0/ With US inflation data coming out this week commodities still ripping, don’t be surprised if we see a continued uptick in volatility to piggyback on the ongoing geopolitics dynamics.

Best stay on your toes - 🧵👇

Best stay on your toes - 🧵👇

1/ SPX chopped around in a range last week with the 4400/4450 area capping the market and 4280 support tested multiple times. Support was finally broken today (as expected) and we are now sitting at key 4225 area. Next key supports below are 4120/4050.

2/ Europe and EM stocks underperformed on a relative basis where Russia/Ukraine consequences are being felt the most. Biggest outflow ever from European equities as investors were caught wrong-footed from beginning of 2022.

3/ Key levels to watch on SPX from @spotgamma 4225 and 4120 where gamma positioning changes steeply, should provide some hedging support, but until post FOMC, high VIX unlikely to provide "vanna" rally fuel. Will be watching HIRO for signs of put unwinds as markets selloff.

4/ Starting to see more defensive positioning from @42macro dispersion analysis which suggests that markets hopes of a post-Omicron bounce may be fading. Also evident in poor performance from Airlines $JETS AND leisure and hospitality sector as #Oilprices spike to new highs.

5/ Huge sector dispersion last week as commodity sectors on a tear whilst tech, consumer and financials take a beating. Banks were over-owned and are now a pain trade it seems with yields lower and curves flatter.

6/ COMING THIS WEEK: China inflation data, ECB meeting, Feb US CPI and Michigan Sentiment. @saxomarketcall

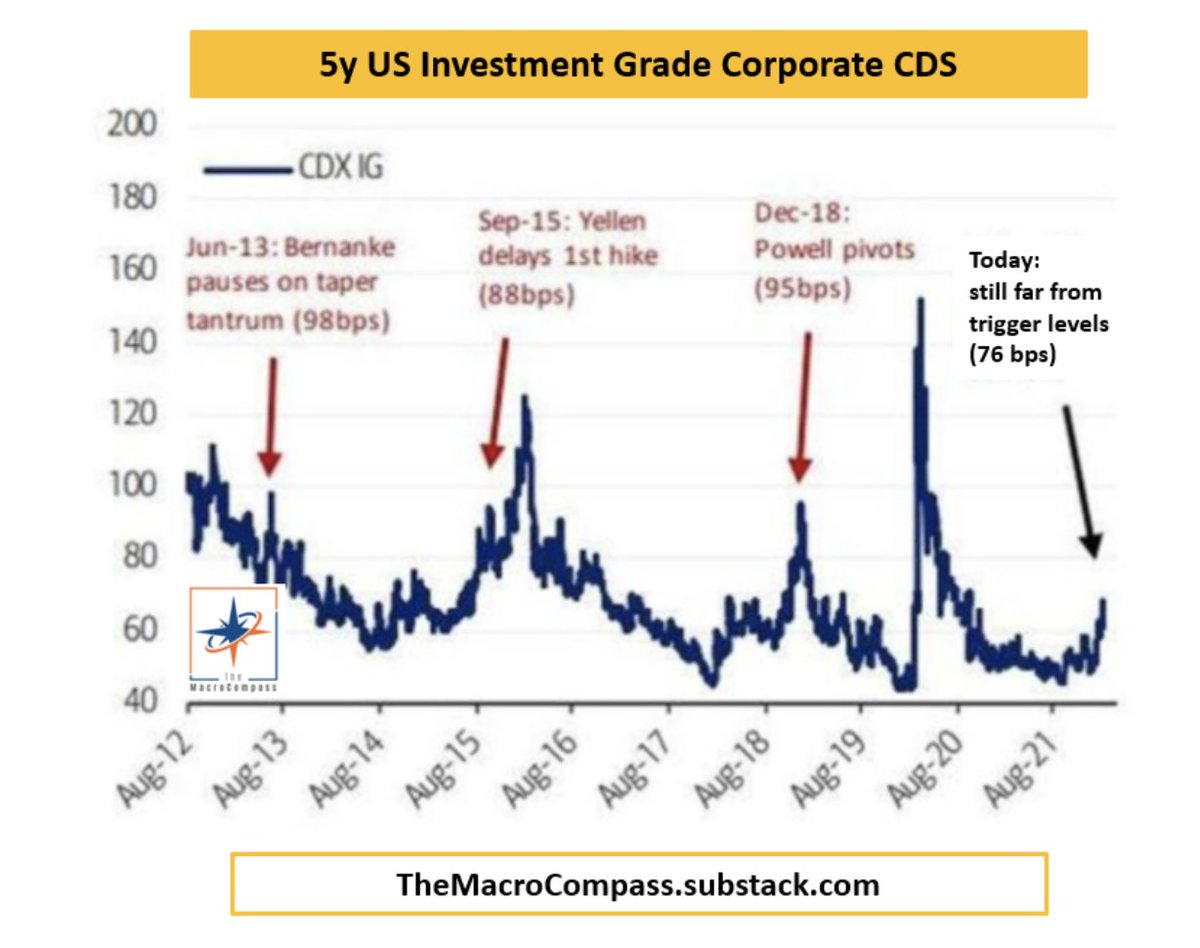

7/ Great summary from @MacroAlf on the current state of play in macro and how the FED put strike may be more credit dependant than equity (SPX level) themacrocompass.substack.com/p/bears-knocki…

8/ Join our community to get all of this info & more in real-time through our FREE Discord group chat (discord.gg/Dee5gFay) , weekly zoom calls, market reports, & exclusive option trade ideas.

Start your 14-day free trial for full access

options-insight.com/macro-insight-…

Start your 14-day free trial for full access

options-insight.com/macro-insight-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh