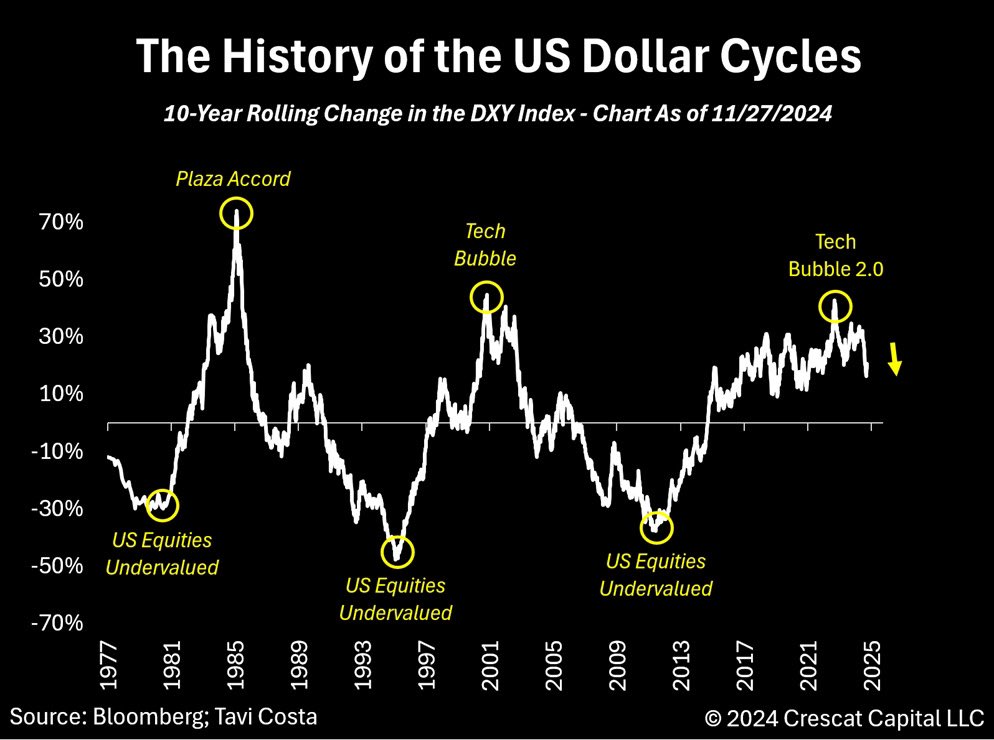

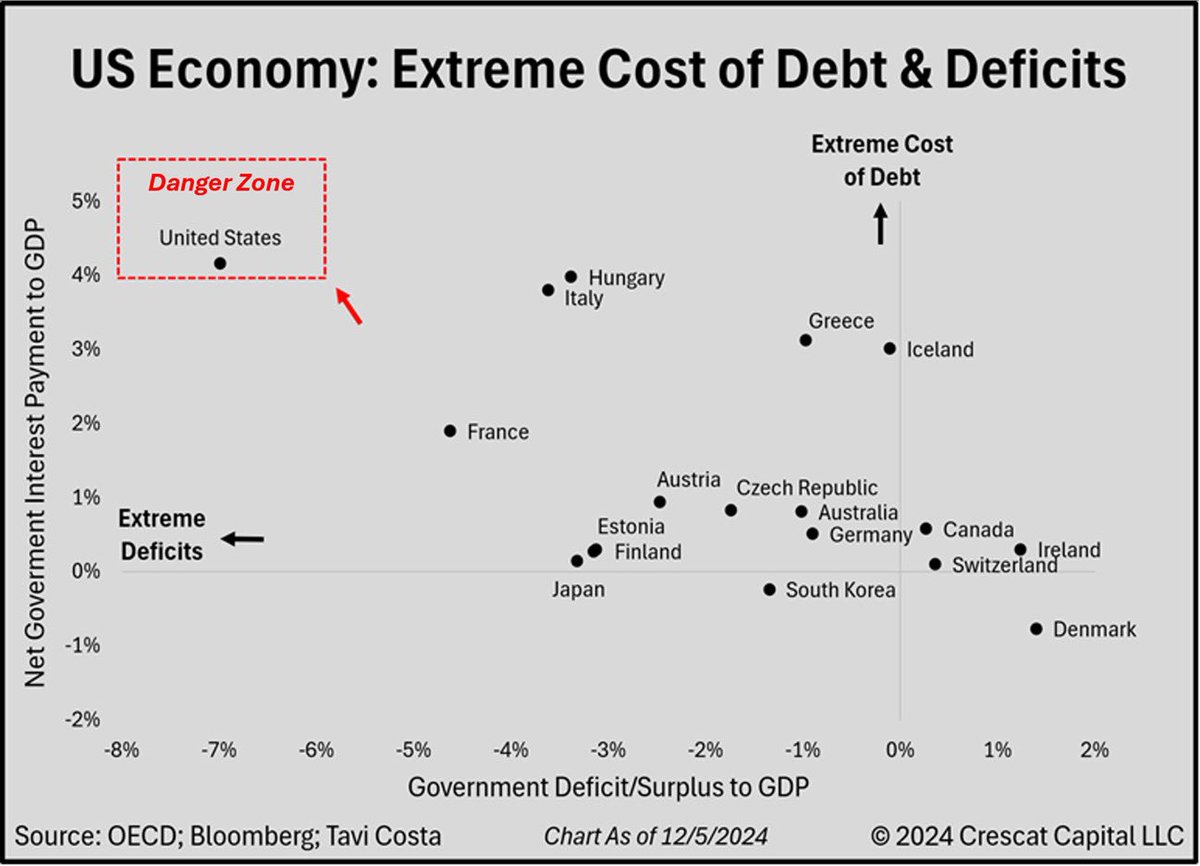

For the first time in history, the US is experiencing a confluence of three macro extremes all at once:

▪️ The debt problem of the 1940s

▪️ The rising inflationary environment of the 1970s

▪️ The excessive financial asset valuations of the late 1990s

Thread 👇👇👇

▪️ The debt problem of the 1940s

▪️ The rising inflationary environment of the 1970s

▪️ The excessive financial asset valuations of the late 1990s

Thread 👇👇👇

Any one of these three economic states endangers the health of markets and the economy.

Together they are a highly explosive mix.

The disparities have evolved from an era of misguided monetary and fiscal policies.

Together they are a highly explosive mix.

The disparities have evolved from an era of misguided monetary and fiscal policies.

At this juncture, policy makers have become their own prisoners.

How can they put a lid on the inflation while preventing cost of capital from rising at the same time?

No wonder we have the largest spread between the Taylor Rule and Fed funds rate in 51 years.

How can they put a lid on the inflation while preventing cost of capital from rising at the same time?

No wonder we have the largest spread between the Taylor Rule and Fed funds rate in 51 years.

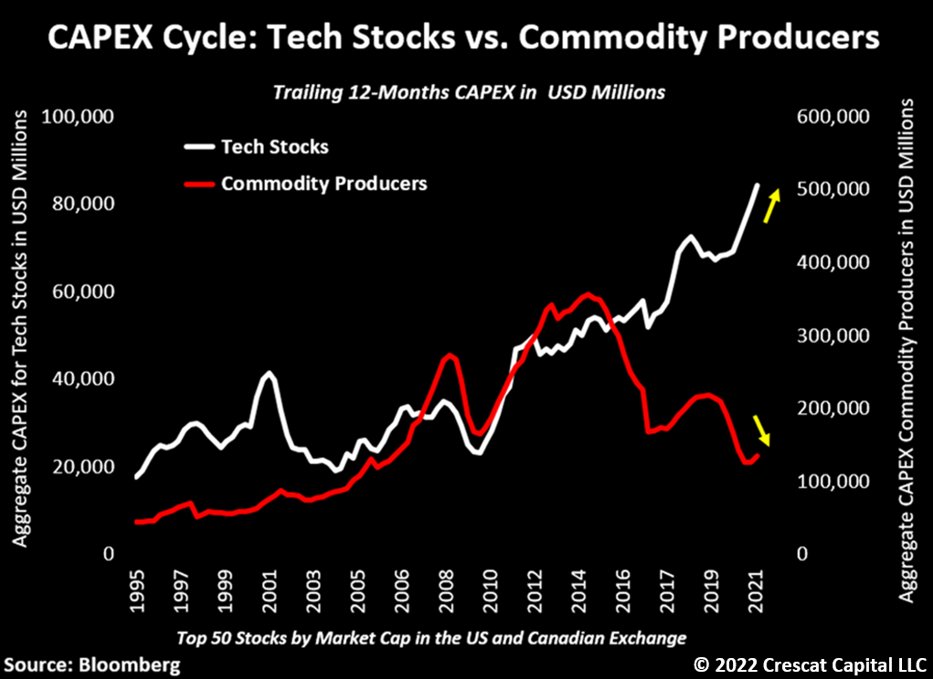

The pandemic issues have exposed some important secular trends, particularly the chronic under investments in natural resources.

For a long time, the incremental dollar entering financial markets has almost entirely been allocated into one sector of the economy, technology.

For a long time, the incremental dollar entering financial markets has almost entirely been allocated into one sector of the economy, technology.

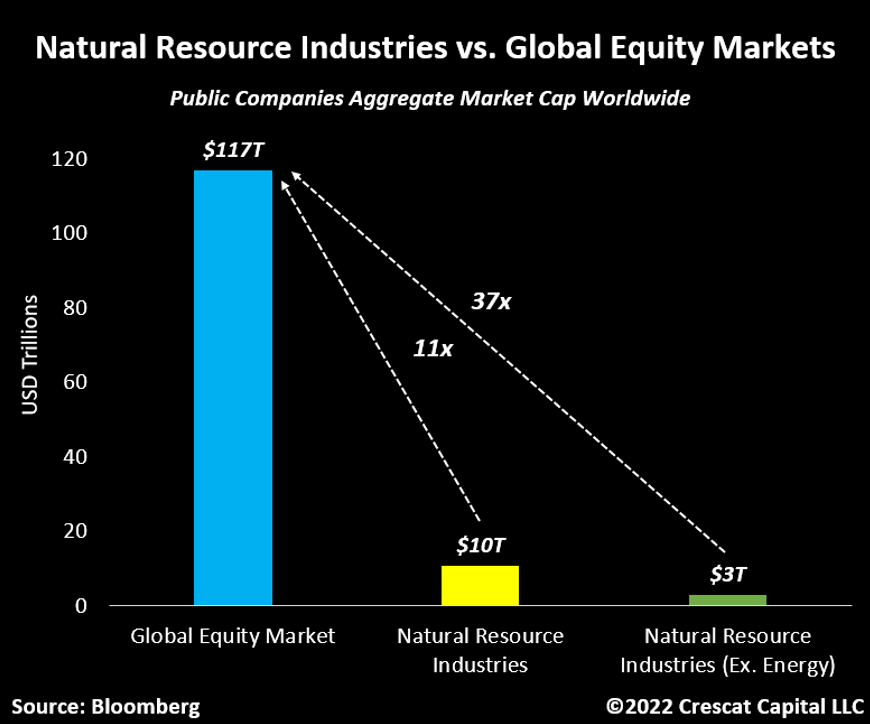

Driven mostly by tech related companies, global equity markets have grown to an aggregate amount of almost $120T.

That is 11x the size of the overall natural resource industries worldwide.

Excluding the energy sector, these industries represent only 2.5%. of the market.

That is 11x the size of the overall natural resource industries worldwide.

Excluding the energy sector, these industries represent only 2.5%. of the market.

We’re starting to see a rush of institutional capital into the resource markets as more investors look for ways to hedge inflation.

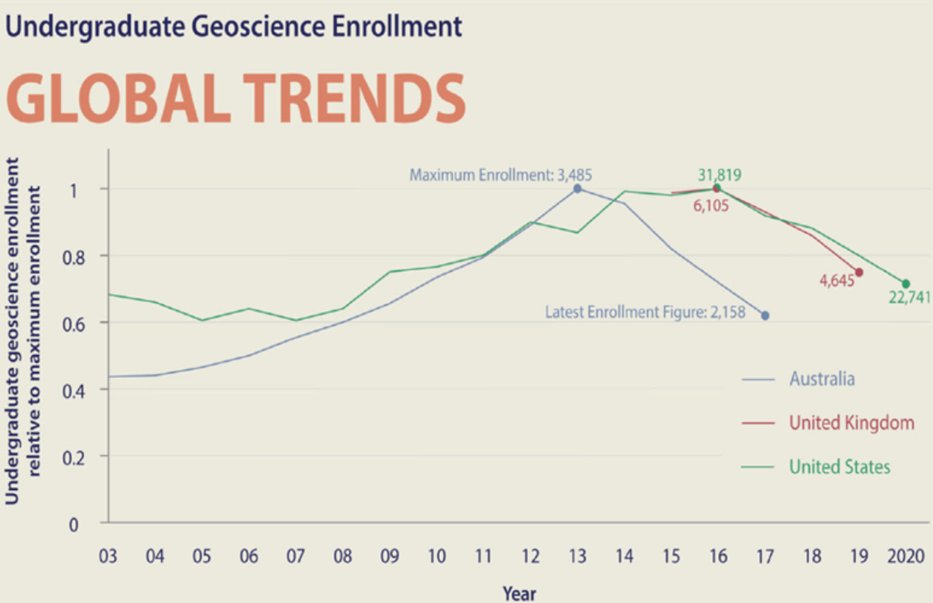

The fundamental problem is:

These industries suffer from a shortage of skilled management and labor to effectively deploy the capital.

The fundamental problem is:

These industries suffer from a shortage of skilled management and labor to effectively deploy the capital.

Too many years of inexpensive cost of capital and a financially repressive environment have lured investors into going out on the risk curve.

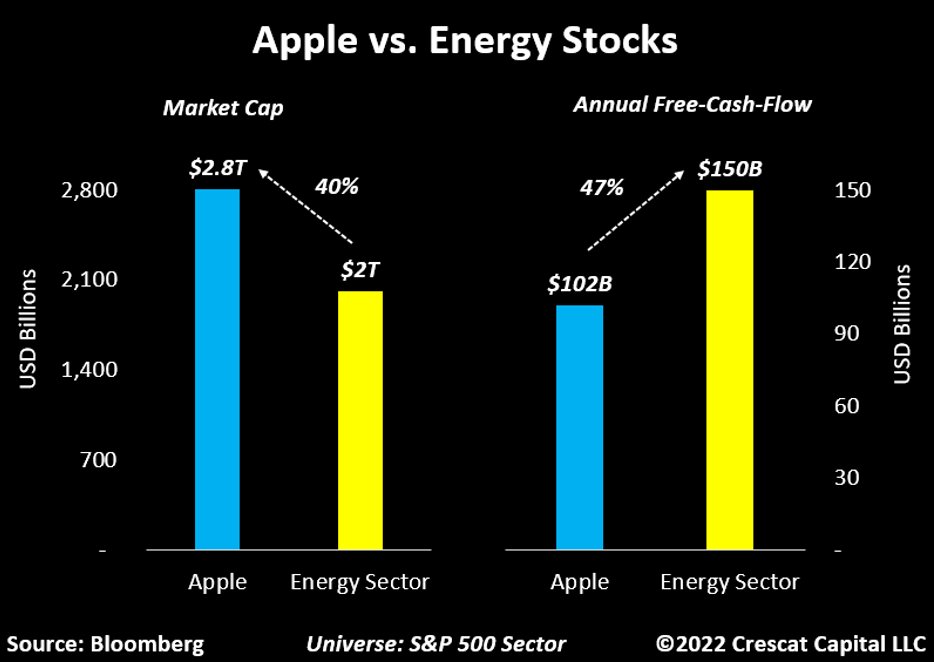

These shifts in capital allocation have created enormous market inconsistencies.

Let’s look at one example.

These shifts in capital allocation have created enormous market inconsistencies.

Let’s look at one example.

Apple’s market cap is 40% larger than the entire energy sector.

While most people justify this disparity due to fundamental differences:

Energy stocks generate almost 50% more in annual free-cash-flow than Apple.

What if oil prices break out well above $100/bbl?

While most people justify this disparity due to fundamental differences:

Energy stocks generate almost 50% more in annual free-cash-flow than Apple.

What if oil prices break out well above $100/bbl?

Or, as we mentioned before:

When was the last time any of the bigger market cap companies deployed capital into a new mining project of significant size?

The answer is, not in very long time.

When was the last time any of the bigger market cap companies deployed capital into a new mining project of significant size?

The answer is, not in very long time.

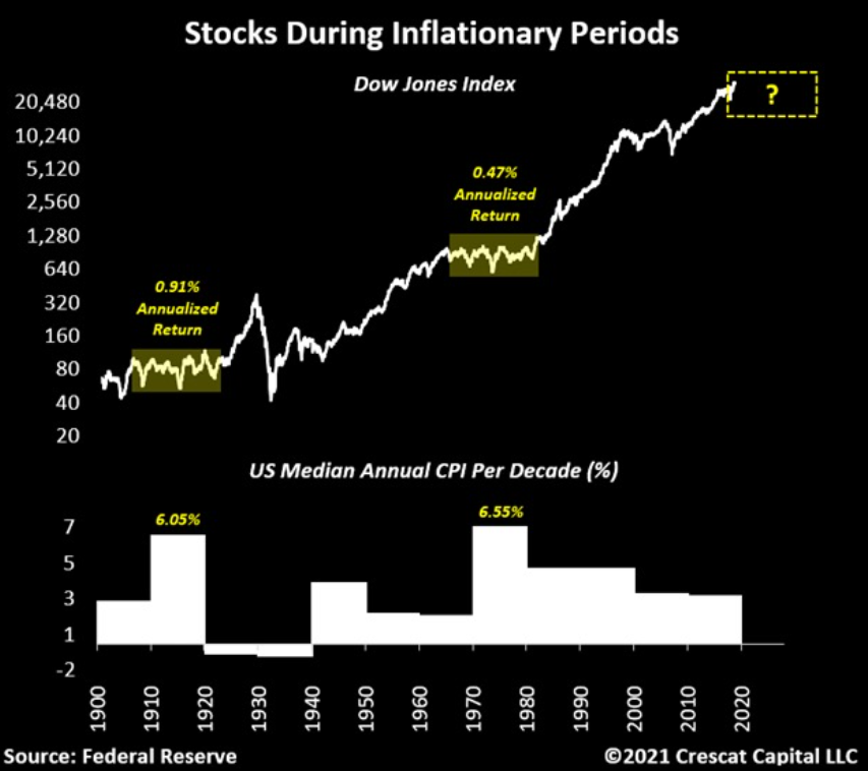

Different than the last 30 years, one of the principal reasons we believe inflation will be sustainable this time around has to do with longer-term trends in capital allocation that have built up over many years already.

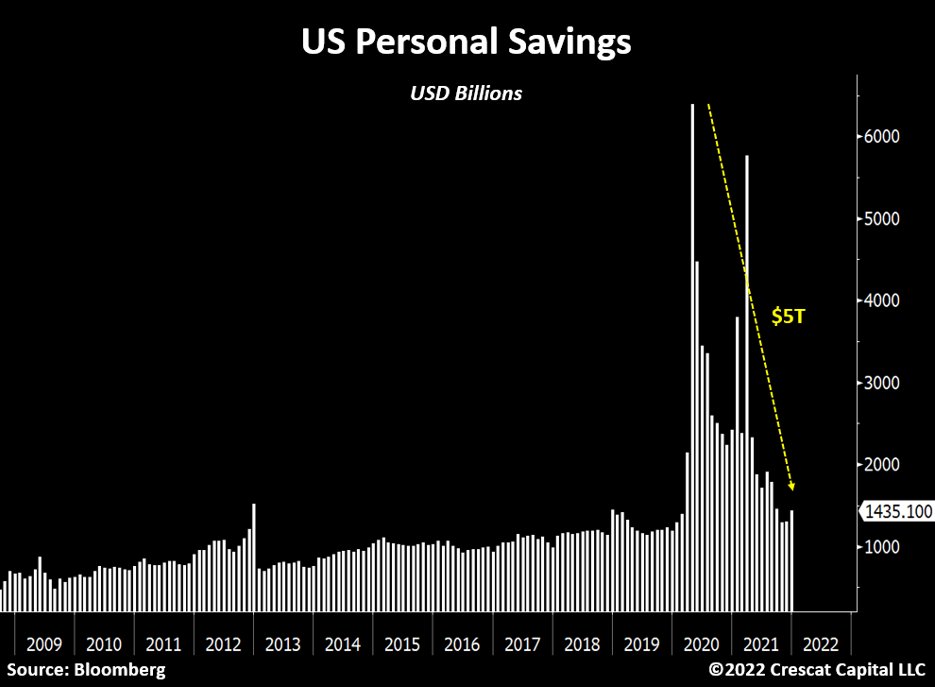

After the Covid handout of money to consumers, the government financed a once-in-a-lifetime boost to corporate fundamentals.

Sales, profit margins, earnings, and free-cash-flow have all surged recently.

But is this as good as it gets for US companies?

Sales, profit margins, earnings, and free-cash-flow have all surged recently.

But is this as good as it gets for US companies?

US households drew their personal savings from record levels to historical lows in the last 18 months, a spending spree that totaled almost $5 trillion.

To put this into perspective:

That was close to 25% of the nominal GDP pre-pandemic.

To put this into perspective:

That was close to 25% of the nominal GDP pre-pandemic.

With absence of organic growth in the economy, this fundamental improvement is at peak levels and most of the positive news is behind us.

Also:

The Fed is being forced to tighten monetary conditions late in the business cycle due the worst inflationary problem in over 40yrs.

Also:

The Fed is being forced to tighten monetary conditions late in the business cycle due the worst inflationary problem in over 40yrs.

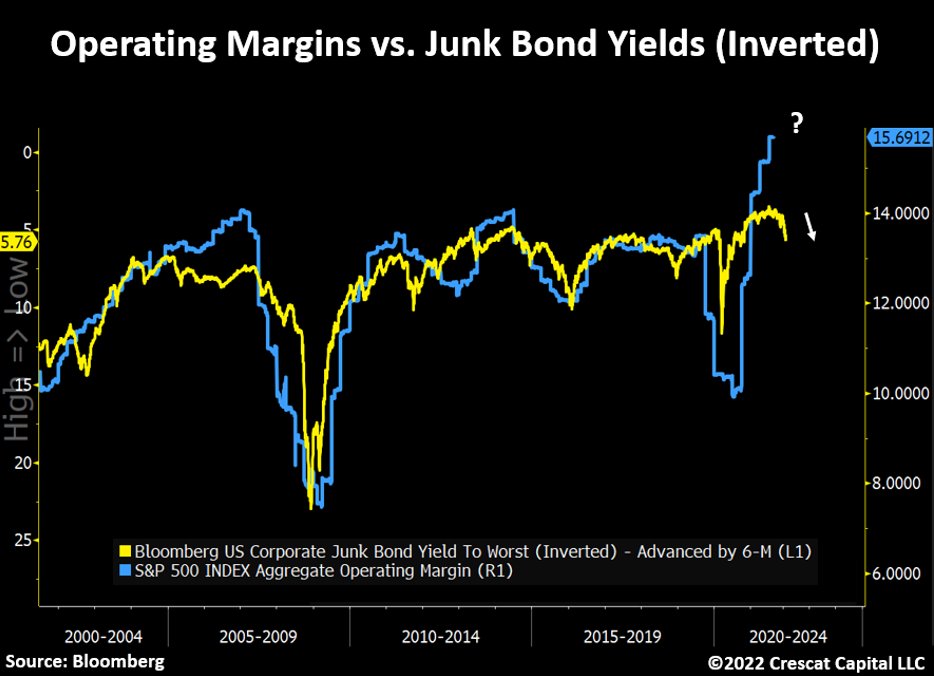

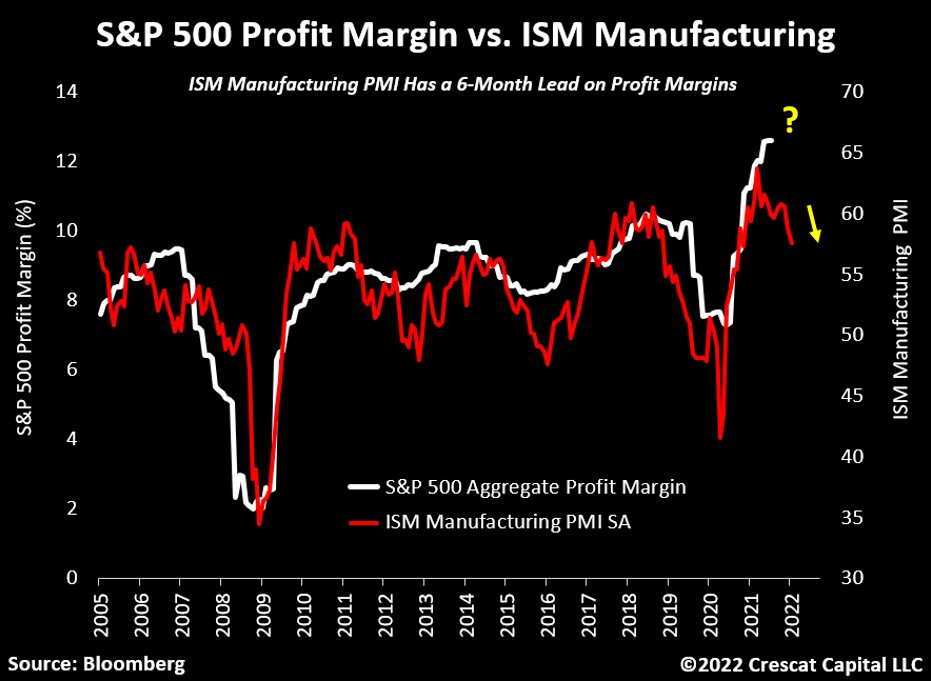

Historically, tightening financial conditions lead to profit margin contractions.

A strong reason for us to believe US companies are currently at peak earnings.

A strong reason for us to believe US companies are currently at peak earnings.

Additionally:

The ISM manufacturing PMI tends to lead profit margins for S&P 500 companies by 6 months and is in a bearish divergence.

The ISM manufacturing PMI tends to lead profit margins for S&P 500 companies by 6 months and is in a bearish divergence.

This notion that stocks benefit from inflation is a total fallacy.

If a business today is not growing at double digits, it is simply not keeping up with true inflation.

If a business today is not growing at double digits, it is simply not keeping up with true inflation.

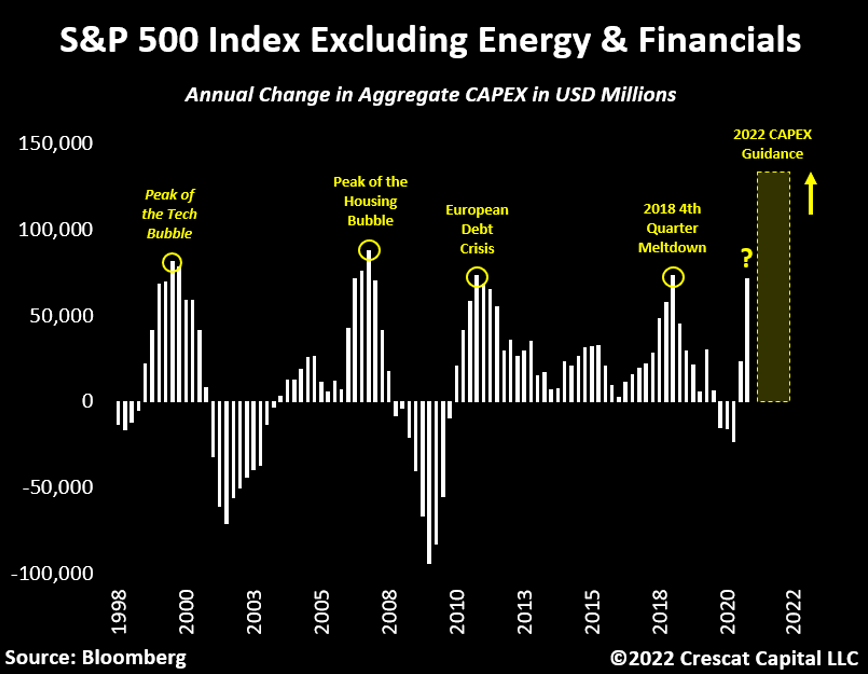

Excluding the energy and financials, the median FCF growth for the S&P 500 is now contracting by -1.61%.

Note that these numbers are in nominal terms.

With headline CPI running at 7.5% YoY, their bottom-line fundamentals are down almost double digits in real terms.

Note that these numbers are in nominal terms.

With headline CPI running at 7.5% YoY, their bottom-line fundamentals are down almost double digits in real terms.

More importantly:

Wall Street analysts now expect the largest annual increase in CAPEX of the last 30 years, a sign of the peak of the cycle for all sectors outside of energy and materials.

Wall Street analysts now expect the largest annual increase in CAPEX of the last 30 years, a sign of the peak of the cycle for all sectors outside of energy and materials.

Another reason to believe profit margins are likely to get squeezed:

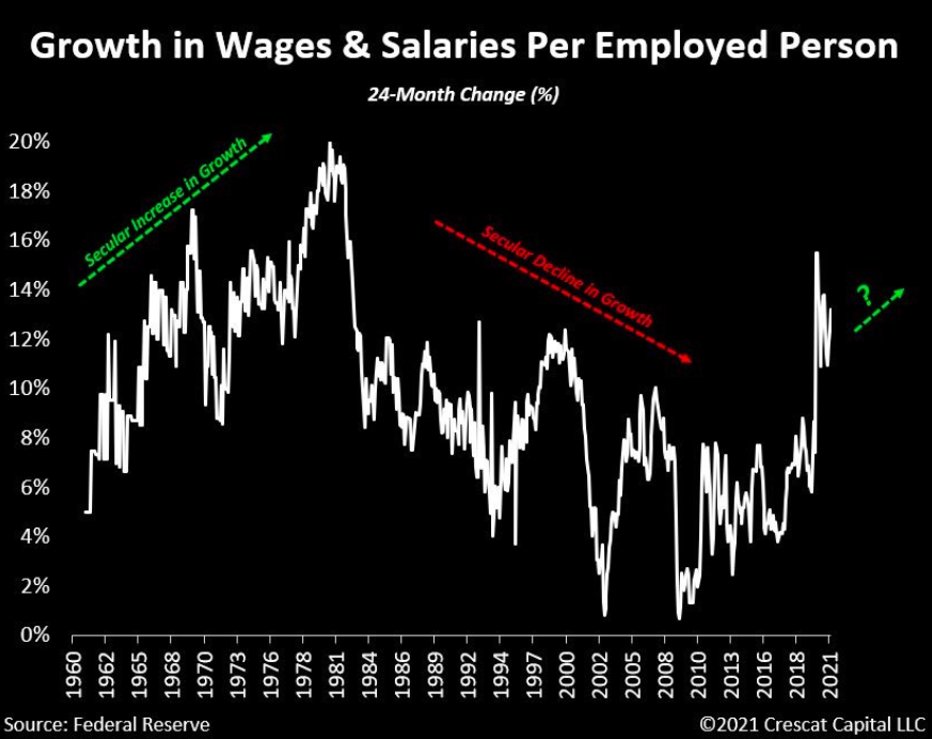

After more than 30 yrs of declining wage and salary growth, labor cost has finally begun to trend upward.

Similar to the late 1960s, we think this is marking the onset of secular growth in labor remuneration.

After more than 30 yrs of declining wage and salary growth, labor cost has finally begun to trend upward.

Similar to the late 1960s, we think this is marking the onset of secular growth in labor remuneration.

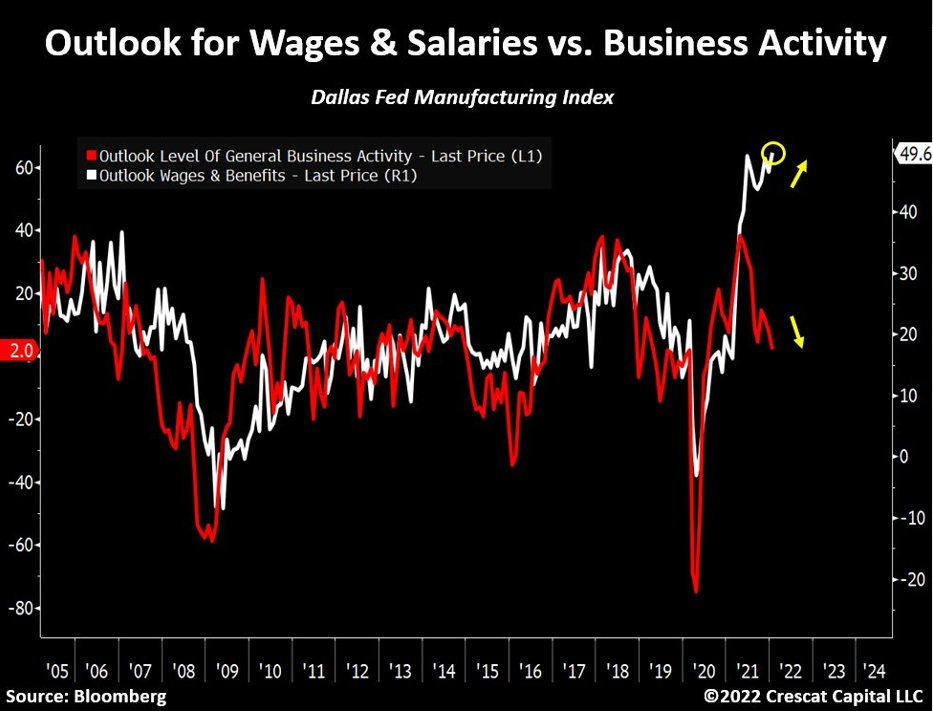

The outlook for wages and salaries just reached new highs while business activity continues to weaken.

This is another important development that points to a coming squeeze in corporate profit margins from peak levels.

This is another important development that points to a coming squeeze in corporate profit margins from peak levels.

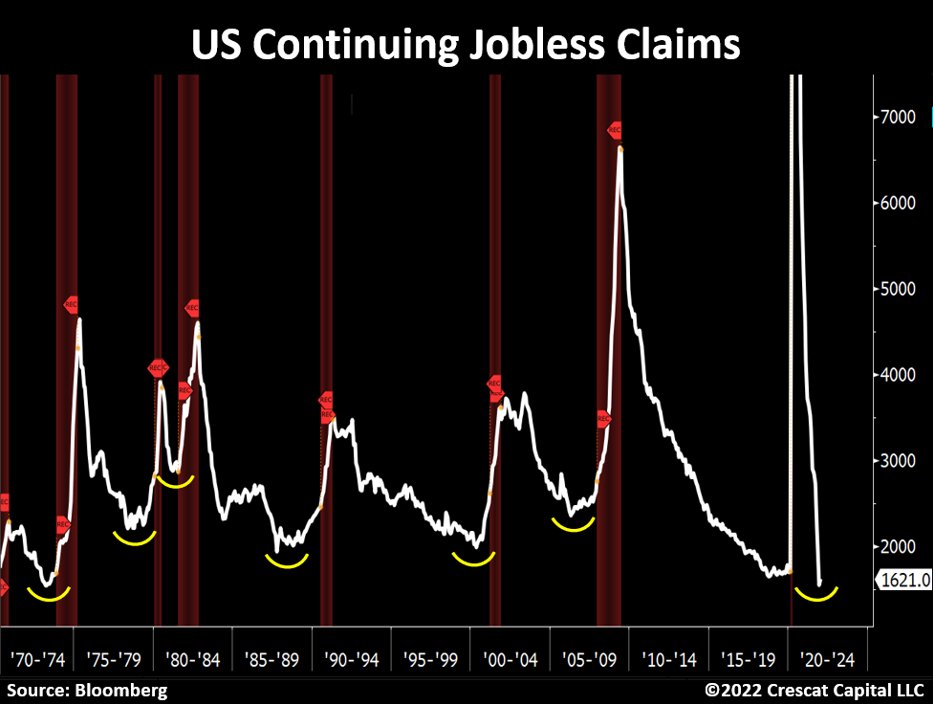

A tight labor market often precedes recessions.

The unemployment rate, one of the best contrarian indicators in history, is now near all-time lows.

As shown below, continuing jobless claims are also flashing the same signal.

The unemployment rate, one of the best contrarian indicators in history, is now near all-time lows.

As shown below, continuing jobless claims are also flashing the same signal.

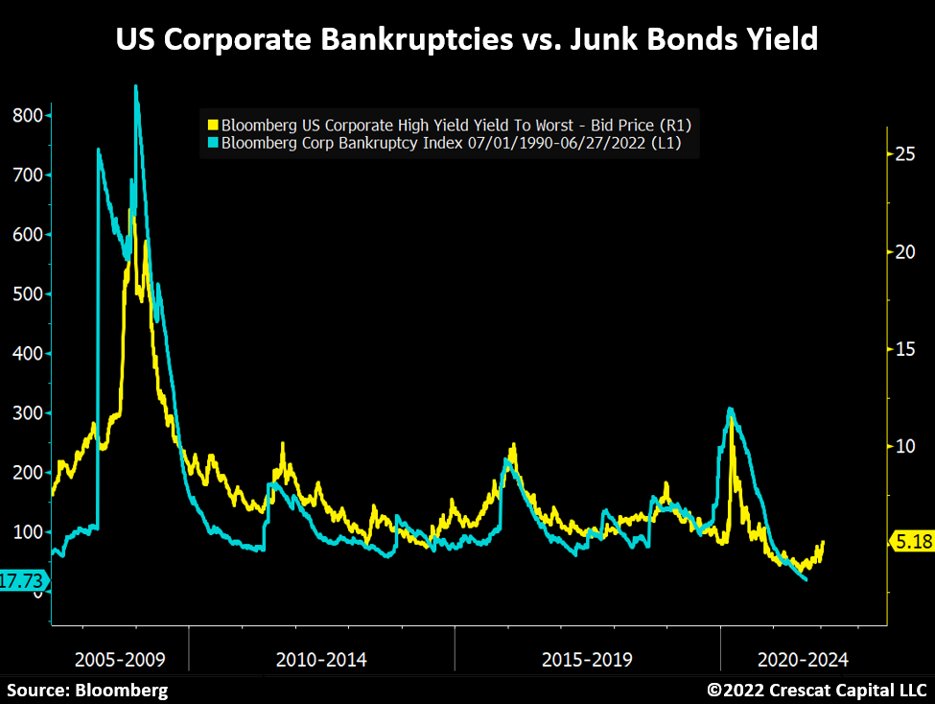

After reaching historic lows, credit spreads are starting to widen again, a foreboding recessionary sign if it continues.

Courtesy of @crescatkevin

Courtesy of @crescatkevin

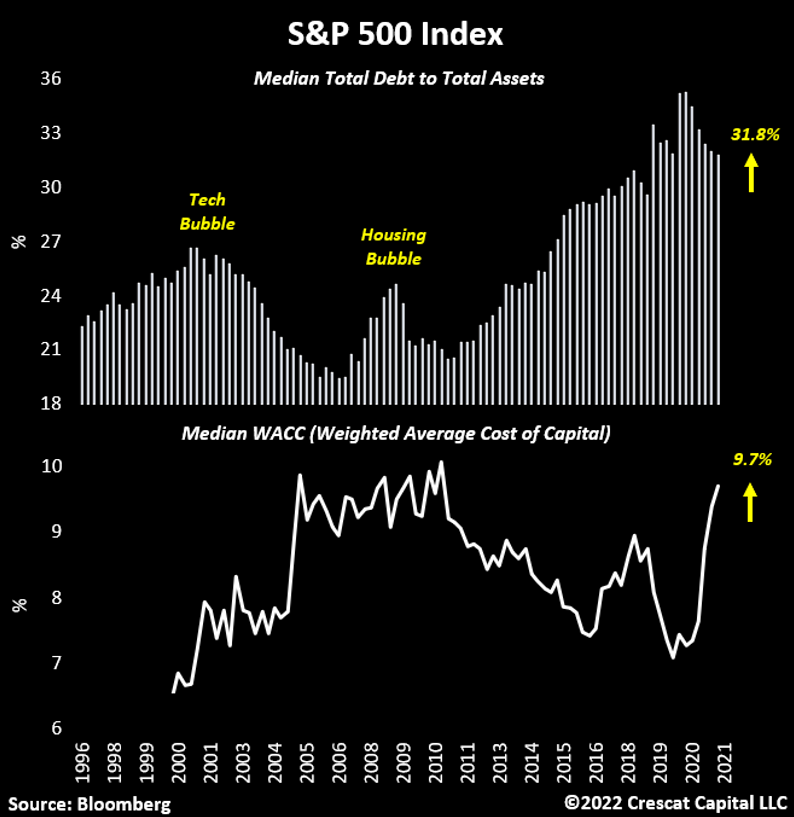

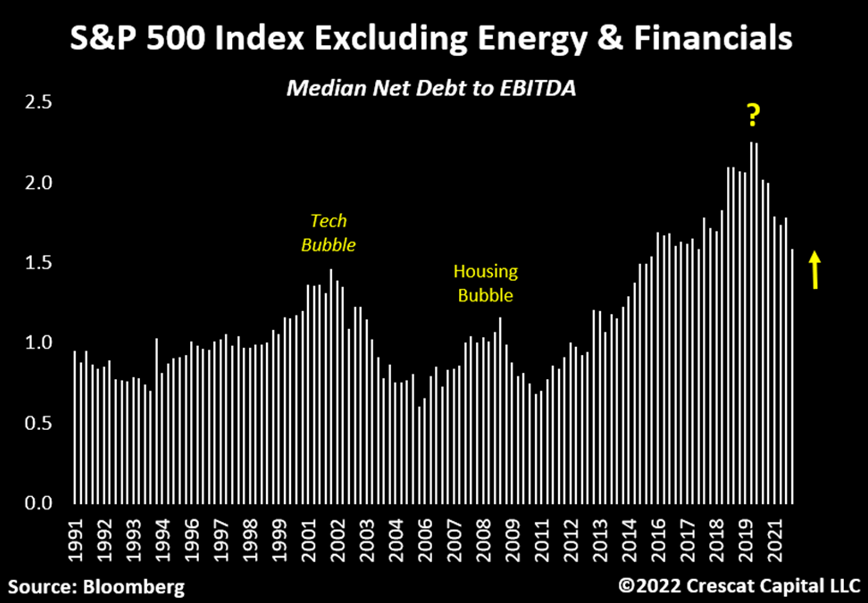

In a rising cost of capital environment, the size of balance sheets matter.

The median WACC for S&P 500 companies is now at its highest levels since 2008.

The issue is:

Corporations are significantly more indebted than they were back at the peak of the tech and housing bubble.

The median WACC for S&P 500 companies is now at its highest levels since 2008.

The issue is:

Corporations are significantly more indebted than they were back at the peak of the tech and housing bubble.

The median S&P 500 net debt to EBITDA ratio is also significantly higher than it was at the peak of the tech and housing bubble.

It’s bewildering to think that such a ratio remains historically elevated at a time when corporate income statements are massively inflated.

Imagine if we really are at peak earnings, how do we justify this level of leverage?

Imagine if we really are at peak earnings, how do we justify this level of leverage?

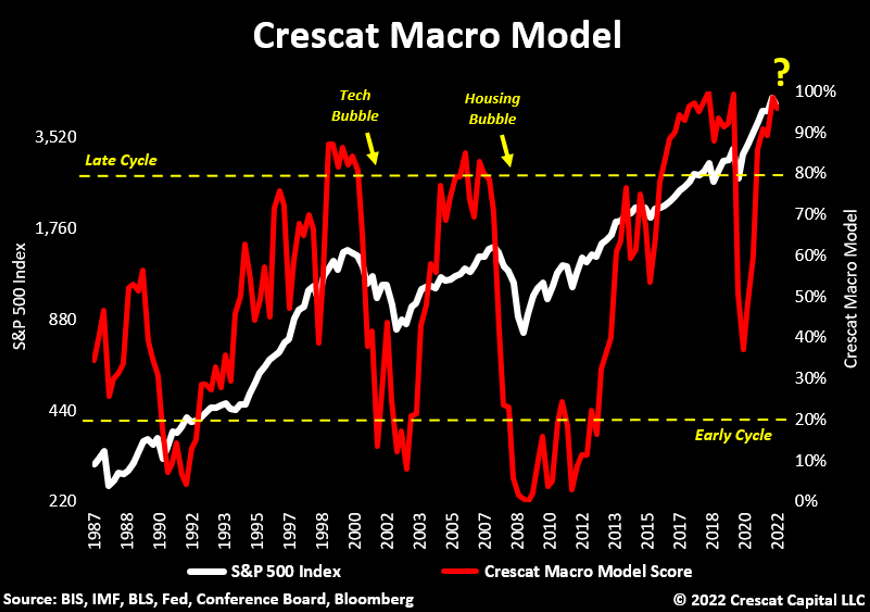

Our 16-factor macro model helps us identify what stage of the business cycle we are in.

It naturally swings between expansion and contraction tied to changes in asset valuations and credit availability.

The score of this model is now signaling an important bearish signal.

It naturally swings between expansion and contraction tied to changes in asset valuations and credit availability.

The score of this model is now signaling an important bearish signal.

Late in the business cycle, the current macro imbalances in the US economy have become true political constrains.

Meanwhile, the inflation genie is out of the bottle.

This is perhaps most bullish set up for tangible assets in history.

crescat.net/february-resea…

Meanwhile, the inflation genie is out of the bottle.

This is perhaps most bullish set up for tangible assets in history.

crescat.net/february-resea…

• • •

Missing some Tweet in this thread? You can try to

force a refresh