Osmosis- A uber inflationary token that has a chart that says "I dont care".......this could be top signal but lets break it down

2/ so what is osmosis, well osmosis is a dex that is built on the osmosis chain, the dex has all kinds of pools ranging from a 50/50 to an 80/20 split which allows more flexibility and creativity for degens to you know, "do DEFI"

3/ What I really like about osmosis (these are not the only things)

1. The ux is amazing, from little touches of swap 50% or lp with one asset instead of having to take multiple steps to compound

2. the aprs are nuts and ham

3. dual incentive pools

1. The ux is amazing, from little touches of swap 50% or lp with one asset instead of having to take multiple steps to compound

2. the aprs are nuts and ham

3. dual incentive pools

4/ so I consider osmosis the comfy dex, I could go on and on with the list of things I like about it but the coolest one is that each day around epoch time (the time when rewards are dropped to you) I can choose which token im bullish on and I can use my osmo reward to DCA

5/ so now you kinda understand osmosis,

(if not here is a video)

lets break down some of the token stuff and why its doin what it do

(if not here is a video)

lets break down some of the token stuff and why its doin what it do

6/ what the snap did @osmosiszone and @sunnya97 not get the memo, the osmo token supply is inflating at over 73%

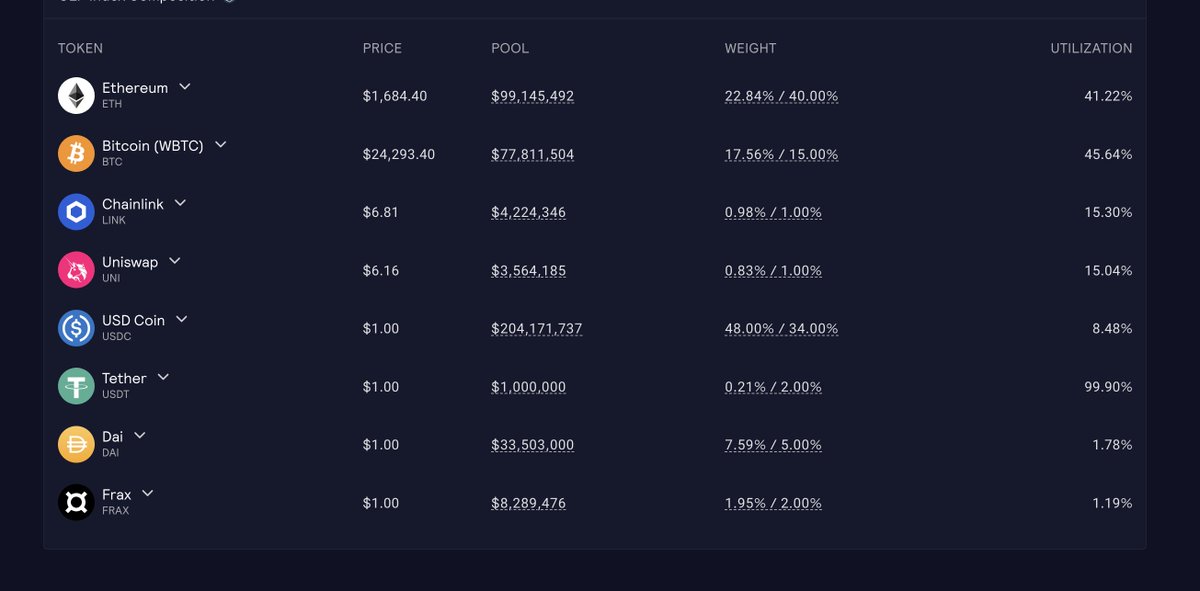

7/ How is the osmo token able to do this well if you look here the osmo token has the most liquidity on the dex in-fact the osmo token alone accounts for a little less than half of all the dex liquidity

8/ since most of the liquidity is in the osmo token this creates buy pressure on the osmo token, and most people compound the rewards into the pools with the osmo token.

9/so farmers mostly keeping osmo token for lp pairs, and new money coming in has to buy some osmo to play the game (this creates buy +buy pressure on osmo token), There is not really much selling going on

10/ Now what about in a market down turn and the osmo token is way up wont peeps take profits.......well yes and no, when someone wants to take profits or get some stables you have to unbond their tokens which takes time so you cannot insta dump

11/ so if im needing cash fast what do I do, well I sell any of my other tokens that are liquid....aka usually tokens that are not on osmosis (so it seems osmosis is avoiding the red button 😉 )

12/ Now I know your saying well I just wont lock my tokens then......and I will say well to get the aprs you have to lock the tokens......some even give dual incintives.....This may look like 86% apr but its actually around 155% apr with the juno rewards (no that was not a typo)

13/ so what decides the apr why are some pools higher than others. Im glad you asked, it goes based on swap volume so just like VE tokenomics on curve osmosis kinda has it too. It encourages you to keep throwing money back into the system

14/ so if im I protocol and I want deep liquidity, in order to get the high aprs to attract liquidity I have to have higher swap volume, in order to get higher swap volume I need deep liquidity

traders attract liquidity

and liquidity attracts traders

traders attract liquidity

and liquidity attracts traders

15/ we now have several protocols that are buying the osmo token to lp with their token to increase the liquidity, which boots the pool apr (because osmo price go up) which then attracts more liquidity........aaaannnnddd you have a flywheel

17/ so to sum it up

-protocols buy osmo

-aprs pump (attracting more liquidity aka buy more osmo)

-we have osmo wars with all protocols

-tokens are locked to get high aprs so not easy sell

-protocols buy osmo

-aprs pump (attracting more liquidity aka buy more osmo)

-we have osmo wars with all protocols

-tokens are locked to get high aprs so not easy sell

18/ This is why the osmo price is doin what it do......it has a massive flywheel that incentivizes users to keep playing the game.......@sunnya97 you really are a genius Kudos to you man, I love osmosis and Its apart of my daily routine

19/ now is this without risk.......no, nothing is without risk, the aprs are dependent on the osmo price because it determines the apr but osmosis is looking to have its pools incentives in the future from swap fees and the other protocols giving pool rewards like so

20/ now there are stable coin pools so you do not have to have exposure to the osmo asset and there are some non osmo pairs so you can avoid the pool 2 situation as well

(pool 2 means one of the coins you lp with is the farming coin)

(pool 2 means one of the coins you lp with is the farming coin)

if you guys enjoyed this thread drop a like and share it with a degen near you ......

happy farming......Oh epoch time passed a few hours ago, I need to go compound

https://twitter.com/Rentahomefast/status/1500201103216058375

happy farming......Oh epoch time passed a few hours ago, I need to go compound

• • •

Missing some Tweet in this thread? You can try to

force a refresh