“Be completely objective and recognize what the marketplace is telling you, rather than trying to prove that what you said or did yesterday or six weeks ago was right. The fastest way to take a bath in the stock market is to try to prove that you are right & the market is wrong.”

“The whole secret to winning big in the stock market is not to be right all the time, but to lose the least amount possible when you’re wrong.”

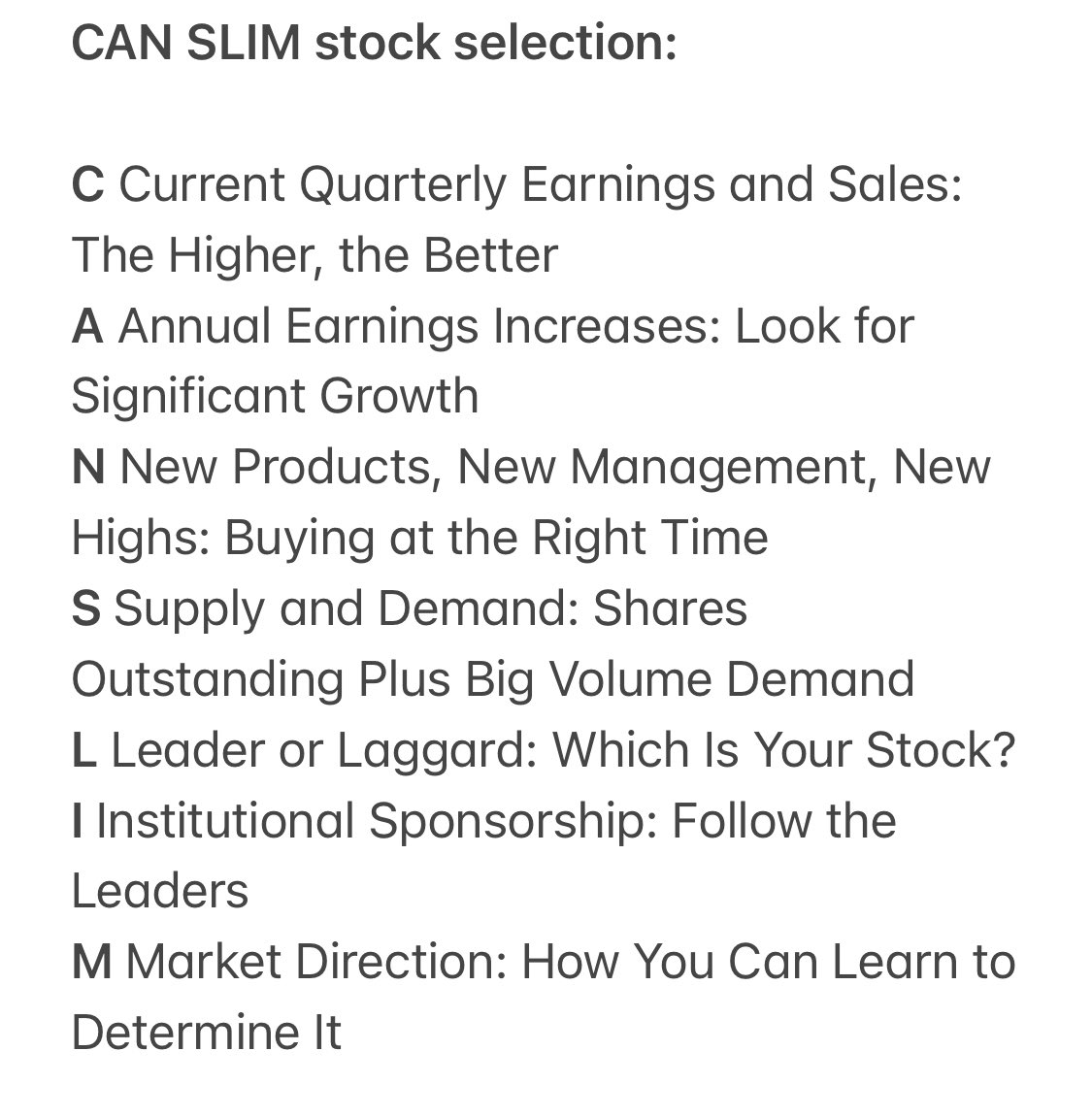

“Charts plus earnings will help you tell the best stocks and general markets from the weaker, riskier stocks and markets that you must avoid altogether.”

“I made a rule that I’d buy each stock exactly at the pivot buy point and have the discipline not to pyramid or add to my position at more than 5% past that point. Then I’d sell each stock when it was up 20%, while it was still advancing.”

“A great trader once noted there are only two emotions in the market: hope and fear. “The only problem,” he added, “is we hope when we should fear, and we fear when we should hope.”

“Success in a free country is simple. Get a job, get an education, and learn to save and invest wisely. Anyone can do it. You can do it.”

“The moral of the story is: never argue with the market. Your health and peace of mind are always more important than any stock.”

Market tops:

“On one of the days in the uptrend, volume for the market as a whole will increase from the day before, but the index itself will show stalling action.”

“I call this “heavy volume without further price progress up.”

“On one of the days in the uptrend, volume for the market as a whole will increase from the day before, but the index itself will show stalling action.”

“I call this “heavy volume without further price progress up.”

Distribution:

“As professional investors liquidate stock. The spread from the average’s daily high to its daily low may in some cases be a little wider than on previous days.”

“As professional investors liquidate stock. The spread from the average’s daily high to its daily low may in some cases be a little wider than on previous days.”

“If one of the indexes is down for the day on volume larger than the prior day’s volume, it should decline more than 0.2% for this to be counted as a distribution day.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh