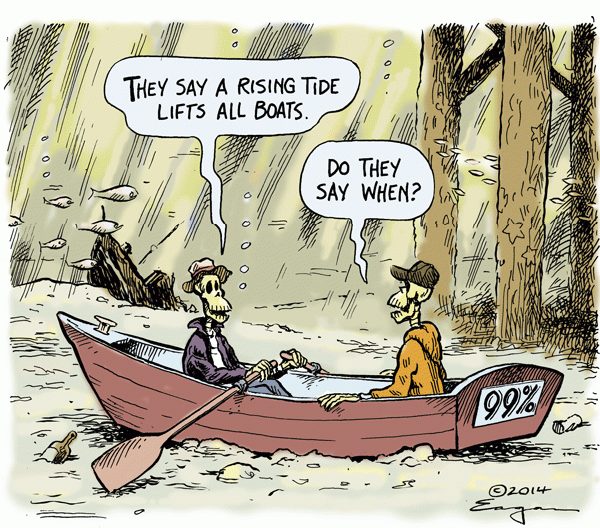

Trickle down economy is a joke. Modern monetary theory with central banks have made a complete joke out it. Those close to the money source get richer, while those farthest earn pennies.

#TrickleDownEconomics

A Thread 🧵 for your awareness 👇

#TrickleDownEconomics

A Thread 🧵 for your awareness 👇

• • •

Missing some Tweet in this thread? You can try to

force a refresh