Is Ukraine war bullish or bearish for crypto?

It's complicated.

Here are 7 potential impacts, sorted from short term to long term 👇

It's complicated.

Here are 7 potential impacts, sorted from short term to long term 👇

1. Collateral damage from liquidity squeeze

Financial sanction means much of Russia’s $1.2 trillion foreign liabilities (half of it is portfolio debt/equity) needs to be written off the book of foreign creditors & investors. Same w accounts receivable from Russia.

Financial sanction means much of Russia’s $1.2 trillion foreign liabilities (half of it is portfolio debt/equity) needs to be written off the book of foreign creditors & investors. Same w accounts receivable from Russia.

Creditors/exporters/investors linked to Russia need more liquidities from market. That combined w/ higher risk aversion, means financial conditions, already tighter than pre-Covid, will keep tightening.

Similar factors also led to more dollar appreciation, which, if you read my post last week, means crypto price drop.

https://twitter.com/TaschaLabs/status/1499778276792938499

All this is short-term muy malo for risk assets including web3.

2. Diversion of funds to greener pastures

Russia is big exporter in energy, grains & metals. Doesn’t take a genius to see that cutting it off of world mkts means commodity prices will have a field day.

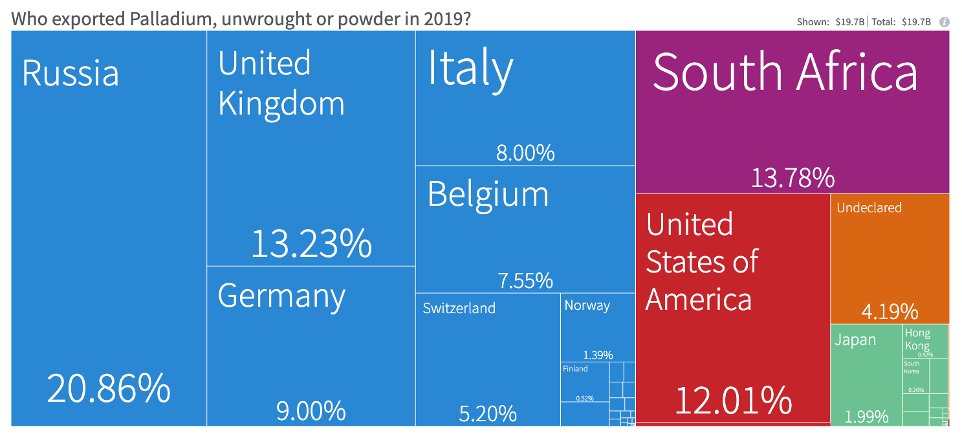

E.g. prospect of 20% of world palladium supply going down the drain…

Russia is big exporter in energy, grains & metals. Doesn’t take a genius to see that cutting it off of world mkts means commodity prices will have a field day.

E.g. prospect of 20% of world palladium supply going down the drain…

Expect FinTwit to make career switch from blockchain experts to agriculture & metal experts soon.

https://twitter.com/TaschaLabs/status/1499945790399258630

Investor $ will move from tech stocks & crypto to commodities. Though we saw 2-day pump of BTC past wk, it was likely prompted by short-term capital flight from Russia & Ukraine. Won’t last imo.

3. Change in Fed response function

US economy is red hot. But rise in commodity prices adds to inflation woe & if it triggers global recession later in the yr partly through impact on commodity importers, e.g. Asia, Europe, it'll in turn affect US.

US economy is red hot. But rise in commodity prices adds to inflation woe & if it triggers global recession later in the yr partly through impact on commodity importers, e.g. Asia, Europe, it'll in turn affect US.

There’s still no reason for Fed not to hike rates, but if financial conditions keep tightening & recession risks grow, QT may be increasingly hard to pull off.

https://twitter.com/TaschaLabs/status/1499030998281080834

Instead of QT, some type of price control to directly target food & fuel cost increase may be in the cards. No QT this yr would be bullish for crypto & equities in 2nd half. But too early to count on it yet.

4. Recession on the horizon

If we get a war-induced recession in 6-12 months, it’d be bullish for crypto & other exponential growth assets, similar to Covid recession, not the least b/c it’d force the hands of Fed to revert tightening.

If we get a war-induced recession in 6-12 months, it’d be bullish for crypto & other exponential growth assets, similar to Covid recession, not the least b/c it’d force the hands of Fed to revert tightening.

5. Free marketing for decentralization

Media & financial sanctions against Russia have been fast & furious. To my surprise even Telegram banned a Russian news channel I followed :(

Media & financial sanctions against Russia have been fast & furious. To my surprise even Telegram banned a Russian news channel I followed :(

I don’t have value judgment for or against censorship in general. It’s complicated matter & situation-dependent. The crypto libertarian view abt this is often naive.

But the fact that centralized entities like Infura & Circle have broadcasted susceptibility to censorship this past wk certainly strengthen the rhetoric of their decentralized counterparts & showcase use case for the latter.

https://twitter.com/TaschaLabs/status/1499514231091339268

(BTW, like this so far? I write about ideas on investment, macro and human potential. Subscribe to my newsletter for updates 👉 taschalabs.com/newsletter .)

6. Adulting practice for exchanges

Crypto struggled to shed its reputation as financial evasion tool for criminals & drug lords. Regardless of whether you think that perception is justified, it’s what it is & a deterrent to adoption.

Crypto struggled to shed its reputation as financial evasion tool for criminals & drug lords. Regardless of whether you think that perception is justified, it’s what it is & a deterrent to adoption.

It doesn’t help that in the past many exchanges actively shunned regulatory scrutinies.

For crypto to gain mainstream acceptance, mkt operators need to grow up, act like responsible financial industry participants & cooperate w/ social political agendas of jurisdictions they’re in. Whether you like those agendas or not is beside the point.

The war is giving mkt operators an important opportunity to demonstrate that crypto is not enemy of the state. The fact that most large exchanges are signaling themselves as compliant w/ sanction rules is long term bullish for industry growth.

7. Planting season for next wave of mass adoption

It may not seem obvious but Ukraine using blockchain for war financing is a much more bullish event for crypto adoption than El Salvador using bitcoin as legal tender.

It may not seem obvious but Ukraine using blockchain for war financing is a much more bullish event for crypto adoption than El Salvador using bitcoin as legal tender.

El Salvador is a mismanaged predatory state & adopting an ultra volatile asset as official currency is a dubious policy choice at best. Both simply reenforce negative mainstream perception against crypto.

In contrast, Ukraine is a much more legit regime to the west, its self-defense cause widely sympathized by western public, & its usage of crypto for int’l fundraising helping to showcase superiority of blockchain for fast settlement & resilient txn processing compared to tradFi.

Even though amount of crypto funds raised by Ukraine is peanuts relative to funding from tradFi channels, it puts blockchain on the map as legit challenger of traditional banking rails.

The impact of this on public consciousness is greater than 100 Super Bowl ads & it’s free.

https://twitter.com/TaschaLabs/status/1499533320463466497

Bottomline: crypto mkts will continue to be volatile & we likely see more downside going forward. But Ukraine war will turn out a significant & net positive event for adoption & mkt growth in long run.

Strategy to navigate

We'll likely get more external shock events this yr that shake mkts like in past 10 days. You'd want to keep a closer eye on portfolios & stay nimble.

We'll likely get more external shock events this yr that shake mkts like in past 10 days. You'd want to keep a closer eye on portfolios & stay nimble.

Some retail options:

1) Hodle & stake

2) Trade around volatility w/ tight risk control

3) Allocate more towards commodities for now & return to crypto after bigger sell offs

1) Hodle & stake

2) Trade around volatility w/ tight risk control

3) Allocate more towards commodities for now & return to crypto after bigger sell offs

1) is least optimal in this environment but also takes least effort & involve least possible errors. 2) and/or 3) if you’re decent w/ TA & have time to manage trades. All three & more If you’re a true hustler 😇

If you like this:

• Retweet 1st tweet in thread

• Subscribe to my newsletter for more ideas to help you get smarter, richer, freer 👉 taschalabs.com/newsletter

Questions? Thoughts? Put in the comments & I’ll address interesting ones in future articles. Be civil.

• Retweet 1st tweet in thread

• Subscribe to my newsletter for more ideas to help you get smarter, richer, freer 👉 taschalabs.com/newsletter

Questions? Thoughts? Put in the comments & I’ll address interesting ones in future articles. Be civil.

• • •

Missing some Tweet in this thread? You can try to

force a refresh