1. In occasion of Putin’s visit to Beijing, a major gas deal was finalized between Russia and China,portrayed as a sign of consolidation of relations between revisionist powers.But energy-wise, there is more than meets the eye. Thread. reuters.com/world/asia-pac…

2.First the deal.Gazprom and CNPC signed a deal to annually supply 10 bcm of Russian gas from the Sakhalin 3 fields to China via a pipeline connecting the domestic Sakhalin-Vladivostok pipeline to the main Power of Siberia trunkline. (source: Gazprom)

3.The deal will take Gazprom supplies to China (about 4 bcm in 2020) to 48 bcm in the second half of the decade, adding to the 38 bcm expected to be shipped through Power of Siberia as of 2025, following a major deal between the two countries in 2014 reuters.com/article/us-chi…

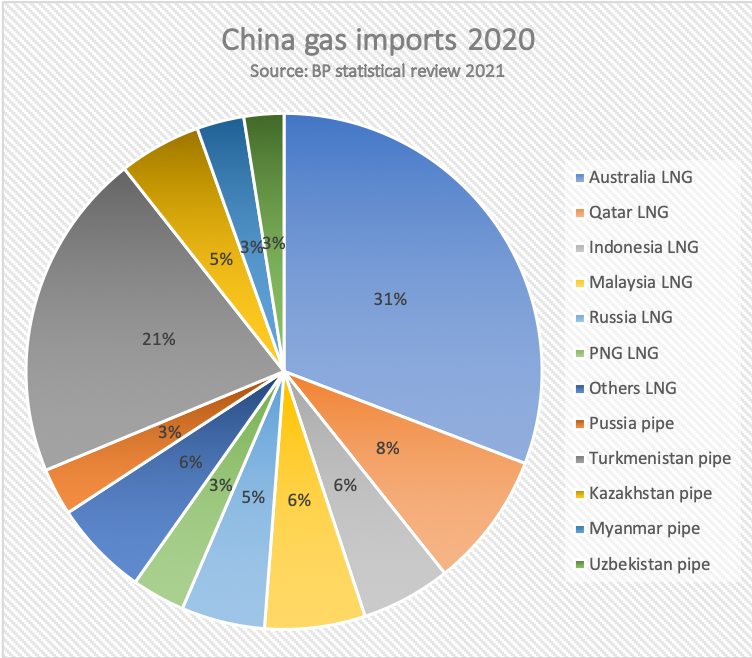

4.This would turn Russia into the largest gas supplier to China, one of the fastest growing gas markets. Above Australia, with which relations get increasingly tense, and Qatar, which has recently received by the US the status of non-NATO ally

5.However, no deals were finalized on a much larger project and prize for Russia: the Soyuz Vostok pipeline, a 50-60 bcm project expected to ship gas from Yamal’ to China via Mongolia. Soyuz Vostok would allow to divert to China resources that currently can only reach Europe

6.Soyuz Vostok makes a lot of strategic and commercial sense for Russia. It moves the bilateral terms of EU-Russia energy relations in favour of Russia, providing the possibility to switch supplies from west to east. Europe and China would have to compete.

7.Also, it would prevent Yamal’ resources from going stranded as a result of Europe’s decarbonization plans

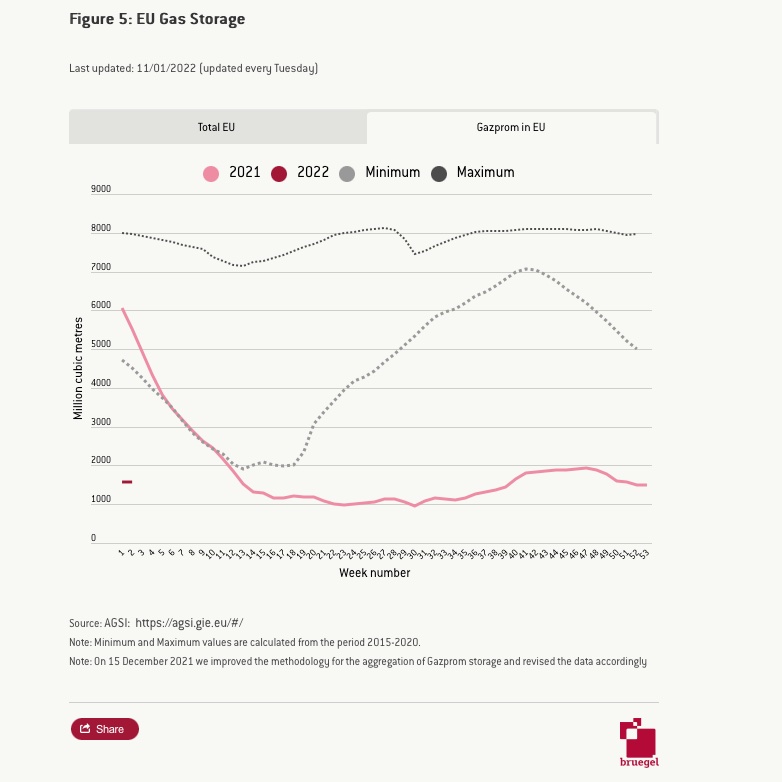

8.without a deal on Soyuz Vostok, China denied Russia the big prize – one that European should be quite afraid of. For the time being, Beijing does not seem too interested to compete with Europeans for Russian supplies, beside what already happens on LNG markets

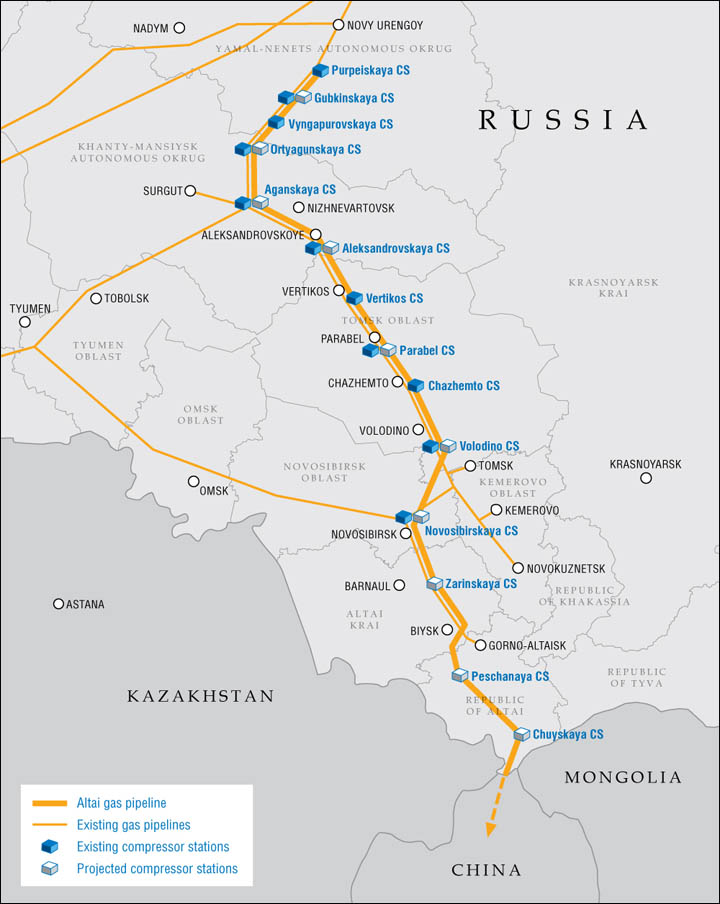

9.And there is a precedent for that. In occasion of the deal of 2014, China let down Russia’s as for Soyuz Vostok predecessor: the defunct Altai pipeline, also aimed at shipping Yamal’ gas to China and play the European and Chinese markets against each other

10. In both 2014 and now, the deals were finalized in a situation of weakness for Russia – in both cases, as a result of isolation in the context of Russia’s policy towards Ukraine. It's Groundhog Day...again.

11. So for now we see a pattern:

- China signs deals with Russia when Russia is most in need

- China prefers to limit gas dependence on Russia to the strictly necessary

- China prefers not to compete with Russia’s other piped gas clients and secure physically exclusive access

- China signs deals with Russia when Russia is most in need

- China prefers to limit gas dependence on Russia to the strictly necessary

- China prefers not to compete with Russia’s other piped gas clients and secure physically exclusive access

12. So, not a revolution here for the time being. More an evolution in line with Chinese terms. However, one thing should be noticed about the deal. Russia and China agreed to trade gas in euros to shield the trade from US sanctions

13.This seems overall a nice outcome for Europe. It kept (for now) a monopsony on Yamal’s piped exports, while the euro got another little boost to its international stand as a reserve currency

14.Perhaps, however, the US won’t be thrilled to see again that euro’s international status is increasingly boosted through adversaries’ interests to protect their energy relations from US geoeconomic statecraft.

15. So, beside gas flow geography, I would look at the currency aspect (also on ideational, beside material grounds) as the most consequential in today’s deal from a transatlantic perspective/FIN

• • •

Missing some Tweet in this thread? You can try to

force a refresh