Yesterday, users flooded to #Fantom for the launch of @AndreCronjeTech's @solidlyexchange.

After months of skirmishes, the #veSolidWars were officially kicking off and the excitement was palpable.

Then... ALL HELL BROKE LOOSE.

My attempt at a recap. 👇🧵

After months of skirmishes, the #veSolidWars were officially kicking off and the excitement was palpable.

Then... ALL HELL BROKE LOOSE.

My attempt at a recap. 👇🧵

Quick Background

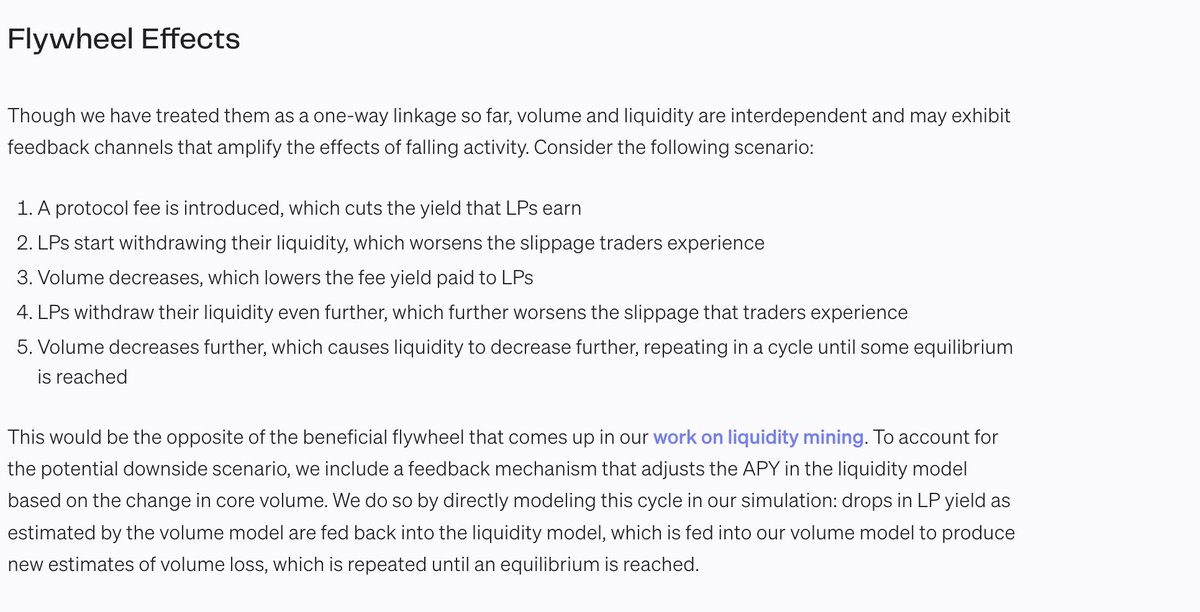

When @AndreCronjeTech announced his new AMM Solidly, he distributed ownership to the top #Fantom protocols as ranked by TVL.

This ignited a battle for control that eventually coalesced into a struggle for control between two teams: @SolidexFantom + @0xDAO_fi

When @AndreCronjeTech announced his new AMM Solidly, he distributed ownership to the top #Fantom protocols as ranked by TVL.

This ignited a battle for control that eventually coalesced into a struggle for control between two teams: @SolidexFantom + @0xDAO_fi

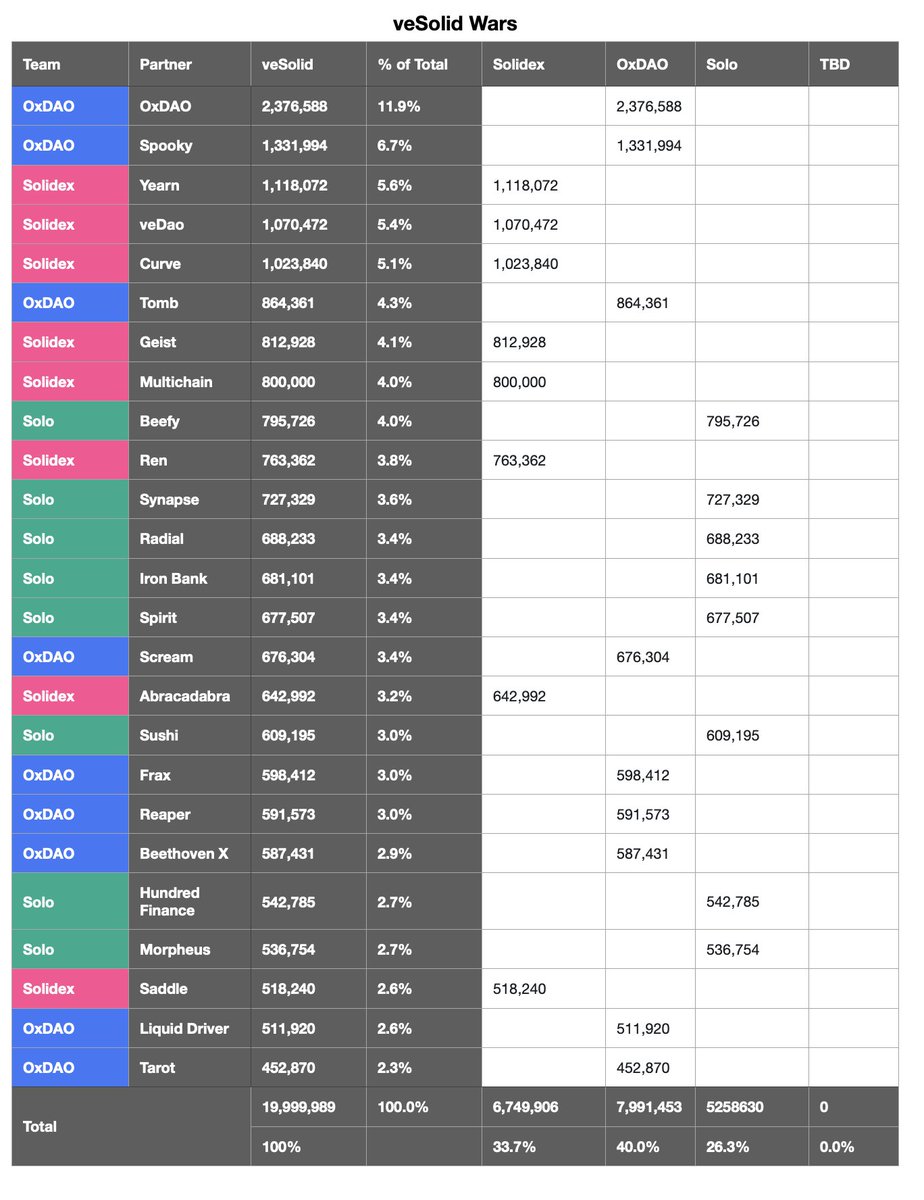

As the day began, we heard from the holdouts...

👉 @SpookySwap would remain neutral

👉 @SynapseProtocol would delay / go solo for now

👉 In the final minutes, @fraxfinance joined #0xDAO

That increased @0xDAO_fi's lead at 40% to @SolidexFantom's 33.7%.

Victory? Not quite.

👉 @SpookySwap would remain neutral

👉 @SynapseProtocol would delay / go solo for now

👉 In the final minutes, @fraxfinance joined #0xDAO

That increased @0xDAO_fi's lead at 40% to @SolidexFantom's 33.7%.

Victory? Not quite.

As the launch of @solidlyexchange grew closer, folks realized the @0xDAO_fi team had gone radio silent.

They were supposed to be ship their competitor to @SolidexFantom before emissions began, but now it seemed they wouldn't hit their deadline.

And people started wigging out.

They were supposed to be ship their competitor to @SolidexFantom before emissions began, but now it seemed they wouldn't hit their deadline.

And people started wigging out.

$OXD dumped. $WeVE pumped. Theories swirled.

And finally, 30 minutes before Solidly would go live they announced: it wasn't ready and they offered no timeline.

And all eyes turned @SolidexFantom whose "dedicated team" approach suddenly looked validated.

...until it didn't.

And finally, 30 minutes before Solidly would go live they announced: it wasn't ready and they offered no timeline.

And all eyes turned @SolidexFantom whose "dedicated team" approach suddenly looked validated.

...until it didn't.

At 12:00 AM UTC, emissions began on @solidlyexchange and hungry yield farmers poured in.

Things were... buggy.

At first it seemed like it was just launch overload, but it quickly became clear something was seriously wrong.

Top pools on @SolidexFantom were producing 0 rewards.

Things were... buggy.

At first it seemed like it was just launch overload, but it quickly became clear something was seriously wrong.

Top pools on @SolidexFantom were producing 0 rewards.

This meant folks LPing things like $WeVE were watching their stacks get eaten alive and earning none of the expected $SOLID or $SEX to make up for the loss.

@_veDAO_'s @nickbtts was the first diagnose and communicate the details: @SolidexFantom fucked up.

@_veDAO_'s @nickbtts was the first diagnose and communicate the details: @SolidexFantom fucked up.

@SolidexFantom would eventually publish a full disclosure of the issue even as they were quickly addressing UI bugs in the system displaying wild yields.

It was bad news though for the rekt and their partners, as there would be no systematic fix until the next round (next week).

It was bad news though for the rekt and their partners, as there would be no systematic fix until the next round (next week).

Oh... and somewhere in here Putin started dropping bombs on our brothers and sisters in Ukraine.🤦♂️😩

So where does this leave us?

👉 @SolidexFantom is working on a fix for next week

👉 Partners are still accruing value from their allocations

👉 Yield farmers redeployed to incentivized pools

👉 Many are demanding recompense from #Solidex

👉 Still no launch details from @0xDAO_fi

👉 @SolidexFantom is working on a fix for next week

👉 Partners are still accruing value from their allocations

👉 Yield farmers redeployed to incentivized pools

👉 Many are demanding recompense from #Solidex

👉 Still no launch details from @0xDAO_fi

How am I playing it?

👉 Still farming all I can, pools I'm in below

👉 Still bullish $WeVE, just bought some more

👉 Still love this shitshow, even on the hard days

👉 Still farming all I can, pools I'm in below

👉 Still bullish $WeVE, just bought some more

👉 Still love this shitshow, even on the hard days

https://twitter.com/wagmiAlexander/status/1496920484046422018

I have so many more thoughts, but have run out of steam.

Since @solidlyexchange doesn't have an official Discord, @JackNiewold and I set one up here.

Feel free to join if you haven't had enough #Solidly yet!

discord.gg/G7Q43vY2

Since @solidlyexchange doesn't have an official Discord, @JackNiewold and I set one up here.

Feel free to join if you haven't had enough #Solidly yet!

discord.gg/G7Q43vY2

• • •

Missing some Tweet in this thread? You can try to

force a refresh