How to get URL link on X (Twitter) App

Predictive setups

Predictive setups

2018-2020

2018-2020

Swing → Confirmed Upswing

Swing → Confirmed Upswing

What is an Earnings Comparison?

What is an Earnings Comparison?

Mistake 1: Impatience

Mistake 1: Impatience

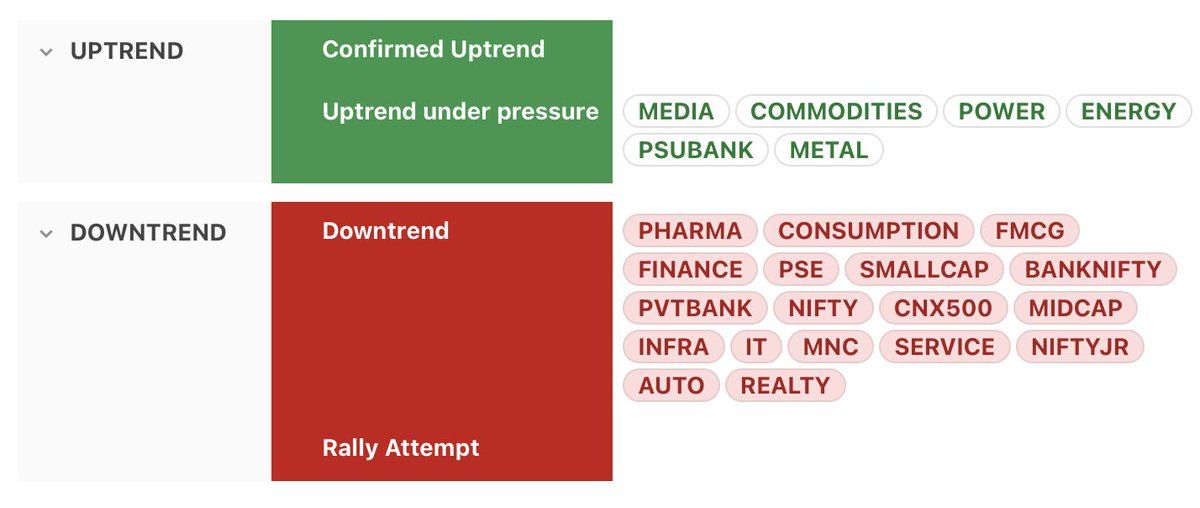

Trend

Trend

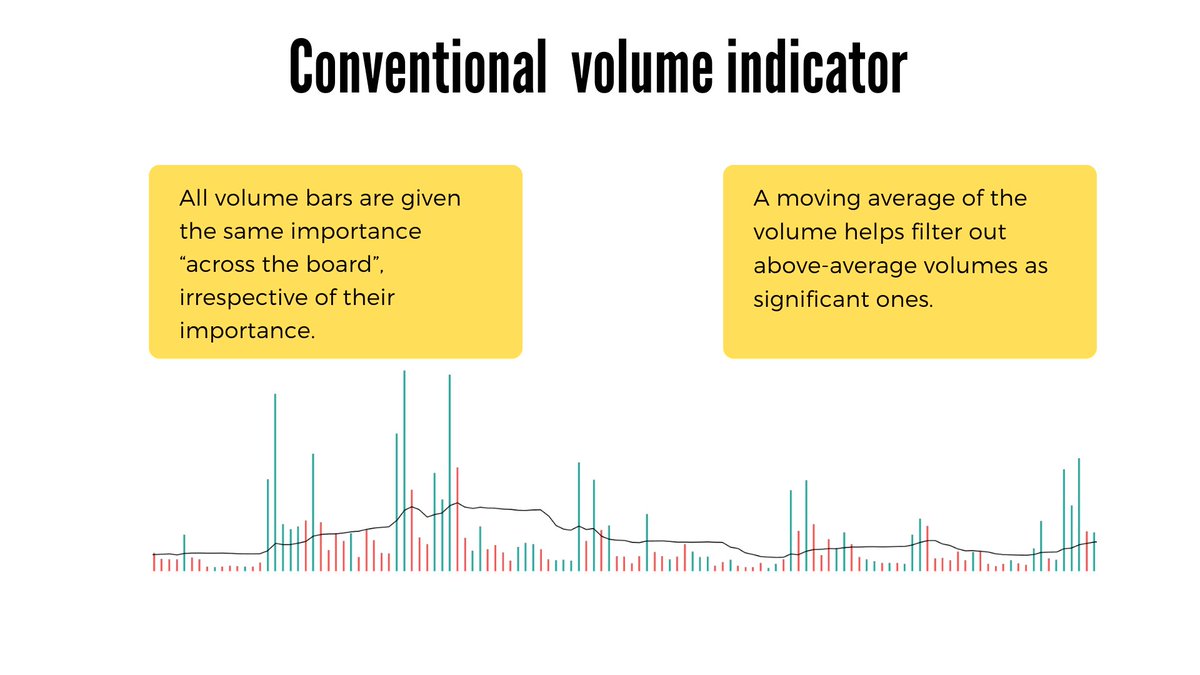

The conventional volume indicator is full of ‘noise’ in that all volume bars are given the same importance. Color & size are the two informations they provide. But this information is “across the board”, irrespective of when it’s important enough or not.

The conventional volume indicator is full of ‘noise’ in that all volume bars are given the same importance. Color & size are the two informations they provide. But this information is “across the board”, irrespective of when it’s important enough or not.

If this weekly gap-up coinicides with a new-high base breakout, it’s even much stronger. As per O’ Neil, gap-ups that are also base breakouts are the most powerful base breakouts.

If this weekly gap-up coinicides with a new-high base breakout, it’s even much stronger. As per O’ Neil, gap-ups that are also base breakouts are the most powerful base breakouts.

Trend

Trend