Complete Guide to Swing Trading

A Mega Thread 🧵

With Live Charts and Examples

Comment " Yes " and Retweet if You want PDF version

A Mega Thread 🧵

With Live Charts and Examples

Comment " Yes " and Retweet if You want PDF version

Criteria for Swing Trading :

Uptrend HH HL Structure

Stage 2 Uptrend

Volume Expansion during Breakout

Pullbacks with Lower Volume

Base Formation ( Rectangle , Vcp Etc)

Relative Strength > 0

21 ema > 50 ema > 200 ema

Stocks near 52 week High

Stocks near All time High

1/n

Uptrend HH HL Structure

Stage 2 Uptrend

Volume Expansion during Breakout

Pullbacks with Lower Volume

Base Formation ( Rectangle , Vcp Etc)

Relative Strength > 0

21 ema > 50 ema > 200 ema

Stocks near 52 week High

Stocks near All time High

1/n

What is HH HL Structure ?

1. A stock Maintains Bullish Momentum till it holds the last Swing .

2. Swings is an area from where stock reverses

3. As it is widely known Trend is your Friend A structure of Higher High is good for buying as overall momentum is in buying side

3/n

1. A stock Maintains Bullish Momentum till it holds the last Swing .

2. Swings is an area from where stock reverses

3. As it is widely known Trend is your Friend A structure of Higher High is good for buying as overall momentum is in buying side

3/n

A structure of Lower Highs is good for selling side , as each bounces will be sold off

Previous Swings will now act as Resistance in Downtrend and Support in Uptrend

4/n

Previous Swings will now act as Resistance in Downtrend and Support in Uptrend

4/n

Enter Stage 2 Uptrend

Stage 2: The Ideal Buy Point for Traders Traders should look for bases within an existing Stage 2 uptrend and focus on breakouts on volume. Intermediate term traders can also use investor buy points

5/n

Stage 2: The Ideal Buy Point for Traders Traders should look for bases within an existing Stage 2 uptrend and focus on breakouts on volume. Intermediate term traders can also use investor buy points

5/n

Traits in Stage 2 Breakout above the resistance zone & 30 week MA on big volume Post initial breakout, there is usually a retest of the breakout point 30 week MA starts turning up shortly after the breakout

6/n

6/n

Read More About Stage Analysis

7/n

https://twitter.com/JayneshKasliwal/status/1492721206969061380?t=gxVZ0JAS5GLSqu9Q9hgUzA&s=19

7/n

Volume Expansion on breakout :

Volume Plays an important Role in Sucess of Breakout.

If Breakouts occur on Low Volumes its is likely to Fail , But breakdowns can happen on Low Volumes

Pic :Distribution to be looked at top of trend

8/n

Volume Plays an important Role in Sucess of Breakout.

If Breakouts occur on Low Volumes its is likely to Fail , But breakdowns can happen on Low Volumes

Pic :Distribution to be looked at top of trend

8/n

Pullback with less volumes

Low volume pullbacks are often a sign of weak longs taking profit, but suggest that the long-term uptrend remains intact.

High volume pullbacks suggest that there could be a near-term reversal.

9/n

Low volume pullbacks are often a sign of weak longs taking profit, but suggest that the long-term uptrend remains intact.

High volume pullbacks suggest that there could be a near-term reversal.

9/n

Base Formation

Basing refers to a consolidation in the price

Basing periods are accompanied by declining volume and there is an equilibrium between supply and demand.

It could be rectangle base , Cup and Handle Base or Volatilty contraction pattern

12/n

Basing refers to a consolidation in the price

Basing periods are accompanied by declining volume and there is an equilibrium between supply and demand.

It could be rectangle base , Cup and Handle Base or Volatilty contraction pattern

12/n

Relative Strength

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

13/n

Relative strength is a strategy used in momentum investing and in identifying value stocks.

It focuses on investing in stocks or other investments that have performed well relative to the market as a whole or to a relevant benchmark.

13/n

Type

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 65 period for 3 months of Trading

14/n

“Relative Strength”

Choose any

By bharattrader

By traderlion

By Modhelius

I use by bharattrader

In setting use 65 period for 3 months of Trading

14/n

0 line that helps to differentiate between underperformer and outperformer

>1 Outperforming the markets

<0 Underperforming the markets

When RS Goes above 2 its too much heated and generally goes into consolidation.

15/n

>1 Outperforming the markets

<0 Underperforming the markets

When RS Goes above 2 its too much heated and generally goes into consolidation.

15/n

Select Stocks where RS Line is postive and continously outperforming

These stocks tend to outperform in strong and weak markets

So stick to selecting stocks that are outperforming where RS line is Postive

Read More on RS :

16/n

These stocks tend to outperform in strong and weak markets

So stick to selecting stocks that are outperforming where RS line is Postive

Read More on RS :

https://twitter.com/JayneshKasliwal/status/1480449068891455488?s=20&t=3trilrPKVKDu98T8phKpvw

16/n

Role of emas

21>50>200 ema

Signifies Strong Uptrend

Moving Averages plot the Avg price which will help us identify the overall trend

These Avgs give Dynamic Support to price and hence price bounces off these emas

17/n

21>50>200 ema

Signifies Strong Uptrend

Moving Averages plot the Avg price which will help us identify the overall trend

These Avgs give Dynamic Support to price and hence price bounces off these emas

17/n

Whenever 21 ema is sloping upwards its called uptrend

Whenever 21 ema is sloping downwards its called dowtrend

Whenever 21 ema is sideways its called consolidation

Buy in uptrend

Sell in downtrend

18/n

Whenever 21 ema is sloping downwards its called dowtrend

Whenever 21 ema is sideways its called consolidation

Buy in uptrend

Sell in downtrend

18/n

More About Moving AVGs:

19/n

https://twitter.com/JayneshKasliwal/status/1465601681190645761?s=20&t=3trilrPKVKDu98T8phKpvw

19/n

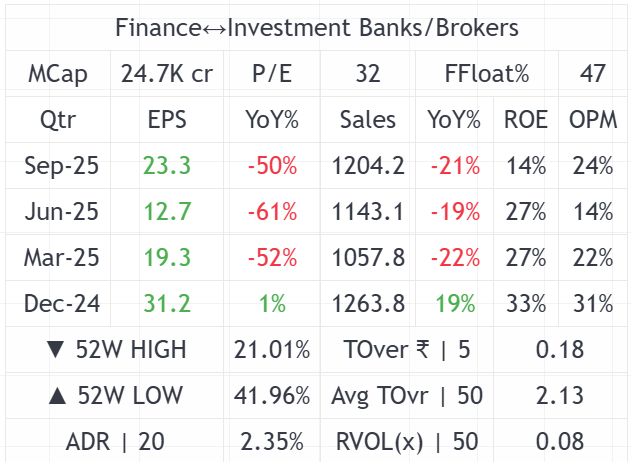

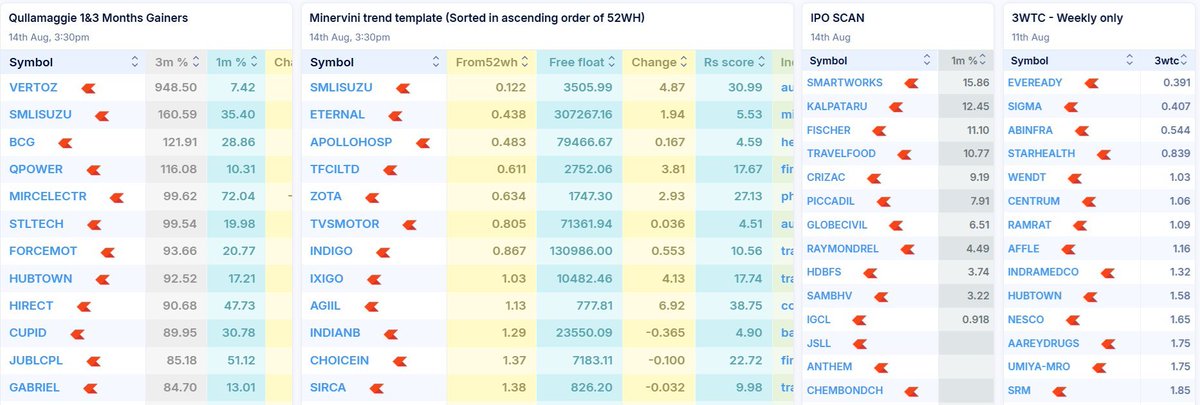

52 WEEK high Stocks :

Stocks near 52 week high have a lot of demand

We basically want stocks that are in demand where prices keep going up

Buy High Sell Higher should be thinking in Swing trading

Screener : 52 week breakout Stocks chartink.com/screener/copy-…

20/n

Stocks near 52 week high have a lot of demand

We basically want stocks that are in demand where prices keep going up

Buy High Sell Higher should be thinking in Swing trading

Screener : 52 week breakout Stocks chartink.com/screener/copy-…

20/n

SWING TRADING MENTORSHIP :

Don't waste This Dip to Buy Multibagger Stocks !✅Mentorship starting in mid March on weekends only .

✅Covering Stage Analysis ,Relative Strength,Moving Average and How to find Super Stocks and more ...

LINK FOR ENQUIRY:

wa.link/si4jn4

Don't waste This Dip to Buy Multibagger Stocks !✅Mentorship starting in mid March on weekends only .

✅Covering Stage Analysis ,Relative Strength,Moving Average and How to find Super Stocks and more ...

LINK FOR ENQUIRY:

wa.link/si4jn4

Follow @JayneshKasliwal For More Such Trading Techniques and Join Telegram :

t.me/Techno_Charts

Retweet anf Comment " Yes " for PDF

t.me/Techno_Charts

Retweet anf Comment " Yes " for PDF

drive.google.com/drive/folders/…

DRIVE LINK FOR

Pdf made by @JayneshKasliwal

Open Folder: Educational Pdfs

Name : Complete Guide to Swing Trading

More than 15+ Pdfs shared

Retweet And Share

// End //

DRIVE LINK FOR

Pdf made by @JayneshKasliwal

Open Folder: Educational Pdfs

Name : Complete Guide to Swing Trading

More than 15+ Pdfs shared

Retweet And Share

// End //

• • •

Missing some Tweet in this thread? You can try to

force a refresh