📡 Edenred stock up +6% today.

Very good set of results released this morning at 7am CET. Outlook 2022 is also out.

Let's review them in 3 tweets and elaborate a conclusion on them!

🧵👇

$EDEN.PA $EDEN

Very good set of results released this morning at 7am CET. Outlook 2022 is also out.

Let's review them in 3 tweets and elaborate a conclusion on them!

🧵👇

$EDEN.PA $EDEN

FY 2021

· Revenue €1,627m (1% above CSS)

· Operating revenue LFL +13.9% (vs +13.1% CSS)

· EBITDA €670m (2% above CSS).

· Strong FFO €556m (+20%YoY) meant fast delevering (1.2x ND/EBIDA)

Despite less favourable comps in Q4, #EDENRED posted 12.4% operating revenue LFL growth

· Revenue €1,627m (1% above CSS)

· Operating revenue LFL +13.9% (vs +13.1% CSS)

· EBITDA €670m (2% above CSS).

· Strong FFO €556m (+20%YoY) meant fast delevering (1.2x ND/EBIDA)

Despite less favourable comps in Q4, #EDENRED posted 12.4% operating revenue LFL growth

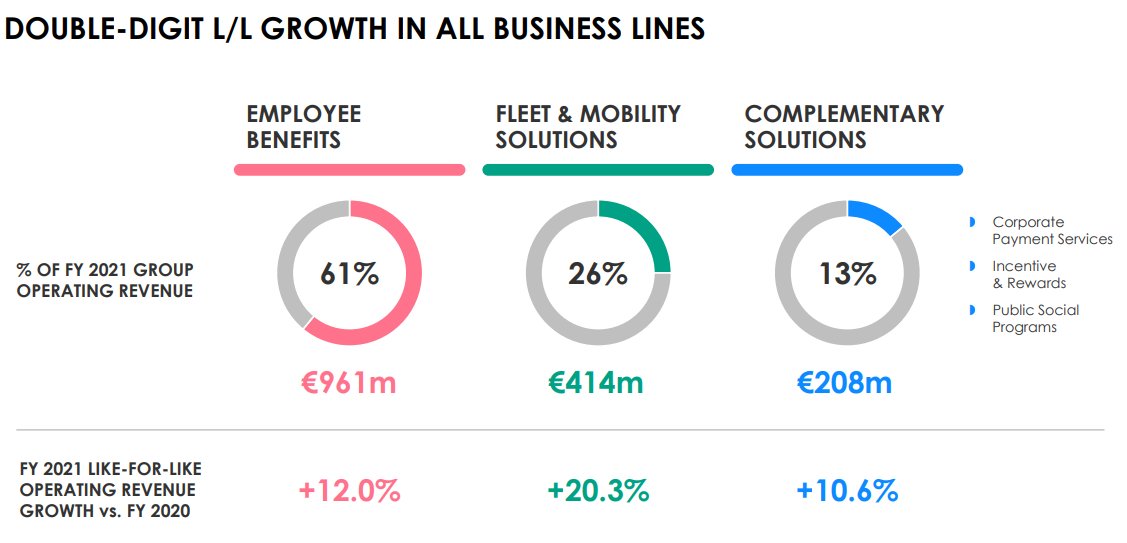

All segments and regions contributed to this performance with double-digit LFL growth, and Edenred benefited from strong sales momentum in the SME market.

· Employee Benefits +12%

· Fleet and Mobility +20%

· Complementary Solutions +11%

· Europe +12%

· LatAm +18%

· RoW +17%

· Employee Benefits +12%

· Fleet and Mobility +20%

· Complementary Solutions +11%

· Europe +12%

· LatAm +18%

· RoW +17%

Outlook 2022:

· Oper. Revenue >+8%

· EBITDA > +10%LFL

· FCF/EBIDA conversion >65%

Edenred is confident in its capacity to maintain sustained organic growth in all geographies and segments. Also it confirmed its continued transition towards fully digital solutions.

· Oper. Revenue >+8%

· EBITDA > +10%LFL

· FCF/EBIDA conversion >65%

Edenred is confident in its capacity to maintain sustained organic growth in all geographies and segments. Also it confirmed its continued transition towards fully digital solutions.

Takeaways:

·Very strong growth across the board, which draws the quality of the business momentum.

·Ebitda Margins back at pre-covid levels (41%).

·Very strong FCF (77% of conversion from EBITDA).

·Stong outlook22

·Strong BSheet that allows M&A/Higher shareholder remuneration.

·Very strong growth across the board, which draws the quality of the business momentum.

·Ebitda Margins back at pre-covid levels (41%).

·Very strong FCF (77% of conversion from EBITDA).

·Stong outlook22

·Strong BSheet that allows M&A/Higher shareholder remuneration.

• • •

Missing some Tweet in this thread? You can try to

force a refresh