At the implementation of Mara Phones, the total funding for this project which was intended to create 450 jobs over five years stood at R492 million.

As a senior lender, the Industrial Development Coporation approved total facilities amounting to R238 million.

Quick [Thread]

As a senior lender, the Industrial Development Coporation approved total facilities amounting to R238 million.

Quick [Thread]

The IDC is funded through:

1) Divestment from mature investments Internal profits

2) Borrowing in domestic and

international markets.

3) Internal profits

The IDC uses the above monies to provides funding to businesses in the form of loans and equity investments.

1) Divestment from mature investments Internal profits

2) Borrowing in domestic and

international markets.

3) Internal profits

The IDC uses the above monies to provides funding to businesses in the form of loans and equity investments.

What are some of the revenue drivers of the IDC?

1) From the loan funding, the IDC derives income from;

Interest payments and

Capital repayments.

2) From the equity funding, the IDC derives income in the form of;

Dividend receipts and

Capital growth and realisation.

1) From the loan funding, the IDC derives income from;

Interest payments and

Capital repayments.

2) From the equity funding, the IDC derives income in the form of;

Dividend receipts and

Capital growth and realisation.

Funding to clients by the IDC can be structured in a number of ways such as;

Debt,

Equity and Quasi-Equity,

Guarantees,

Trade Finance and

Venture Capital.

Debt,

Equity and Quasi-Equity,

Guarantees,

Trade Finance and

Venture Capital.

The Industrial Development Corporation (IDC) enjoyed a ~5.4% ⬆️ in revenue, from R16.2 billion in FY20 to R17.1 billion for FY21.

The IDC stated that the 5.4% increase in revenue is more than the current inflation of ~4.2% and was mainly from dividends and interest income.

The IDC stated that the 5.4% increase in revenue is more than the current inflation of ~4.2% and was mainly from dividends and interest income.

Mara Phones South Africa (Pty) Ltd, is part of the global Mara Corporation and domiciled in Dubai, United Arab Emirates.

Ashish J. Thakkar is the Founder of Mara Group.

Mara is an African group with operations in technology, banking, real estate and infrastructure.

Ashish J. Thakkar is the Founder of Mara Group.

Mara is an African group with operations in technology, banking, real estate and infrastructure.

Apparently when Ashish J. Thakkar was 15 years old, he told his parents that he wanted to leave his school in Uganda to build a business.

His family gave him a $5,000 loan.

His family gave him a $5,000 loan.

In addition to the South Africa operation, Mara Corporation has a similar smartphone production facility in Rwanda.

It launched its operations in South Africa in 2019 after which it established a state-of-the-art manufacturing plant in the Dube Trade Port, Kwa-Zulu Natal.

It launched its operations in South Africa in 2019 after which it established a state-of-the-art manufacturing plant in the Dube Trade Port, Kwa-Zulu Natal.

In 2018, Mara’s CEO Ashish Thakkar pledged R1.5 billion to build South Africa's first high-tech smartphone plant at the Dube Trade Port outside Durban and associated retail infrastructure during President Cyril Ramaphosa's investment summit which he delivered in 2019.

In 2019 the Mara Phones KZN facility had over 200 youth employees and of them, 67% were women and 94% of them were unemployed but skilled.

Mara was well on its way to reach its target of employing 450 South Africans by 2024.

President Cyril Ramaphosa attended the grand opening.

Mara was well on its way to reach its target of employing 450 South Africans by 2024.

President Cyril Ramaphosa attended the grand opening.

Mara Phones received preferential brand status in SA govt's RT15-2021 communications contract meaning that state organs had to give preference to Mara’s phones if their employees wanted to take out a package until 2026.

This meant that government was the single biggest off taker

This meant that government was the single biggest off taker

2020 came and COVID-19 followed together with the hard lockdowns.

Production at the KZN facility which had commenced in October 2019 was disrupted owing to the worldwide COVID-19 pandemic. Consequently, the production volumes were impacted and were below target.

Production at the KZN facility which had commenced in October 2019 was disrupted owing to the worldwide COVID-19 pandemic. Consequently, the production volumes were impacted and were below target.

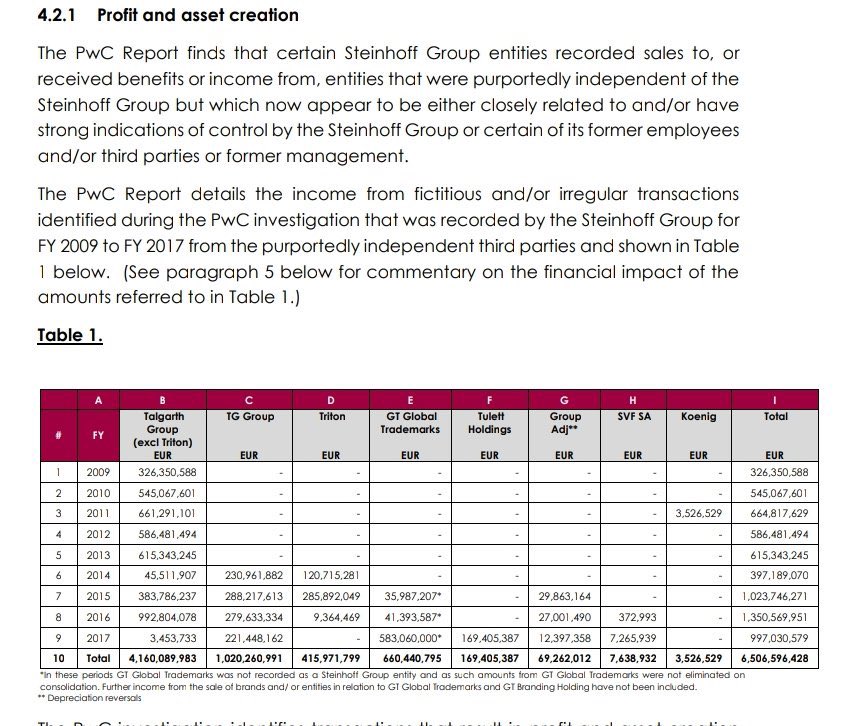

Total funding for the Mara KZN project stood at R492m with the IDC being the senior lender approved total facilities amounting to R238m.

Shortfall=R254m

Mara Phones shareholders were not able to raise their full contribution.

As such, shortfall was provided by Standard Bank.

Shortfall=R254m

Mara Phones shareholders were not able to raise their full contribution.

As such, shortfall was provided by Standard Bank.

IDC has established that in the absence of further capitalisation of Mara Phones, there is no case to be made to inject further debt funding into the company.

The Mara Phones KZN facility will be auctioned.

The Mara Phones KZN facility will be auctioned.

The IDC’s non-performing loans ratio ⬆️ from 26% in 2019/20

to 38% in 2020/21.

The IDC pre-empted this outcome as a consequence of the pandemic.

The expected credit losses ratio weakened from 32% at the end of FY20 to 37% at the end of FY21.

to 38% in 2020/21.

The IDC pre-empted this outcome as a consequence of the pandemic.

The expected credit losses ratio weakened from 32% at the end of FY20 to 37% at the end of FY21.

The IDC writes off investments when all avenues of recovery have been exhausted.

In FY21, R255 million worth of investments were written off vs R2.4 billion in FY20.

The write-offs were provided

for partially through impairments, cushioning the impact on the balance sheet.

In FY21, R255 million worth of investments were written off vs R2.4 billion in FY20.

The write-offs were provided

for partially through impairments, cushioning the impact on the balance sheet.

Auction of the Mara facility in KZN is taking place end of Feb.

A lot of questions are being asked such as

Why the rush by the lenders to recover the monies?

If the business case was solid (govt as off-taker) why don't the lenders carry on with operations?

A lot of questions are being asked such as

Why the rush by the lenders to recover the monies?

If the business case was solid (govt as off-taker) why don't the lenders carry on with operations?

https://twitter.com/MaanoMadima/status/1492087162875125763?t=5lz7wKYAGvozwHMr79DlXg&s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh