The Real Estate Investment Trust is (#REIT) a sixties-era tax shelter designed to allow mom-and-pop investors to buy into income properties. REITs are exempt from corporate tax, but they're also prohibited from managing the buildings they own. 1/

If you'd like an unrolled version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2022/03/01/rei… 2/

pluralistic.net/2022/03/01/rei… 2/

Banning REITs from management roles was supposed to scare off rich people looking for a tax break and keep REITs firmly in the realm of the "little guy." 3/

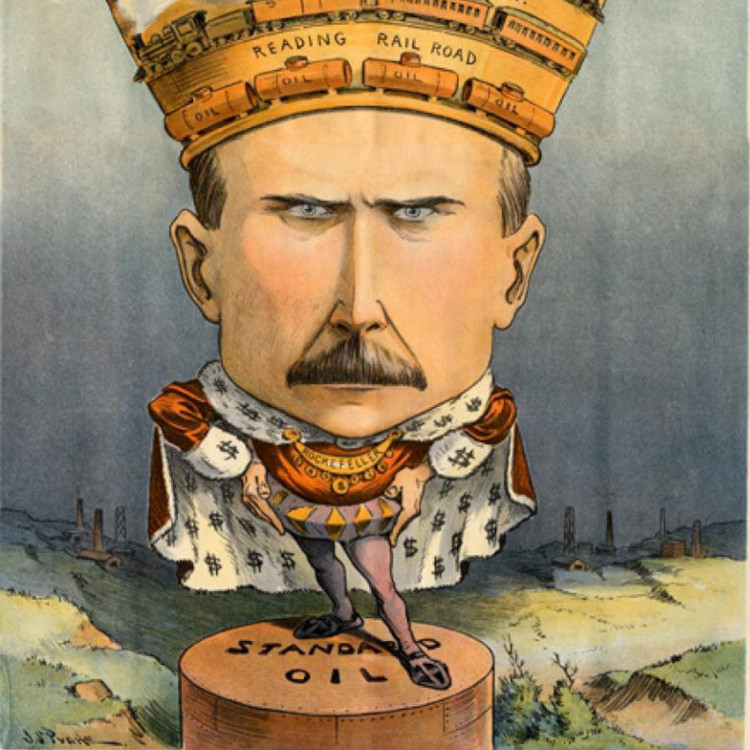

But as with any tax-shelter, the super-rich used REITs as a wedge to create a parallel system of property ownership and taxation reserved for plutocrats.

REITs offer many benefits to the ultra-rich beyond their tax-exempt status. 4/

REITs offer many benefits to the ultra-rich beyond their tax-exempt status. 4/

They offer a highly anonymized vehicle for offshore money-laundering. Billions in oligarch wealth has been converted to tax-free ownership of American commercial real-estate, cleaned, and remobilized as bribes, yachts and cryptos.

https://twitter.com/CZEdwards/status/12135971482745118725/

Not all of that offshore money is truly offshore, of course: when an American oligarch parks his cash on a treasure island, he doesn't spend it there. There's nothing to buy in the BVI or Gibraltar. 6/

That money is sent back to America, anonymized, tax-free, and turned into real-estate via REITs. 7/

(Though of course, a *lot* of that overseas oligarch cash comes from actual overseas oligarchs; post-Crimea invasion, REITs were a handy way for Russian oligarchs to beat US sanctions)

https://twitter.com/CZEdwards/status/12136118552449720338/

Now, recall that REITs have a poison pill: an REIT is allowed to own real-estate, but not manage it. In 1999, hospitality industry lobbyists successfully pushed through the REIT Modernization Act, which effectively ended this stricture. 9/

Under the new law, the REIT can incorporate a wholly owned subsidiary, a "taxable REIT subsidiary corporation" (TRS) which can manage the operations of hospitality businesses like hotels. 10/

You may have noticed the word "taxable" in "taxable REIT subsidiary corporation." Unlike an REIT, a TRS's profits are subject to taxation. 11/

But that's easily evaded: just have the leasing fee the TRS pays to its parent REIT represent 100% of the profits of the hotel it's managing. Now the TRS makes no profits, and the REIT makes all the profits, and the REIT is tax-exempt. 12/

The pandemic supercharged all forms of financial crime, and TRS scams are no exception. As @DRBoguslaw writes for @TheProspect, hotel REITs have found a way to smash their workers' unions, and they're using public money to do it.

prospect.org/labor/predator… 13/

prospect.org/labor/predator… 13/

Remember when it looked like all commercial real-estate would collapse, and when the entire tourist industry trembled on the brink of destruction?

pluralistic.net/2020/08/09/jus… 14/

pluralistic.net/2020/08/09/jus… 14/

The crisis was averted thanks to billions in public subsidy sent to hotels and other businesses, many of them owned by tax-exempt REITs. 15/

