Russian stock market crashed more than 70%, many investors are worried on what would happen if such things happen to Indian markets? Here's couple of important lesson you need to keep in mind before you start your SIP journey. A short thread

Do you know how much is the Asset under management of our mutual fund industry? It's 38.89 Lakh Crore (INR 38.89Trillion) which is 14% of India's GDP. Monthly SIP inflow in Indian mutual fund is more than Rs.11,500 crores. And this is expected to grow much higher in coming years.

Start Early:

It doesn't matter whether you invest 1000 or 10,000, the sooner you start SIP investments better it is. Consider the below table, a 25 year old guy starts with Rs.10,000 monthly SIP for next 35 years. All he has to do is just increase the SIP amount 10% every year.

It doesn't matter whether you invest 1000 or 10,000, the sooner you start SIP investments better it is. Consider the below table, a 25 year old guy starts with Rs.10,000 monthly SIP for next 35 years. All he has to do is just increase the SIP amount 10% every year.

With 14% average returns, if he continues this SIP investment for 35 years, then his fund value will be more than 18 Crores by the time he retires.

But like many others, if you hesitate to invest early and decides to finish all your commitments and then start your SIP investment, you will be in for rude shock. Check the below table, instead of starting your SIP at age 25, if you decide to start at 35 years of age and

even if you double your SIP investment to Rs.20,000 per month, by the time you retire at the age of 60, your fund value would have grown only to 8.6 crores. No matter how small your SIP investment might look like now, just go with whatever amount you can afford to invest.

Expense Ratio:

If you are already investing in a mutual fund, first thing you should check is what's the expense ratio? It could really put a dent on your corpus. Many large fund houses still charge 2% to 3% as expense ratio. Move to direct funds, if you are still with regular.

If you are already investing in a mutual fund, first thing you should check is what's the expense ratio? It could really put a dent on your corpus. Many large fund houses still charge 2% to 3% as expense ratio. Move to direct funds, if you are still with regular.

Fund Managers:

No matter how talented your fund manager could be, statistically 85% of the fund houses across the globe fail to beat the index returns in the long run. By investing in mutual funds, only the fund houses become richer not the investors.

No matter how talented your fund manager could be, statistically 85% of the fund houses across the globe fail to beat the index returns in the long run. By investing in mutual funds, only the fund houses become richer not the investors.

Here's what @morganhousel said about passive investing.

https://twitter.com/morganhousel/status/1407372505585655808?s=20&t=QxvwFlHyBrPZMYuYdEiNsA

Story of a Millionaire Janitor:

The smart investing strategy a janitor used to build an $8 million portfolio, a gas station attendant Ronald Read who started investing in blue chip companies at his early age, died at the age of 92.

The smart investing strategy a janitor used to build an $8 million portfolio, a gas station attendant Ronald Read who started investing in blue chip companies at his early age, died at the age of 92.

All he did was regularly invest few portion of his salary into quality stocks and hold them for years. Stock market is not for people who are looking for get rich quick, if investment is done rightly no other asset class could give you such high returns like equity.

Uncertainty:

