14 year ago, the world's financial system came to the brink of collapse. Central banks scrambled to react. Businesses shuttered. People lost their homes. Many governments fell. Faith in our institutions shattered. The Occupy movement was launched. So was Bitcoin. 1/

What brought on the Great Financial Crisis? The "shadow banking system" - a system of unregulated financial activities that are just like their regulated cousins, except that they're, well, *unregulated*. 2/

The GFC was precipitated by "financial innovation": new tricks that allowed traditional financial activities to take place while evading the controls instituted to head off the kinds of systemic collapses that plagued nations for centuries. 3/

The shadow banking system's "innovations" produced three effects:

I. Leverage: regulated banks must place limits on how much their customers can borrow and gamble with. 4/

I. Leverage: regulated banks must place limits on how much their customers can borrow and gamble with. 4/

"Credit swaps" allowed for effectively unlimited leverage, so that every routine transaction in the real economy could result in fortunes changing hands in the shadow banking world. 5/

II. Rigidity: To reduce the risk of this over-leveraging, shadow banks created brittle, rigid contracts that forced sell-offs or margin calls when certain things took place. In good times, these made the gambling seem safe. During a crisis, these turned into suicide pacts. 6/

III. Bank-runs: When over-leveraged assets hit a bump, the leverage and the rigidity of the contracts meant to "de-risk" it triggered cascading price-drops, which sent investors running for the doors. 7/

When everyone tries to get out of a market at once, you get a bank-run, which drives otherwise sound institutions to collapse. 8/

The shadow-banking system created a whole menagerie of exotic "products" that all shared one characteristic: they were complex. The complexity of these instruments made it hard to know when you were taking a sucker's bet. 9/

Worse, they made it hard for designers, analysts and executives to understand how all the pieces put together - steps taken to make one part of the system less risky could make otherwise sturdy parts far shakier. 10/

Shadow bankers evaded regulation in order to allow massive leverage. Then they evaded *more* regulation to make the system seem less risky. For example, many of these instruments were designed to bypass bankruptcy courts by making both parties promise not to use them. 11/

That made the bets involved seem safer, because you could be sure that someone who owed you money wouldn't ask a judge to wipe out those debts. 12/

But that *also* meant that when the system started to keel over, none of the parties involved could ask a court to reduce the velocity and savagery of the collapse. 13/

As each layer of the shadow banking system failed, it took down other layers, reaching outside of the financial system to smash companies, home-ownership, and local governments. 14/

For all that the complexity made it hard to see how dangerous the shadow banking system was, we weren't completely in the dark. 15/

The shadow banking system was huge, sucking up trillions, and it was obviously doing so by avoiding the regulations installed to prevent financial collapses. It didn't take a rocket surgeon to see that this could go wrong. 16/

And yet, Congress not only failed to act - it explicitly *grew* the shadow banking system. 2000's Commodity Futures Modernization Act in 2000 *banned* regulators from intervening in the swaps market to reduce leverage. 17/

The Act's co-sponsor, Rep Thomas Bliley, said swaps "reflect the unique strength and innovation of American capital markets." He boasted that American shadow bankers were "global leaders in derivatives technology and development." 18/

Even where Congress didn't tie regulators' hands, those regulators chose to sit on them, taking a wait-and-see approach to shadow banking. That is, they decided to wait and see whether it would destroy the world's economy before acting. 19/

If talk of leverage, complexity, rigidity and system risk gives you deja vu, you're not alone. In a superb new paper, @ProfHilaryAllen of @AmericanU's @AUWCL argues that #DeFi, the "distributed finance" wing of #web3, is really "Shadow Banking 2.0."

papers.ssrn.com/sol3/papers.cf… 20/

papers.ssrn.com/sol3/papers.cf… 20/

Allen argues that defi repeats the sins of the original shadow banking system, and then makes them worse. Defi, after all, is the latest iteration of #fintech, and as @raaleh is at pains to remind us, "fintech" is a euphemism for "unregulated bank." 21/

As with the shadow banking system, the point of defi is to offer traditional financial instruments outside of the traditional regulatory framework. As with the shadow banking system, defi's instruments are complex. 22/

As with the shadow banking system, defi enables leverage, compensates for it with rigidity, and is thus vulnerable to bank runs.

