1/ A hot war, a financial war, & nuclear M.A.D...

A question to zoom out: Did high energy prices embolden Putin? Are the commodities markets responsible for Russia’s invasion of Ukraine? @rupert_russell’s timely new book 'Price Wars' says: YES.

penguinrandomhouse.com/books/622647/p…

A question to zoom out: Did high energy prices embolden Putin? Are the commodities markets responsible for Russia’s invasion of Ukraine? @rupert_russell’s timely new book 'Price Wars' says: YES.

penguinrandomhouse.com/books/622647/p…

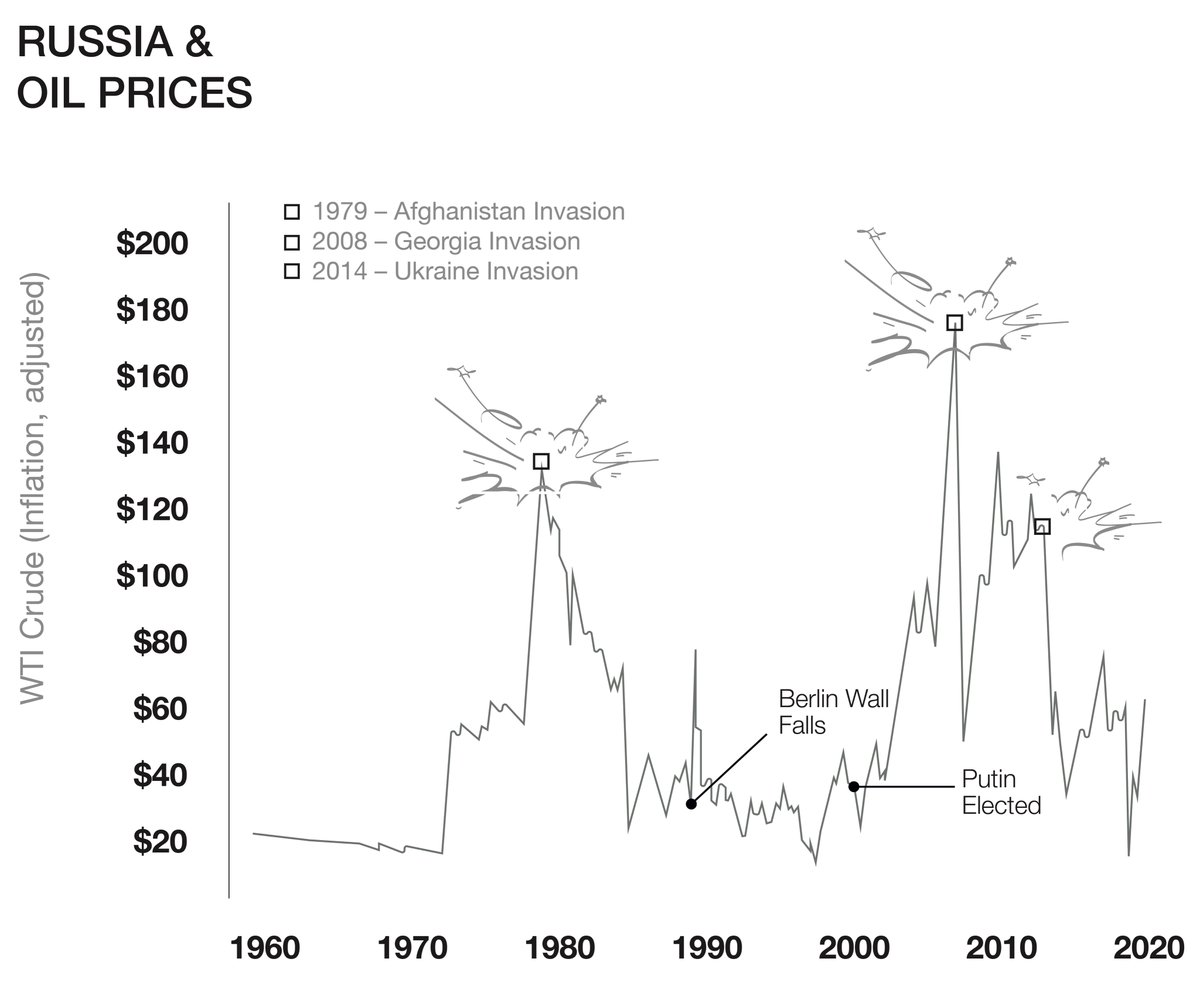

2/ Moscow’s military interventions have come at times of historically high oil prices. And right now, energy prices are approaching triple digits for the second time in a decade. Previous highs:

1979 - Afghanistan invasion

2008 - Georgia invasion

2014 - Ukraine "

2022 - Ukraine "

1979 - Afghanistan invasion

2008 - Georgia invasion

2014 - Ukraine "

2022 - Ukraine "

3/ The Oil price - Conflict relationship is not unique to Russia. Russell draws on @cullenhendrix’s discovery that as oil prices increase, oil exporting petrostates are more likely to initiate military conflict. sci-hub.se/https://journa…

4/ High oil prices lead to conflicts because

- Petrostates get WINDFALL of $$ to spend on their military & FX to buffer sanctions

- Limited supply acts as SHIELD from sanctions on oil exports

- In Russia’s case, the GAS WEAPON becomes more potent

- Which combine into CHESTINESS

- Petrostates get WINDFALL of $$ to spend on their military & FX to buffer sanctions

- Limited supply acts as SHIELD from sanctions on oil exports

- In Russia’s case, the GAS WEAPON becomes more potent

- Which combine into CHESTINESS

5/ So High oil prices-> Conflicts. But why volatile oil prices?

2000's Commodity Futures Modernization Act. It created over-the-counter derivatives. Allowed WallSt to make "commodity index funds". Oil,Food,Metals-previously uncorrelated- turned into another volatile asset class.

2000's Commodity Futures Modernization Act. It created over-the-counter derivatives. Allowed WallSt to make "commodity index funds". Oil,Food,Metals-previously uncorrelated- turned into another volatile asset class.

6/ In effect, the West’s financial centres inflated an oil bubble that in turn, inflated Putin’s chestiness.

⇒ Doesn't mean Putin's brinksmanship is rational

But it informs his sense of confidence. Behind Russia's Nuclear WMD are Wall St Financial WMD

willamette.edu/law/resources/…

⇒ Doesn't mean Putin's brinksmanship is rational

But it informs his sense of confidence. Behind Russia's Nuclear WMD are Wall St Financial WMD

willamette.edu/law/resources/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh