Billionaires around the world are going further and further into debt at an accelerating rate🧐

Time for a thread🧵 explaining why the rich are doing this and how you too can use the same methods the world's richest people use to save massive amounts of money every year!

1/

Time for a thread🧵 explaining why the rich are doing this and how you too can use the same methods the world's richest people use to save massive amounts of money every year!

1/

Financial ‘’experts’’ and economists commonly tell us that we should

‘’pay down our debt as fast as possible and focus on saving money’’.

However the wealthiest people in the world are heavily indebted

Do the rich know something us average Americans don’t...?

2/

‘’pay down our debt as fast as possible and focus on saving money’’.

However the wealthiest people in the world are heavily indebted

Do the rich know something us average Americans don’t...?

2/

The wealthy are employing a technique that most economists and financial ‘’experts’’ rarely talk about in the mainstream news

The wealthy are using the power of leverage!

They use their asset portfolio as collateral to borrow more money, to then buy MORE ''trophy assets''

3/

The wealthy are using the power of leverage!

They use their asset portfolio as collateral to borrow more money, to then buy MORE ''trophy assets''

3/

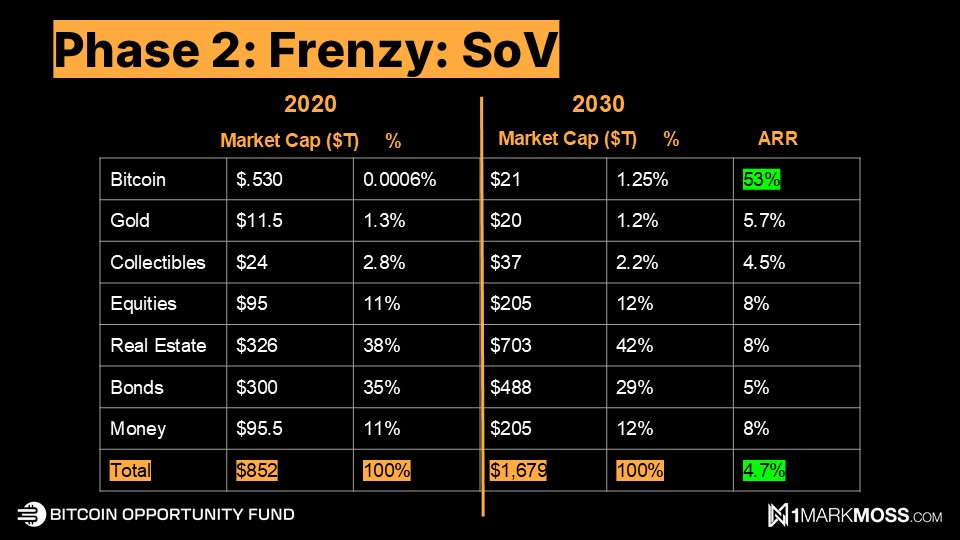

Now what is a trophy asset?

A trophy asset is a very rare and scarce asset that’s in high demand.

Trophy assets are generally world renowned items, think of scarce beach front real estate in Miami or California

In the future, #bitcoin will be regarded as a trophy asset too

4/

A trophy asset is a very rare and scarce asset that’s in high demand.

Trophy assets are generally world renowned items, think of scarce beach front real estate in Miami or California

In the future, #bitcoin will be regarded as a trophy asset too

4/

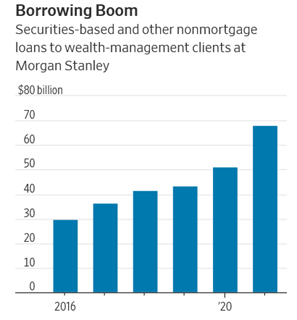

The rich are borrowing to buy these assets at an accelerated rate over recent years

Morgan Stanley wealth-management clients now have $68 billion worth of securities-based and other non mortgage loans

This amount has more than doubled from only five years earlier

5/

Morgan Stanley wealth-management clients now have $68 billion worth of securities-based and other non mortgage loans

This amount has more than doubled from only five years earlier

5/

Put very simply, the rich aren’t selling their assets

They’re using their asset portfolio as collateral, to take out debt and buy more assets that they think will appreciate in value

Now you might be wondering ‘’why are they doing this so rapidly today in 2022’’?

6/

They’re using their asset portfolio as collateral, to take out debt and buy more assets that they think will appreciate in value

Now you might be wondering ‘’why are they doing this so rapidly today in 2022’’?

6/

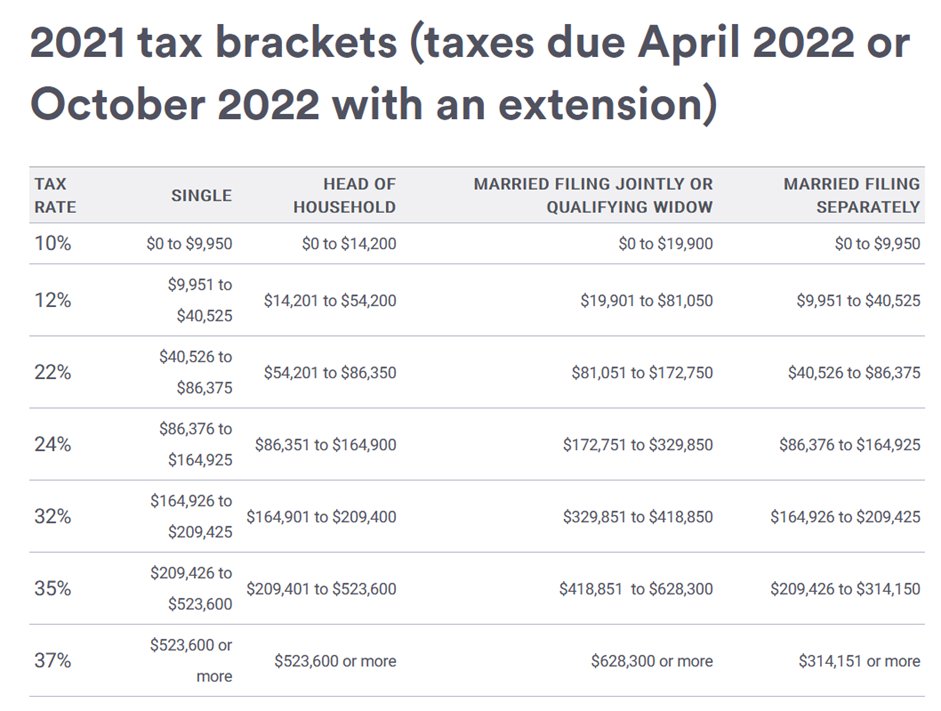

One reason is, if you can cut your expenses, it’s like finding an extra source of income

Taxes are our single biggest expense, with tax rates in some countries accounting for nearly 50% of our total income

If you don't sell your assets, you sidestep those taxes

7/

Taxes are our single biggest expense, with tax rates in some countries accounting for nearly 50% of our total income

If you don't sell your assets, you sidestep those taxes

7/

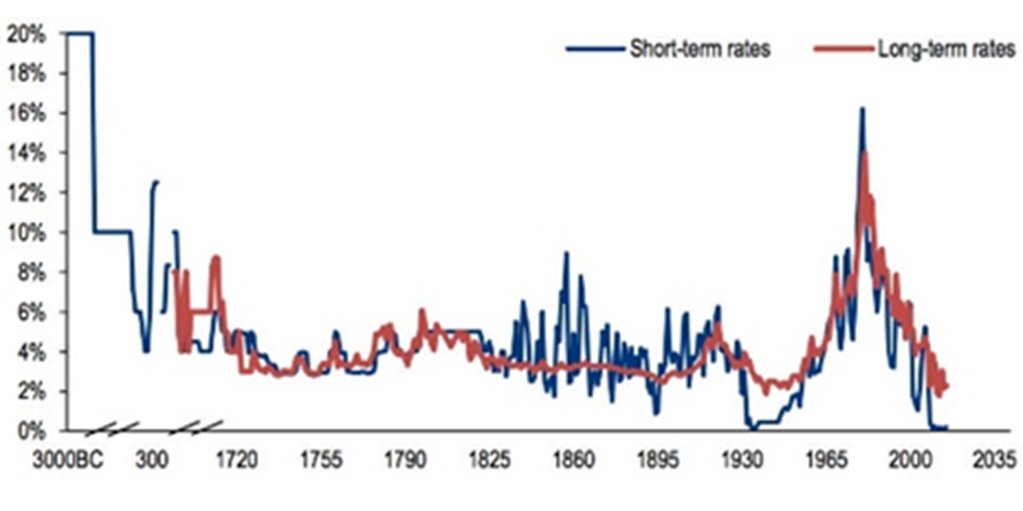

With interest rates at 5000 year lows, it’s literally never been more economically attractive to go into debt

They’re literally giving money away for free!

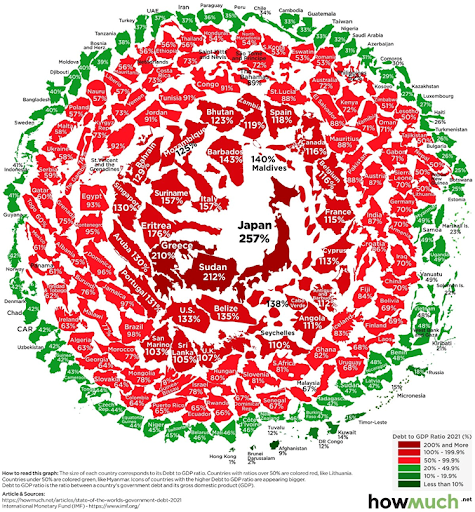

Governments around the world have taken advantage of these low interest rates to be more indebted than ever before

8/

They’re literally giving money away for free!

Governments around the world have taken advantage of these low interest rates to be more indebted than ever before

8/

The last time we saw governments in similar levels of debt was 80 years ago leading into WW2

At this stage of an 80 year long-term debt cycle, with interest rates at 0 and debt levels unsustainably high across the globe, central banks must keep interest rates low.

9/

At this stage of an 80 year long-term debt cycle, with interest rates at 0 and debt levels unsustainably high across the globe, central banks must keep interest rates low.

9/

If interest rates were to rise governments all around the world would default on their massive debt load

Our governments NEED low rates, inflation and currency debasement to deleverage their balance sheet

Put simply their plan is to

10/

Our governments NEED low rates, inflation and currency debasement to deleverage their balance sheet

Put simply their plan is to

10/

Put simply their plan is to print money, devalue the money and pay back their enormous debt with the devalued dollars

Taking on debt in the devaluing currency & buying hard assets is a no brainer in this economic environment for those who have access to debt

11/

Taking on debt in the devaluing currency & buying hard assets is a no brainer in this economic environment for those who have access to debt

11/

With inflation now hitting its highest level in 40 years, its now becoming clear to most people that we’re living through an inflationary time

Savers are always the losers in inflationary times,

The 1920s German hyperinflation is an example of this taken to the extreme

12/

Savers are always the losers in inflationary times,

The 1920s German hyperinflation is an example of this taken to the extreme

12/

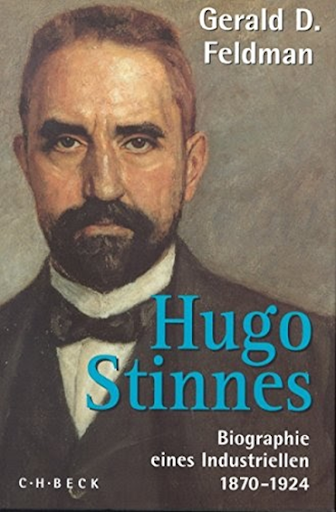

Most people in Germany at the time lost everything as the currency lost all of it’s value in the space of only a handful of years.

But not Hugo Stinnes.

Hugo Stinnes is known as the ‘’inflation king’’ of Germany for how he handled this turbulent economic event.

12/

But not Hugo Stinnes.

Hugo Stinnes is known as the ‘’inflation king’’ of Germany for how he handled this turbulent economic event.

12/

Hugo Stinnes owned a coal business, which he used as an asset to borrow money against

He borrowed massive amounts of the German Marks to diversify into buying more hard assets like shipping and cargo lines (for his coal), as well as Steel companies, real estate and gold

13/

He borrowed massive amounts of the German Marks to diversify into buying more hard assets like shipping and cargo lines (for his coal), as well as Steel companies, real estate and gold

13/

By 1924 he had grown his modest amount of wealth so large he became the richest man in Germany

His hard asset portfolio ballooned in value and the debt he took out in the failing currency was worthless in comparison to his asset portfolio after the currency was worthless

14/

His hard asset portfolio ballooned in value and the debt he took out in the failing currency was worthless in comparison to his asset portfolio after the currency was worthless

14/

Today, currencies all across the globe are being rapidly devalued making the necessity to buy hard assets an essential

It even makes employing a strategy like Hugo Stinnes employed, a great idea or even blueprint to follow, so long as the leverage is used responsibly

15/

It even makes employing a strategy like Hugo Stinnes employed, a great idea or even blueprint to follow, so long as the leverage is used responsibly

15/

Leverage is like fire. It can warm your house, or it can burn your house down

But anyone can use it if they know HOW to use it

Do you want to follow the same wealth building strategies the worlds elite follow to build an all weather portfolio of assets?

Let me show you👇

16/

But anyone can use it if they know HOW to use it

Do you want to follow the same wealth building strategies the worlds elite follow to build an all weather portfolio of assets?

Let me show you👇

16/

In my recent video I explain how you can employ this powerful strategy the wealthy have used for decades to compound their wealth👇

If you like this thread, PLEASE

Like, Comment, and Retweet 🙏

17/

If you like this thread, PLEASE

Like, Comment, and Retweet 🙏

17/

• • •

Missing some Tweet in this thread? You can try to

force a refresh