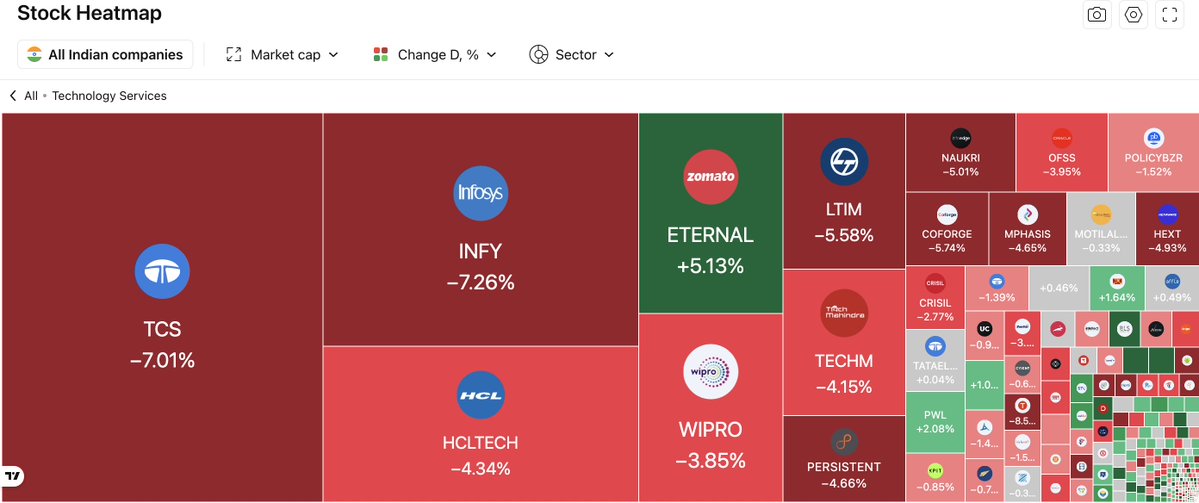

Many companies which were part of Sensex when it was first compiled did not even exit now. With lot technology innovation many banks and transportation stocks gets replaced by IT and Tech stocks. It keeps changing over time.

Many companies which were part of Sensex when it was first compiled did not even exit now. With lot technology innovation many banks and transportation stocks gets replaced by IT and Tech stocks. It keeps changing over time.

Every mutual fund houses use to invest in Yes Bank and DHFL, in fact it was part of top ten holdings of many fund houses. What happened when the scam broke out? DHFL gone bankrupt washing millions of investors hard earned money and Yes bank is still trading as penny stock.

War:

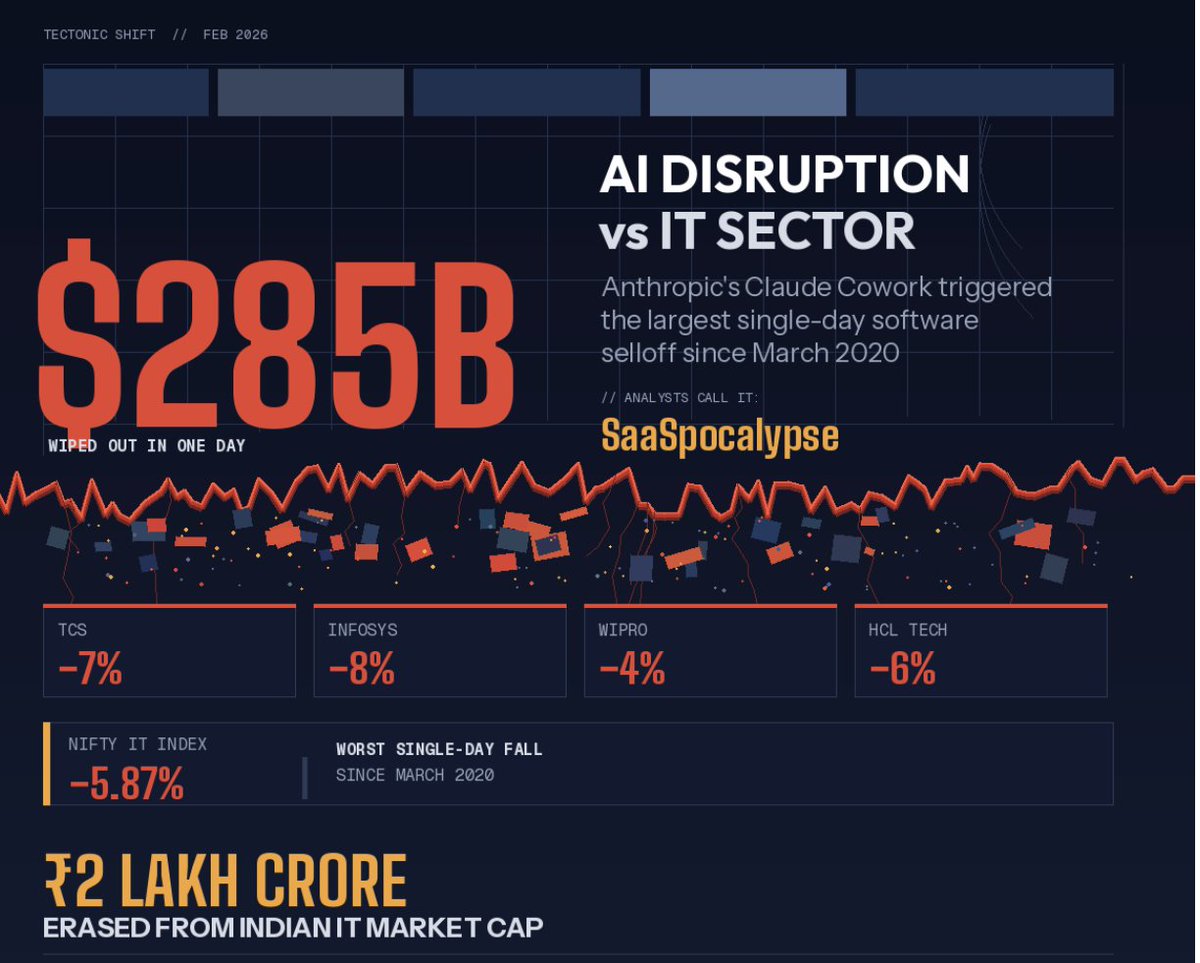

With Russia and Ukraine war intensives each day, many investors are worried on what would happen if such things happen to India? In a matter of few days, Russian stock market crashed more than 70%. You will not even get time to think what needs to be done in such situations.

With Russia and Ukraine war intensives each day, many investors are worried on what would happen if such things happen to India? In a matter of few days, Russian stock market crashed more than 70%. You will not even get time to think what needs to be done in such situations.

Lets find out how US market Dow Jones behaved during the last 100 years. During the world war 1 between 1914 to 1919 Dow Jones crashed more than 50% two times, initially it crashed then recovered completely and again crashed 50% when the world war was about to end.

After the war ends there was a phenomenal growth, many countries which were involved in war has to rebuild their infrastructure which lead to industrial revolution that helped lot of companies revenue grow multi fold. After the world war 1, Dow Jones witnessed a 500% up move.

Boom period was busted in 1929 through Great Depression which was much worse than World War 1, because Dow Jones witnessed a staggering 89.2% drawdown during this phase. It was period of extreme pessimism which lasted till 1945 when world war 2 ended.

If you really want to learn about investor behaviour , how economy was during such time then you should read this amazing book "The Great Depression by Benjamin Roth"

https://twitter.com/kirubaakaran/status/1460833600077656071?s=20&t=QxvwFlHyBrPZMYuYdEiNsA

But again the boom period started, where market rallied 500% from 1949 which was followed by years of consolidation without any movement on either side until Vietnam war was over. After that Dow Jones moved staggering 1450% in next 20 years.

So if we observe closely, in last 100 years we have seen three wars, multiple recessions, a Great Depression , terror attacks. Inspite of all this, Index kept moving up over the years.

SIP Investing Strategy:

By doing SIP in Index ETFs like Nifty bees and Junior bees, we can make average 14% returns in the long run. With 14% average returns, if one continues his SIP investment for 35 years, then his fund value will be more than 18 Crores by the time he retires.

By doing SIP in Index ETFs like Nifty bees and Junior bees, we can make average 14% returns in the long run. With 14% average returns, if one continues his SIP investment for 35 years, then his fund value will be more than 18 Crores by the time he retires.

What if I tell you that you can make more than 200 Crores in 35 years just by investing same Rs.10,000 SIP. Is it really possible? Yes, possible if we can make 24% returns.

By focusing on small cap index, our returns can grow multifold. Small Cap index returns since inception is more than 22%. Any large cap stock was once a small cap stock, these small cap stocks are the real wealth compounders.

I have considered the below rule. By doing this, we are able to generate 24.7% average annual returns which beats the small index returns also able to generate on par small cap mutual funds returns without much expense. Blog post squareoff.in/best-sip-inves…

• • •

Missing some Tweet in this thread? You can try to

force a refresh