A MEGA Thread on $QNT.

Imagine an enterprise level gateway that can connect and allow organisations to interact with each other,

We will explore in this 🧵, how @quant_network has gained traction within its' industry and how their vision complements their financials.

/THREAD

Imagine an enterprise level gateway that can connect and allow organisations to interact with each other,

We will explore in this 🧵, how @quant_network has gained traction within its' industry and how their vision complements their financials.

/THREAD

The vision is the best way to understand the true intentions of a project.

Gilbert Verdian, the CEO of Quant saw problems with the fragmentation of the blockchain market.

Interoperability would prove relevant and there was likely to be no significantly dominant blockchain.

/1

Gilbert Verdian, the CEO of Quant saw problems with the fragmentation of the blockchain market.

Interoperability would prove relevant and there was likely to be no significantly dominant blockchain.

/1

The solution arose where Quant aims to deliver enterprise- grade interoperability for the secure exchange of information and digital assets across any network, platform or protocol at scale and with no extra overhead.

They have a series of patents holding their USP.

/2

They have a series of patents holding their USP.

/2

Since inception, let's discuss the traction that Quant has gained.

2021 was massive enough.

These events say enough:

-Joined Digital Pound Foundation this year

-Partnership with regulated trading platform LCX

-Overledger network established

-Partnership with LACChain.

/3

2021 was massive enough.

These events say enough:

-Joined Digital Pound Foundation this year

-Partnership with regulated trading platform LCX

-Overledger network established

-Partnership with LACChain.

/3

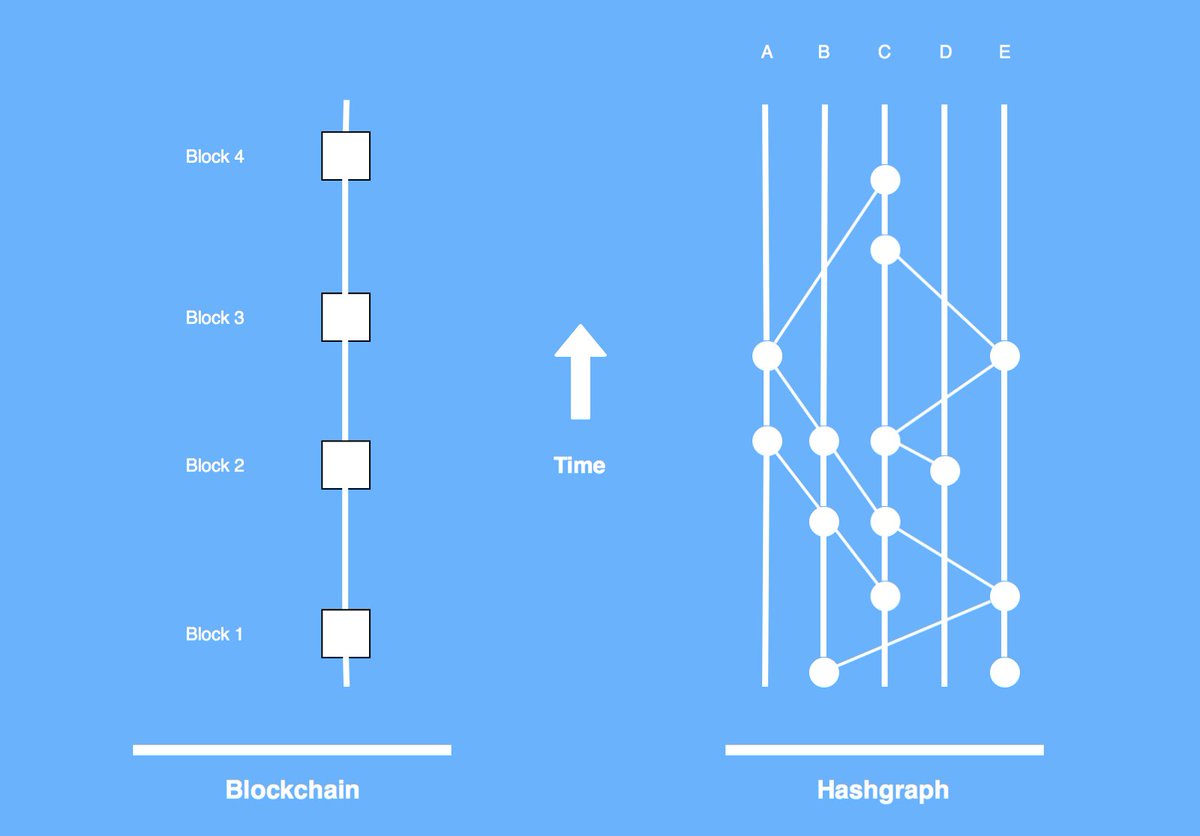

Moving on to the technological aspect.

Achieving interoperability between legacy systems and the emerging world of enterprise blockchain tech is an area of significant interest for many of the world’s leading companies.

/4

Achieving interoperability between legacy systems and the emerging world of enterprise blockchain tech is an area of significant interest for many of the world’s leading companies.

/4

The utility in $QNT for companies is in connecting the vast amount of data held within today’s mostly enterprise tech products with open-source and transparent blockchain-based platforms has the potential to create powerful business models.

Generating further revenues.

/5

Generating further revenues.

/5

Overledger Platform:

A "Distributed Ledger Technology" (DLT) designed for universal enterprise interoperability.

By interconnecting private and public data while maintaining security and speed, they can contribute to the development of a fairer financial system.

/6

A "Distributed Ledger Technology" (DLT) designed for universal enterprise interoperability.

By interconnecting private and public data while maintaining security and speed, they can contribute to the development of a fairer financial system.

/6

Overledger is not a blockchain, but a DLT gateway network that acts as a platform and marketplace.

With the Overledger portal, enterprises choose to connect distributed ledgers, regulatory constituents, existing legacy financial systems, and other data together via APIs.

/7

With the Overledger portal, enterprises choose to connect distributed ledgers, regulatory constituents, existing legacy financial systems, and other data together via APIs.

/7

The Overledger Network is designed for many uses including stablecoin minting, central bank digital currencies (CBDCs), supply chain management, payments and micropayments, marketplace creation, invoice financing, and other financial applications for banks and systems.

/8

/8

It accomplishes this through the utilization an open API framework, which allows developers to create mDapps.

The system allows developers to support for several chains for each application, meaning an mDapp could run on the $BTC, $ETH and $XRP at the same time.

/9

The system allows developers to support for several chains for each application, meaning an mDapp could run on the $BTC, $ETH and $XRP at the same time.

/9

Further, the Overledger API is compatible with Binance Smart Chain (BSC), Stellar, IOTA, EOS, and many other protocols.

$QNT MLT technology is leveraged by the International Monetary Fund (IMF) for use with CBDCs.

These are evident real use cases and acceptances of $QNT.

/10

$QNT MLT technology is leveraged by the International Monetary Fund (IMF) for use with CBDCs.

These are evident real use cases and acceptances of $QNT.

/10

Moving on to the "Industry".

Even if there are is no "exact" competition, what are some of the other blockchain-based companies in the interoperability space?

Let's explore...

/11

Even if there are is no "exact" competition, what are some of the other blockchain-based companies in the interoperability space?

Let's explore...

/11

There are 0 competitors that do what Quant does. $Dot & $Cosmos do interoperability between blockchains yes but not between “legacy systems” aka centralized databases (that run the current world) / private blockchains and public blockchains.

That connection is crucial.

/12

That connection is crucial.

/12

Financials.

The current price is $143.83

-42,911 wallet holders.

-The top 100 holders collectively own 72.49% tokens of Quant.

This is important to know, when considering upcoming dumps/buybacks.

/13

The current price is $143.83

-42,911 wallet holders.

-The top 100 holders collectively own 72.49% tokens of Quant.

This is important to know, when considering upcoming dumps/buybacks.

/13

Tokenomics.

Three main use cases.

-As the currency of payment for using network resources

- Pay for yearly licensing fees in order to make use of and participate in the Overledger Network

-Quant tokens are paid by Quant’s treasury system to gateway operators.

/14

Three main use cases.

-As the currency of payment for using network resources

- Pay for yearly licensing fees in order to make use of and participate in the Overledger Network

-Quant tokens are paid by Quant’s treasury system to gateway operators.

/14

Whilst there is no need for a full disclosure.

I'd like to mantain transparency with my reader. I currently do not own any $QNT, nor did I create this thread for promotional purposes.

However, upon my research findings I am looking for to DCA in on any further dips.

I'd like to mantain transparency with my reader. I currently do not own any $QNT, nor did I create this thread for promotional purposes.

However, upon my research findings I am looking for to DCA in on any further dips.

Liked the thread? Give me a follow: @Crypto8Fi

Want to learn more about the assets shaping crypto?

Check out our Medium here: medium.com/@crypto8fi

Help this thread get out to more $QNT faces by RTing/Faving the first tweet, linked below:

Want to learn more about the assets shaping crypto?

Check out our Medium here: medium.com/@crypto8fi

Help this thread get out to more $QNT faces by RTing/Faving the first tweet, linked below:

https://twitter.com/Crypto8Fi/status/1491059103824678912?s=20&t=yeqkDtjE0s5eMa9Nd7_38A

• • •

Missing some Tweet in this thread? You can try to

force a refresh