Read our newsletter for actionable, data-backed insights for long-term investors, financial advisors, and analysts 👇

4 subscribers

How to get URL link on X (Twitter) App

It all traces back to Section 174 of the U.S. tax code.

It all traces back to Section 174 of the U.S. tax code.

Consider a coin-flip game to simulate an asset with zero long-term returns.

Consider a coin-flip game to simulate an asset with zero long-term returns.

The Buffett Indicator is the ratio of the market value of equity (MVE) to the gross domestic product (GDP).

The Buffett Indicator is the ratio of the market value of equity (MVE) to the gross domestic product (GDP).

It's well proven that consumer confidence predicts economic activity.

It's well proven that consumer confidence predicts economic activity.

Regarding short-term trends, last year's worst-performing sector (Communication Services: -22%) was among the best performers in H1’23 (+19%).

Regarding short-term trends, last year's worst-performing sector (Communication Services: -22%) was among the best performers in H1’23 (+19%).

The fundamental problem with picking stocks is it's not a 50/50 chance as most investors think.

The fundamental problem with picking stocks is it's not a 50/50 chance as most investors think.

Call it irony or foreshadowing, Sun Microsystem's campaign was "We put the dot in dot com".

Call it irony or foreshadowing, Sun Microsystem's campaign was "We put the dot in dot com".

The idea of leverage is simple. Compounding takes time to work - but you can accelerate the process by using debt.

The idea of leverage is simple. Compounding takes time to work - but you can accelerate the process by using debt.

The Fed funds rate is the interest rate banks charge each other to lend Federal Reserve funds overnight.

The Fed funds rate is the interest rate banks charge each other to lend Federal Reserve funds overnight.

A lot of Teledyne's rapid growth had been due to acquisitions.

A lot of Teledyne's rapid growth had been due to acquisitions.

2/ A company can get into the S&P 500 if it passes these three basic conditions:

2/ A company can get into the S&P 500 if it passes these three basic conditions:

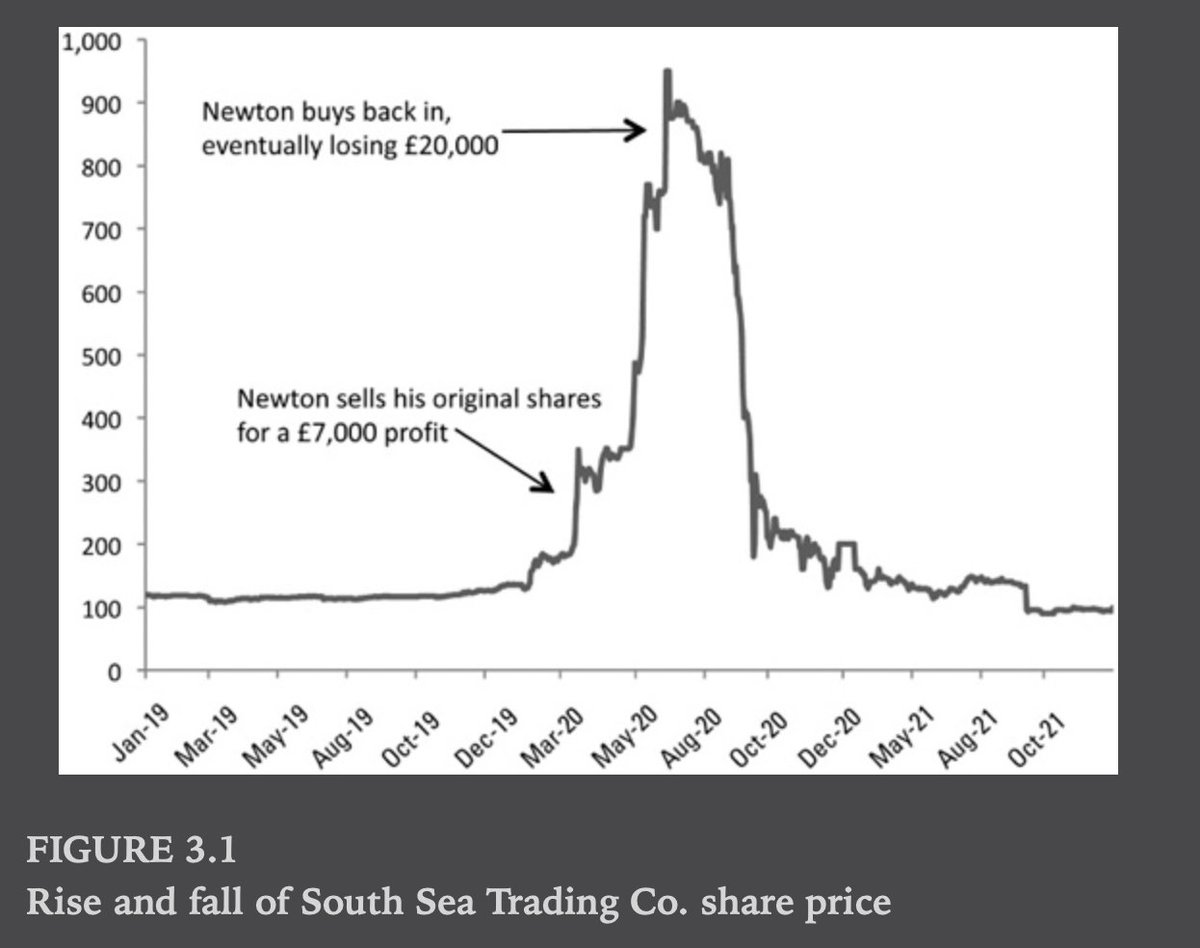

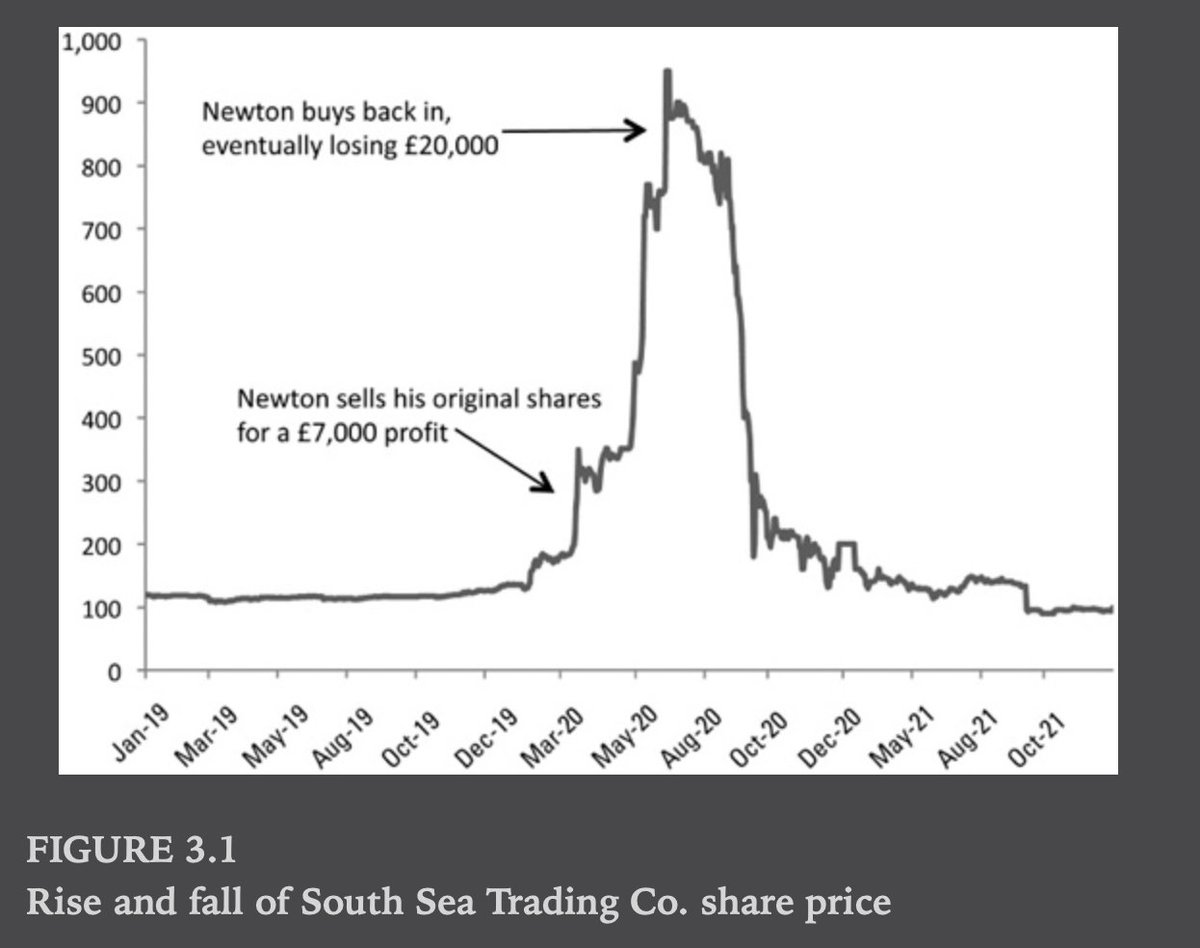

Ironically, the South Sea bubble also began with irresponsible spending - by the British Govt.

Ironically, the South Sea bubble also began with irresponsible spending - by the British Govt.

2/ Hedge fund managers only had to deliver on their promise. The $500k would just be a bonus.

2/ Hedge fund managers only had to deliver on their promise. The $500k would just be a bonus.

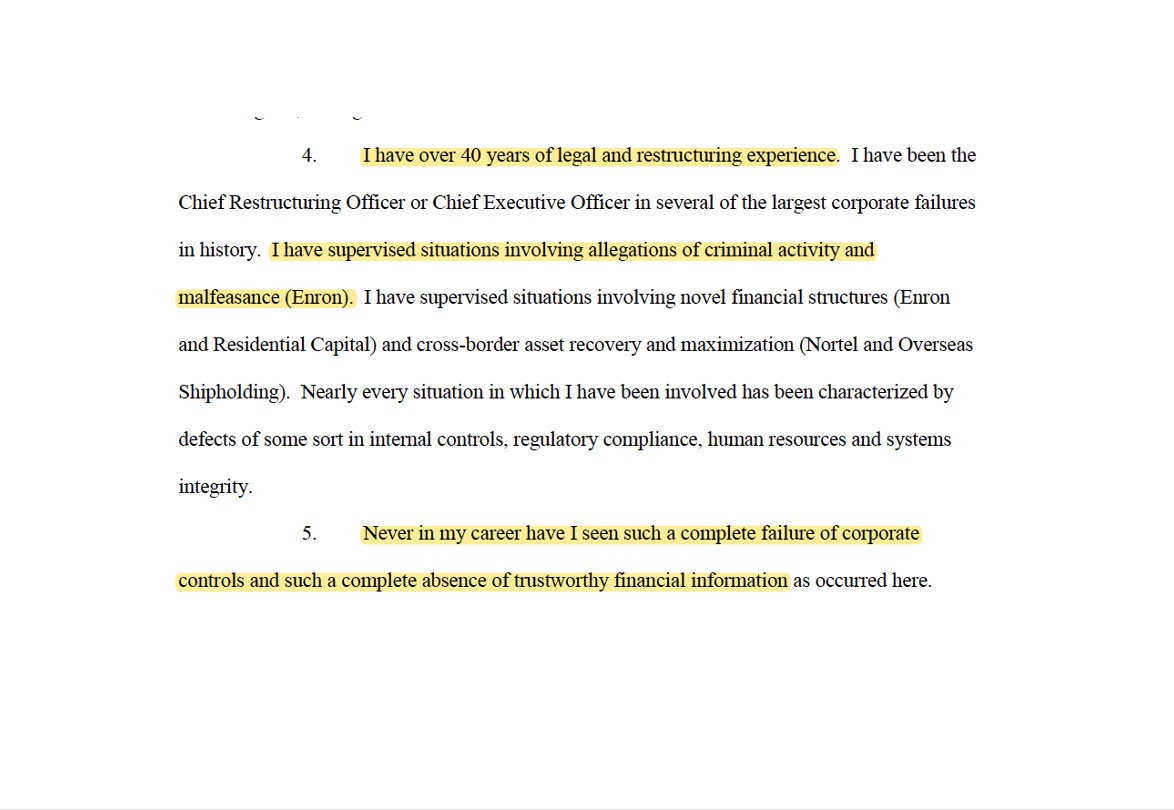

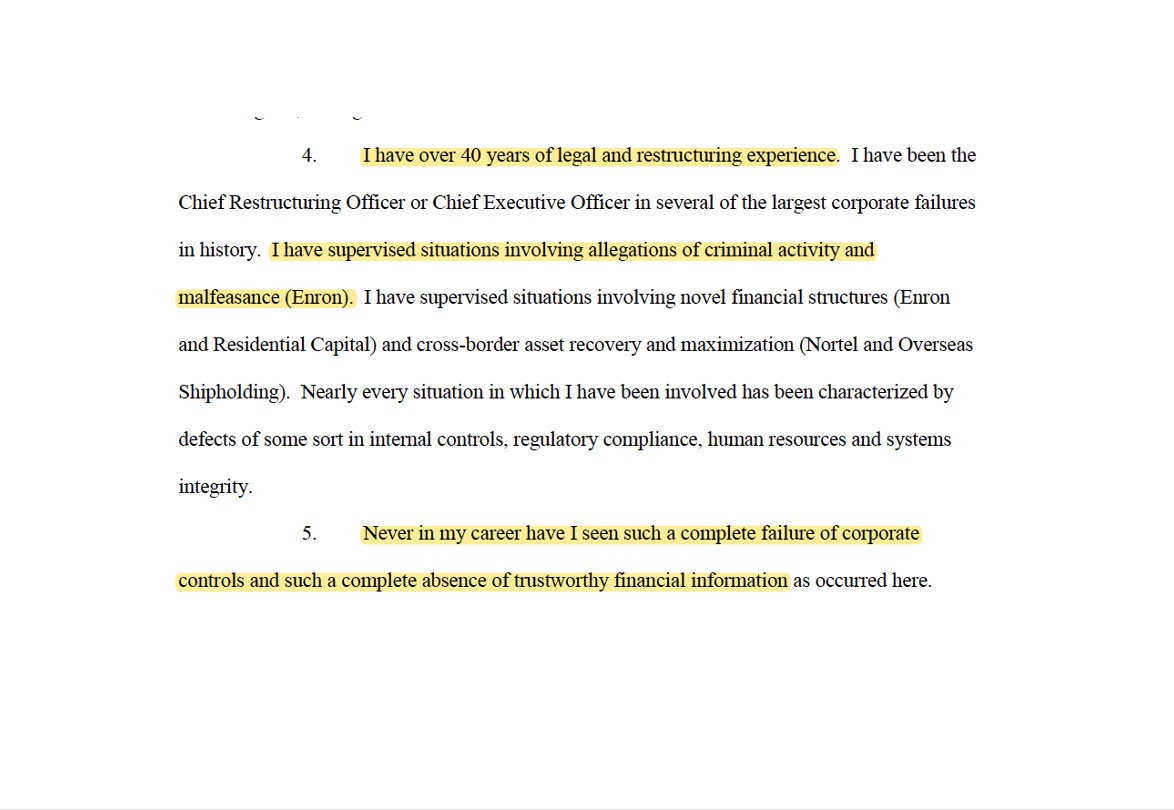

2/ The company did not have any cash management system.

2/ The company did not have any cash management system.