Defi's pitch is that you don't have to trust a regulated bank to play fair (which is compelling, as regulated banks are awfully sleazy). 23/

Defi's pitch is that you don't have to trust a regulated bank to play fair (which is compelling, as regulated banks are awfully sleazy). 23/

But defi replaces regulated banks with something even riskier: "new intermediaries who are often unidentified and unregulated." 24/

In shadow banking 1.0, money-market mutual funds were billed as a way to anchor abstract financial transactions to the real economy, a safe and reliable way to cash out of your investments. They proved to be anything but. 25/

In shadow banking 2.0, we have #stablecoins like Tether, which are pegged to real money like the US dollar and (allegedly) backed by dollar-denominated assets. Hypothetically, Tether has $1 worth of assets for every $1 worth of Tether it has issued. 26/

In reality, it's an open secret that Tether is a colossal fraud, issuing worthless paper backed by empty promises.

In shadow banking 1.0, we had complex financial instruments that you had to be a finance expert to begin to understand. 27/

In shadow banking 1.0, we had complex financial instruments that you had to be a finance expert to begin to understand. 27/

In shadow banking 2.0, we have #smartcontracts, which you need to be a financial expert *and* a coder to make sense of.

These smart contracts don't just create instability by being too complex to understand and vulnerable to coding errors - they're also fraud magnets. 28/

These smart contracts don't just create instability by being too complex to understand and vulnerable to coding errors - they're also fraud magnets. 28/

In the glory days of the Big Con, ropers for con artists would ride the railroads, looking for marks and setting up the con. 29/

If the mark was a gambler, they'd send a telegram ahead to their confederates calling for a stock swindle, where the gambler would be out of his depth. If the mark was a stock broker, they'd call for a horse-racing scam, because brokers didn't understand the ponies. 30/

The Venn intersection of "people who code" and "people who understand finance" is so small it's a *sphincter*. 31/

Scammers who work smart contracts don't even need to change up the swindle: no matter whether the mark is a coder or a banker, there will be key elements of the game they can't make heads nor tails of. 32/

Smart contracts introduce extraordinary brittleness into shadow banking 2.0. They allow defi loans to automatically liquidate if the value of collateral dips below a set threshold. 33/

That could send the borrower into a selling frenzy, liquidating other assets, driving down their prices, triggering other automated liquidations. 34/

There are theoretical ways to build circuit-breakers into smart-contracts to prevent this kind of cascade, like having them consult another contract before firing, or even waiting for a human referee (an "oracle") to give the go-ahead. 35/

But each of these transactions comes with "gas fees" for the computing to run them, and penny-pinching shadow bankers are loathe to pay these fees. 36/

Likewise theoretical is the way that stablecoins could constrain leverage in defi: but "when stablecoins are used as collateral for loans, the proceeds of those loans are... collateral for other loans, which can then be used as collateral for further loans, and so on." 37/

Leverage plus brittleness leads to bank runs. Stablecoins are (alleged) to be redeemable for real money. 38/

If (when) leverage and brittleness trigger a stampede for the exit, exchanges and issuers will be on the hook to find a *lot* of actual dollars to make the "investors" of the defi world whole.

When that happens, it won't just be the defi world that gets sucked under. 39/

When that happens, it won't just be the defi world that gets sucked under. 39/

As with shadow banking 1.0, shadow 2.0 is increasingly woven into the real economy, thanks to ventures like @jpmorgan's blockchain team and the regulated banks working towards issuing their own stablecoin. 40/

Shadow banking 1.0 crashed the world's economy and destroyed millions of lives in part because regulators sat by and watched as it created risk that is loaded onto all of our books. The same thing is happening with defi right now. 41/

Allen proposes several kinds of regulation to head that off, mirroring existing securities regulation. 42/

For example, licensing stablecoins and requiring that they have a bona fide economic purpose beyond speculation, and limiting dapp investment to people who demonstrate a knowledge of both finance and programming. 43/

Allen notes that defi advocates will accuse her of focusing solely on defi's risks and not its benefits, notably, decentralization. Allen counters by citing a paper from @BIS_org that critiques the "decentralisation illusion"

bis.org/publ/qtrpdf/r_… 44/

bis.org/publ/qtrpdf/r_… 44/

The paper argues that defi orgs tend to concentration because of the consensus mechanisms that underpin them, and because of the need to create centralized nodes to perform key parts of any financial system. 45/

I'm aware that there are web3 advocates who dispute this, and can point to some proof of stake mechanisms and other measures that are designed to maintain decentralization of the system. 46/

But there's another kind of decentralization that is far harder to dispute: decentralization of wealth. 47/

The exchanges and systems that produce and manage cryptocurrencies may or may not be decentralized to a greater or lesser degree, but the *value* of those cryptocurrencies is even more concentrated than real money:

gizmodo.com/bitcoin-s-ineq… 48/

gizmodo.com/bitcoin-s-ineq… 48/

That's the decentralization I care about. I don't care how distributed the *banks* are if all the money is owned by the same number of billionaires (or even fewer billionaires, for that matter). 49/

