There are some odd stuff about $SOLID emissions.

Some important stuff are not explained in Andre's posts.

Also, there is potentially a mistake in the contract so basic yet so impactful, it's funny.

Two reasons why $SOLID emissions are extremely high for a short time👇 (1/10)

Some important stuff are not explained in Andre's posts.

Also, there is potentially a mistake in the contract so basic yet so impactful, it's funny.

Two reasons why $SOLID emissions are extremely high for a short time👇 (1/10)

Reason #1: Locked $SOLID has very little effect on emissions (minor)

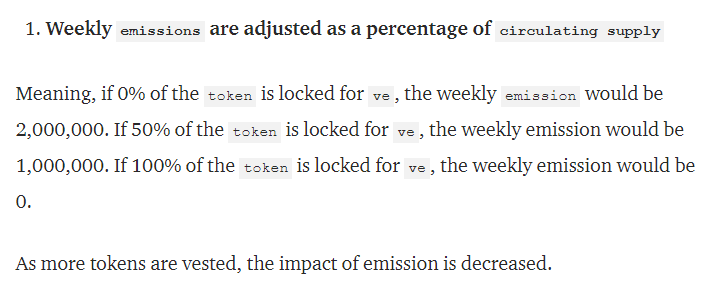

Let's take this part of Andre's medium post. There's nothing wrong with the explanation itself & platforms works as explained. What's missing is the dynamics behind "circulating supply". (2/10)

Let's take this part of Andre's medium post. There's nothing wrong with the explanation itself & platforms works as explained. What's missing is the dynamics behind "circulating supply". (2/10)

Reason #1 -cont:

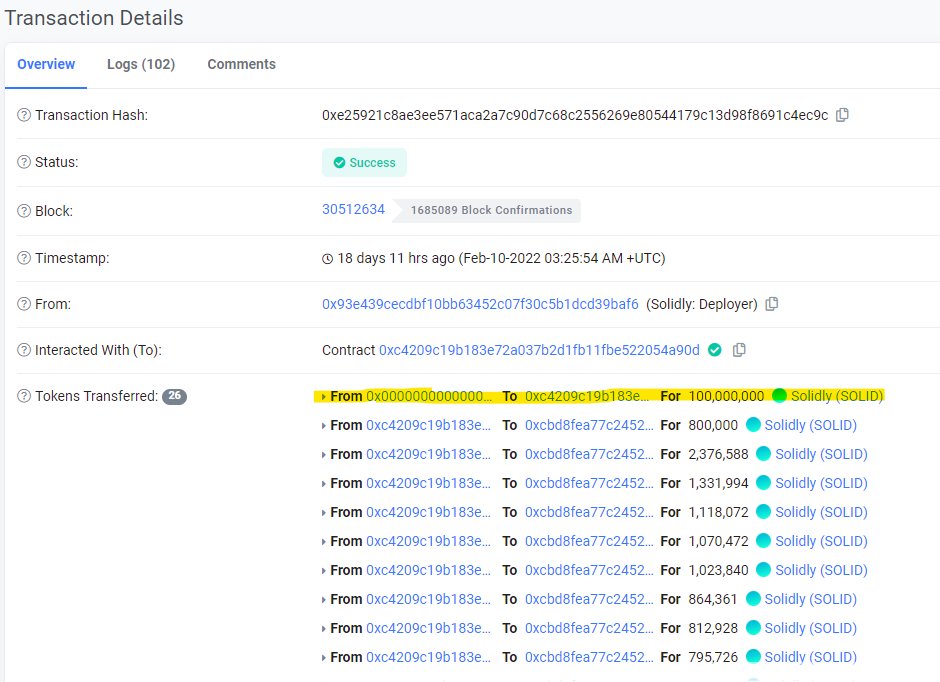

You probably know that 20M $SOLID were airdropped to protocols. What you may not know is that initial mint was 100M $SOLID. Yes, that's 80M tokens left in the contract. So 80% of the starting circulating supply could not be locked to begin with. (3/10)

You probably know that 20M $SOLID were airdropped to protocols. What you may not know is that initial mint was 100M $SOLID. Yes, that's 80M tokens left in the contract. So 80% of the starting circulating supply could not be locked to begin with. (3/10)

Reason #1 -cont:

This also means that even in the extreme scenario where every single $SOLID holder locked their token, next week's emission will only decrease by ~35%. Majority of $SOLID is in the contract itself & can't be locked. (4/10)

This also means that even in the extreme scenario where every single $SOLID holder locked their token, next week's emission will only decrease by ~35%. Majority of $SOLID is in the contract itself & can't be locked. (4/10)

Reason #2: Potential bug in emission amount calculation

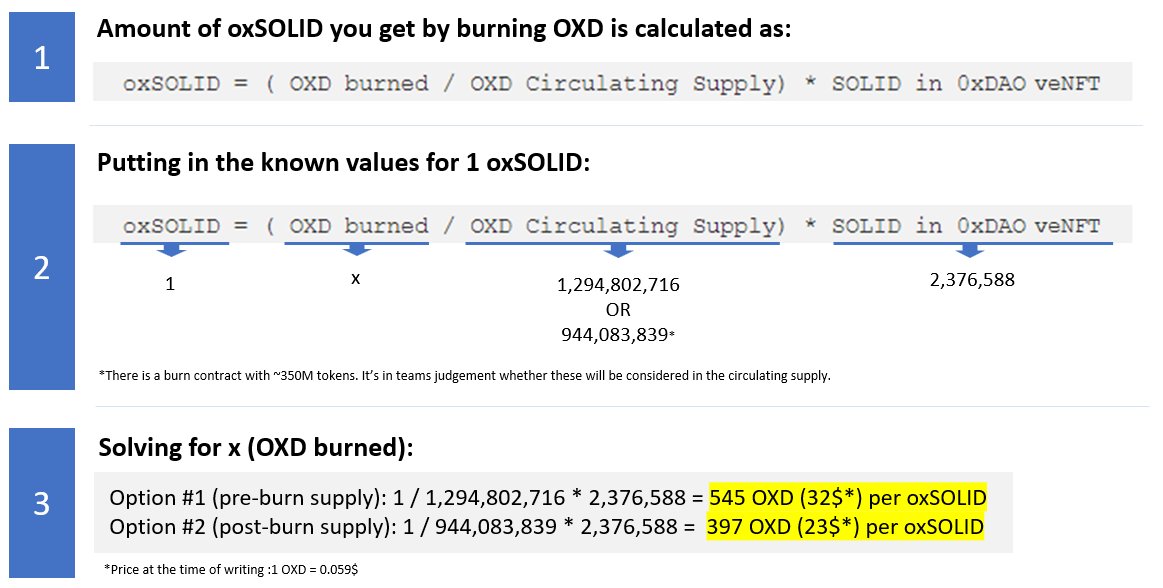

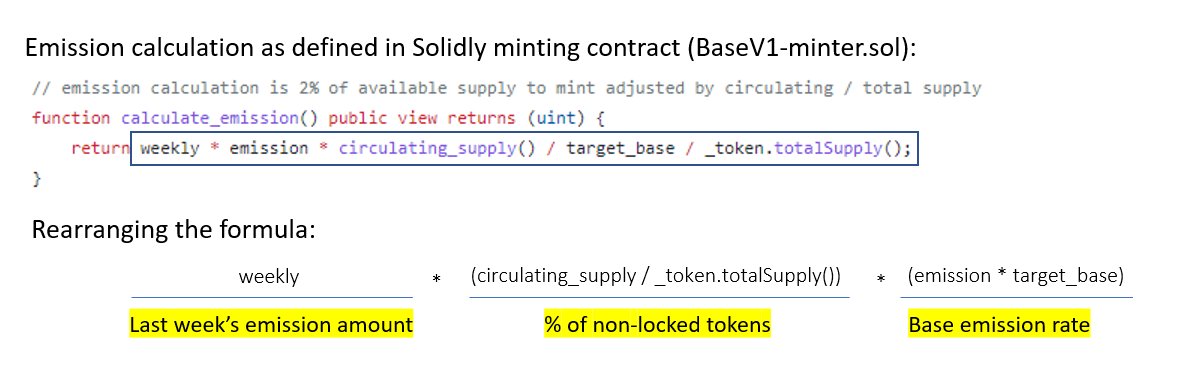

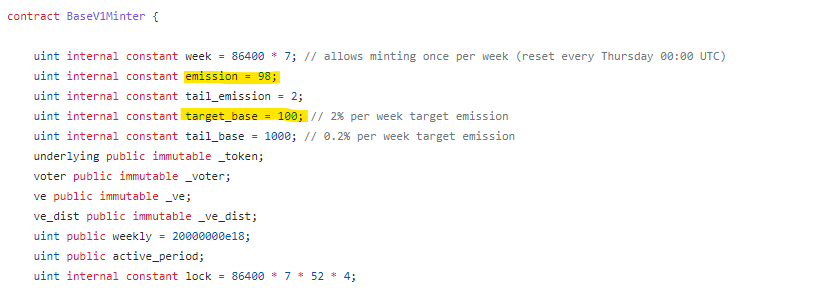

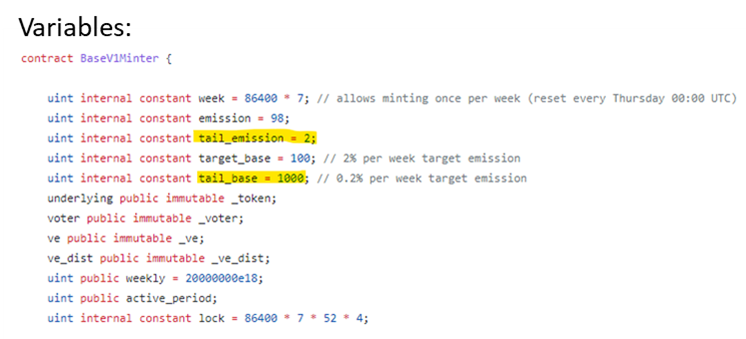

In the Solidly contracts, the emission amount is based on three factors:

1. Last week's emission amount (starting with 20M in week 1)

2. % of non-locked tokens

3. A base emission rate that is adjusted using 1 & 2 (5/10)

In the Solidly contracts, the emission amount is based on three factors:

1. Last week's emission amount (starting with 20M in week 1)

2. % of non-locked tokens

3. A base emission rate that is adjusted using 1 & 2 (5/10)

Reason #2 -cont:

The problem lies with the base emission rate. Notice how the comment in the code said the base emission calculation was 2% of available supply? Well it's not. It's the opposite. It's 98%. That x49 of the intended emission rate. (6/10)

The problem lies with the base emission rate. Notice how the comment in the code said the base emission calculation was 2% of available supply? Well it's not. It's the opposite. It's 98%. That x49 of the intended emission rate. (6/10)

