Thread: How drawdowns make you a better trader ?🧵

1) As they say :

“A smooth sea never made a skilled sailor.”

Similarily,

Easy and calm markets will never make you a great trader !

1) As they say :

“A smooth sea never made a skilled sailor.”

Similarily,

Easy and calm markets will never make you a great trader !

2)

-Experiencing volatile markets,

-Handling large directional moves, -Going through a drawdown &

-Bouncing back to hit a new equity high.

All of the above are important to build your psychology & character as a trader & help you scaleup !

-Experiencing volatile markets,

-Handling large directional moves, -Going through a drawdown &

-Bouncing back to hit a new equity high.

All of the above are important to build your psychology & character as a trader & help you scaleup !

3) It was August 2016,

I was heavily short on JustDial.

Just Dial dropped by 40 percent in a couple of months & I made a whopping 300 %, thanks to leverage, on my capital in just 2 months.

The profit amassed was 72 Lakhs.

I was ecstatic and on cloud nine😬

I was heavily short on JustDial.

Just Dial dropped by 40 percent in a couple of months & I made a whopping 300 %, thanks to leverage, on my capital in just 2 months.

The profit amassed was 72 Lakhs.

I was ecstatic and on cloud nine😬

4) They say that success breeds complacency & complacency breeds failure.

This was my first million digit profit and at the age of 24,it seemed a lot of money.

I thought that it is really easy to make money in the stock market & started taking wild risks(gambling)

This was my first million digit profit and at the age of 24,it seemed a lot of money.

I thought that it is really easy to make money in the stock market & started taking wild risks(gambling)

5) After a big profit, I became over confident

A few months later,

I took a pair trade in HPCL & BPCL.

I was short on HPCL & long on BPCL. My logic for the trade was that they both had diverged & should revert back to mean.

So I took a big position size due to my overconfidence.

A few months later,

I took a pair trade in HPCL & BPCL.

I was short on HPCL & long on BPCL. My logic for the trade was that they both had diverged & should revert back to mean.

So I took a big position size due to my overconfidence.

5) But to my surprise, HPCL declared their quarterly results & announced a bonus. HPCL opened with a 7 % gap up & BPCL was down by 1 %

I was sitting on a huge loss but I didn’t close my position. In fact, I added more to it as both deviated even more & hence should converge.

I was sitting on a huge loss but I didn’t close my position. In fact, I added more to it as both deviated even more & hence should converge.

6) My huge position size was making me restless :(

Afte market close, I looked for any bad news that could make the price of HPCL go down.

My loss kept on widening & finally closed the trade with a huge loss.

I gave back almost all of the profits that I had made earlier😔

Afte market close, I looked for any bad news that could make the price of HPCL go down.

My loss kept on widening & finally closed the trade with a huge loss.

I gave back almost all of the profits that I had made earlier😔

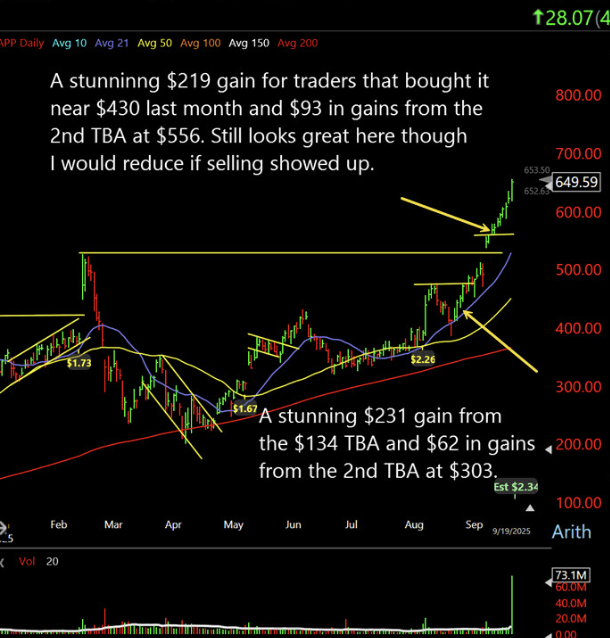

7) This trade made me understand 2 imp. things, which completely changed me as a trader:

-Never avg a losing trade.

-Always have proper position size & risk management in place, no matter how good a setup it is.

Before this trade, I had never seen a drawdown ever !

-Never avg a losing trade.

-Always have proper position size & risk management in place, no matter how good a setup it is.

Before this trade, I had never seen a drawdown ever !

8) For the first time ever, I felt the emotional pain as a trader.

I was in deep mental agony and emotional pain😢

Life had hit rock bottom.

I couldn’t muster the courage to even punch a single trade.

I was in deep mental agony and emotional pain😢

Life had hit rock bottom.

I couldn’t muster the courage to even punch a single trade.

9) After this loss making trade, I understood one thing that if I want to be a better trader.

Then I need to control my risk because:

A good trader needs to be a good risk manager &

One needs to be emotionally & mentally strong to endure drawdowns

Then I need to control my risk because:

A good trader needs to be a good risk manager &

One needs to be emotionally & mentally strong to endure drawdowns

10) In 2016, I decided to take a break from trading.

I realised that if I had to be in this full time & make a living out of it, I had to find a method to this madness & be more system driven.

I realised that more than strategy, I needs to build psychology to succeed in trading

I realised that if I had to be in this full time & make a living out of it, I had to find a method to this madness & be more system driven.

I realised that more than strategy, I needs to build psychology to succeed in trading

11) I started reading many books.

The ones that had the most impact on me trading psychology were:

Market Wizards, Hedge Fund Market Wizards by Jack Schwager and

Trading in the Zone by Mark Douglas.

The ones that had the most impact on me trading psychology were:

Market Wizards, Hedge Fund Market Wizards by Jack Schwager and

Trading in the Zone by Mark Douglas.

12) After such a big drawdown, I vowed that I’ll never take the markets lightly and always manage my risk at all times.

No matter how sure you are about a trade. Market can suprise you ;)

So always manage risk and I approached the markets again with a new perspective !

No matter how sure you are about a trade. Market can suprise you ;)

So always manage risk and I approached the markets again with a new perspective !

13) On 21st Sept 2018, I had sold 330 PE overnight and YesBank opened 10% lower and closed the day at -33%. But I survived as I bought 320 put as protection.

If I had not bought 320 PE then would have lost 10 L

I had learnt that good trading is all about managing risk :)

If I had not bought 320 PE then would have lost 10 L

I had learnt that good trading is all about managing risk :)

14) Ms. Nirmala Sitaraman Candle

On 21st Sept 2019, BankNifty rallied almost 10% intraday with huge IV spike in calls.

I had 27200 CE sold and booked loss in that at 220. The same option was trading at 2230 few hours later.

Would have lost heavily if I had not managed my risk

On 21st Sept 2019, BankNifty rallied almost 10% intraday with huge IV spike in calls.

I had 27200 CE sold and booked loss in that at 220. The same option was trading at 2230 few hours later.

Would have lost heavily if I had not managed my risk

15) Demonetisation

- Surgical Strike

- Flash Crash in March 19

- Lower Circuit on index in March 20

Have survived all major black swans without any major loss.

After making huge losses at the start of my career, I have realised that good trading is all about managing risk.

- Surgical Strike

- Flash Crash in March 19

- Lower Circuit on index in March 20

Have survived all major black swans without any major loss.

After making huge losses at the start of my career, I have realised that good trading is all about managing risk.

16) I go thru atleast 2 drawdowns > 7% every year.

Drawdowns are inevitable for a trader.

Anyone telling you otherwise is lying or selling dreams!

Life of a trader is not as rosy as it looks on social media !

You can learn strategies but psychology is built over time!

Drawdowns are inevitable for a trader.

Anyone telling you otherwise is lying or selling dreams!

Life of a trader is not as rosy as it looks on social media !

You can learn strategies but psychology is built over time!

17) You have to live through drawdowns as a trader. That’s the hard truth !

We can only manage risk & follow our systems.

Never take markets lightly & never make a loss so big that affects you emotionally

We can only manage risk & follow our systems.

Never take markets lightly & never make a loss so big that affects you emotionally

18) I always keep my mistakes & lessons learnt in front of my screen while trading.

Bcz we as traders tend to commit the same mistakes everytime.

So seeing your learnt lessons everyday ensures that you avoid them.

Bcz we as traders tend to commit the same mistakes everytime.

So seeing your learnt lessons everyday ensures that you avoid them.

19) If possible also write about your biggest losses and how you felt that time so that you make sure you never go thru that emotional pain again by repeating earlier mistakes.

20) We as traders get complacement when we are on a winning streak & my largest losses have come after my largest winning streaks

Lesson :

Never get complacement & always remember that market is supreme🙏

So stay humble always !

Lesson :

Never get complacement & always remember that market is supreme🙏

So stay humble always !

21) I have also written about my largest losses & the reason for the drawdown.

Was it my fault ?

Did Market conditions change?

How I felt during the drawdown ?

What could I have done better ?

Lesson :

All this gives you the confidence to sail your next drawdown smoothly.

Was it my fault ?

Did Market conditions change?

How I felt during the drawdown ?

What could I have done better ?

Lesson :

All this gives you the confidence to sail your next drawdown smoothly.

22) Also scaling up in tradinghappen with time and gradually.

You cannot go the gym & start lifting heavy weights from day 1,right ?

Similarily, scaling up in trading takes time & happens gradually :)

You cannot go the gym & start lifting heavy weights from day 1,right ?

Similarily, scaling up in trading takes time & happens gradually :)

23) Intially 1000 Rs loss se dar lagega, fir 10000 Rs se & kuch time baad 1 lakh loss b farak nai padega

I can trade upto 1000 lots without any fear. But if you ask me do 10000 lots then I may not be comfortable.

So every has their risk limit which changes with time.

I can trade upto 1000 lots without any fear. But if you ask me do 10000 lots then I may not be comfortable.

So every has their risk limit which changes with time.

24) So don’t copy traders on twitter and think that “ Yaar yeh toh daily 5-10 lakh banata hai “

We never know how much risk they took or if they do it consistently.

Always check for 3 years of P&L before believing anyone :)

“Dikhawe pe mat jao.. apni akkal lagao”

We never know how much risk they took or if they do it consistently.

Always check for 3 years of P&L before believing anyone :)

“Dikhawe pe mat jao.. apni akkal lagao”

25) Reason for this thread :

-No one talks about drawdown but it’s a part of traders life

-Always manage risk & Follow your systems

-Don’t be afraid of losses & drawdown as no system can make money all the time

Goodluck on your Trading Journey !

-End

-No one talks about drawdown but it’s a part of traders life

-Always manage risk & Follow your systems

-Don’t be afraid of losses & drawdown as no system can make money all the time

Goodluck on your Trading Journey !

-End

• • •

Missing some Tweet in this thread? You can try to

force a refresh