The lesson of shadow banking 1.0 is that an untethered finance sector doesn't just harm the gamblers who enter its casino: when the shadow banks collapse, they take the rest of us down with them. 50/

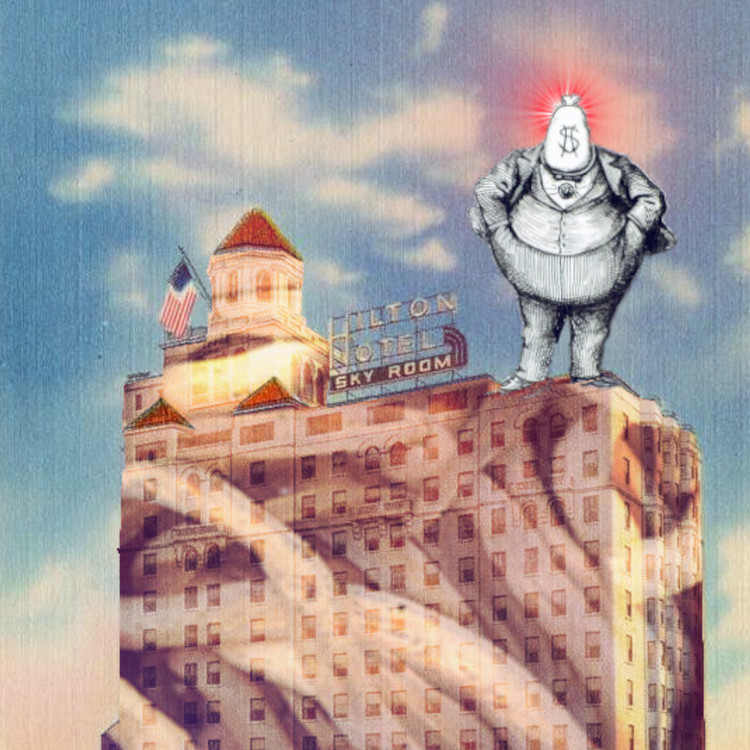

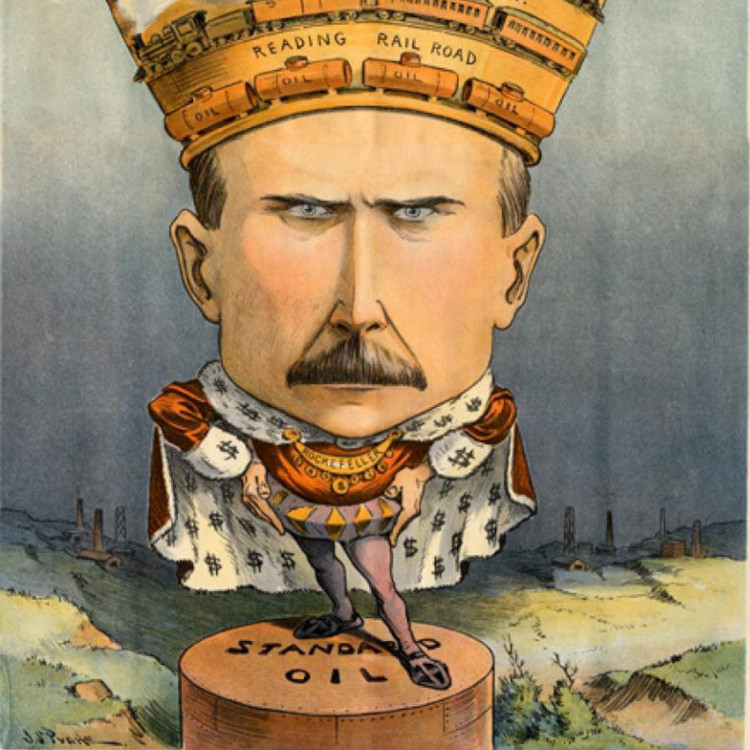

Image:

Derrich (modified):

commons.wikimedia.org/wiki/File:Mamm…

CC BY-SA 3.0:

creativecommons.org/licenses/by-sa…

Ed Uthman (modified):

flickr.com/photos/euthman…

CC BY-SA 2.0:

creativecommons.org/licenses/by-sa… 51/

Derrich (modified):

commons.wikimedia.org/wiki/File:Mamm…

CC BY-SA 3.0:

creativecommons.org/licenses/by-sa…

Ed Uthman (modified):

flickr.com/photos/euthman…

CC BY-SA 2.0:

creativecommons.org/licenses/by-sa… 51/

ETA - If you'd like an unrolled version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2022/03/02/sha…

pluralistic.net/2022/03/02/sha…

• • •

Missing some Tweet in this thread? You can try to

force a refresh