Reason #2 -cont:

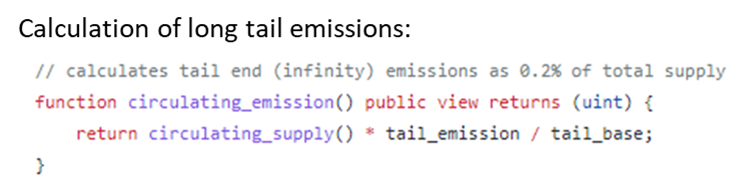

Solidly contract defines one more type of emission calculation: long tail emissions called "circulating_emission" in the code. It's set to 0.2% of total supply & supposed to take over once the initial 100M is mostly emitted (7/10)

Solidly contract defines one more type of emission calculation: long tail emissions called "circulating_emission" in the code. It's set to 0.2% of total supply & supposed to take over once the initial 100M is mostly emitted (7/10)

Reason #2 -cont:

The formula for circulating_emissions is in the screenshot. We see same structure for calculating base emission rate here as well. The only difference is, the variables are defined correctly to calculate the desired 0.2%. (8/10)

The formula for circulating_emissions is in the screenshot. We see same structure for calculating base emission rate here as well. The only difference is, the variables are defined correctly to calculate the desired 0.2%. (8/10)

This is my validation to believe that the value of "emission = 98" is indeed an error for the main emission formula. I believe the original intention was to have "emission = 2" and use it as the numerator for both emission implementations. Don't know what went wrong. (9/10)

In short: $SOLID has a soft-cap of 100M tokens. The emissions are giving away x49 of the intended amount of $SOLID each week until most of that 100M is distributed. (10/10 - END)

• • •

Missing some Tweet in this thread? You can try to

force a refresh