20y Pro Options Trader. Institutional framework.

Volatility first. Structure next. Execution last.

Start Here👉 https://t.co/QvFQ7NuXX2

4 subscribers

How to get URL link on X (Twitter) App

1/

1/

2/ But GS see a very different profile, which seems to include a lot of very short dated local gamma supply. This means dealers lose gamma in both directions.

2/ But GS see a very different profile, which seems to include a lot of very short dated local gamma supply. This means dealers lose gamma in both directions.

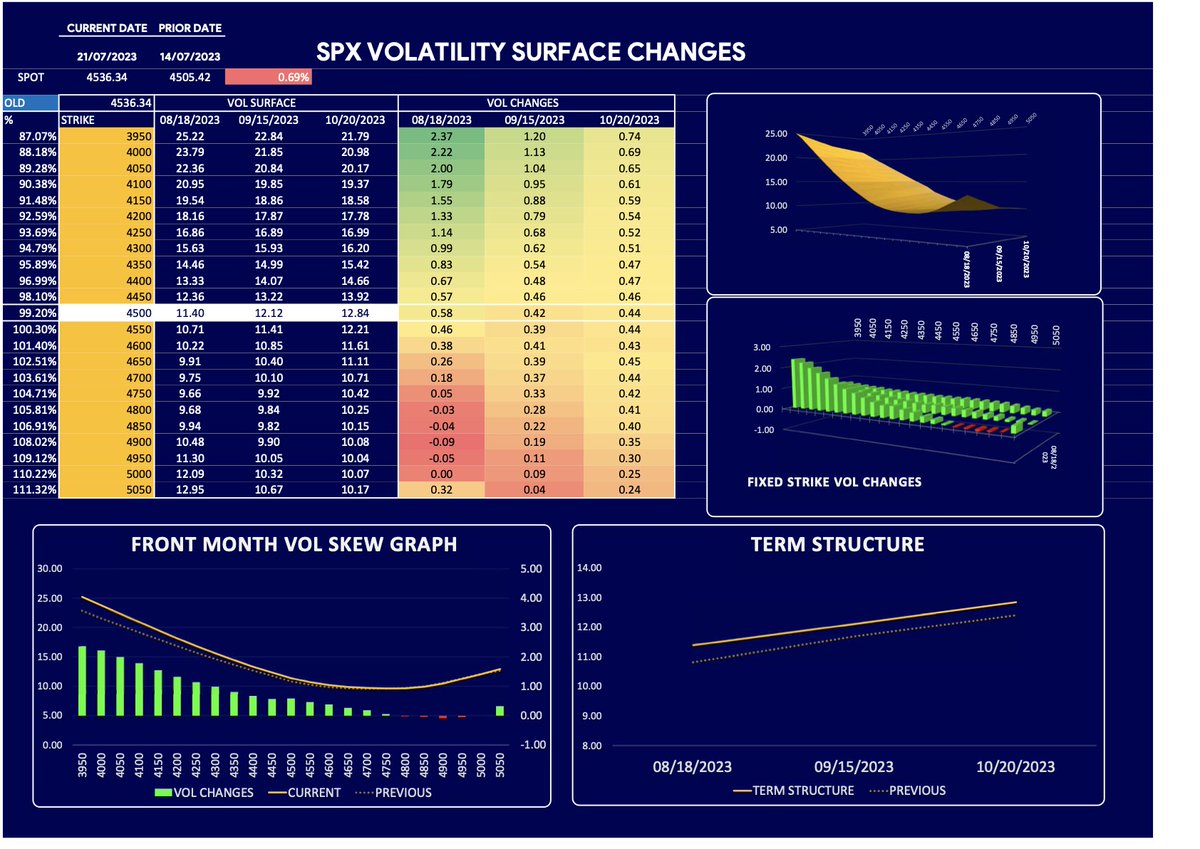

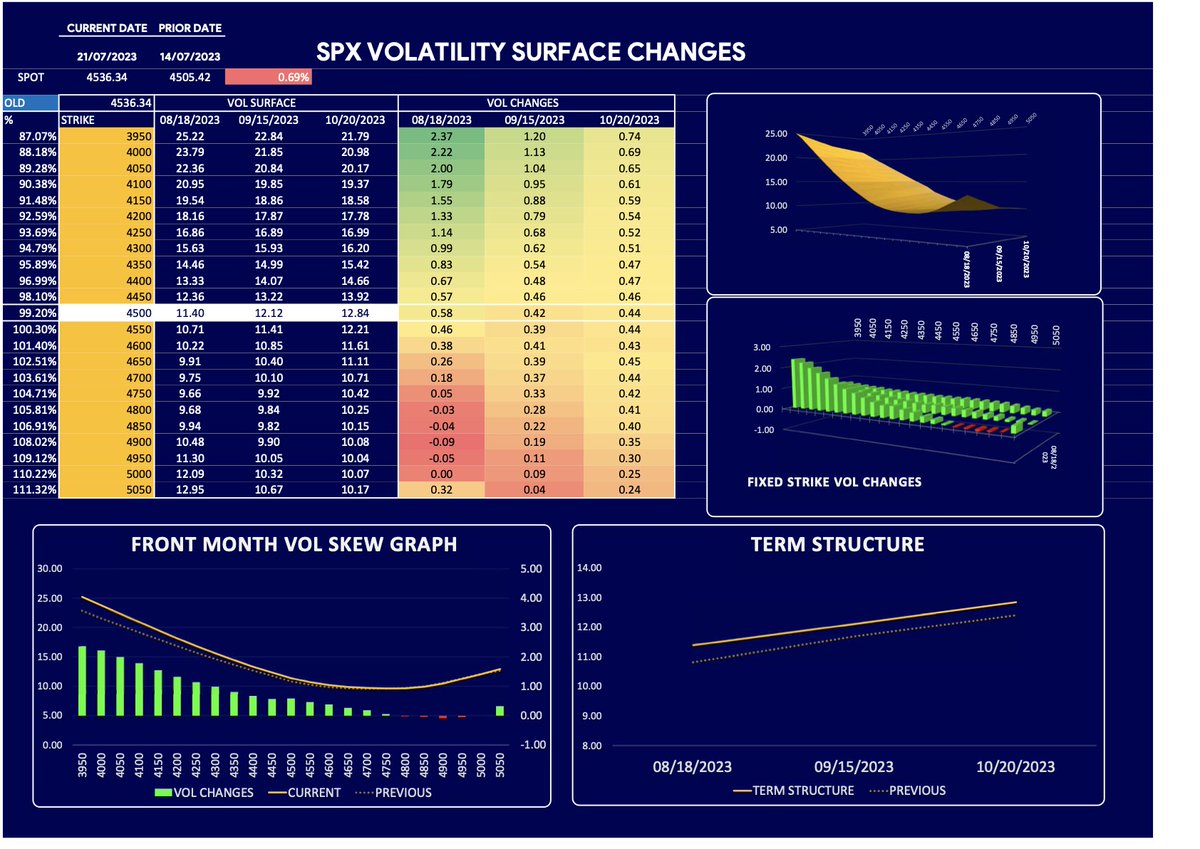

2/ VIX curve pretty flat despite higher SPX, showing 13 level acting as a floor for now. Spot up/Vol up isn;'t always bearish, but does spell some instability may be coming.

2/ VIX curve pretty flat despite higher SPX, showing 13 level acting as a floor for now. Spot up/Vol up isn;'t always bearish, but does spell some instability may be coming.