1 - @EvmosOrg, the long awaited EVM Hub of @cosmos, brings full EVM-compatibility to Cosmos. Built on Cosmos’s IBC, Tharsis’s Evmos has the potential to take an already robust multi-chain ecosystem to the next level. My thread on everything you need to know about $EVMOS 🧵

2 - In 2016, Evmos originated as Ethermint which aimed to bring the scalability of Tendermint’s consensus protocol to $ETH, or EVM-based applications. Over time as ETH scaling solutions like $MATIC emerged, the original Ethermint chain’s value proposition was no longer unique

3 - Pivoting to position the project in a cutting edge space, Evmos now aims to deliver multiple highly secure, fast finality, EVM-based chains that provide interoperability & greater composability for smart contracts in the Interchain. The need has even been addressed by Vitalic

4 - Though intended for the Ethereum beacon chain, in this proposal Vitalic details the need for a Tendermint-like consensus model. This is among other things is exactly what $EVMOS strives to deliver

https://twitter.com/VitalikButerin/status/1428939068897849345?s=20&t=gbPzUa-uieWGCJIYO-kpjw

5 - The Evmos team is led by Federico Kunze Küllmer & Akash Khosla. Federico's a full-time Cosmos contributor since 2017, Akash was previously a Software Engineer at @Anchorage. Together they share a focus in organic community-led growth, displayed by their efforts @CalBlockchain

6 - They envision Evmos becoming an “application-agnostic chain that will be interoperable with the ETH Mainnet, EVM-compatible environments, & other BFT chains via IBC, making it easy for users and developers to easily move value between chains.” Yes that means Evmos <> Ethereum

7 - Between the ever-growing Solidity developer base, the number of deployed applications on $ETH (as well as other EVM-compatible chains like $FTM & $AVAX), and the clear need for an EVM chain within IBC, Evmos, upon launch, is poised for immediate adoption & growth

8 - The primary benefactor of said growth is the $EVMOS token. The Evmos team believes its incentive systems & the token distribution model will be the first step towards building an L1 that aligns with, rather than alienates, stakeholders. That’s a big statement

9 - The $EVMOS token will be the first token on an EVM that drives governance outcomes for the EVM. They’re targeting the vast majority of tokens to be owned and controlled by everyone other than the team. This best guarantees inclusion & alignment with devs, users, & validators

10 - The $EVMOS token will be utilized in the following ways:

- Paying devs & network operators via built-in shared fee revenue model (the dApp Store)

- Voting on protocol upgrades

- Registering tokens on the ERC20 module for EVM-IBC integration

- Usage incentives for apps

- Paying devs & network operators via built-in shared fee revenue model (the dApp Store)

- Voting on protocol upgrades

- Registering tokens on the ERC20 module for EVM-IBC integration

- Usage incentives for apps

11 - The $EVMOS token will have an initial supply of 200 million tokens at genesis, split between the Rektdrop, community pool & strategic reserve. In its 1st yr, 300M tokens will be issued (highly inflationary). Inflation will decrease yearly under an exponential decay schedule

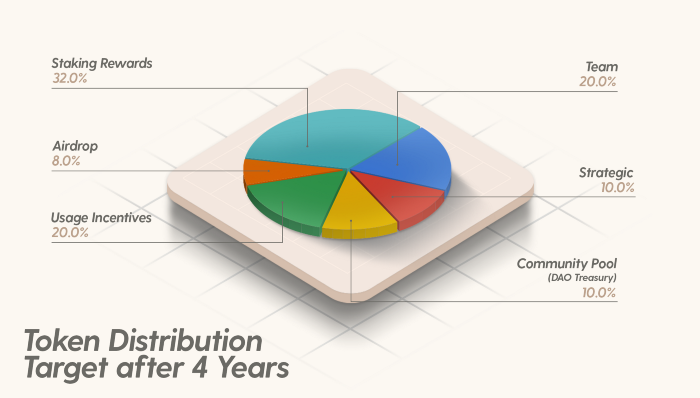

12 - Evmos’ target is to distribute 1B tokens over the first four years where it’ll reach it’s “Half Life.” Newly released tokens will be distributed in the following way, on a per-block basis (image 1). After 4 years, however, distribution will be modified as seen in image 2.

13 - Usage Incentives will initially be used to sponsor gas payments for end users. The community, via governance, decides which dApp(s) will receive gas subsidies for their users for a single epoch (1 week). This mechanism aims to drive network usage toward these dApps.

14 - Soon, Usage Incentives will aim to drive TVL. $EVMOS tokens will be allocated to a contract where DEX LPs or other liquidity IOUs. (i.e. a UNIv2 LP position or AAVE aToken) would be locked. Governance controls this and it will effectively serve as a decentralized $AVAX Rush

15 - While Usage Incentives will total 200M $EVMOS tokens, it could grow to be larger if governance decides that it'd be of benefit to the network. As we’ve seen such incentivization unlock significant growth across many chains & protocols, this aspect poses massive potential

16 - Fees on Evmos will be split as rewards between developers & network operators via a shared fee revenue model called the dApp Store. Fee distribution will be implemented as a 50/50 split between contract deployers + validators and is also governance controlled (common trend)

17 - For more information on $EVMOS tokenomics and omitted facets of it like the strategic reserve, community pool, etc. visit Tharsis’ blog article here: evmos.blog/the-evmos-toke…

Also follow their Twitter - @EvmosOrg to stay up to date with everything $EVMOS-related

Also follow their Twitter - @EvmosOrg to stay up to date with everything $EVMOS-related

18 - Evmos’ ERC20 module allows DeFi protocols to integrate with Evmos + the @cosmos eco. W/ the x/erc20 module, devs can build smart contracts on Evmos & use the generated tokens for other IBC connected apps (i.e. earning $OSMO staking rewards or using $ATOM for governance)

19 - Also (pretty cool capability IMO), validators can even define their minimum fees in ERC20 tokens in the application configuration to allow users to pay tx fees with stablecoins and other ERC20s deployed on Evmos. Think $UST, $USDC, etc. all being used for EVMOS gas fees…

20 - New ERC20 Token Pairs are added via a governance proposal. If the governance proposal passes, the Token Pair is added to the x/erc20 module. Therefore, for the $UST Token Pair to be added onto EVMOS, it would first have to pass a governance vote. More community power!

21 - Soon, non-Cosmos native tokens will be able to be added. With Evmos’s upcoming EVM bridge deployments, users can transfer existing ERC20s on $ETH, L2s, and other EVM-based chains - $FTM, $AVAX, etc. to Evmos and use the x/erc20 module to convert them into native Cosmos Coins

22 - Through EVMOS, users can:

- Convert $ATOM into tokens & use them to buy NFTs

- Liquid stake $OSMO

- Use the staking voucher as an ERC20 token on a DeFi protocol

- Build new applications that experiment with Interchain composability of application-specific blockchains

- Convert $ATOM into tokens & use them to buy NFTs

- Liquid stake $OSMO

- Use the staking voucher as an ERC20 token on a DeFi protocol

- Build new applications that experiment with Interchain composability of application-specific blockchains

23 - As EVMOS is still pre-launch + still nascent in terms of ecosystem development, I will create a follow-up thread in the coming weeks/months as more info is available. EVMOS will launch at the end of this month (February 2022) and will be the first EVM Hub on Cosmos and IBC.

24 - With such positioning & tech focused on interoperability, not just within Cosmos but also with EVM platforms, $EVMOS could quickly begin to gain market share in the EVM space. Once EVM-native dApps & tokens integrate w/ EVMOS, the table will be set for this to take place

25 - Bringing Solidity & EVM to Comos & IBC unlocks a powerful market segment. With the proven utility of IBC + increased interest among devs & users, EVMOS serves as an important bridge. With many legacy dApps & tokens now accessible, the network effect potential here's enormous

26 - EVMOS truly can fill in one of the last remaining pieces of the puzzle for Cosmos & IBC. It is pre-launch, however, meaning it has much to prove before its role is solidified. Between the tech, tokenomics, market positioning, & more, $EVMOS is a token to keep your eye on

Q&A 1 - $EVMOS x $SCRT - ERC-20 Token Pairs onboarded onto EVMOS are able to be used throughout IBC. This means SCRT’s privacy layer will be able to be added to tokens initially native to $ETH or other EVM L1s like $FTM. Through a governance vote, $sCVX can be brought to SCRT.

Q&A 2 - $EVMOS x Celesita - Together they’re building a settlement layer for EVM rollups called “Cevmos." The settlement chain will be implemented as a Celestia rollup using Optimint instead of the Tendermint Core consensus engine that is used on existing Cosmos chains

Q&A 2 (cont) - The settlement chain won’t compete for gas w/ non-rollup txs, resulting in lower fees & more scale. The Cevmos chain will be connected via IBC to Evmos, utilizing the $EVMOS token for security & gas. That means interoperable smart contracts on Cosmos + the EVM eco

• • •

Missing some Tweet in this thread? You can try to

force a refresh