The role of geothermal is something I grappled with a lot in researching the book. I came to see enhanced geothermal as potentially pivotal to decarbonizing electricity, and a technology that should be a top priority for RD&D funding. Here's why... 🧵 (1/)

https://twitter.com/raygreenleyvo/status/1499070085935341570

For now, geothermal is a minuscule share even among U.S. renewable energy sources, and one that's barely growing and confined to a narrow region.

eia.gov/todayinenergy/…

eia.gov/todayinenergy/…

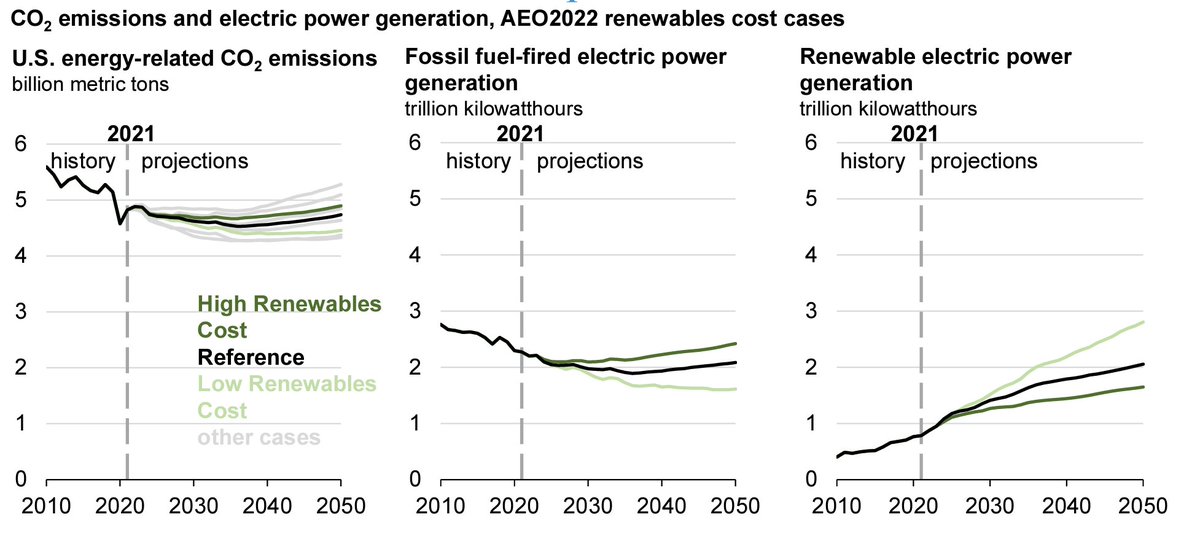

Wind and solar for now dominate the growth of clean electricity nationwide, a trend that EIA's just released #AEO2022 expects to continue, with scant additions of geothermal. But there's a catch. (3/)

eia.gov/outlooks/aeo/n…

eia.gov/outlooks/aeo/n…

Those scenarios would leave U.S. emissions flat overall, with progress in electricity stalling. Yet President Biden has pledged 100% clean electricity by 2035, and net-zero overall by 2050. As I explain in the book, clean electricity will be pivotal to that broader goal. (4/)

From interviews with dozens of experts and my own research, it's become clear that wind & solar will lead the way as the cheapest options. But challenges will emerge as their market share grows, due to their variable nature. (5/)

lazard.com/perspective/le…

lazard.com/perspective/le…

Wind and solar can complement each other to an extent, our research has shown. But to move toward 100% clean electricity, we're going to need a lot more other sources and storage, linked with more robust transmission. (6/)

That's where geothermal comes in. It will be competing with nuclear, hydro, storage, and perhaps carbon-capturing fossil and biomass plants to supplement cheaper wind and solar for 24/7 clean electricity. (7/)

As a tiny share of U.S. generation now, and with slow growth in recent decades, geothermal is starting out behind. Most existing plants lie where resources are so shallow that steam can be seen, leaving a limited number of suitable sites. (8/)

But as DOE pointed out in its GeoVision study, enhanced geothermal technologies could open up vast regions to exploration, allowing production to soar. The challenge will be demonstrating new technologies and bringing down their costs. (9/)

energy.gov/eere/geotherma…

energy.gov/eere/geotherma…

Historically, we've seen prices for some clean electricity technologies like wind and solar plummet, while those for others like nuclear, solar thermal, and, yes, geothermal remained stubbornly high. Why the difference? (10/)

lazard.com/perspective/le…

lazard.com/perspective/le…

Wind and solar PV are modular. They can be built in factories at ever larger scales and installed around the world. Competition and learning-by-doing relentlessly drive down their costs, by 15% or more per doubling, as @ramez and others have shown. (11/)

rameznaam.com/2020/05/14/sol…

rameznaam.com/2020/05/14/sol…

Geothermal, nuclear, and solar thermal, haven't been enjoying that transformational progress, because they've had less doing to learn from. One-at-a-time, site-specific deployments don't scale up as readily as modular wind and solar PV. (12/)

But geothermal is uniquely poised for a breakout moment. Companies like @fervoenergy, @Eavor and others are adapting technologies like horizontal drilling from the oil & gas industry to tap into deep geothermal resources that weren't economically accessible before. (13/)

Enhanced geothermal is costly for now, and technologies need further development and demonstration. But it's modular and scalable. So once broader deployments get underway, they can drive costs down those same learning-by-doing curves that made wind and solar cheap. (14/)

So what could jumpstart that virtuous cycle of learning-by-doing for geothermal, with deployment --> cost declines --> more deployment --> ...? Without policy or initial investments, geothermal could languish, since wind and solar are dominating deployments for now. (15/)

That's why decisions by companies like Google and a growing number of states to insist on 24/7, 100% clean electricity are so pivotal. They're creating a market demand "pull" for resources like geothermal that can balance variable wind and solar.

canarymedia.com/articles/clean…

canarymedia.com/articles/clean…

Pairing that market demand "pull" with a policy "push" of RD&D for enhanced technologies can turbocharge the virtuous cycle of deployments and declining costs. Initiatives like DOE's FORGE site provide that push, and a testing ground for new technologies. energy.gov/eere/geotherma…

DOE continues to announce new support for geothermal technology RD&D. The bipartisan infrastructure legislation accelerated those efforts, and Build Back Better bill would have done far more.

energy.gov/articles/doe-a…

energy.gov/articles/doe-a…

Although lots of $ is being devoted to next-gen nuclear technologies too, they're at least a decade away from substantial deployments. Pilot plants with new geothermal technologies are already under construction and could scale up fast.

technologyreview.com/2021/12/08/104…

technologyreview.com/2021/12/08/104…

Geothermal still won't be viable in some places, but it could become viable across vast swaths of the western US, and even parts of Texas, West Virginia, etc.

All of this puts geothermal at a pivotal moment -- it could remain a bit player, or, with a kick from policy & industry, it could soon enjoy the explosive growth and learning-by-doing that drove wind and solar, while serving as a potent complement to their variable output.

I cover all of this and more, with insights from innovators like @TimMLatimer of @fervoenergy, energy systems experts like @JesseJenkins @MichaelEWebber and @vsiv, in Chapter 5 of Confronting Climate Gridlock,

amazon.com/Confronting-Cl…

amazon.com/Confronting-Cl…

Thank you @raygreenleyvo for the question, and for narrating the audio version of the book for @TantorAudio.

https://twitter.com/raygreenleyvo/status/1499070085935341570?s=20&t=9AsiIdo-4yVuHT6OtTd47g

And thank you to everyone who has supported the book so far.

amazon.com/Confronting-Cl…

indiebound.org/book/978030025…

amazon.com/Confronting-Cl…

indiebound.org/book/978030025…

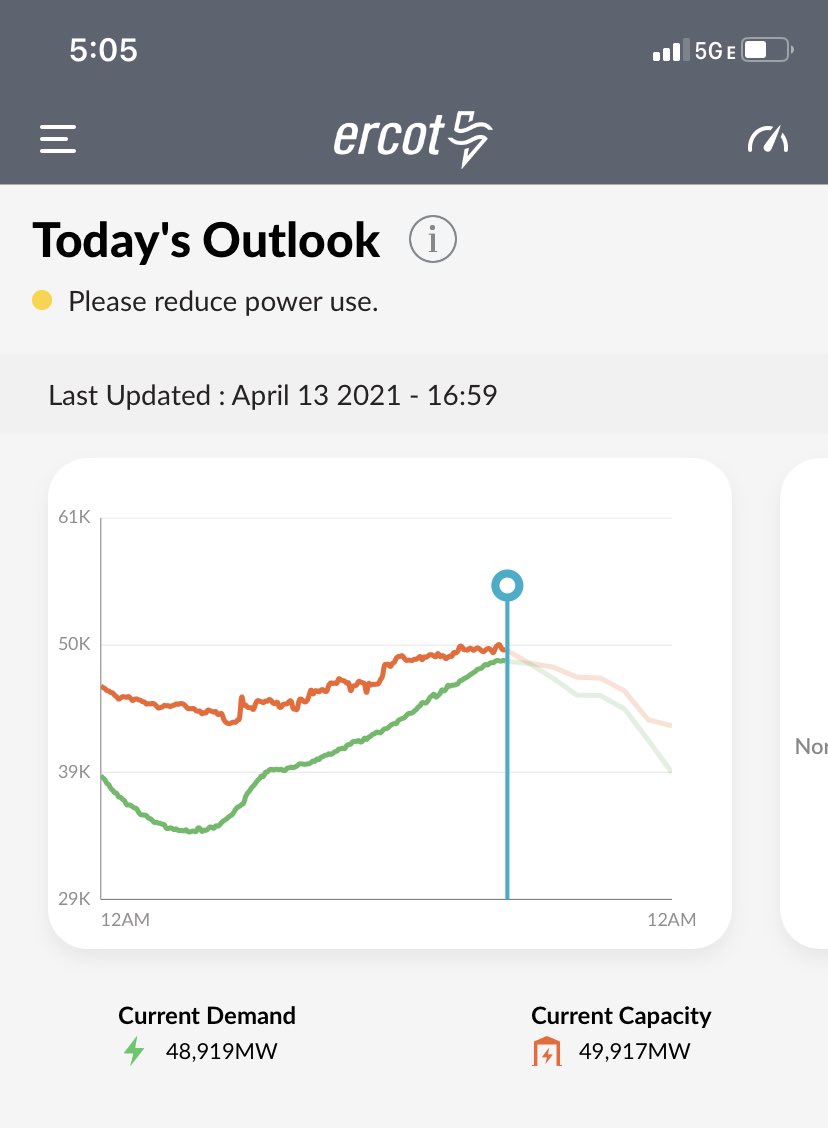

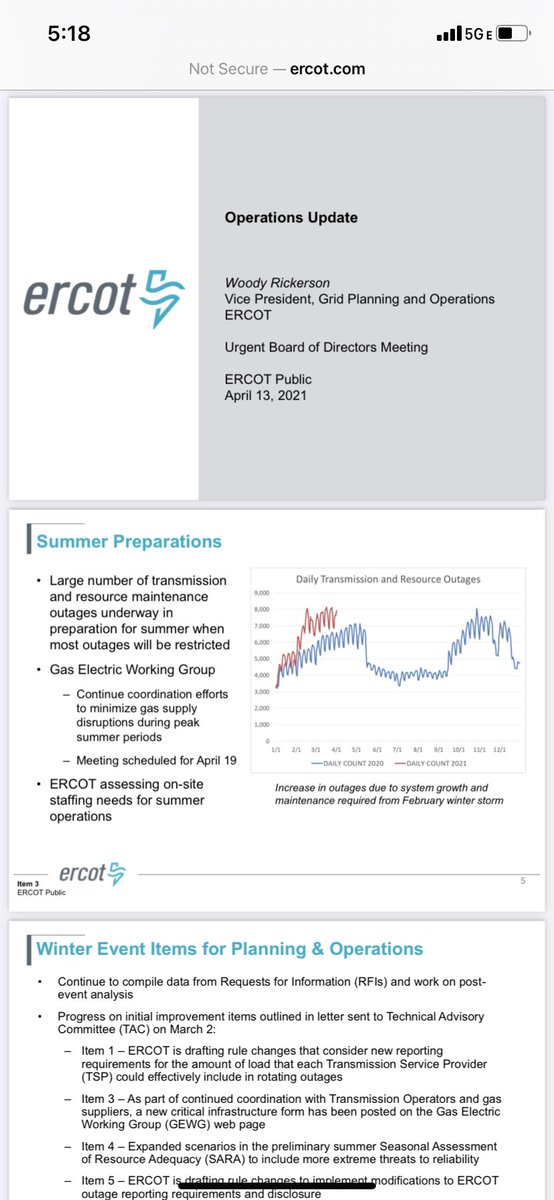

A leading competitor to geothermal became a whole lot less appealing this week.

https://twitter.com/gilbeaq/status/1499864251019759620

• • •

Missing some Tweet in this thread? You can try to

force a refresh