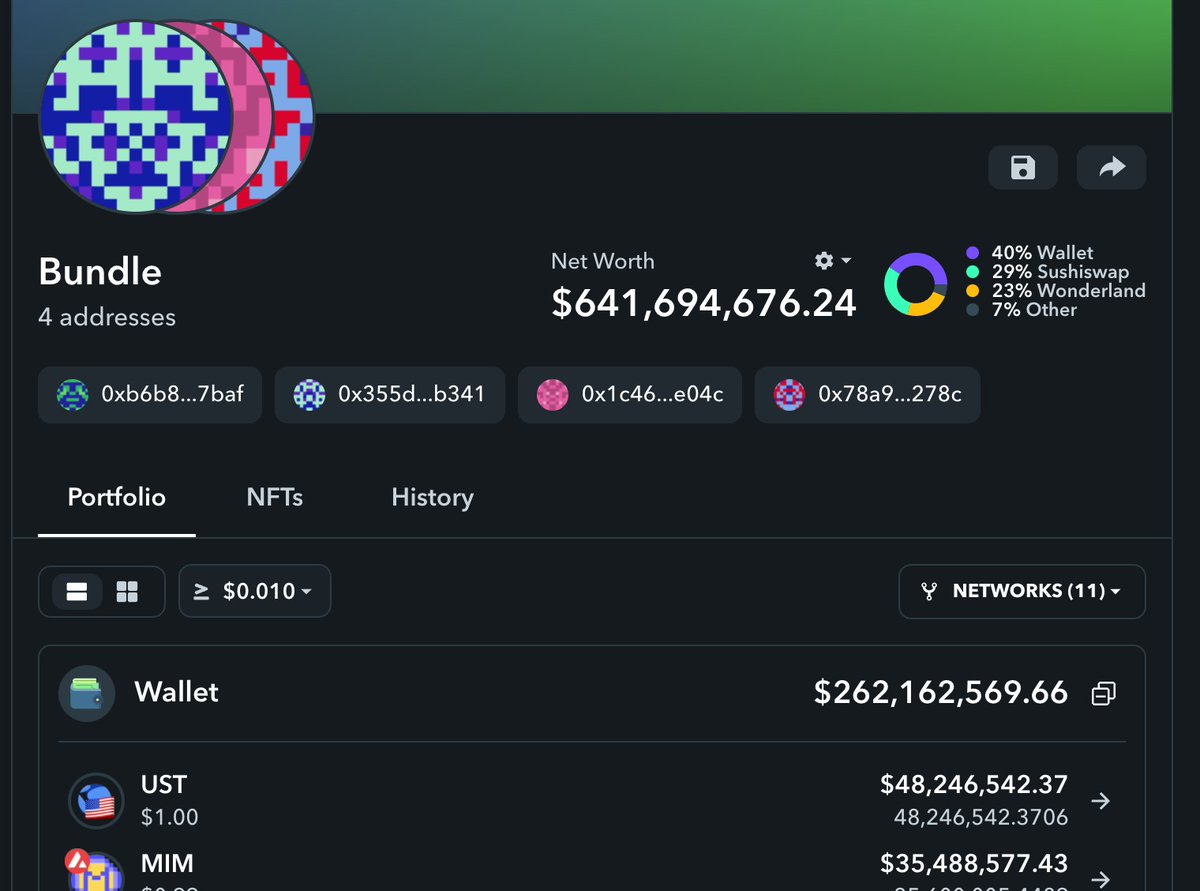

/1 Track Your Portfolio Automatically

Easily track your portfolio by connecting your wallet and adding addresses.

My personal favorite is @zapper_fi

Other great ones:

@debankdefi

@zerion_io

@ape_board

Easily track your portfolio by connecting your wallet and adding addresses.

My personal favorite is @zapper_fi

Other great ones:

@debankdefi

@zerion_io

@ape_board

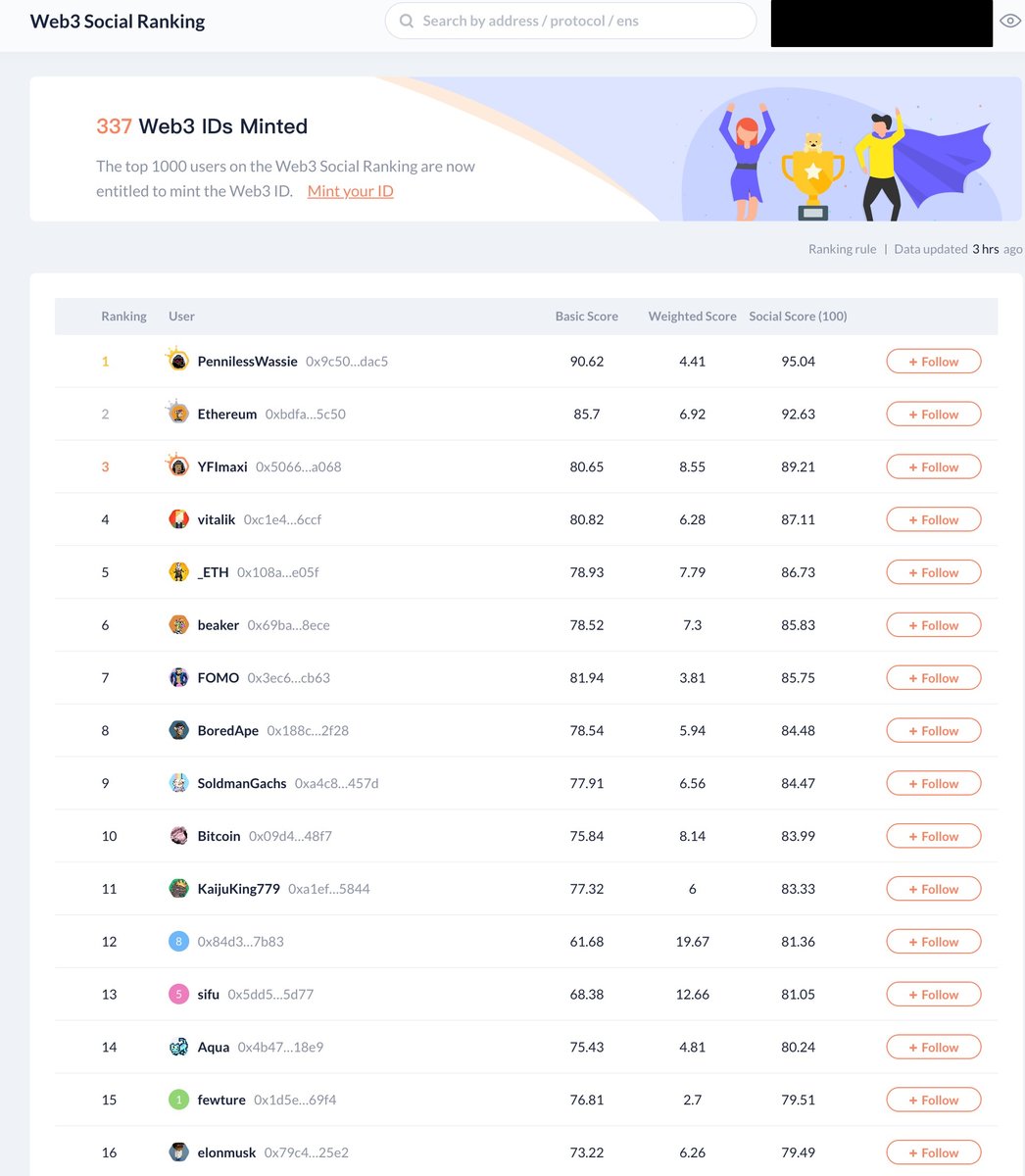

/2 Monitor Whale Wallets

@debankdefi has a ranking of different top wallets.

