Some initial thoughts on the #berkshirehathaway annual report.

Random fact, the cover is black for the first time since 2005. Prior to that, 1988 featured a black cover with some funky neon blue.

$BRK $BRKA $BRKB #warrenbuffett #charliemunger

Random fact, the cover is black for the first time since 2005. Prior to that, 1988 featured a black cover with some funky neon blue.

$BRK $BRKA $BRKB #warrenbuffett #charliemunger

Buffett points out that Berkshire paid $3.3 billion or 8/10ths of ALL federal corporate income tax in the United States. That's some $9 million per day to the US Treasury.

Float amounts to an incredible $147 billion. Better still, because of share repurchases, the figure is up 25% over the past two years to just shy of $100k per $BRKA. That's $66 per $BRKB share of (essentially, and for now) better-than-cost-free money working for shareholders

Berkshire repurchased 9% of its shares over the last two years at a total cost of $51.7 billion. These actions increased ownership for continuing shareholders by 10%.

Berkshire's holdings of US Treasuries amounted to $144 billion at year-end. Berkshire holds 0.50% of publicly-held debt in the US.

$AAPL is one of Berkshire's "big four" businesses at yearend. Berkshire's 5.55% ownership was worth $161 bn and Berkshire's share of its earnings amounted to $5.6bn. BRK only received $785 million in dividends; the remainder is below the water so-to-speak.

The other three "giants" aside from Apple are railroad BNSF, energy giant Berkshire Hathaway Energy, and the first group, Berkshire's collection of insurance companies.

Buffett remembers Paul Andrews, founder of TTI, who died in 2021. He also credits Andrews with Berkshire's 2010 acquisition of BNSF. Both TTI and BSNF were based in Fort Worth, Texas.

The BRK annual meeting will be in person again this year!!! Mark your calendars for April 30. Proof of covid vaccine will be required. Also Buffett's cousin-but-not-really-cousin Jimmy Buffett has partnered with BRK RV manufacturer on a branded boat. Buffett has the first order.

Getting into the 10K now ... shares outstanding as of February 14, 2022 amounted to $1,476,142 Class A-equivalents. This brings $BRKA's share count down to a level not seen since 1997/98. 1997 count: 1,234,127; 1998 count: 1,518,548. Increase due to the General Re acquisition.

Operating earnings (not the flashy meaningless net income figure) increased to $27.5 billion in 2021, up from $21.9 billion in 2020. Op. earnings are up 15% from the $24 billion reported in 2019.

All major segments of BRK are pulling their weight. Insurance underwriting profits mean yet another year of negative-cost float. $728m of underwriting profit in 2021 means BRK was PAID 0.50% on its average float of $142.5bn. BRK borrows money at a lower cost than US or EUR govts.

GEICO reported a $1.26 bn profit. Its combined ratio of 96.7% means it earned 3.3% of premiums as profit. This is on top of its float. Both claim frequencies (how many accidents) and severity (how much damage) were up significantly.

BRK Primary Group reported another consistently stellar year, with a 94.8% combined ratio and $607 million of underwriting profits. This group is an underappreciated collection of gems within $BRKB.

The reinsurance group reported a pre-tax underwriting loss of $930 million. This isn't as poor a result as it seems. Property/casualty was in the black. Retro and periodic payment annuity business is impacted by deferred charge amortization and discount accretion charges.

As a whole, the insurance operations had favorable loss development of $3.1 billion. Negative numbers are good in this table because it shows $BRKA continues to be conservative in its underwriting.

Here's a cool table illustrating the long-tail of Berkshire's insurance operations. Contrast short-tail GEICO which pays out most of its losses the first year, with long-tail medical liability which can take decades to conclude. This is what causes float to be long-lasting.

BNSF performed well in 2021. Carloadings were just shy of 2019 levels. Pre-tax earnings were $7.9bn; net earnings were $6bn.

BHE continues to be an incredible asset to BRK. Buffett notes that its earnings were a mere $122 million in the year 2000. This is slightly misleading as a comparison because a TON of capital has been put into the business. Net earnings > pre-tax b/c energy tax credits.

Profit margins remain strong across MSR categories. Unfortunately, we don't have detail on the MSR-specific balance sheet, which WB used to include.

MSR-specific commentary: Precision Castparts pre-tax earnings were $1.2 billion. Berkshire paid $37 billion for PCC in 2016. The company continues to be hurt by covid but it's clear Buffett overpaid.

I wish we had more on Lubrizol. All we know is revenues increased 8.6% to $6.5 billion and pre-tax earnings decreased 51%. No $ figure. BRK notes a fire and impairment charges hit the bottom line. What I do like here is that BRK doesn't add these back. No adjusted earnings here.

As an aside on Lubrizol, it's interesting to note that a business that used to report a full annual/10K now takes up two paragraphs w/in $BRKA.

You can find Lubrizol (and other) reports here: theoraclesclassroom.com/archives/

You can find Lubrizol (and other) reports here: theoraclesclassroom.com/archives/

Ditto for Marmon. This is a BIG business with over 100 subs of its own. Two paragraphs. Please, Warren, give us the net income figure in $$$.

Another big biz, IMC (originally Iscar), gets one paragraph. Again, no $ just relative references. You're killing us analytical types, Warren. @ChrisBloomstran

@ChrisBloomstran Building products category reported solid results led by Clayton. Clayton's results also include that from its $19 billion loan portfolio. This is the not-so-mini "bank" buried in Berkshire.

Consumer products also hit it out of the park, led by Forest River (+28% unit sales!). Given the moats around these businesses, they shouldn't have too much trouble passing along cost increases.

Service and retailing also coming in with overall great results. That 0.5% margin for McLane is a good reminder of how brutal the business is. It generates decent economics b/c it has huge sales compared to capital employed, but it's gotten tougher over time.

TTI and aviation led the great results in service. Revenues up 29% and pre-tax earnings up a whopping 67%!

Berkshire's retailing segment is dominated by Berkshire Hathaway Automotive and the four furniture retailers.

Retailing segment revenues up 20% and pre-tax earnings up 76%, led by auto (+48%) and furniture (+68%). Incredible to think how small See's Candies has become, relatively, compared to the sister companies it helped finance.

Tough goings for McLane, former $WMT subsidiary BRK bought in 2005. $BRK expects continued difficulties in 2022.

The not-so-small "iceberg" growing below the surface is BRK's equity method investments. This category will shrink next year (2023) when Pilot is consolidated. BRK is slated to increase its ownership to 80% that year.

Deep into the bowels of the $BRKA annual report now, we can see detail on a major portion of @GEICO's float. That $1.8 billion listed below is GEICO's portion of Berkshire's favorable loss development in 2021.

Similarly, we can get a *rough* approximation of the float from the reinsurance group from this table. $37 billion of unpaid losses/expenses must be netted by the $10.6 bn of deferred charges, for a rough est. of $26 bn of float.

Really getting deep into the $BRK #berkshirehathaway annual now... the $119 million difference between the equity statement and the cash flow statement for repurchases is due to the fact that some 2020 repurchases were made late in Dec. and paid for in early January 2021.

An awesome 73% of the BRK equity portfolio comes from four companies, UP from 68% in 2020. $BRKB hasn't lost its penchant for concentration!

More on the "mini bank" within Berkshire, mostly made up of Clayton's portfolio. Just $4 million of non-performing loans reside on the books. Berkshire doesn't securitize or otherwise shed risks here, it underwrites carefully and for keeps. The record speaks for itself.

Such a cool table showing the MASSIVE $155 BILLION investment (net) #berkshirehathaway has in its rail and utility businesses.

Here's a good reminder of the fact that #WarrenBuffett paid a premium for many of the wonderful businesses $BRK owns. It recognized its mistake with PCC last year with a $10bn write-down of goodwill.

Here's a good reminder of why $BRKA can be so flexible in its investments on the insurance side. It has a whopping $301 billion of capital. Premium volume of $69 billion was just 23% of its capital. Customers of $BRKB insurers are extremely safe.

Here's another example of Berkshire's conservatism. The pension funds it manages on behalf of subsidiary companies are fully funded AND assume a modest 6.1% rate of return going forward. (Oh, and they're managed by Warren Buffett, Todd Combs, and Ted Weschler to boot!)

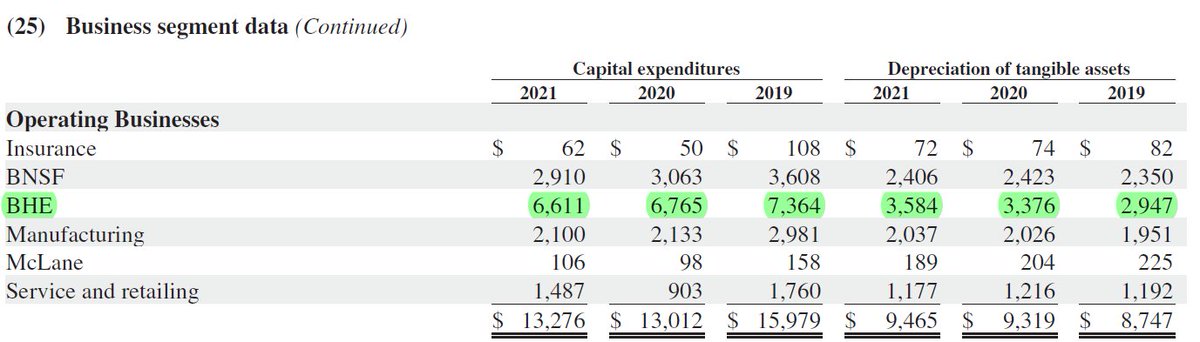

Some cool capex vs. depreciation info showing continued organic investment in Berkshire's many operating businesses.

Take a close look at Berkshire Hathaway Energy's capex vs. depreciation. HUGE investment happening at BHE. $BRKB $BRKA

I'm loving the fact that Greg Abel was given a voice in this year's letter. #berkshirehathaway is doing more on #Sustainability than many people realize.

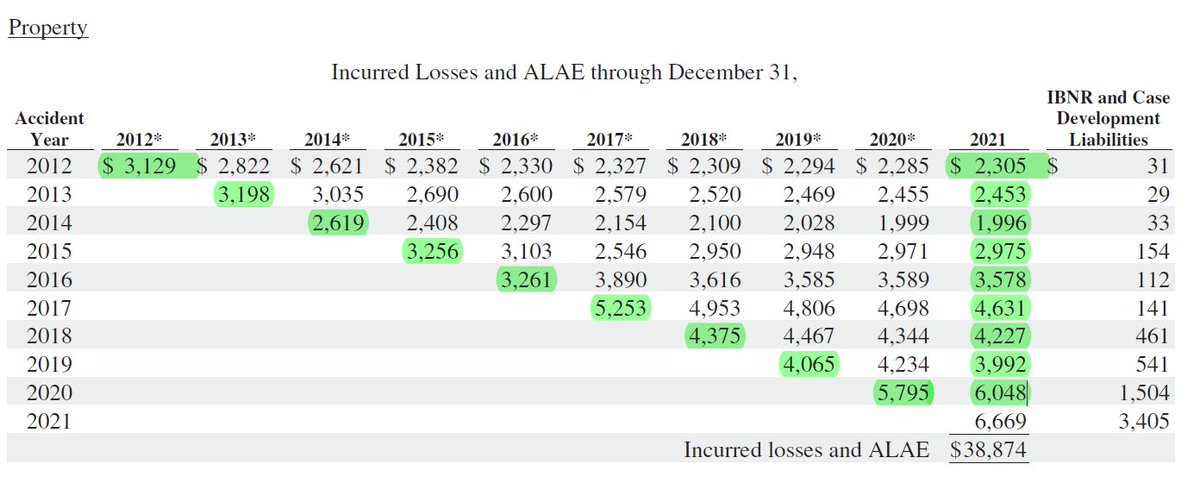

Another cool $BRK table for you geeks out there. This is one of a few loss development tables in the $BRKA $BRKB 10k. Compare the figures in the far left (original estimate) to the 2021 figures. This shows how Berkshire conservatively underwrites over time.

• • •

Missing some Tweet in this thread? You can try to

force a refresh