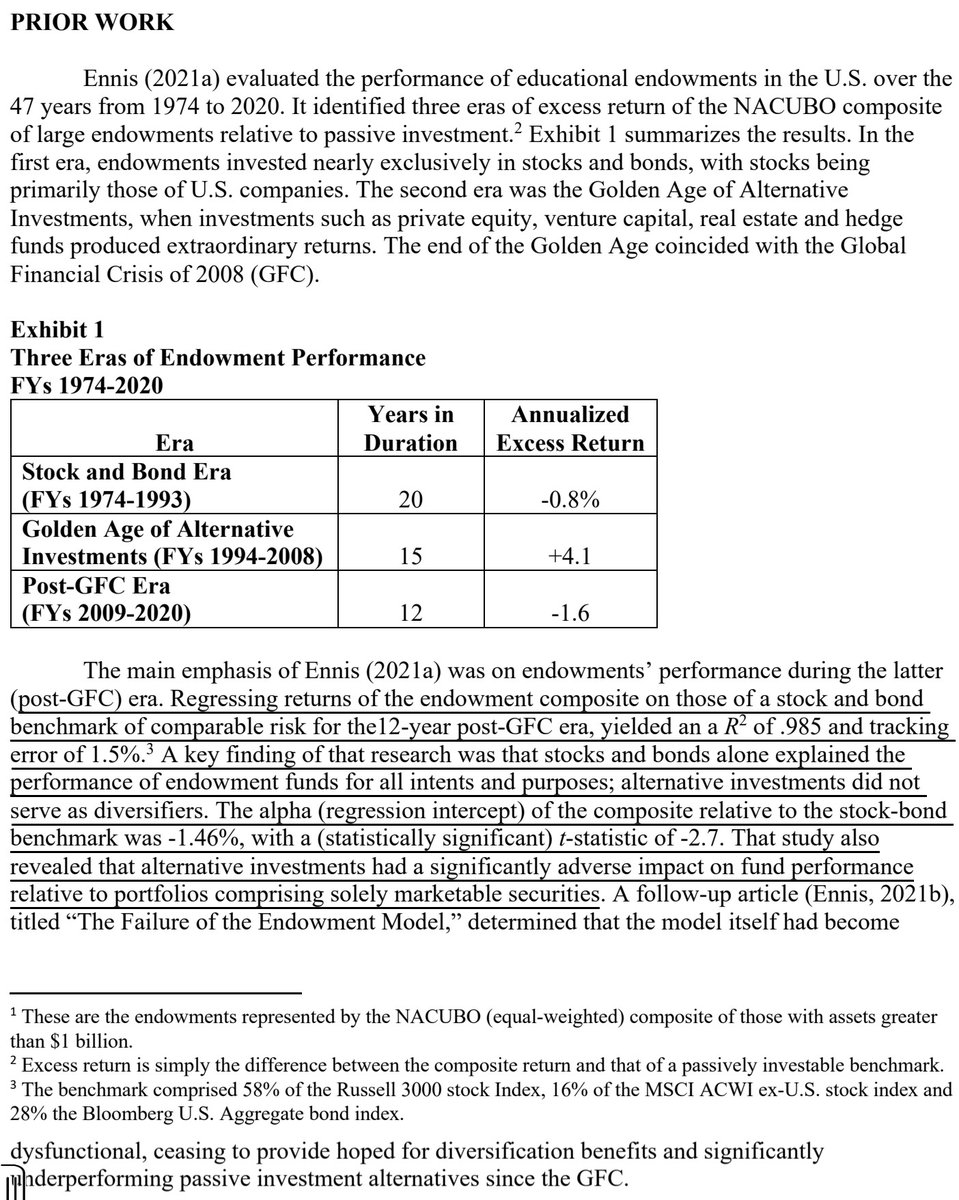

1/ Modern Endowment Story: A Ubiquitous United States Equity Factor (Ennis)

"Endowments' overwhelming exposure to the U.S. equity market over the most recent 5–7 years raises important questions regarding risk tolerance and diversification."

papers.ssrn.com/sol3/papers.cf…

"Endowments' overwhelming exposure to the U.S. equity market over the most recent 5–7 years raises important questions regarding risk tolerance and diversification."

papers.ssrn.com/sol3/papers.cf…

2/ Over the most recent six years, the NACUBO equal-weighted composite of large endowments has had a beta to the benchmark of 1.0 and R² of .998. This is a dazzlingly tight fit, considering that the independent variables are restricted to fully investable, broad market indexes."

3/ "The U.S. equity market risk premium is embedded in the principal asset classes that endowments employ. (I make no attempt to adjust for the return smoothing characteristic of private markets. The correlations and betas would no doubt be greater if I had done so.)"

4/ "U.S. equity market beta has been an important driver of return across the board — in public markets and private; in hedge funds; in real estate; in U.S. and non-U.S. equities; and in some segments of fixed income."

5/ "The trend toward smaller fixed-income allocations and lower creditworthiness are consistent with the crowding out of the Aggregate bond index evident in Exhibit 2. That is, reported fixed income allocations have declined, and what remains has become more equity-like."

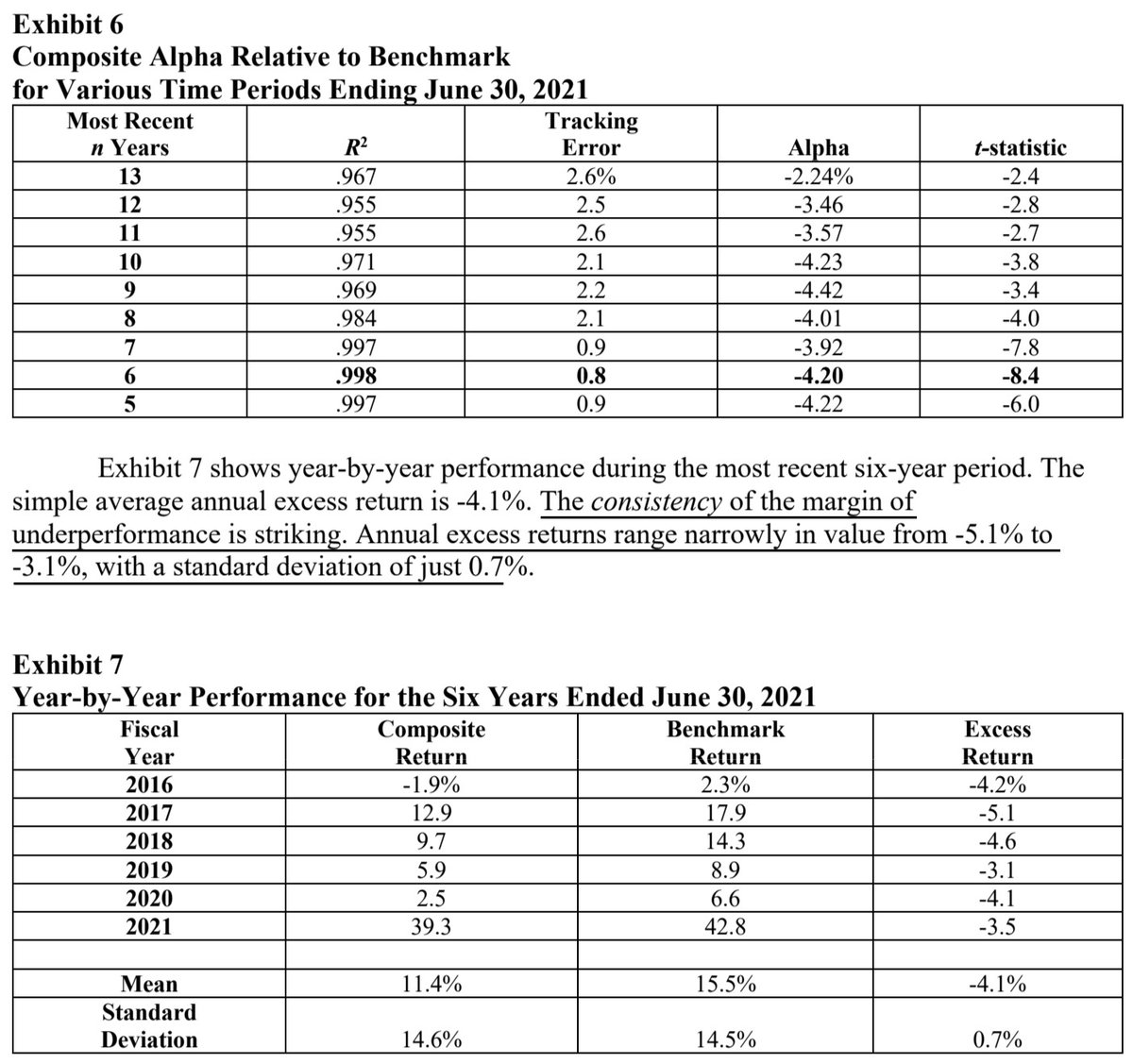

6/ "Exhibit 6 shows regression statistics of the composite relative to benchmark with the index weights shown in Exhibit 2.

"For the last six years, alpha reaches a value of -4.2% with a t-statistic of -8.4: an extraordinary degree of statistical significance."

"For the last six years, alpha reaches a value of -4.2% with a t-statistic of -8.4: an extraordinary degree of statistical significance."

7/ "The endowment composite’s Sharpe ratio of .67 is approximately 70% as large as those of the other two return series. In other words, the opportunity cost experienced by the endowment composite is approximately 30% of the risk premium available during the period."

8/ "The margin of underperformance reported here, about 4% per year, exceeds the upper end of the range of their estimated cost by about one percentage point per year. I find this result a bit puzzling unless the cost estimate is low."

9/ "Funds’ home-country bias takes on added importance in light of extraordinary valuation levels.

"At CAPE of 37, investors buying U.S. equities are paying 54% more for earnings than are investors in other markets. Endowments are paying up heavily to bet on their home market."

"At CAPE of 37, investors buying U.S. equities are paying 54% more for earnings than are investors in other markets. Endowments are paying up heavily to bet on their home market."

• • •

Missing some Tweet in this thread? You can try to

force a refresh