I monitor Whale wallets to see what they're investing in.

Create your own with a spreadsheet.

• Find your favorite protocols.

• See what the top wallets are.

• Reverse engineer.

• Profit

@debankdefi has a ranking of different top wallets.

I monitor Whale wallets to see what they're investing in.

Create your own with a spreadsheet.

• Find your favorite protocols.

• See what the top wallets are.

• Reverse engineer.

• Profit

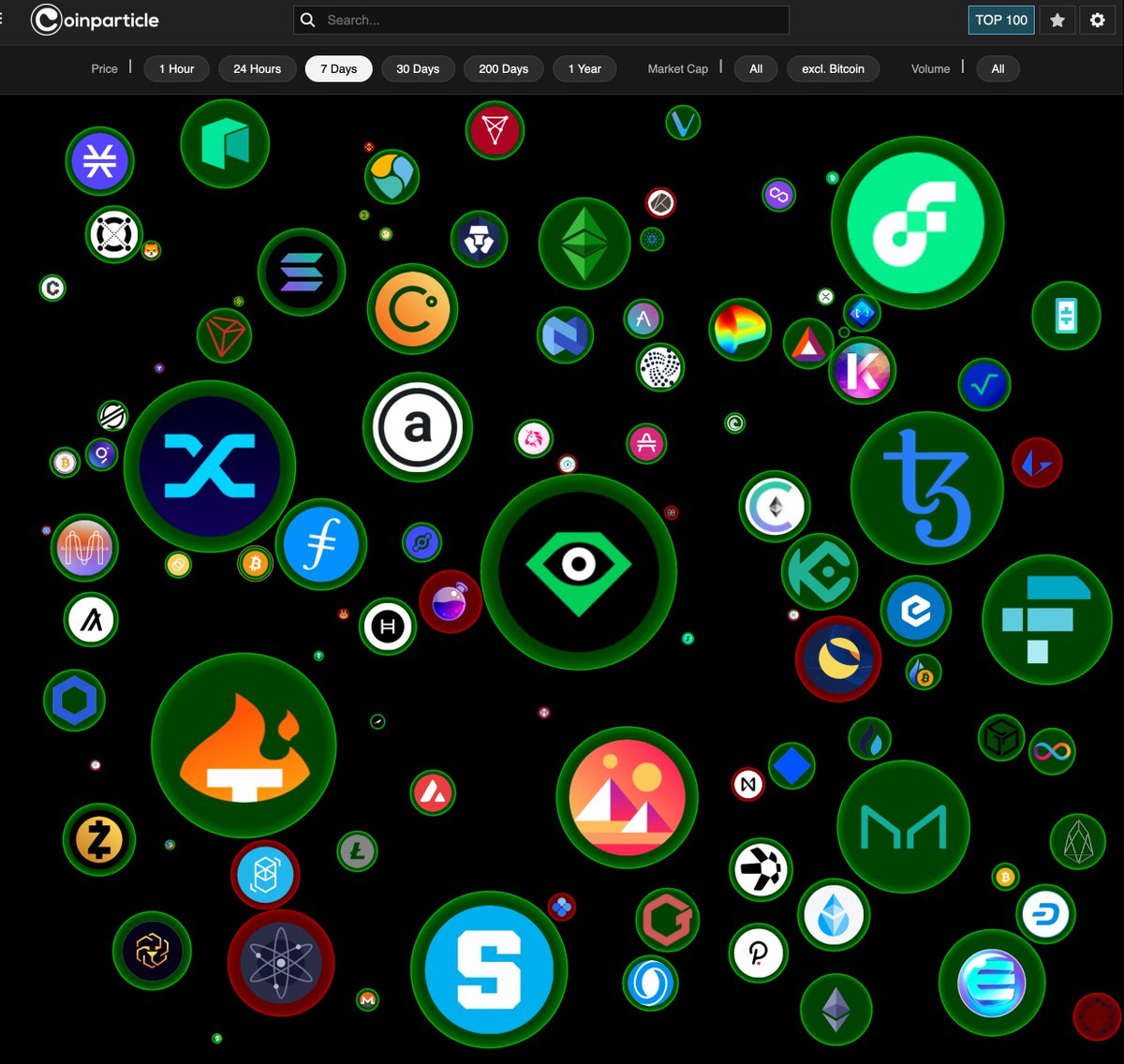

/3 Visualize the biggest winners and losers

I like to watch which coins are the biggest gainers and losers on a weekly basis.

I'm a visual learner.

@Coinparticle illustrates this data better than the typical +12%.

And it helps me to see how it stacks relative to other coins.

I like to watch which coins are the biggest gainers and losers on a weekly basis.

I'm a visual learner.

@Coinparticle illustrates this data better than the typical +12%.

And it helps me to see how it stacks relative to other coins.

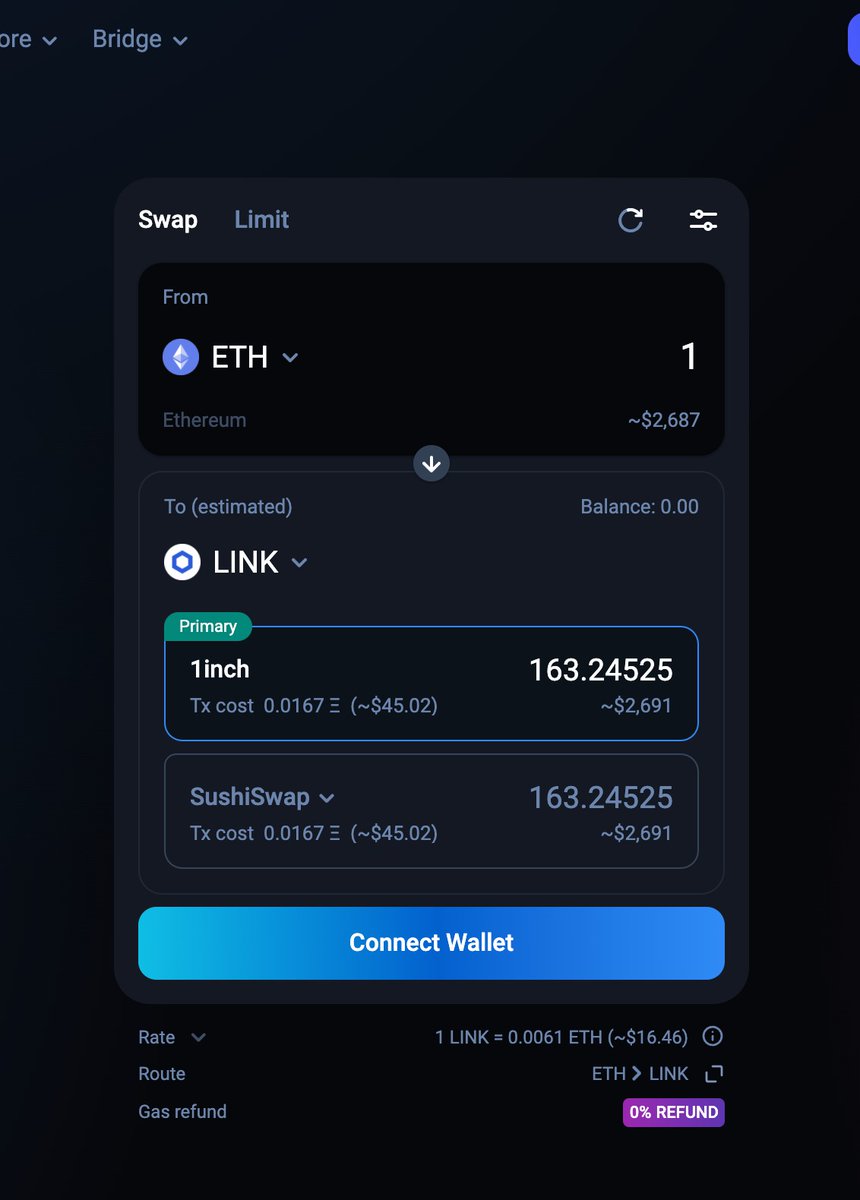

/4 Swapping Coins

I usually go with the top DEX for each protocol.

• @traderjoe_xyz for AVAX

• @Spirit_Swap for FTM

• @Pancakeswap for BSC

@1inch and @sushiswap are great too for multi-chain

I usually go with the top DEX for each protocol.

• @traderjoe_xyz for AVAX

• @Spirit_Swap for FTM

• @Pancakeswap for BSC

@1inch and @sushiswap are great too for multi-chain

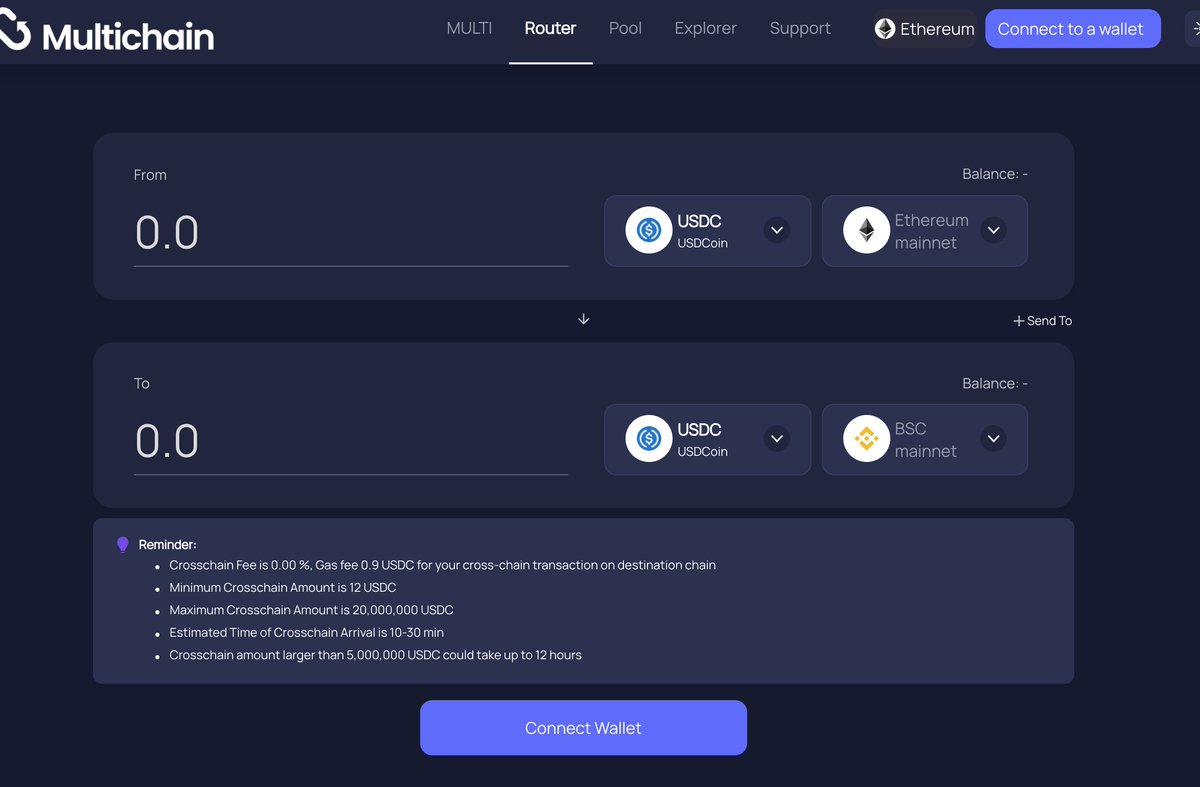

/5 Bridging to Different Protocols

We're living in a multi-chain world.

Bridges can help you move your tokens across different chains.

• @multichainorg (Anyswap)

• @Synapseprotocol

Also, some protocols have NATIVE bridges which might be cheaper.

We're living in a multi-chain world.

Bridges can help you move your tokens across different chains.

• @multichainorg (Anyswap)

• @Synapseprotocol

Also, some protocols have NATIVE bridges which might be cheaper.

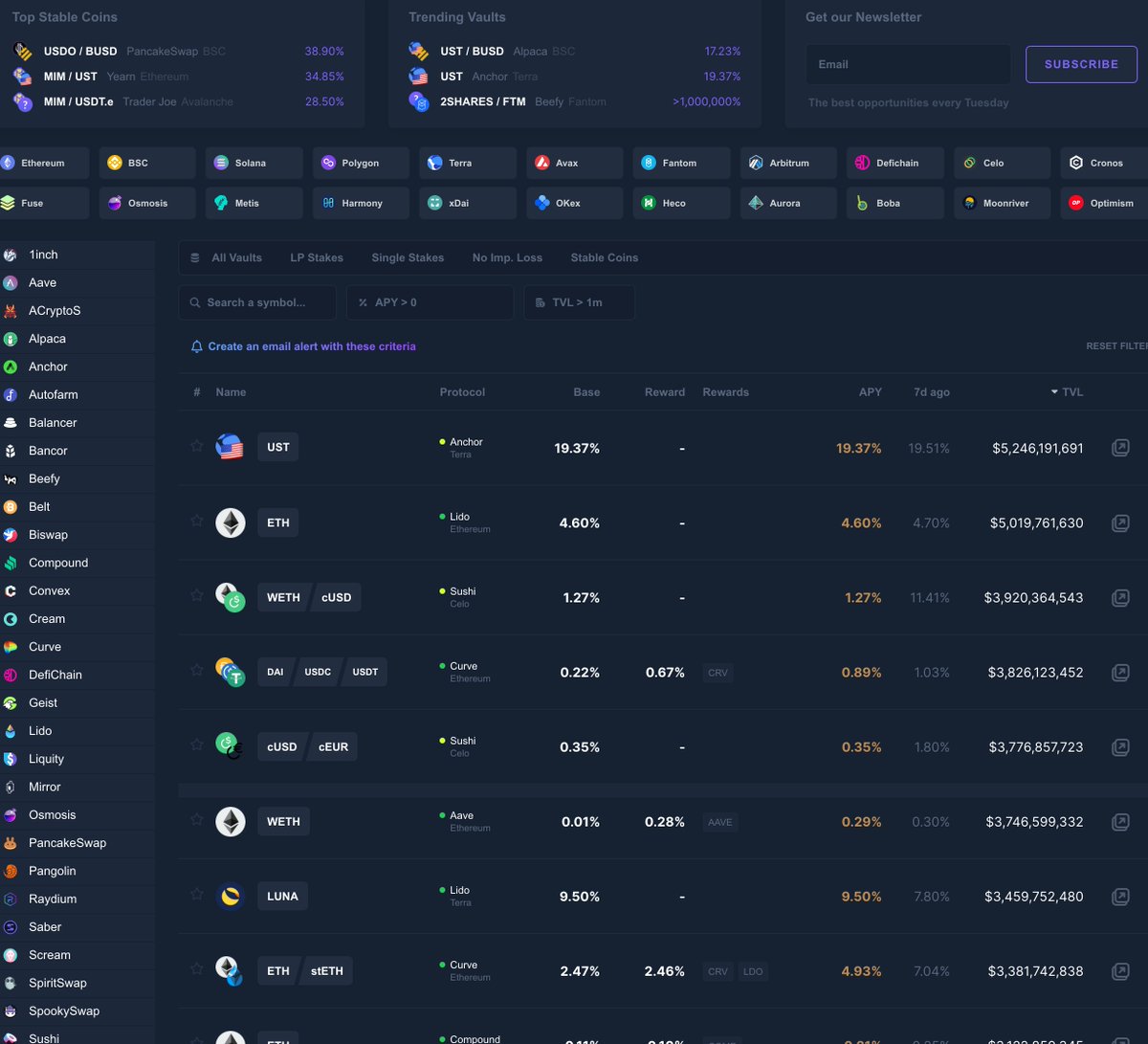

/6 See the Best Stablecoin Rates

Yields on stable-coins go up and down all the time.

@0xCoindix is dashboard that monitors the best stable coin rates across different chains.

Yields on stable-coins go up and down all the time.

@0xCoindix is dashboard that monitors the best stable coin rates across different chains.

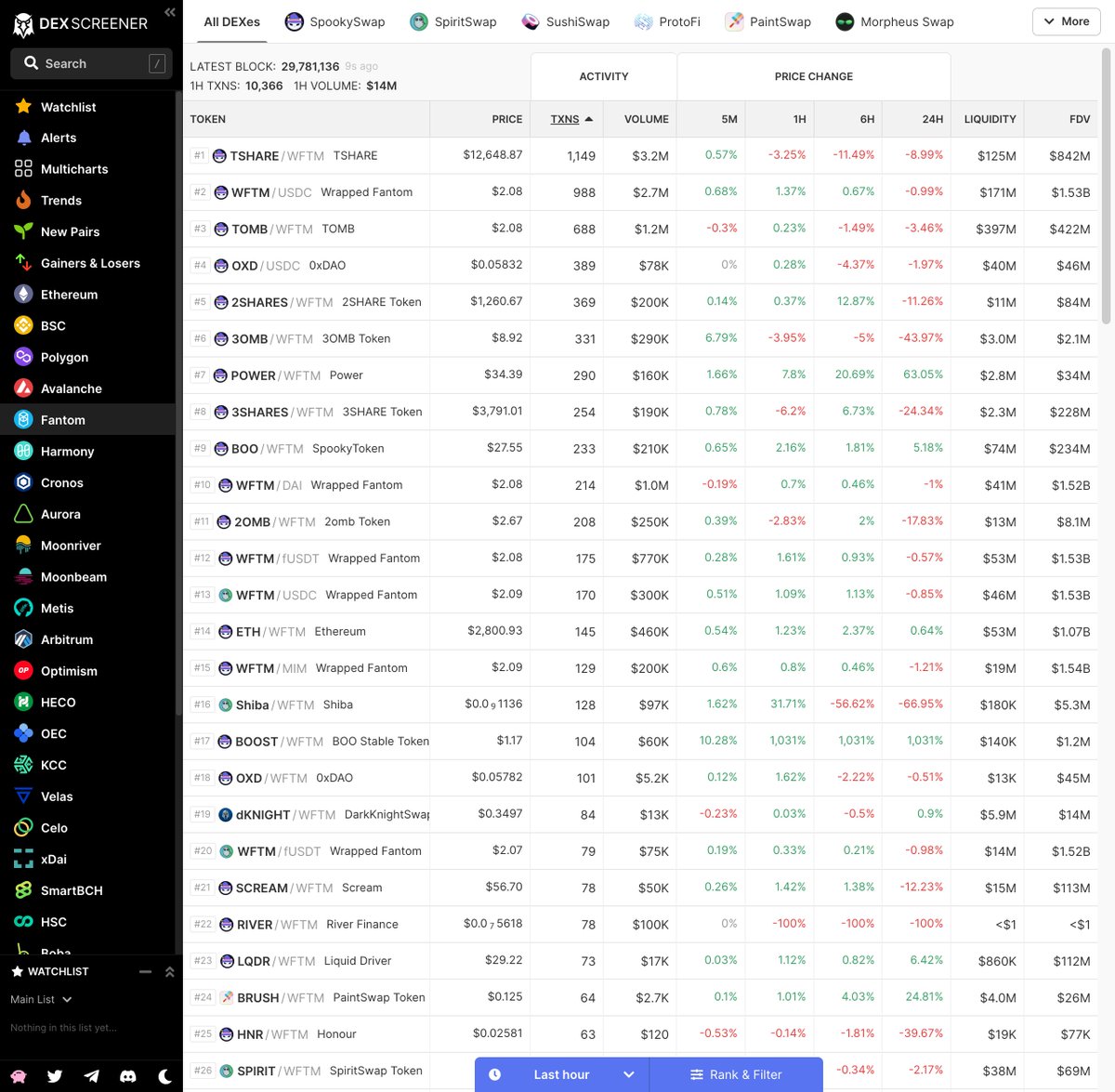

/7 Real Time Action

@dexscreener is the most underrated tool in DeFi

• Watch transactions in Real Time

• See Trends

• Set price alerts

They also have telegram alerts for trends.

@dexscreener is the most underrated tool in DeFi

• Watch transactions in Real Time

• See Trends

• Set price alerts

They also have telegram alerts for trends.

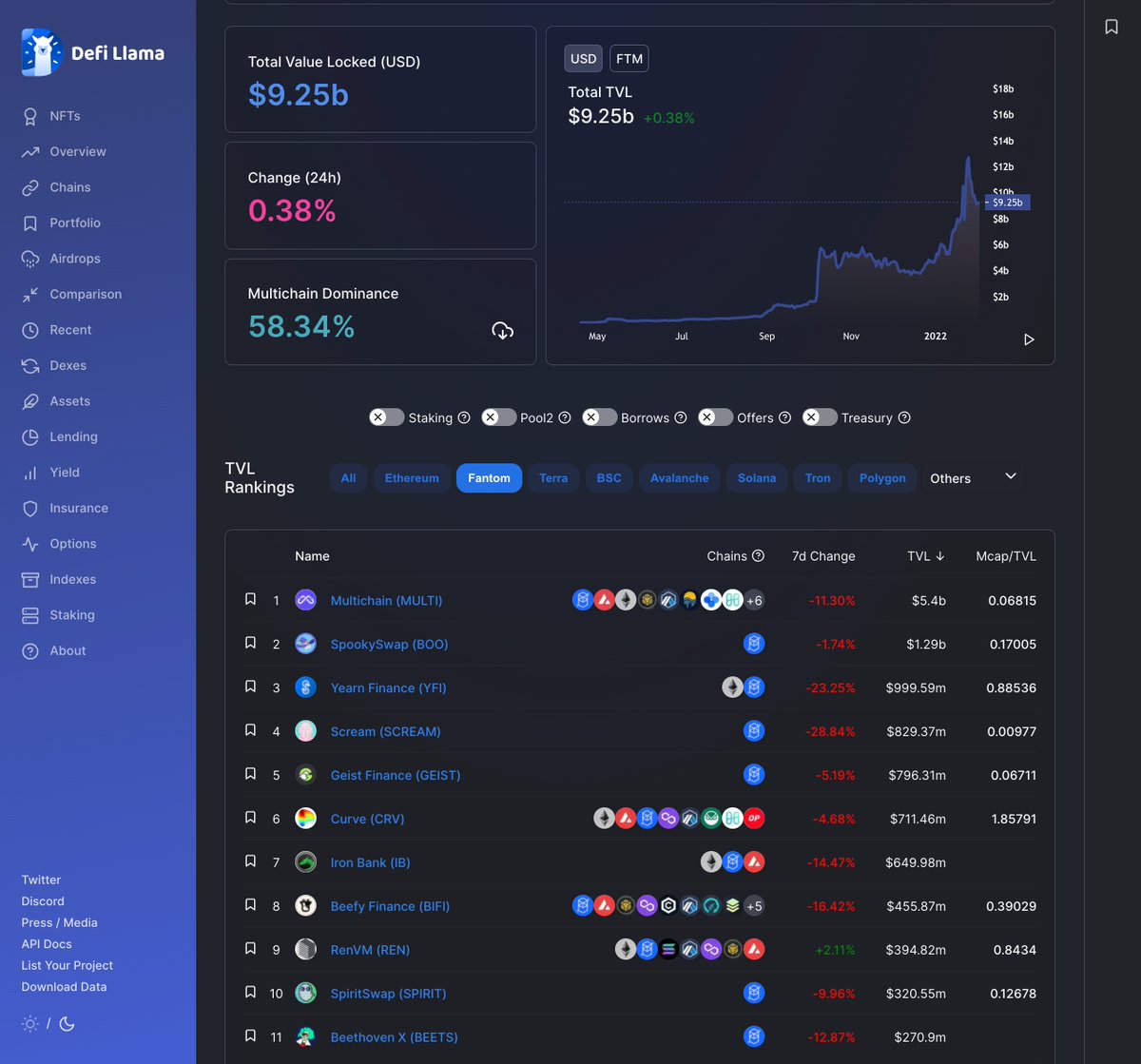

/8 Monitor TVL on Different Chains

@DeFillama

If you're bullish on a Chain, this can help you monitor the up and coming dapps.

The mcap / TVL ratio shows you which Chains are undervalued such as FTM.

@DeFillama

If you're bullish on a Chain, this can help you monitor the up and coming dapps.

The mcap / TVL ratio shows you which Chains are undervalued such as FTM.

