China Property (thread #2)

Continued stress as developers sales -50% YoY, but home price drop eased.

Property equities $CHIR retreated but +1% YTD.

Bonds -33% YTD with "sell first, think later" mentality. No trust.

More background in prev thread:

1/

Continued stress as developers sales -50% YoY, but home price drop eased.

Property equities $CHIR retreated but +1% YTD.

Bonds -33% YTD with "sell first, think later" mentality. No trust.

More background in prev thread:

https://twitter.com/ssinvestments8/status/1484059606355570689?t=zLnMECSp8DwvBTpxBPR5hw&s=19

1/

Total lack of trust with hidden off-balance sheet debt uncovered bit by bit.

Basically hidden as "minority interest" within balance sheet equity.

With net debt to total equity and to shareholders equity at 68% and 115%, it implies hidden debt at 41% of equity.

h/t @jpmorgan

2/

Basically hidden as "minority interest" within balance sheet equity.

With net debt to total equity and to shareholders equity at 68% and 115%, it implies hidden debt at 41% of equity.

h/t @jpmorgan

2/

Land sales is tied to 40%+ of local govt revenue and developers are being forced to deleverage, resulting in lower land acquisitions.

This is a funding problem for social welfare and local govt credit.

When all problems are tied together, a quick solution seems unlikely.

3/

This is a funding problem for social welfare and local govt credit.

When all problems are tied together, a quick solution seems unlikely.

3/

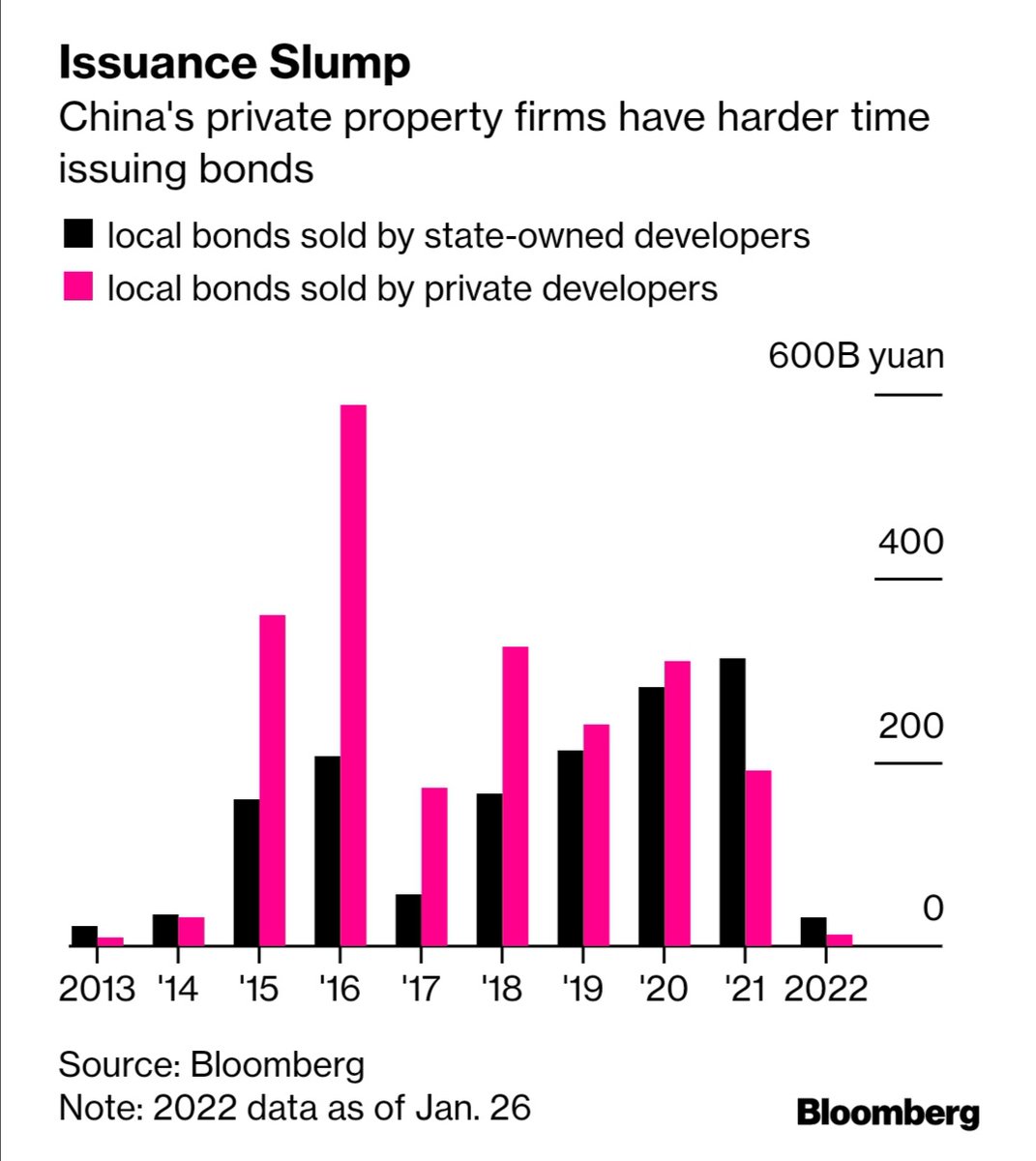

The tone has shifted to easing for the sector, but it's unclear if it means for the entire sector or just the state-owned developers.

Most bonds in the mkt are issued by privately-owned developers but mostly just the state-owned players have access to liquidity, i.e. oxygen.

4/

Most bonds in the mkt are issued by privately-owned developers but mostly just the state-owned players have access to liquidity, i.e. oxygen.

4/

• • •

Missing some Tweet in this thread? You can try to

force a refresh