Co-Founder & CEO of Azuria Capital LLC. Macro thinker, history student, value-oriented investor. Native of Sao Paulo, Brazil 🇧🇷 E-mail: tavi@azuriacapital.com

45 subscribers

How to get URL link on X (Twitter) App

2) Junior miners to gold ratio also breaking out from a 14-year downward trend

2) Junior miners to gold ratio also breaking out from a 14-year downward trend

In my opinion, the answer can be distilled into 2 primary points:

In my opinion, the answer can be distilled into 2 primary points:

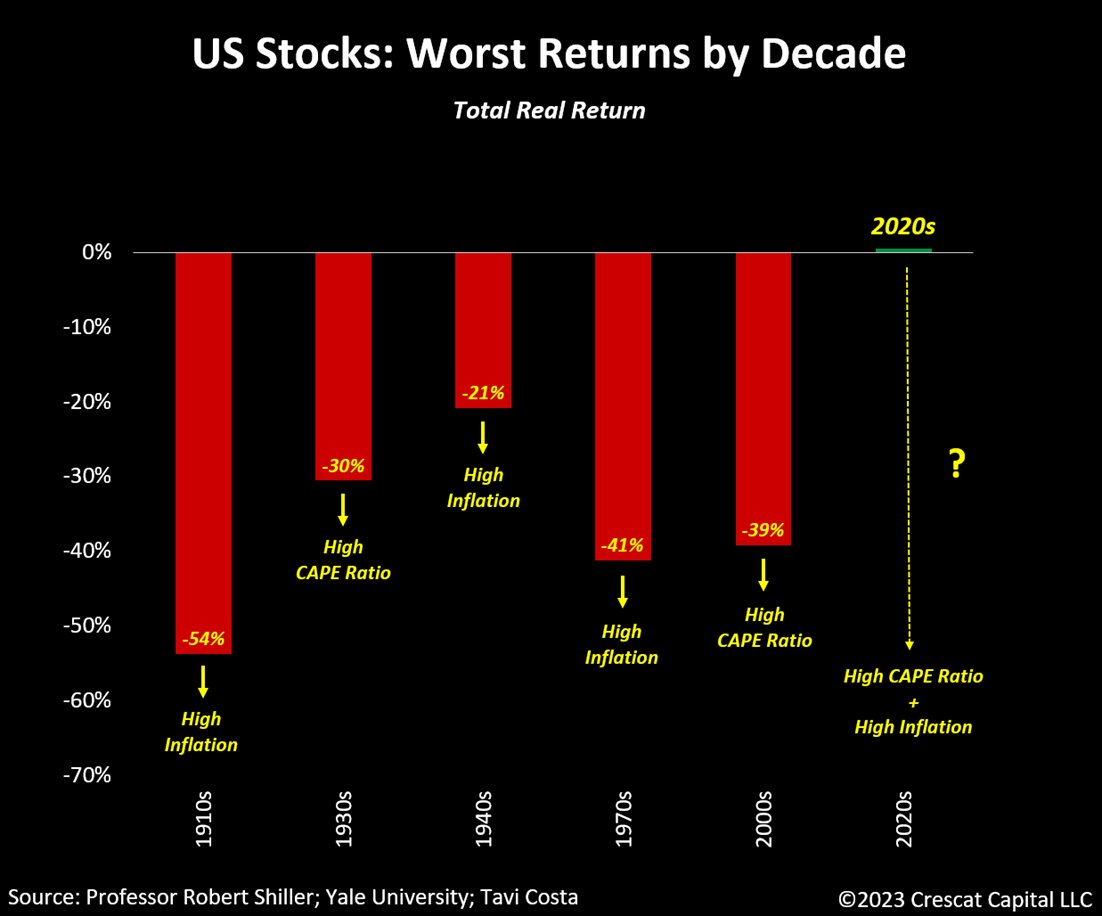

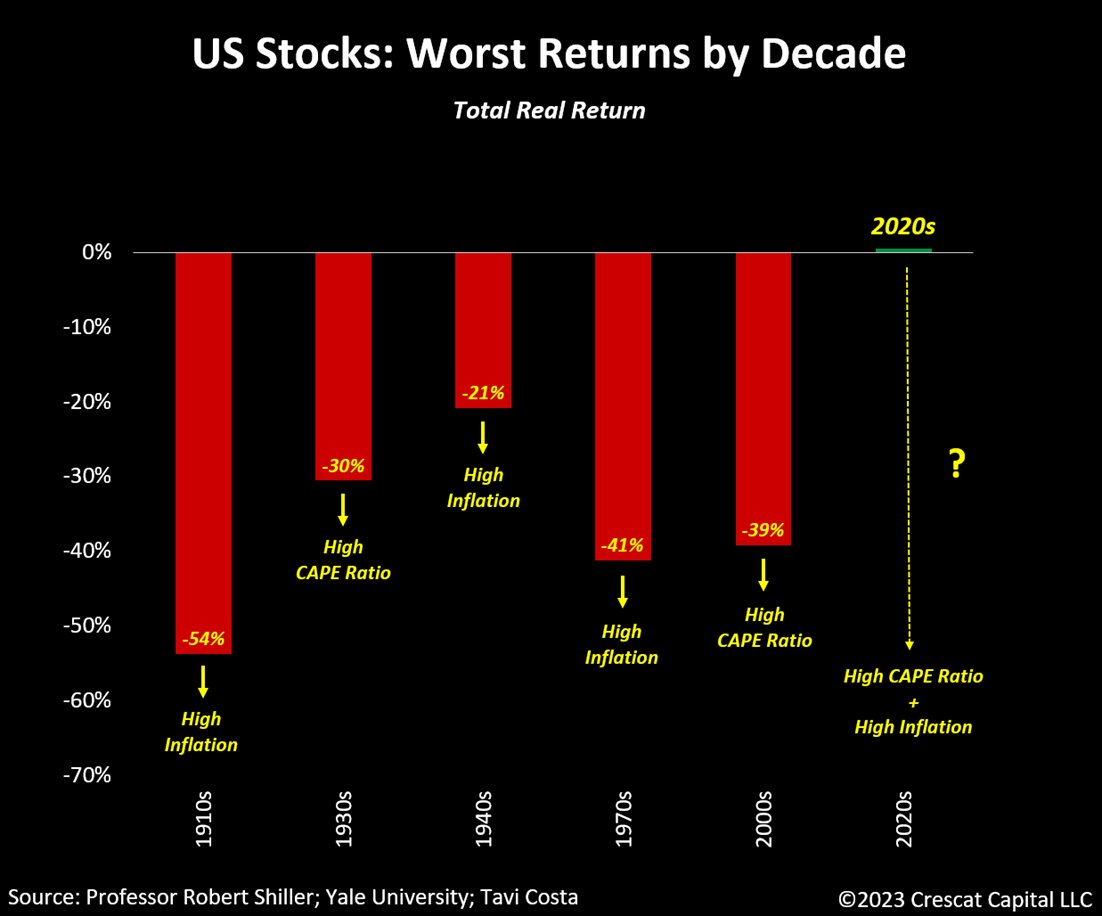

While our concerns are fueled by the pervasive speculation in the US stock market, there also exists a parallel narrative where long-neglected economies present themselves with exceptional value and promising growth opportunities.

While our concerns are fueled by the pervasive speculation in the US stock market, there also exists a parallel narrative where long-neglected economies present themselves with exceptional value and promising growth opportunities.

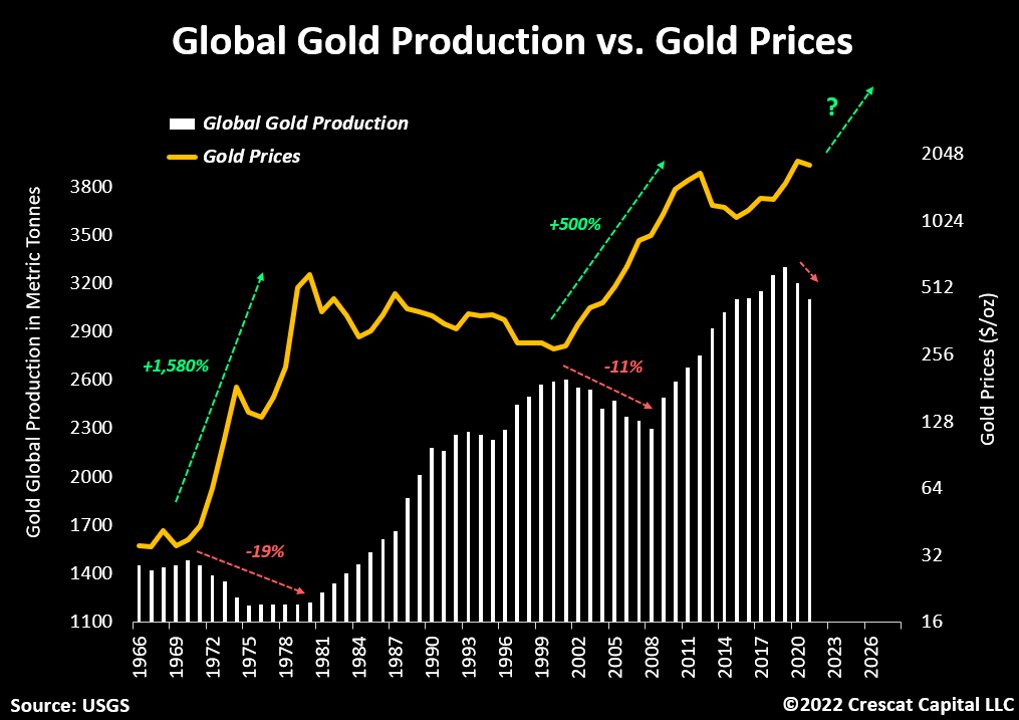

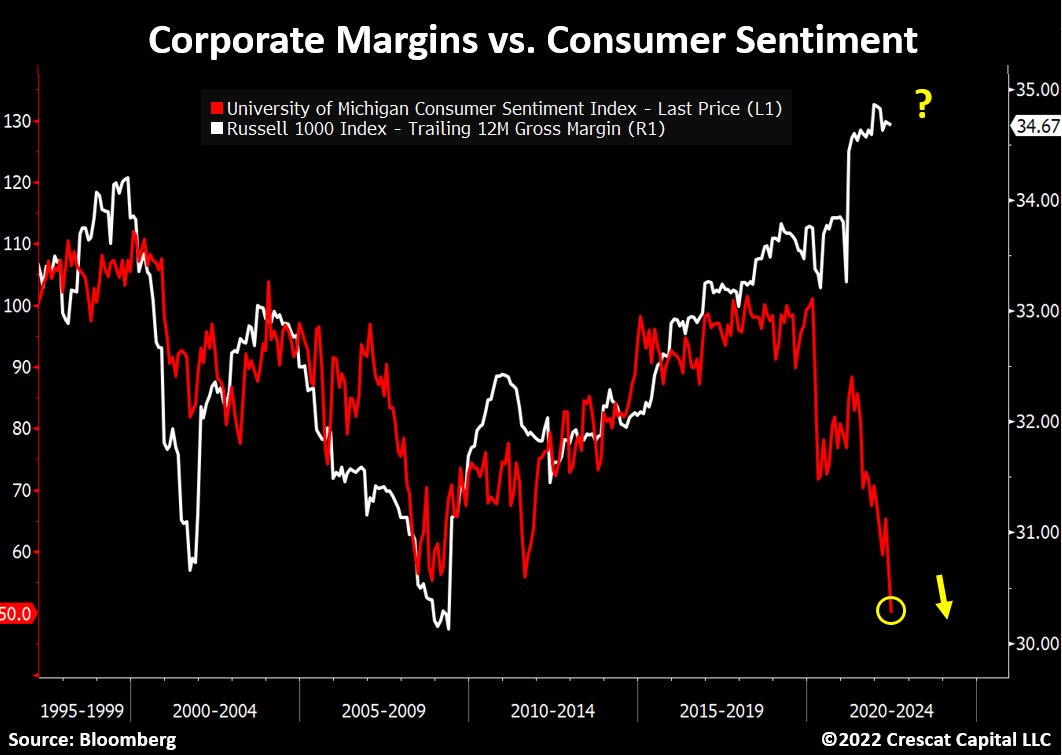

Conventional investment strategies are poised to undergo a significant restructuring, placing a prominent emphasis on investments in hard assets.

Conventional investment strategies are poised to undergo a significant restructuring, placing a prominent emphasis on investments in hard assets.

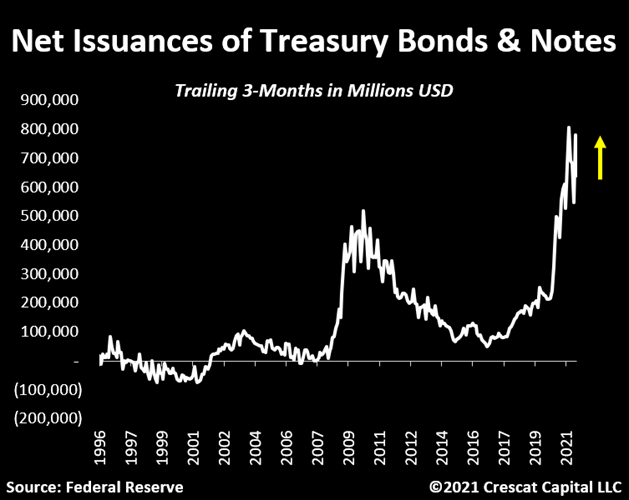

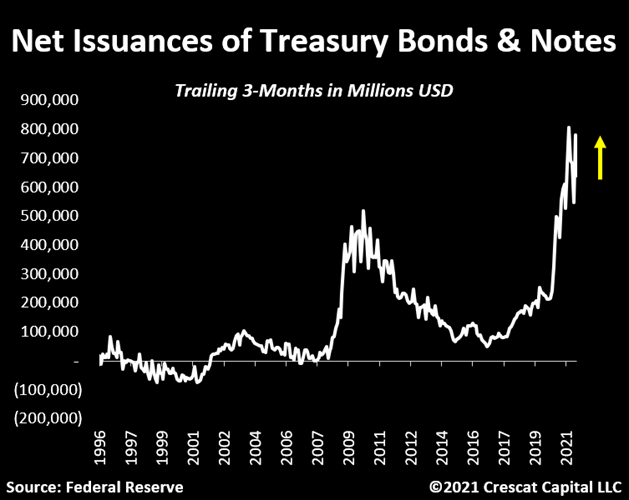

Following the COVID era, we have entered a period of fiscal dominance among major developed economies.

Following the COVID era, we have entered a period of fiscal dominance among major developed economies.

There is a significant shift underway in the composition of debt maturities issued by the US government that could profoundly increase the supply of long duration Treasuries.

There is a significant shift underway in the composition of debt maturities issued by the US government that could profoundly increase the supply of long duration Treasuries.