“The biggest mistake you can make in risk management is finding yourself on the wrong side of a trend with a large position size, stubbornly letting it continue to run against you without exiting. If you don’t know what to do in a market the safest thing to do is to go to cash.”

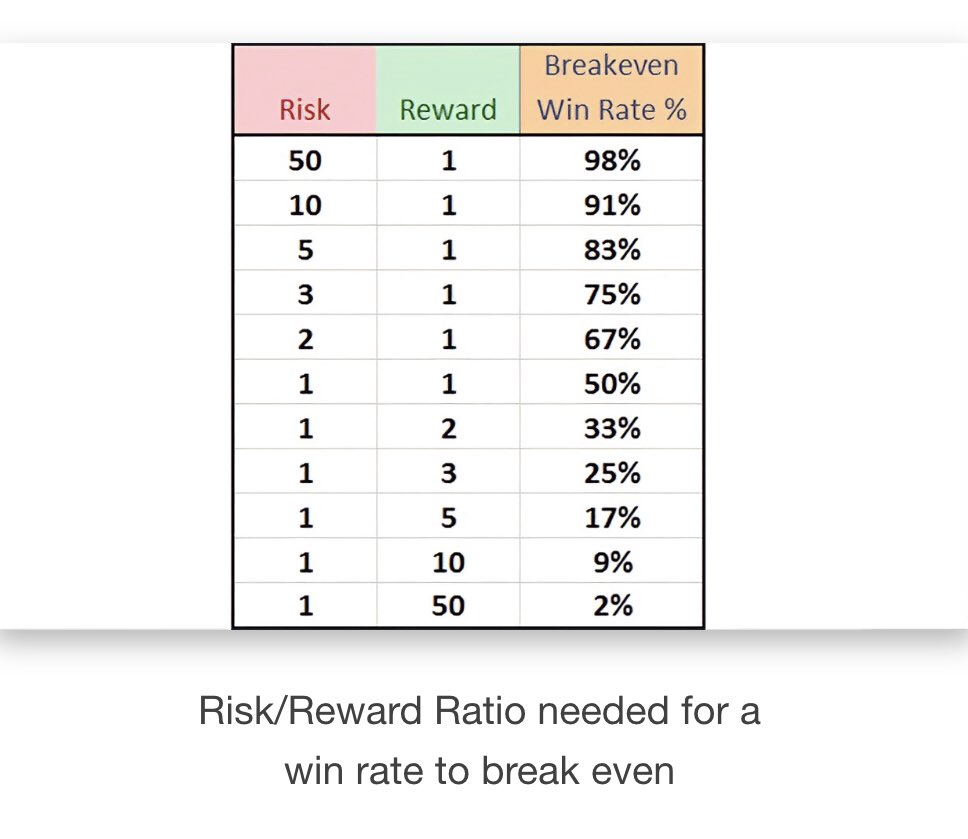

“Trades must be asymmetric; the downside risk is carefully planned and managed, but the upside profits are open-ended. This is a critical part of trading success.”

“Most profitable traders understand that the winning% for the best traders is only about 50%-60% regardless of trading method. Having big winning trades & small losing trades is an edge. Large losses are the primary cause of unprofitable trading across all time frames & methods.”

“You don’t have to be right all the time, you just need to be right big and wrong small.”

Allow winners to run as far as possible with the use of trailing stops; you could have a huge win with the right entry & trend. Know how much you will risk on any one trade, & don’t enter a trade where the upside is not at least three times your risk of loss if your stop is hit.

“It’s not the winning percentage of a trader that determines their profitability, but the size of all their winning trades versus the size of all their losing trades. This is the math that determines profitability.”

“The goal of trailing stops, like stop losses, is to put the trailing stop loss at a level that shouldn’t be reached if the trend is going to continue.”

“Position sizing is determined by the placement of your technical stop loss. The stop loss comes first, then your position size is based on the loss you would take if your stop loss is triggered and you exit the trade for a loss. Base position sizing on potential max loss.”

“A trader’s primary job is not to make money, but to protect what they already have so they can continue to grow their capital over time.”

“Working longer hours or working harder is how most professions make money, but this isn’t true for trading. The best trades come when you’re patient & wait for the right entry signal & set up. More trading doesn’t necessarily mean more profits, and it’s usually the opposite.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh