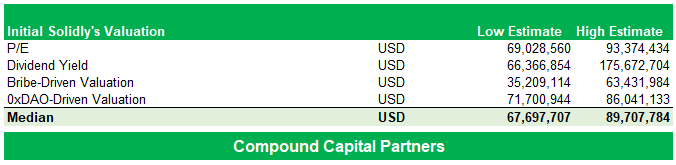

[BULL CASE] After releasing our base case indicative valuation for $SOLID, we have received numerous responses requesting for the bull case valuation. Based on our preliminary analysis, we project an initial Mcap of $375M - $527M.

🧵…

@wagmiAlexander @bobbybanzai @kamikaz_ETH

🧵…

@wagmiAlexander @bobbybanzai @kamikaz_ETH

1/ Bull Case Basis:

With the launch of $SOLID, the $FTM ecosystem would be at the forefront of DeFi innovations. $SOLID tokenomics are designed specifically for protocols and is expected to serve as the liquidity hub for existing and new projects looking to list their tokens...

With the launch of $SOLID, the $FTM ecosystem would be at the forefront of DeFi innovations. $SOLID tokenomics are designed specifically for protocols and is expected to serve as the liquidity hub for existing and new projects looking to list their tokens...

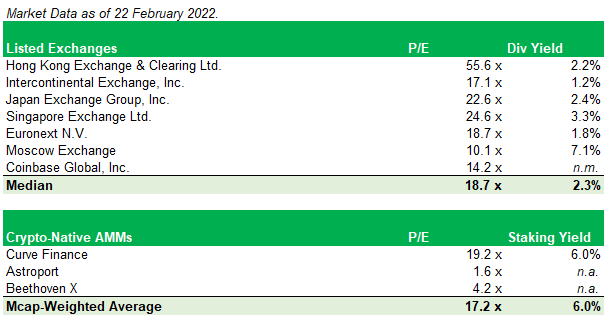

2/ ... $SOLID takes inspirations from the $veCRV model while incorporating changes to better align incentives (e.g. rewarding trading volumes, increasing governance value, etc.). It is expected to start an economic war similar to the $CRV & $CVX bribe and accumulation war.

3/ Due to @AndreCronjeTech reputation & the new tokenomics, the project has attracted attention from all top $FTM protocols – and spawning two multi-billion dollar protocols, $OXD and $SEX. The lead up brought in several billions in TVL & the community is quite bullish on $SOLID.

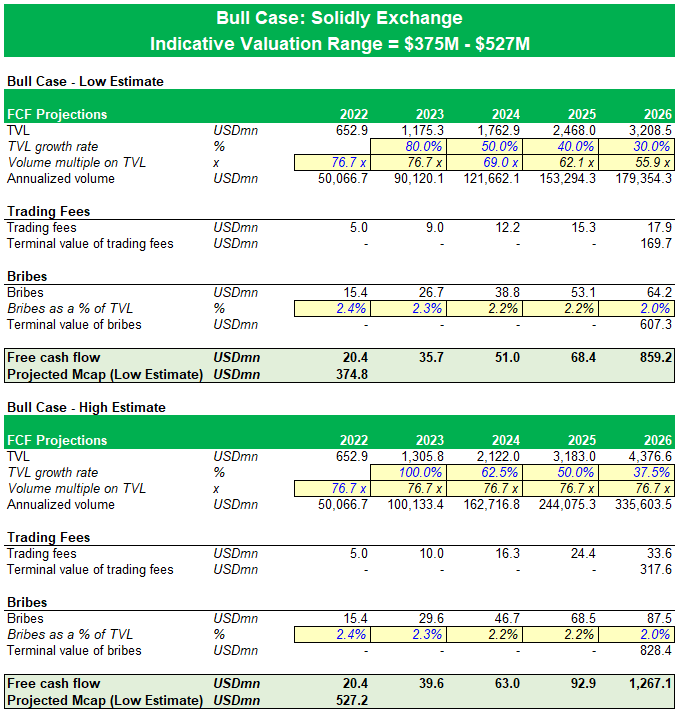

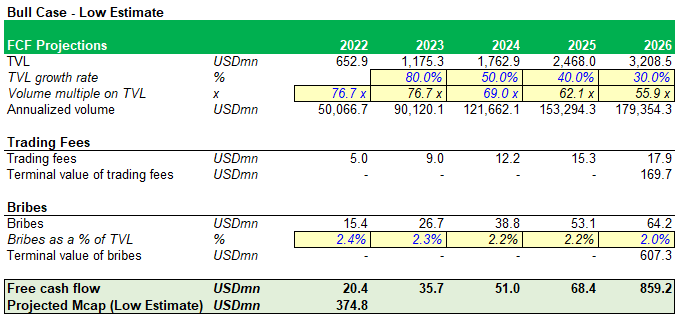

4/ Bull Case – Low Estimate

Based on our DCF model, we project an initial Mcap of $375M. The model assumes starting $SOLID TVL of $653M, a 25% premium from the base case. This reflects the flywheel effect where $FTM ecosystem tokens are rising in price ahead of $SOLID launch...

Based on our DCF model, we project an initial Mcap of $375M. The model assumes starting $SOLID TVL of $653M, a 25% premium from the base case. This reflects the flywheel effect where $FTM ecosystem tokens are rising in price ahead of $SOLID launch...

5/… thereby increasing the starting TVL. Model assumes TVL growth rate of 80% & 50% in first 2 years, based on 50% of $USDC projections within their recent Investors Presentation – before declining down to a terminal rate of 13%, reflecting 10-yr CAGR of US equities Mcap growth.

6/ Model assumes a declining trading volume relative to TVL size to reflect market maturity over the years. Bribes are based on $CVX latest round, adjusted for size differences. The terminal bribe/TVL ratio is based on #FTX deposit bonus at 2% (highest tier), declining...

7/ … incrementally down from 2.4% to reflect market maturity. Terminal growth is assumed to be 13% based on 10-yr CAGR of US equities Mcap growth. The free cash flows are discounted back at 25% to reflect the high-risk nature of investing in digital assets.

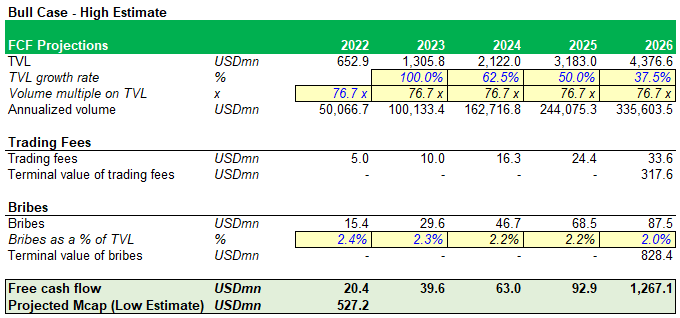

8/ Bull Case – High Estimate

Model projects an initial Mcap of $527M. The model works from the same framework as the low estimate with the exceptions of TVL growth and the trading volume multiple. The TVL is slightly more aggressive at 100% & 62.5% in the first 2 years.

Model projects an initial Mcap of $527M. The model works from the same framework as the low estimate with the exceptions of TVL growth and the trading volume multiple. The TVL is slightly more aggressive at 100% & 62.5% in the first 2 years.

9/ However, still materially lower than $USDC projections of 160% & 100% as presented in their Investors Presentation. The trading volume multiple is assumed constant over the years reflecting high trading activities in a bullish environment.

10/ We are happy to hear feedback/views from the $FTM $SOLID community. Please share your thoughts in the comments below.

We note that the starting Mcap may trade at an artificially high price due to low trade liquidity, but we expect the Mcap to normalize over the medium-term.

We note that the starting Mcap may trade at an artificially high price due to low trade liquidity, but we expect the Mcap to normalize over the medium-term.

11/ Disclaimer: Information contained herein are for educational and informational purposes only, and should not be construed as an offer to sell or a solicitation to buy any related financial instruments.

• • •

Missing some Tweet in this thread? You can try to

force a refresh