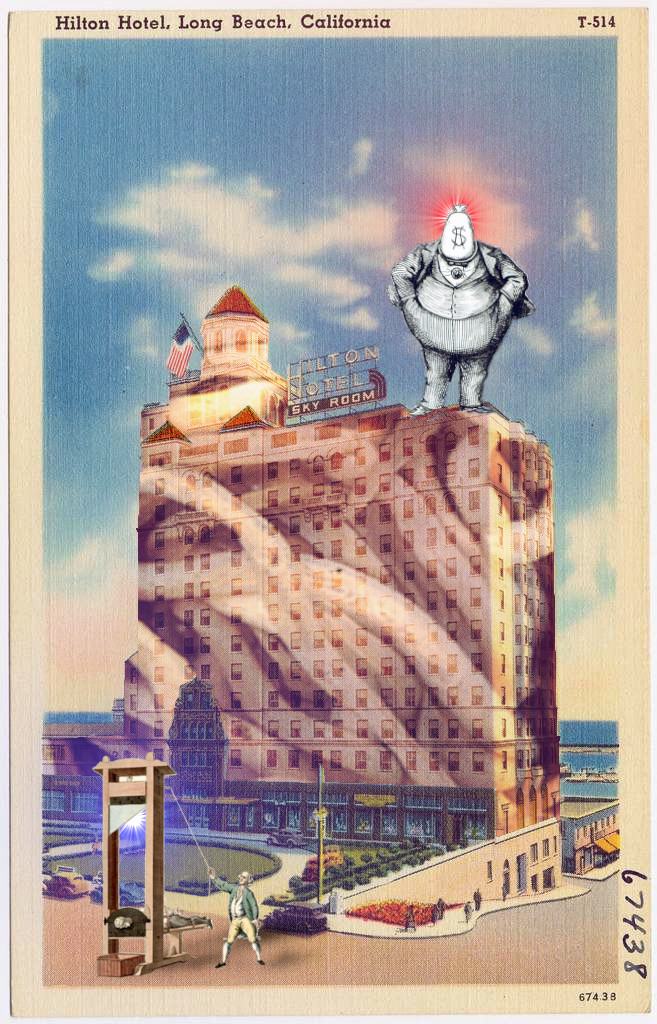

The big, name-brand hotels in large US cities are mostly "hollow" - Hiltons and Marriotts who've sold their names to TRSes who remit all the profits to REITs. 16/

As Boguslaw puts it, "the TRS was the perfect tool for parasitic investors to suck out profits from the marrow of hospitality firms, leaving brand-name hotels hollowed out and largely controlled by the burrowing REIT." 17/

Hotel work was hard before the pandemic, but at least hotel employees were unionized. Hotel REITs used the pandemic as a pretext to attack these workers. As hotel REIT DiamondRock CEO Mark Brugger told his shareholders, "Never waste a good crisis as they say. 18/

We are doing things that we’ve never done before. We’ve combined jobs we’ve never combined before. We’re running at efficiency levels on low occupancy we’ve never done before."

seekingalpha.com/article/438665… 19/

seekingalpha.com/article/438665… 19/

Here's RLJ Lodging Trust CEO Leslie Hale: "We’re pretty confident based on the way that we’re operating today and the occupancies that we’re running and efficiencies that we’ve learned that we will not have to go back to 2019 levels of labor."

seekingalpha.com/article/444616… 20/

seekingalpha.com/article/444616… 20/

What does that look like? Well Hawai'i's union hotels are at 90% pre-pandemic occupancy, but only 64% staffing. The hotels charge guests full price, but don't provide daily housekeeping. 21/

Even without daily room-cleaning, housekeepers are being worked to exhaustion: "They are letting workers suffer while hundreds are still waiting to have their jobs back" (Ruby Rubina, housekeeper, Hilton Hawaiian Village Honolulu). 22/

Analysts love the sound of this. They're calling for a 40% staffing cut and a $5b cut to hospitality workers' wages:

forbes.com/sites/michaelg… 23/

forbes.com/sites/michaelg… 23/

Hotel execs are fully onboard. Park Hotels CEO Thomas Baltimore: "We have been talking with the union about opportunities to rightsize [the labor] model." 24/

Remember, the entire basis for REITs owning hotels is a cheat, a way to let rich people take advantage of a tax-shelter created for "the little guy." It should come as no surprise that these same plutes are using other "little guy" tax breaks to hide billions. 25/

#TheIRSFiles from @propublica are full of revelations about REIT tycoons using the money they've saved by destroying the commercial real-estate sector to lobby for even more tax breaks. 26/

REIT tycoon Steven Roth dropped $5m lobbying for a 20% tax rate on REIT earnings in the Trump tax bill. That deduction now nets him $5m *per year* on dividends from his Vornado Realty Trust.

pluralistic.net/2021/08/11/the… 27/

pluralistic.net/2021/08/11/the… 27/

Congress is (finally) taking (baby) steps to address this scam. In @SenSherrodBrown and @MarkWarner's letter to @SECGov chair @GaryGensler, they called for mandatory REIT transparency reports detailing the number of subcontractors and other non-payroll employees. 28/

"We urge you to ensure that future SEC rulemaking captures this long-term trend of companies’ increasing use of outsourcing, independent contractors, and subcontracting, which will be a critical data point in understanding companies’ human capital management." 29/

That's a small start, but at least it would get some facts into evidence. A meatier proposal comes froom @4TaxFairness, who've called on @IRSnews to close the "loophole that allows REITs to consolidate profits to a small handful of shareholders."

americansfortaxfairness.org/wp-content/upl… 30/

americansfortaxfairness.org/wp-content/upl… 30/

"This dodge allows a small group of wealthy taxpayers to enjoy all the tax advantages of a REIT without fulfilling the system’s original intent of opening up real estate investment to middle-income households." 31/

Boguslaw closes his article by noting that the union that represents the majority of organized hotel workers is UNITE HERE, a key power-bloc for Democrats seeking re-election. 32/

"Ordering the IRS and the SEC to enforce powers over predatory REITs is a good start on Biden reversing the trend of power flowing from unionized workers to profiteering vultures. 33/

"Making a public commitment to the largely female, immigrant union workforce that helped him win his campaign would be even better." 34/

Image:

SuSanA Secretariat (modified)

flickr.com/photos/gtzecos…

CC BY 2.0:

creativecommons.org/licenses/by/2.… 35/

SuSanA Secretariat (modified)

flickr.com/photos/gtzecos…

CC BY 2.0:

creativecommons.org/licenses/by/2.… 35/

• • •

Missing some Tweet in this thread? You can try to

force a refresh