The first million is the hardest.

Four people, four stories.

Here's how they made their first million.

👇 🧵

Four people, four stories.

Here's how they made their first million.

👇 🧵

1/ First on the list is the most active tweeter in the world - @elonmusk. He's also pretty rich.

But it didn't start that way. Though Elon was good with science and programming as a kid, his first jobs were, well... unconventional.

But it didn't start that way. Though Elon was good with science and programming as a kid, his first jobs were, well... unconventional.

2/ He worked in a farm and a lumber mill, and he rented out his house for beer parties to pay for college!

But after college (and a short internship), Elon hit upon an idea while struggling with the local Yellow Pages.

He wanted to make an online city guide. Zip2 was born.

But after college (and a short internship), Elon hit upon an idea while struggling with the local Yellow Pages.

He wanted to make an online city guide. Zip2 was born.

3/ Built on borrowed internet and pizza, the venture grew fast.

But then, there were merger struggles and Elon left after Zip2 was sold for $305M.

But this got him $22 Million at 28 - Which he reinvested in X.com, later Paypal.

No looking back since.

But then, there were merger struggles and Elon left after Zip2 was sold for $305M.

But this got him $22 Million at 28 - Which he reinvested in X.com, later Paypal.

No looking back since.

4/ Kevin O'Leary - Mr.Wonderful from Shark Tank - was fired from an icecream shop as a boy because he refused to scrape gum off the floor.

He decided to never work for a boss again.

He picked up cinematography in his college years.

This unlikely passion kicked off his journey.

He decided to never work for a boss again.

He picked up cinematography in his college years.

This unlikely passion kicked off his journey.

5/ When he joined MBA, @kevinolearytv struck a deal with his dean to make a recruiting film for the college - in return for extra credit.

The film netted him a profit. It also got him a team of peers to work with.

They went on to shoot sports films for TV.. Netting > $100k!

The film netted him a profit. It also got him a team of peers to work with.

They went on to shoot sports films for TV.. Netting > $100k!

6/ Kevin quit his TV film business and teamed up with a friend who was writing code for graph plotters.

Kevin used his business savvy to sell the code as a package to plotter manufacturers. When the company went public...

Mr. Wonderful made his first million.

Kevin used his business savvy to sell the code as a package to plotter manufacturers. When the company went public...

Mr. Wonderful made his first million.

7/ Mark Cuban, another Shark Tank member, started a little differently.

After making some money by buying a bar in college, @mcuban joined Mellon Bank as a junior - He was fired soon after for forming a club without his "boss's permission."

Mark left for Dallas, frustrated.

After making some money by buying a bar in college, @mcuban joined Mellon Bank as a junior - He was fired soon after for forming a club without his "boss's permission."

Mark left for Dallas, frustrated.

8/ He found a job in a retail store while studying computers on his own in the night.

One day, Mark got a $15k deal for the store but his boss wanted him to manage the store instead.

Mark disobeyed thinking the 15k would be redemption enough.

He was fired instead. Strike 2

One day, Mark got a $15k deal for the store but his boss wanted him to manage the store instead.

Mark disobeyed thinking the 15k would be redemption enough.

He was fired instead. Strike 2

9/ After this, Mark decided not to work for a boss, like Mr. Wonderful, and started his own software reseller, MicroSolutions.

It sold to Compuserve in 1990 for $30M, and he made $2M off of it - at the age of 32.

He's never looked back, going on to make many more millions.

It sold to Compuserve in 1990 for $30M, and he made $2M off of it - at the age of 32.

He's never looked back, going on to make many more millions.

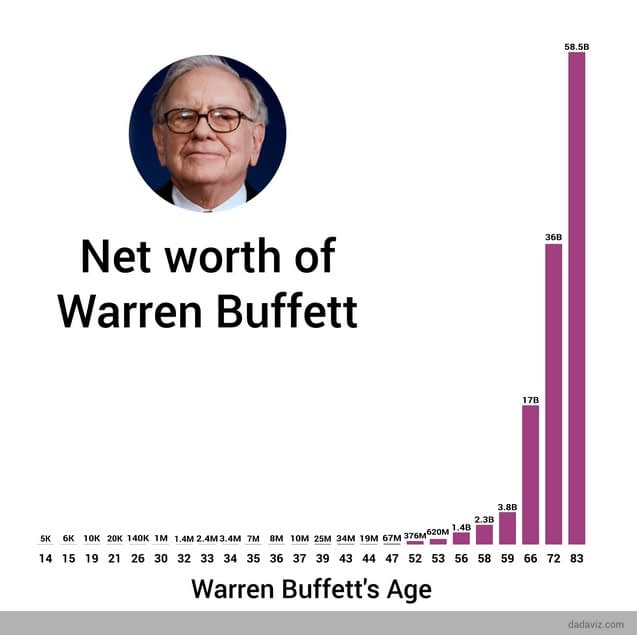

10/ This list is incomplete without Warren Buffett, though the story is famous and... long. TLDR:

Buffett's strength was time. He started early, investing money he got selling papers.

He went on to business school and got a job with his idol, value investor Ben Graham.

Buffett's strength was time. He started early, investing money he got selling papers.

He went on to business school and got a job with his idol, value investor Ben Graham.

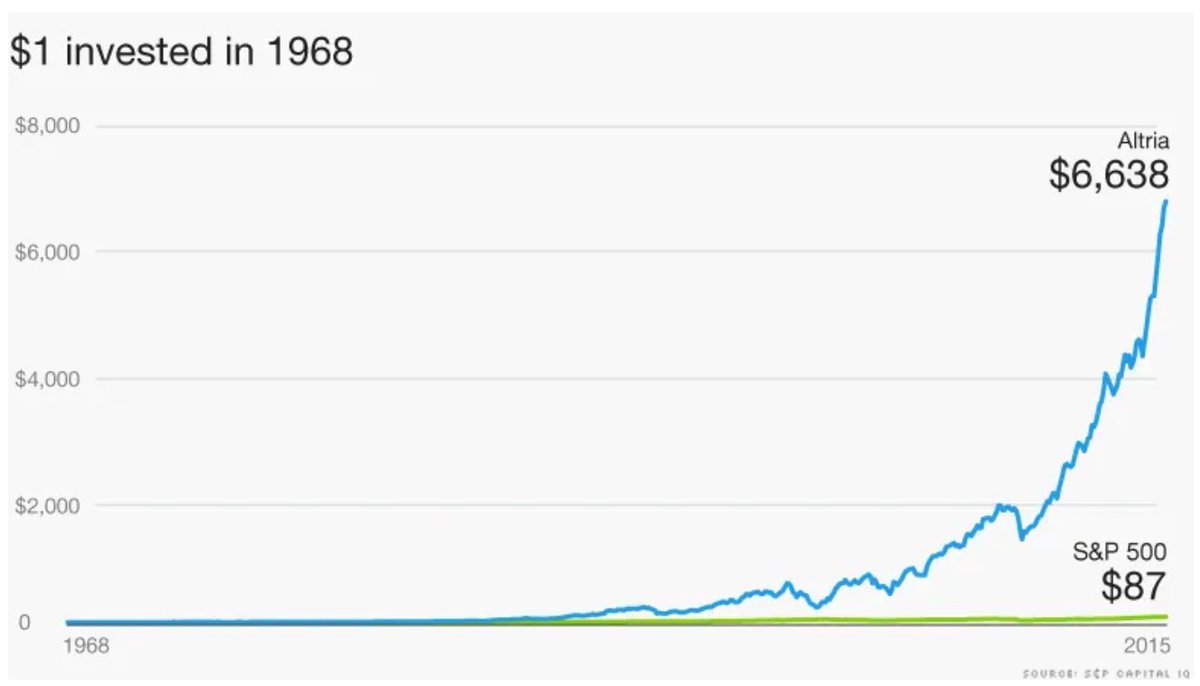

11/ Buffett's acumen got him great returns.

In turn, this track record got him other people's money to manage, and he kept doing better.

His approach changed when he met Charlie Munger who got him to buy more good companies than underpriced ones. (Not so simple, but just, ok?)

In turn, this track record got him other people's money to manage, and he kept doing better.

His approach changed when he met Charlie Munger who got him to buy more good companies than underpriced ones. (Not so simple, but just, ok?)

12/ With his focus, patience, and Munger's partnership, Buffett made his first million at age 31.

But the remarkable part is the consistent growth afterwards - Of his $117B today, more than $110B was earned after he turned 60!

No wonder he's the poster boy of compound interest.

But the remarkable part is the consistent growth afterwards - Of his $117B today, more than $110B was earned after he turned 60!

No wonder he's the poster boy of compound interest.

13/ So there you have it.

To sum up in Buffett's words, "There is more than one way to get to heaven," and each of these m(b)illionaires got there in different ways.

What would you take away from these stories for your wealth-building goals?

Let me know!

To sum up in Buffett's words, "There is more than one way to get to heaven," and each of these m(b)illionaires got there in different ways.

What would you take away from these stories for your wealth-building goals?

Let me know!

• • •

Missing some Tweet in this thread? You can try to

force a refresh