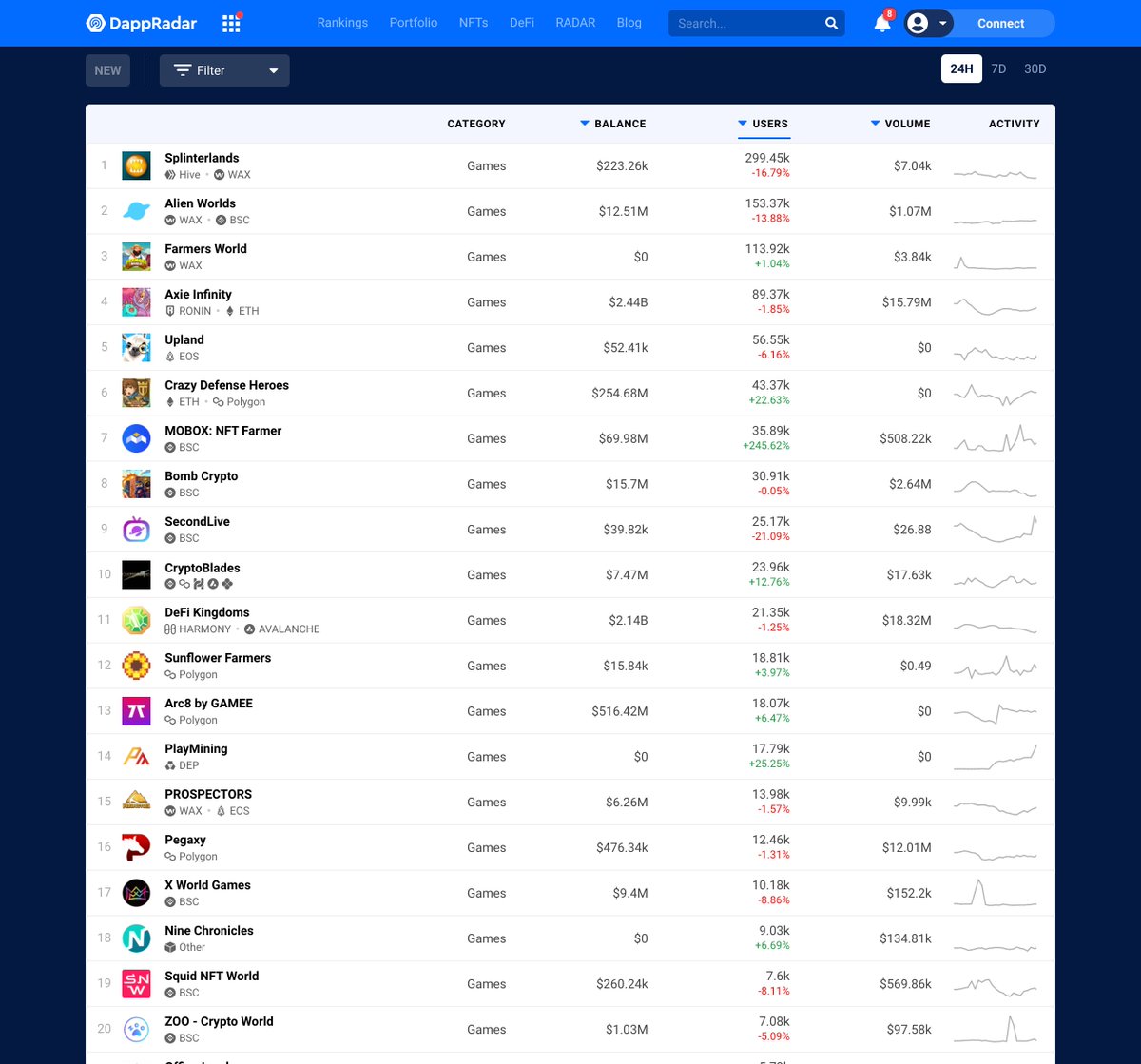

/9 Monitor GameFi Stats

GameFi has a ton of potential. I use @dappradar to monitor the TVL and # of users.

It's an easy way for me to stay on top of what games are trending.

GameFi has a ton of potential. I use @dappradar to monitor the TVL and # of users.

It's an easy way for me to stay on top of what games are trending.

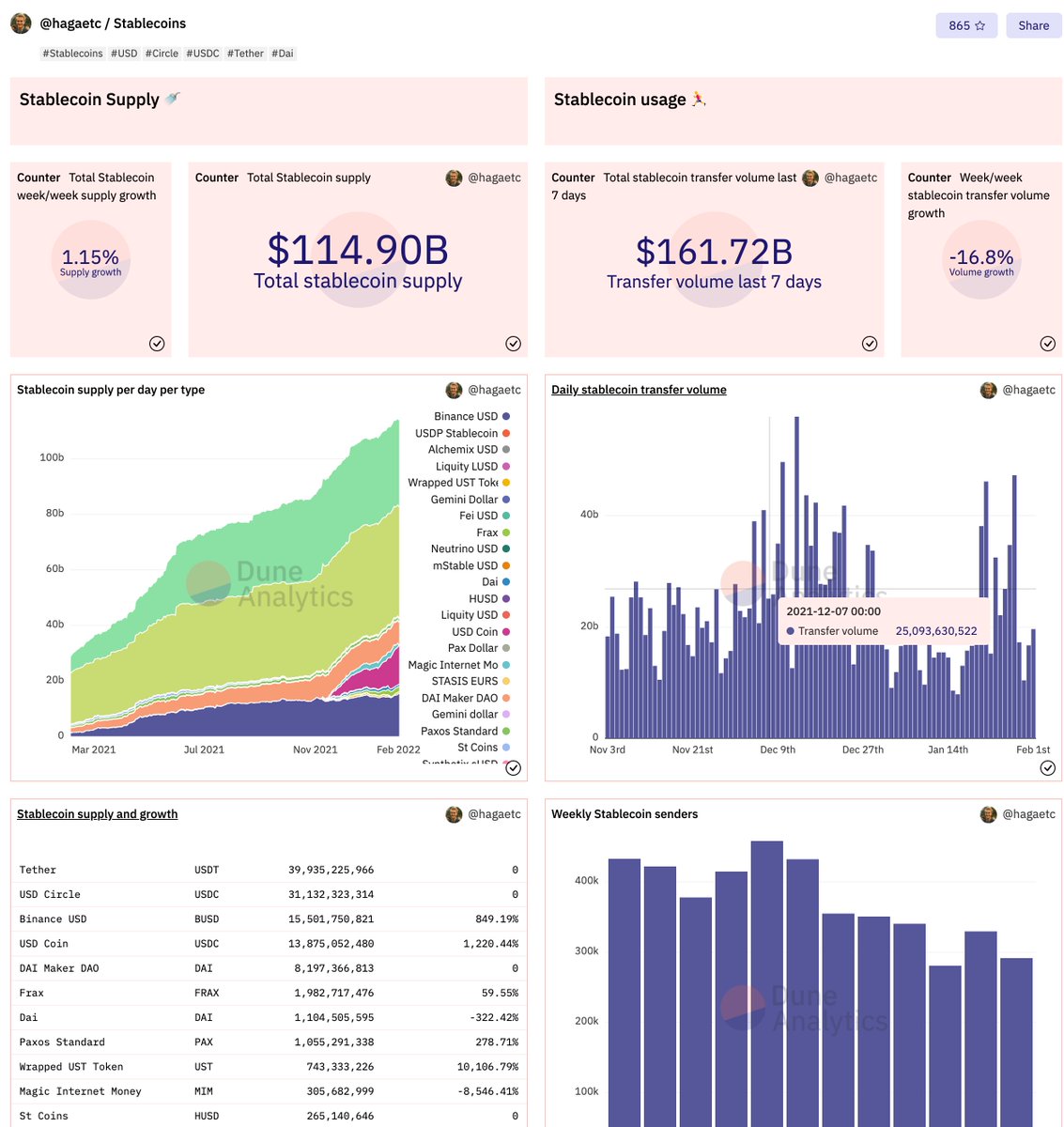

/10 Visualize data from the Blockchain /w @Duneanalytics

You could easily spend hours in the dashboards here each day.

Go to Discover -> Rank Dashboards

To see what's possible.

You could easily spend hours in the dashboards here each day.

Go to Discover -> Rank Dashboards

To see what's possible.

