1/ On SWIFT

39.9% of you are right. Congratulations!

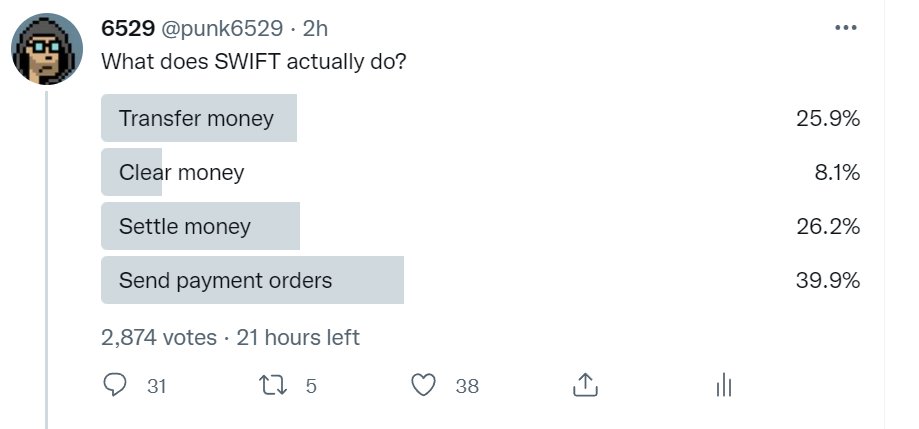

SWIFT is a banking industry consortium messaging system

The banks transfer/settle with each other or an intermediary (correspondent bank) via the currency zone's central bank run RTGS (Real Time Gross Settlement) systems

39.9% of you are right. Congratulations!

SWIFT is a banking industry consortium messaging system

The banks transfer/settle with each other or an intermediary (correspondent bank) via the currency zone's central bank run RTGS (Real Time Gross Settlement) systems

2/ Banning Russia from SWIFT will be very annoying to Russia bc all banking IT systems are integrated with SWIFT so businesses in short-term won't be able to transact.

It doesn't prevent a bank from making a payment to a Russian bank tho.

To prevent payments, you need sanctions

It doesn't prevent a bank from making a payment to a Russian bank tho.

To prevent payments, you need sanctions

3/ The US sanctions to-date on the systemically important Russian banks specifically exempt energy payments so Europe can keep paying for natural gas.

Taking Russia out of SWIFT adds admin costs to the payment process but does not prevent these payments from happening

Taking Russia out of SWIFT adds admin costs to the payment process but does not prevent these payments from happening

4/ I will be surprised if European countries cut off their own energy supplies.

The time for Europe to diversify its energy mix was 20 years ago.

It is not an overnight task and it is expensive in money, projection of geopolitical power and domestic politics

The time for Europe to diversify its energy mix was 20 years ago.

It is not an overnight task and it is expensive in money, projection of geopolitical power and domestic politics

5/ Diversification would be most or all of the below:

a) nuclear (domestically unpopular)

b) more LNG capacity (expensive, volatile prices)

c) redundant west & east med pipelines (expensive)

d) renewables + batteries (expensive)

All of these are 10 to 20 year projects

a) nuclear (domestically unpopular)

b) more LNG capacity (expensive, volatile prices)

c) redundant west & east med pipelines (expensive)

d) renewables + batteries (expensive)

All of these are 10 to 20 year projects

6/ Having the most cost-efficient energy is not the same as having the most geopolitically secure energy mix.

Sometimes it means running pipelines thousands of miles out of the way to avoid potential future enemies

Sometimes it means running pipelines thousands of miles out of the way to avoid potential future enemies

7/ Sometimes it means the exercise of hard power.

Over the last 30 years the United States has spent trillions of dollars and many US lives (and countless third party lives) to secure stable energy supplies for US and global economy.

Over the last 30 years the United States has spent trillions of dollars and many US lives (and countless third party lives) to secure stable energy supplies for US and global economy.

8/ But that age is ending.

The US is functionally energy independent post shale and has been messaging to Europe for multiple administrations that it is not willing to bear the cost for Europe's energy and geopolitical security.

The US is functionally energy independent post shale and has been messaging to Europe for multiple administrations that it is not willing to bear the cost for Europe's energy and geopolitical security.

9/ On this topic, the main difference between Obama and Trump is that Obama politely told Merkel that Germany needed to up its military spending and not do Nord Stream 2 and Trump just tweeted it out.

But the policy is the same regardless

But the policy is the same regardless

10/ The United States has been progressively reducing its military footprint in the Middle East for 20 years.

It has spent trillions of dollars in the Middle East and, broadly, it does not need to anymore, so it won't.

It has spent trillions of dollars in the Middle East and, broadly, it does not need to anymore, so it won't.

11/ The world at large underestimates the USA's ability to go it alone

The US has various challenges but it is energy and agriculturally independent, impossible to attack externally and can ramp up manufacturing in a crunch.

It still the most well positioned country

The US has various challenges but it is energy and agriculturally independent, impossible to attack externally and can ramp up manufacturing in a crunch.

It still the most well positioned country

12/ Europe, on the other hand, has major long-term strategic problems:

a) completely absent in modern tech companies (largest EU tech company is SAP)

b) weak in next generation tech: machine learning, crypto, robotics, etc

But more immediately...

a) completely absent in modern tech companies (largest EU tech company is SAP)

b) weak in next generation tech: machine learning, crypto, robotics, etc

But more immediately...

13/ ...without a coherent political structure / political will to project power externally.

On paper, EU should be a big player - the economy is the size of the USA broadly speaking.

But any geopolitical issue becomes a debating society and there is no EU army to speak of.

On paper, EU should be a big player - the economy is the size of the USA broadly speaking.

But any geopolitical issue becomes a debating society and there is no EU army to speak of.

14/ Europe's high-level options are:

a) Consolidate into an international class military power, shift social to military spending, project forward to peacekeep its own neighborhood, build its own energy supplies and so on

or

b) stay within the status quo

a) Consolidate into an international class military power, shift social to military spending, project forward to peacekeep its own neighborhood, build its own energy supplies and so on

or

b) stay within the status quo

15/ Since 14(a) requires a bunch of countries who have quite different views about their identity and national security to agree, it is a very tough project.

Barring a huge forcing function like a direct invasion into the heart of Europe I do not see it happening.

Barring a huge forcing function like a direct invasion into the heart of Europe I do not see it happening.

16/ There is no free lunch on this topic.

When we say the EU might need to project its own military power in North Africa, the Eastern Med and the Persian Gulf, it means...

....threatening to kill people or actually killing them (like the US did)

When we say the EU might need to project its own military power in North Africa, the Eastern Med and the Persian Gulf, it means...

....threatening to kill people or actually killing them (like the US did)

17/ National security, in general, and energy security, specifically, is not a picnic.

Lives and whole nations hang in the balance based on leaders' decisions.

And, usually, leaders don't like to say this out loud. It is too raw.

The official story is usually "human rights".

Lives and whole nations hang in the balance based on leaders' decisions.

And, usually, leaders don't like to say this out loud. It is too raw.

The official story is usually "human rights".

18/ I think Ukraine is in a very tough spot. I think Europe cannot, in substance, help Ukraine.

There is an alternative timeline where Ukraine played for time. Russia is in long-term structural decline and will be weaker in 10 and 20 years.

But that is not this timeline

There is an alternative timeline where Ukraine played for time. Russia is in long-term structural decline and will be weaker in 10 and 20 years.

But that is not this timeline

19/ Anyway, back to SWIFT.

If you kick out a bank or a small country out of SWIFT, it is a death sentence for international trade even without sanctions, because nobody is going bother building custom payment order channels for them.

If you kick out a bank or a small country out of SWIFT, it is a death sentence for international trade even without sanctions, because nobody is going bother building custom payment order channels for them.

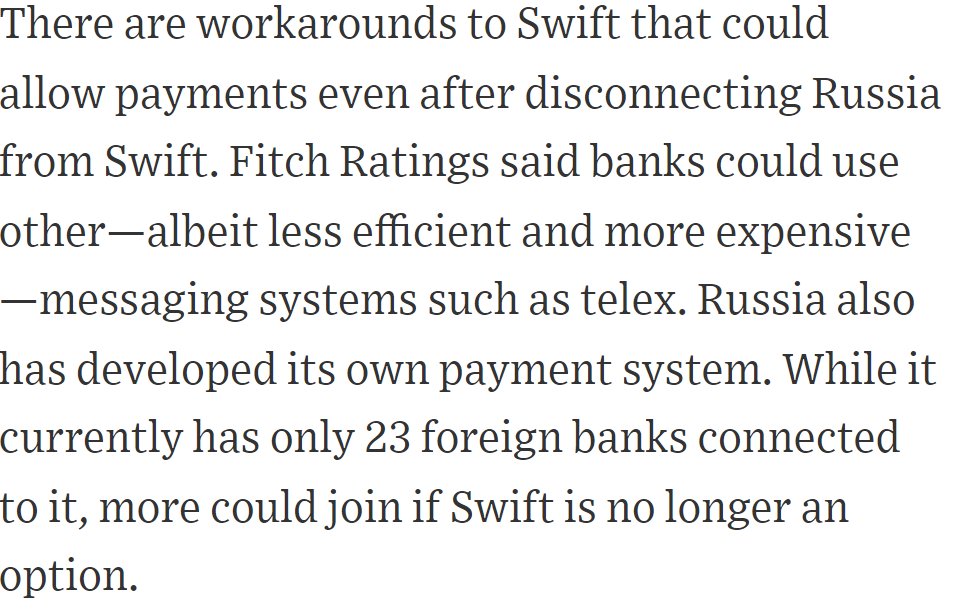

20/ It is unknown what will happen if you kick a country the size of Russia, that both Europe and China plan to continue to pay for energy, out of SWIFT.

The energy payments will continue, manually at first, but possibly with the Russian payment order system later (SPFS)

The energy payments will continue, manually at first, but possibly with the Russian payment order system later (SPFS)

21/ I have no doubt it will be quite difficult for Russia in the short-term, but in the medium term it might help Russia boot up its own alternative payment order system.

And China and India will be wondering if they need to do the same preemptively.

And China and India will be wondering if they need to do the same preemptively.

22/ So I wonder about the second order effects if anyway you are going run a sanctions loophole for energy payments.

The West has effective control of SWIFT, including for intelligence purposes. If payment order systems distribute, it weakens the West's control.

The West has effective control of SWIFT, including for intelligence purposes. If payment order systems distribute, it weakens the West's control.

23/ I do not have an inside view of the systems and the US seems to be pushing for a SWIFT ban.

So it might be that it has examined the short vs medium effects and thinks it is worth it.

Or is responding to other political or other pressures.

So it might be that it has examined the short vs medium effects and thinks it is worth it.

Or is responding to other political or other pressures.

24/ But none of these topics are a 'free lunch'. None of them are solely about if the US/EU want to support Ukraine or not (of course they support Ukraine, as does most of the world).

But Ukraine is one part of a broader set of calculations in Europe/US

But Ukraine is one part of a broader set of calculations in Europe/US

25/ "Can we help Ukraine?", "What precedent is being set for Baltics/Scandinavian and other EU border regions?", "energy security", "preservation of leverage through the western financial system", "what if Russia cuts off gas?", "domestic economic considerations" etc

26/ And hanging over all this discussion is the fact that the US and Russia are still the world's preeminent nuclear powers.

The Us and Russia/Soviet Union have fought many many proxy wars over the years, but have been very careful to avoid direct conflict

The Us and Russia/Soviet Union have fought many many proxy wars over the years, but have been very careful to avoid direct conflict

27/ This is a wise decision on both sides, across many administrations on both sides

Proxy conflicts are horrible for the countries involved but do not present an existential risk to all life on earth as a direct conflict would.

I expect this pattern will continue here

Proxy conflicts are horrible for the countries involved but do not present an existential risk to all life on earth as a direct conflict would.

I expect this pattern will continue here

28/ There will be no direct NATO-Russian war.

Ukraine is, effectively, on its own militarily and should make its decisions strictly in its national interest.

The rest is going to be a balancing act of both sides of who is inflicting economic pain on the other side/themselves

Ukraine is, effectively, on its own militarily and should make its decisions strictly in its national interest.

The rest is going to be a balancing act of both sides of who is inflicting economic pain on the other side/themselves

29/ I know this is tougher than the topics we normally talk about here, but it is better to be able to watch the news and decode what is being said than to not.

Sanctions, SWIFT, energy security, NATO -- all of these are being discussed in a very specific geopolitical context

Sanctions, SWIFT, energy security, NATO -- all of these are being discussed in a very specific geopolitical context

30/ We are nowhere near a post-physical world. Our higher order goods are still built on a base of hard geopolitical and energy security.

If you squint deeply into the horizon, you could see how a world might look different in decades

If you squint deeply into the horizon, you could see how a world might look different in decades

31/ Highly distributed cost-effective renewables, a much deeper global digital integration, an overlaying of national identities/myths with horizontal global identities/myth might soften the geopolitical stressors over time.

But that is not where we are today

But that is not where we are today

32/ We have to work to build that world on both a hard/technical level and a soft/social/myth/meme level.

It is a project for us, for our children and probably for our grandchildren too.

And we need to avoid disasters along the way.

It is a project for us, for our children and probably for our grandchildren too.

And we need to avoid disasters along the way.

33/ In the short-term, I continue to hope that the war in Ukraine ends as soon as possible.

War is one of the two parties doing their calculus wrong about the cost of the war.

The longer it takes for this to clarify the more people will suffer

War is one of the two parties doing their calculus wrong about the cost of the war.

The longer it takes for this to clarify the more people will suffer

34/ But more broadly the rest of the decade is going to be challenging geopolitically.

The USA I believe does not have the interest (need? capacity?) in being the global security provider.

So regional conflicts are going to flare up everywhere

The USA I believe does not have the interest (need? capacity?) in being the global security provider.

So regional conflicts are going to flare up everywhere

35/ Crimea, Syria, Ukraine are the beginning unfortunately, not the end, of the USA withdrawing somewhat from the world.

We will see more countries try to figure out what they need to do for their own national security and some of them will be opportunistic

We will see more countries try to figure out what they need to do for their own national security and some of them will be opportunistic

36/ So we are going to have a very unusual decade:

a) on the ground, it will feel like a reversion to the past

b) meanwhile the digital world will accelerate into science fiction land

a) on the ground, it will feel like a reversion to the past

b) meanwhile the digital world will accelerate into science fiction land

37/ If you can get a "stake" (skills, assets, etc) in the digital world I think it is a positive.

It give you a level of flexibility during this time.

It give you a level of flexibility during this time.

38/ In theory, the digital world can be better in that it is non-rivalrous.

In the physical world, only one country can control a certain mountain pass.

In the digital world, this does not necessarily apply. People can live their lives in parallel, in harmony

In the physical world, only one country can control a certain mountain pass.

In the digital world, this does not necessarily apply. People can live their lives in parallel, in harmony

39/ But we need to work for the digital world to end up that way.

It will not happen automatically that way I believe.

We have to work for it, we have to fight for it.

❤️

It will not happen automatically that way I believe.

We have to work for it, we have to fight for it.

❤️

40/ If you got here for the first time through this thread, please note that this is not a geopolitical account.

I care about how JPGs might help prevent an overly centralized future and so indirectly care about financial infrastructure.

More here:

I care about how JPGs might help prevent an overly centralized future and so indirectly care about financial infrastructure.

More here:

https://twitter.com/punk6529/status/1448399827054833668

• • •

Missing some Tweet in this thread? You can try to

force a refresh