#WeeklyIndexCheck CW09/2022

Market Quadrant:

⦿ Trend: Downtrend

⦿ Momentum: Negative & worsening

⦿ Breadth: Oversold

⦿ Bias: Bearish

Market Quadrant:

⦿ Trend: Downtrend

⦿ Momentum: Negative & worsening

⦿ Breadth: Oversold

⦿ Bias: Bearish

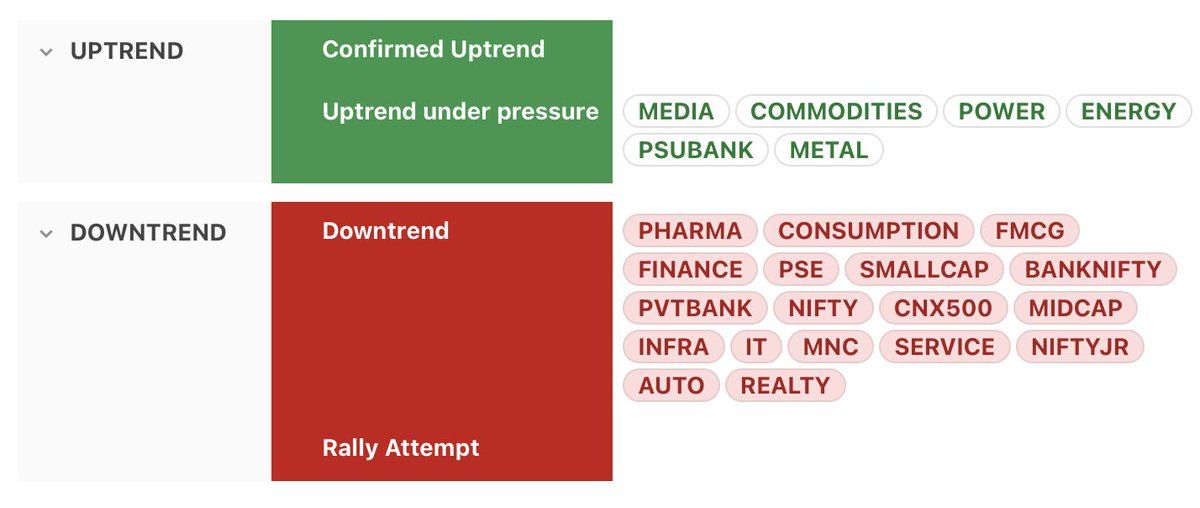

Trend

⦿ Most major indices (including Nifty, CNX500, Midcap, Smallcap) stay in downtrend.

⦿ Auto & Realty join the red list this week

⦿ Metals, PSUbank, Power & Energy stay in uptrend under pressure.

⦿ Most major indices (including Nifty, CNX500, Midcap, Smallcap) stay in downtrend.

⦿ Auto & Realty join the red list this week

⦿ Metals, PSUbank, Power & Energy stay in uptrend under pressure.

Momentum

⦿ No index is having positive momentum

⦿ Most indices (including Nifty, CNX500, Midcap, Smallcap) are showing negative & worsening momentum

⦿ Only Energy, IT, Metal & PSE are having negative but improving momentum

⦿ No index is having positive momentum

⦿ Most indices (including Nifty, CNX500, Midcap, Smallcap) are showing negative & worsening momentum

⦿ Only Energy, IT, Metal & PSE are having negative but improving momentum

Market Breadth

Higher timeframes stay bearish, lower timeframes stay oversold.

⦿ 9% → 14% above 20 SMA (oversold)

⦿ 12% → 13% above 50 SMA (oversold)

⦿ 30% → 31% above 150 SMA (bearish bias)

⦿ 36% → 37% above 200 SMA (bearish bias)

Higher timeframes stay bearish, lower timeframes stay oversold.

⦿ 9% → 14% above 20 SMA (oversold)

⦿ 12% → 13% above 50 SMA (oversold)

⦿ 30% → 31% above 150 SMA (bearish bias)

⦿ 36% → 37% above 200 SMA (bearish bias)

% of stocks above/below 20& 50MA

⦿ The Ratio between stocks above & below 50MA is now 0.17, while that for 20MA is 0.17.

⦿ The 10-day cumulative ratio for stocks above 50MA is 0.15.

⦿ A value >2 is good for swing trades on the long side.

⦿ The Ratio between stocks above & below 50MA is now 0.17, while that for 20MA is 0.17.

⦿ The 10-day cumulative ratio for stocks above 50MA is 0.15.

⦿ A value >2 is good for swing trades on the long side.

20% up/down in 5 days

The number of stocks up 20% in past 5 days is back to being greater than those down 20% in 5 days. Such brief bullish upthrusts are trading oppurtunites in the very short-term.

The number of stocks up 20% in past 5 days is back to being greater than those down 20% in 5 days. Such brief bullish upthrusts are trading oppurtunites in the very short-term.

Stockbee Market Monitor

On a modified Stockbee market monitor, number of stocks 25% plus quarter stays less than 25% down quarter for second consecutive week.

Both 13% up in 34 days, & up 25% up in a month have stayed red, which shows bearish phase in shorter-term as well.

On a modified Stockbee market monitor, number of stocks 25% plus quarter stays less than 25% down quarter for second consecutive week.

Both 13% up in 34 days, & up 25% up in a month have stayed red, which shows bearish phase in shorter-term as well.

Primary Breadth Ratio

Overall, the market is bearish, as the number of stocks up 25% plus in a quarter is less than that down 25% plus in a quarter.

The ratio between the two is the primary breadth ratio, which is now less than 1.

Overall, the market is bearish, as the number of stocks up 25% plus in a quarter is less than that down 25% plus in a quarter.

The ratio between the two is the primary breadth ratio, which is now less than 1.

That’s all for this week. If you'd like to read this as a newsletter, find it here:

world.hey.com/nitinranjan/we…

world.hey.com/nitinranjan/we…

• • •

Missing some Tweet in this thread? You can try to

force a refresh