This is a pretty climatic moment. I'm not a geopolitical expert or capable of solving 5D chess that gets played during wartime situations. But, we can look at how the charts are reacting to this.

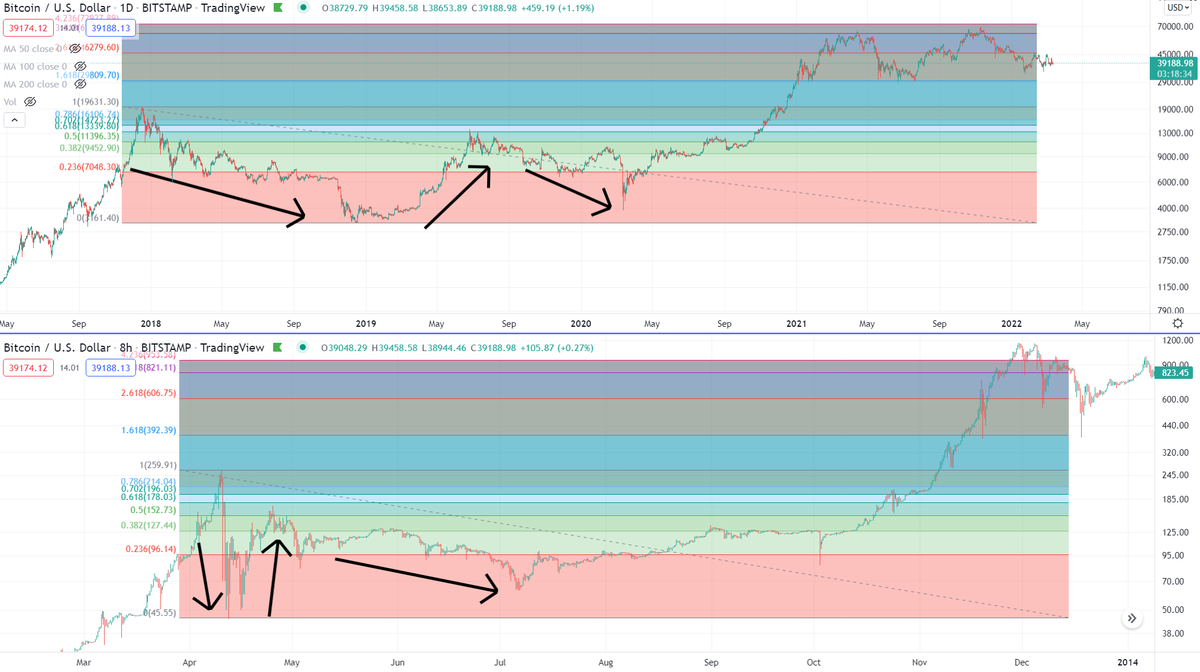

It appears Bitcoin is now deviating from it's 5.5 month structure.

1/12

It appears Bitcoin is now deviating from it's 5.5 month structure.

1/12

At the same time that this is all occurring, significant things are happening market wide. For example, in 2014, this was OIL's breakdown level. 5-years of higher lows, then it crashed from here. This moment has caused OIL to break through that resistance.

2/12

2/12

At the same time, precious metals are breaking upward, having the biggest days they've seen in years, with Gold, Silver, and Platinum all pushing up.

3/12

3/12

At the same time, the DXY, or the U.S. Dollar Currency Index is taking a pop upwards as well, up almost 1% in a day, which is a big move for the DXY in one day. A "flight to safety".

4/12

4/12

Also, the U.S. Stock Market Futures are taking a hit. With the Dow Jones -856. And, not looking pretty.

5/12

5/12

We've studied the Dow Jones in relation to the 1920's many times and that we are in a giant bubble.

6/12

6/12

There was a volatility range that occurred up near these equivalent areas of a bubble structure back in the 1920s. The lowest end of that boundary is around 32,000 for the DJI (The DJI is at 32,200 right now pre-market).

Not sure what would happen if it dipped below that.

7/12

Not sure what would happen if it dipped below that.

7/12

But as we can see, commodities are taking off, and equities are taking a fall overnight. And, cryptos are getting lumped in with that equities basket... being tied to the stock market...

8/12

8/12

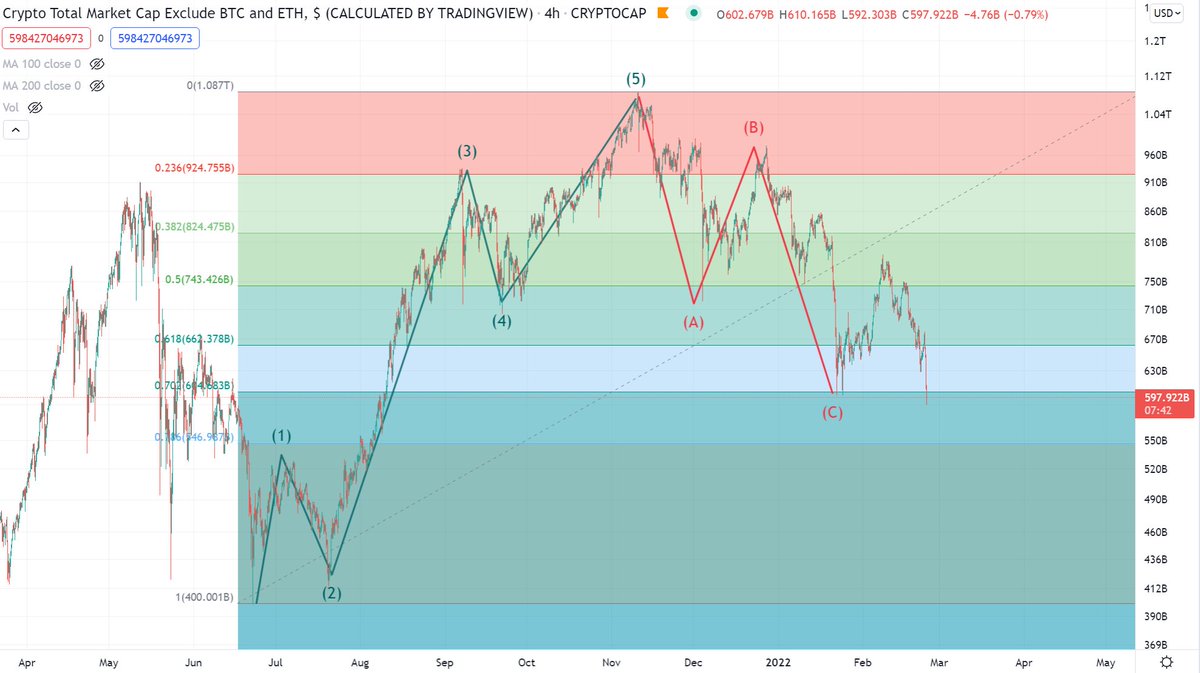

A concerning thing for me is that TOTAL3, the remaining altcoin market is dipping below the .702 retracement level. If we were to have an Elliott Wave structure, this is starting to deviate during this event.

9/12

9/12

We've spent a lot of time going through the inverse / inverted charts to show how these things usually play out, and while it would have been nice to fully rely on a 5.5 month fractal, I kept pointing to this because it's the most common way things happen.

10/12

10/12

While it's a climatic moment, and I can't reasonably conclude to any degree what the next move will be during this geopolitical event or the consequences of it, especially with it happening in the last several hours, my fingers are crossed we're following that structure.

11/12

11/12

We see oil breaking out. Logic points me that could lead to more inflation. Gold, silver and precious metals are breaking out, inflation hedge assets. Those were also the leaders in 2020. But I've got my eyes on that stock market.

Fingers are crossed this wraps up soon.

12/12

Fingers are crossed this wraps up soon.

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh