1/ What do you get when you combine high fuel costs, impending emissions limitations starting in 2023, and record high scrap steel prices?

Large ships sold for scrap at much younger ages than usual despite an optimistic outlook on earnings.

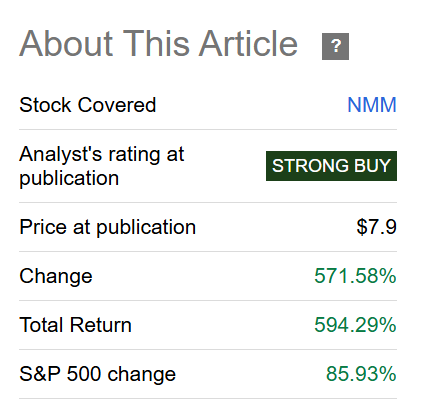

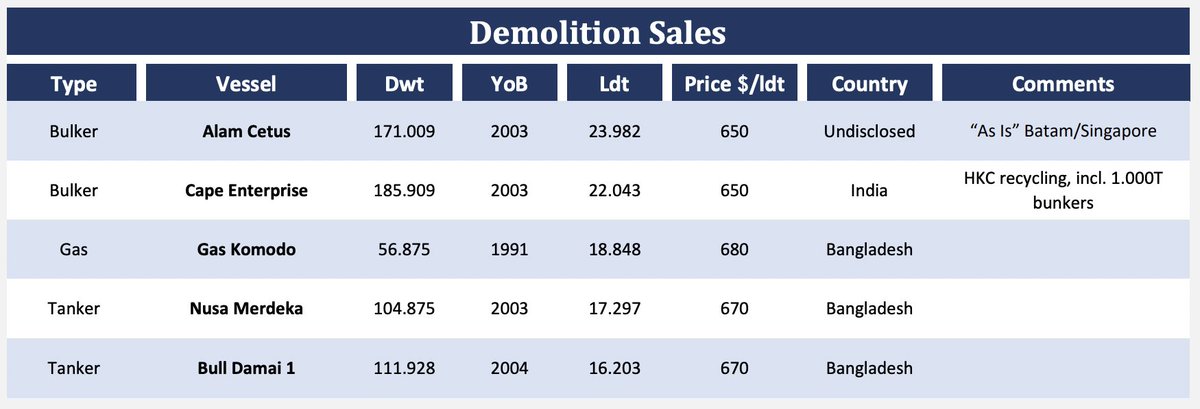

Last week's demo sales per Advanced:

Large ships sold for scrap at much younger ages than usual despite an optimistic outlook on earnings.

Last week's demo sales per Advanced:

2/ It is no surprises to see large 18 and 19 year old tankers sold for scrap last week considering the weak rate environment but it is a bit of a surprise to see young capesize bulk vessels scrapped with rate futures expecting highly profitable rates in the balance of 2022:

3/ But I can't argue with the decision to sell an asset nearing the end of its life for more than double the scrap value that similar vessels fetched only 18 months ago.

That is nearly $15m of cash for each cape sold last week which can now be redeployed into a younger vessel.

That is nearly $15m of cash for each cape sold last week which can now be redeployed into a younger vessel.

4/ It is becoming hard to refinance these old polluting vessels. That $15m of capital from an 19 year old vessel that can't be financed when sold for scrap can easily buy an 8 year old eco vessel financed at 50-70% which garners much higher rates.

5/ High scrap prices, lack of ship finance, and new carbon regulations requiring expensive retrofits will ensure that old ships get scrapped much earlier than usual. Even in a strong rate environment, average capesize demolition age will likely be closer to 20 going forward.

6/ Meanwhile average fleet age continues to rise and the orderbook for new ships remains at all time lows as a percent of fleet.

We are on a collision course with a massive supply shortage of ships.

We are on a collision course with a massive supply shortage of ships.

7/ This dynamic is playing out across shipping sectors but is especially pronounced in drybulk and tankers whose orderbooks are insufficient to replace scrapping and meet growing demand.

This is incredibly bullish for drybulk and tanker equities.

This is incredibly bullish for drybulk and tanker equities.

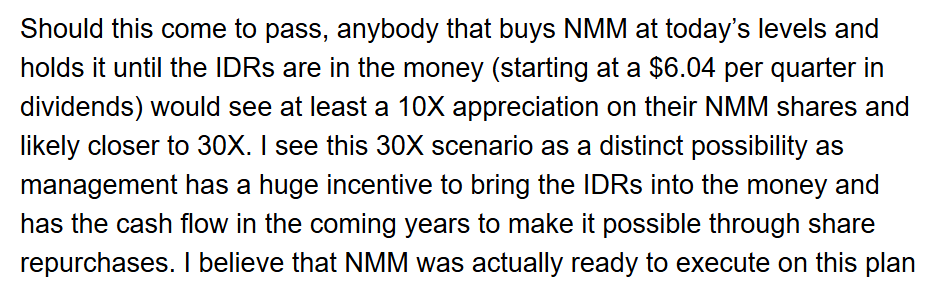

8/ Many of the largest and highest quality names in drybulk and tankers like $SBLK, $GOGL, $EURN, $FRO, $DHT have already surged and now trade at or above NAV. Although these remain great investments they are no longer 'cheap' relative to peers.

9/ Fortunately there are still some incredible bargains to be had with the smaller and more idiosyncratic names if you are willing to do DD and understand the risks.

Some of my favorite bargains of the moment include $NMM, $SHIP, $TNP and $CMRE.

Some of my favorite bargains of the moment include $NMM, $SHIP, $TNP and $CMRE.

• • •

Missing some Tweet in this thread? You can try to

force a refresh