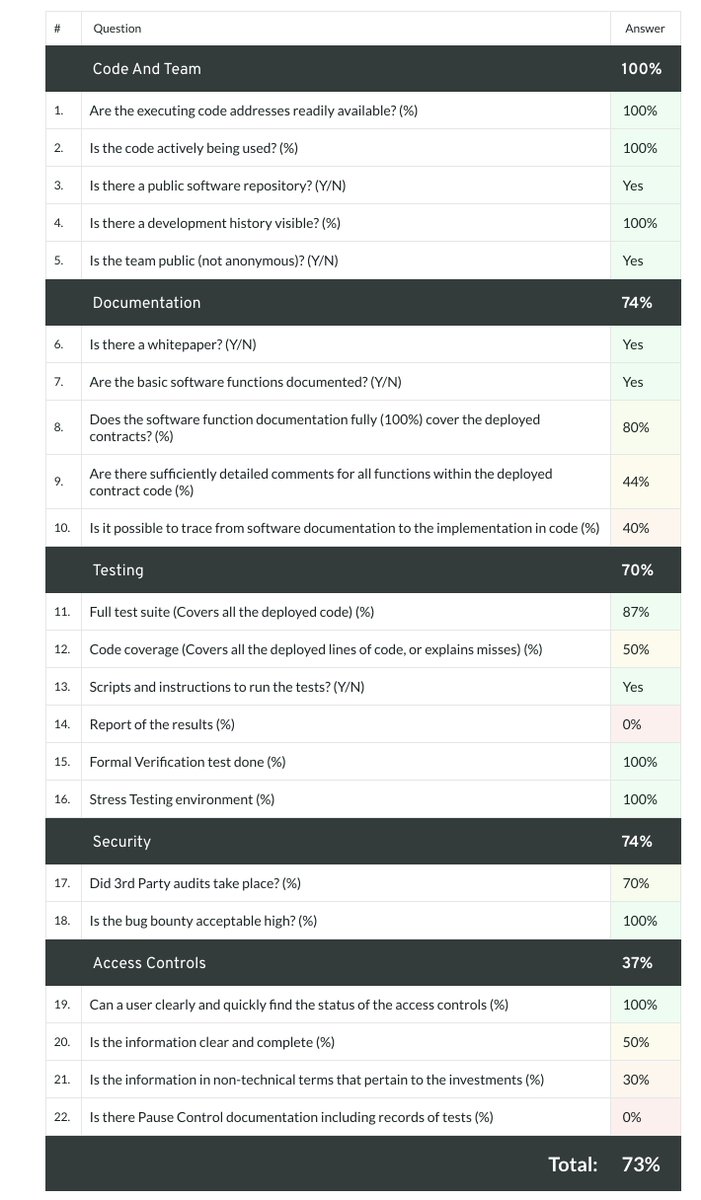

/11 Protocol Safety

Most of us don't have the ability to see how safe a protocol is.

There are platforms out there dedicated to evaluating risks.

@DeFiSafety is my favorite.

@rugdocio is popular. Careful, they have "pay to play" to be featured.

Most of us don't have the ability to see how safe a protocol is.

There are platforms out there dedicated to evaluating risks.

@DeFiSafety is my favorite.

@rugdocio is popular. Careful, they have "pay to play" to be featured.

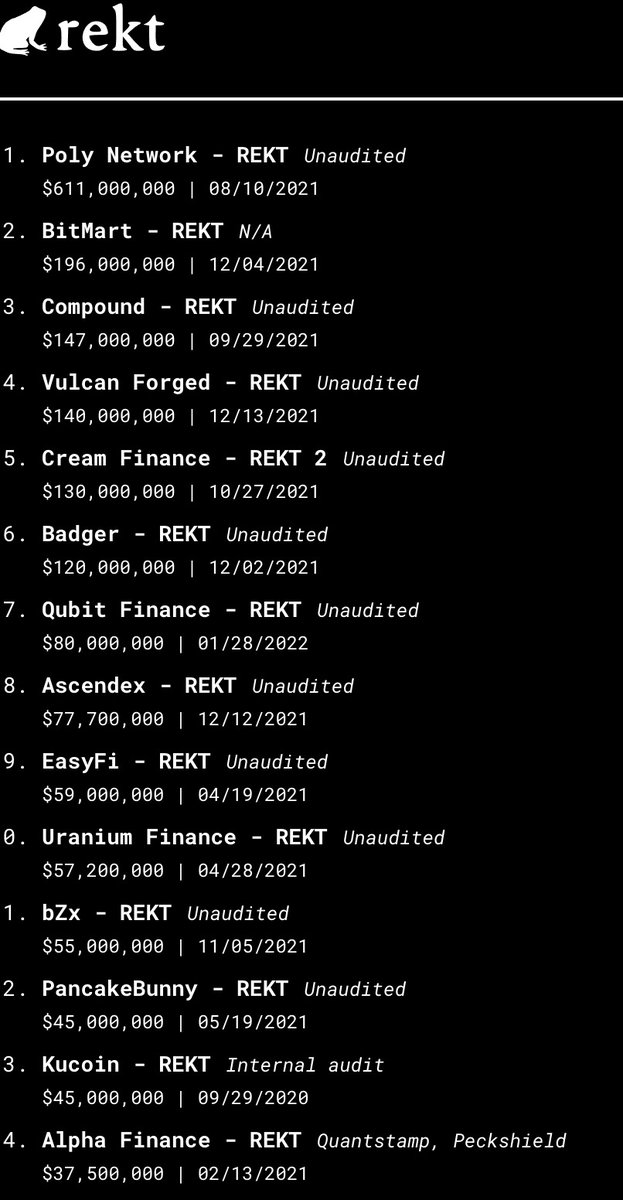

/12 Stay on Top of Exploits

@RektHQ shares stories on how different platforms get exploited.

It's a great way to keep up with all the creatives methods scammers are using.

@RektHQ shares stories on how different platforms get exploited.

It's a great way to keep up with all the creatives methods scammers are using.

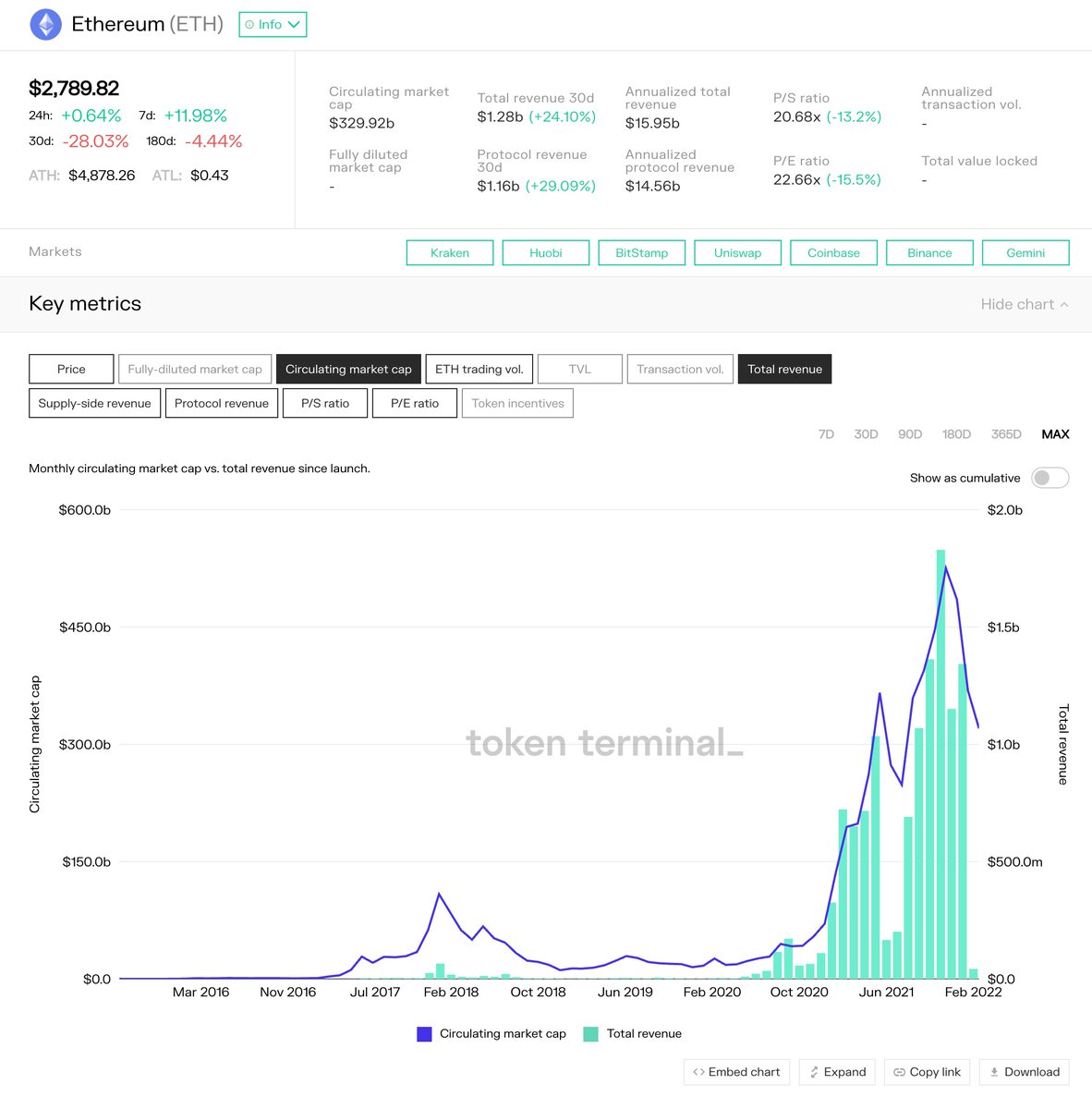

/13 Evaluate key metrics and revenue of different protocols.

Think of it like reading the P/E and different metrics of TradFi companies.

I recommend @TokenTerminal

Think of it like reading the P/E and different metrics of TradFi companies.

I recommend @TokenTerminal

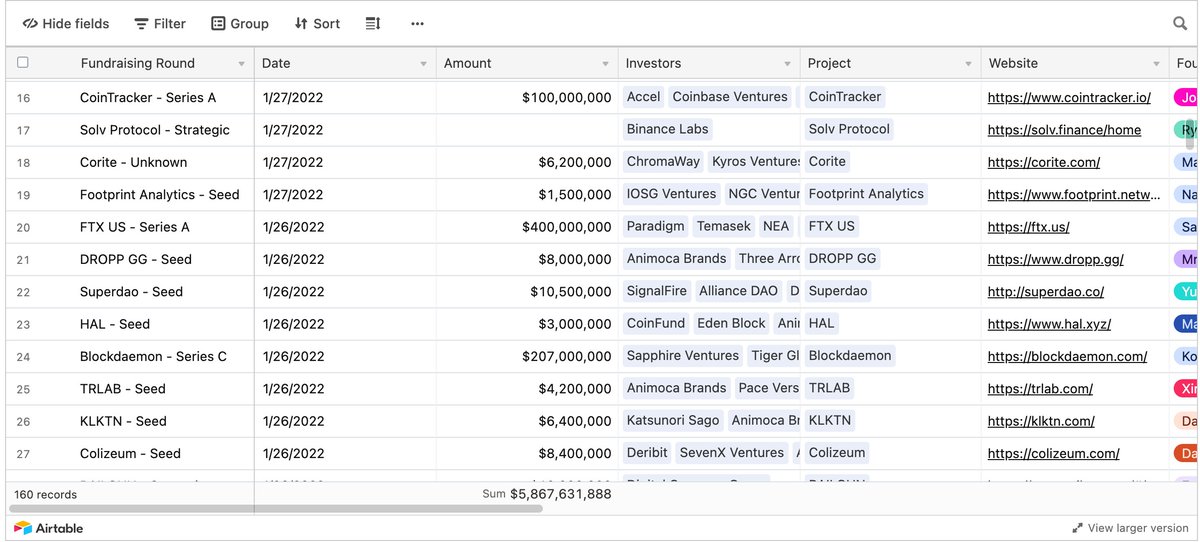

/14 Crypto Fundraising

Want to know what the suits are investing in?

Use @dovemetrics to see where the fundraising's going.

It's a great way to see what the trends are.

Want to know what the suits are investing in?

Use @dovemetrics to see where the fundraising's going.

It's a great way to see what the trends are.

/15 Staying Anon on chain

• @BISQ_network - anon fiat onboarding for BTC

• @WasabiWallet - Coin mixing for BTC

• @TornadoCash - Coin mixing for ETH.

Tornado comes highly recommended by @0xsifu

• @BISQ_network - anon fiat onboarding for BTC

• @WasabiWallet - Coin mixing for BTC

• @TornadoCash - Coin mixing for ETH.

Tornado comes highly recommended by @0xsifu

/16 Privacy

Some tools to help you maintain your privacy.

@Mullvladnet - Privacy focused VPN

@ProtonMail - Privacy focused email

@simple_login - Email Aliases

@Bitwarden - Open source password manager

@brave - Privacy browser

Some tools to help you maintain your privacy.

@Mullvladnet - Privacy focused VPN

@ProtonMail - Privacy focused email

@simple_login - Email Aliases

@Bitwarden - Open source password manager

@brave - Privacy browser

/17 Staying on top of News

There are plenty of media outlets covering Crypto.

The best imo:

@decryptmedia

@theblock_

@Blockworks_

There are plenty of media outlets covering Crypto.

The best imo:

@decryptmedia

@theblock_

@Blockworks_

And finally, don't feel like you have to use every tool.

"Absorb what is useful, discard what is useless and add what is specifically your own" - Bruce Lee

"Absorb what is useful, discard what is useless and add what is specifically your own" - Bruce Lee

Did you enjoy this?

Follow me @thedefiedge for more threads on DeFi and investing principles.

I share deeper insights and what I'm buying on my weekly newsletter.

Subscribe at TheDeFiEdge.com

Follow me @thedefiedge for more threads on DeFi and investing principles.

I share deeper insights and what I'm buying on my weekly newsletter.

Subscribe at TheDeFiEdge.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh