1/ $POOL Investor Day Thread

Listened to the Pool Corp (#POOL) Investor Day earlier. Been an owner of $POOL since 2014 and still tear up a bit on every call, such a beautiful business, the type you will tell your grandkids about. Here are some notes.

Listened to the Pool Corp (#POOL) Investor Day earlier. Been an owner of $POOL since 2014 and still tear up a bit on every call, such a beautiful business, the type you will tell your grandkids about. Here are some notes.

2/#POOL reiterated '22 guidance for 17%-19% revenue growth (9-10% price, 3-4% volume, 5% M&A) and 15-17% EPS growth. Demand still strong with customers remaining booked through '22 and often into '23 with large backlogs. Sees post '22 revenue growth back to the 6-9% LT model.

3/#POOL noted they are a natural population migration beneficiary. 1,000 people/day moving to FL and TX. Often from NE and NW states where pool ownership was not attractive. Down in FL and TX these folks are adding pools and upgrading existing pools which is helping drive demand

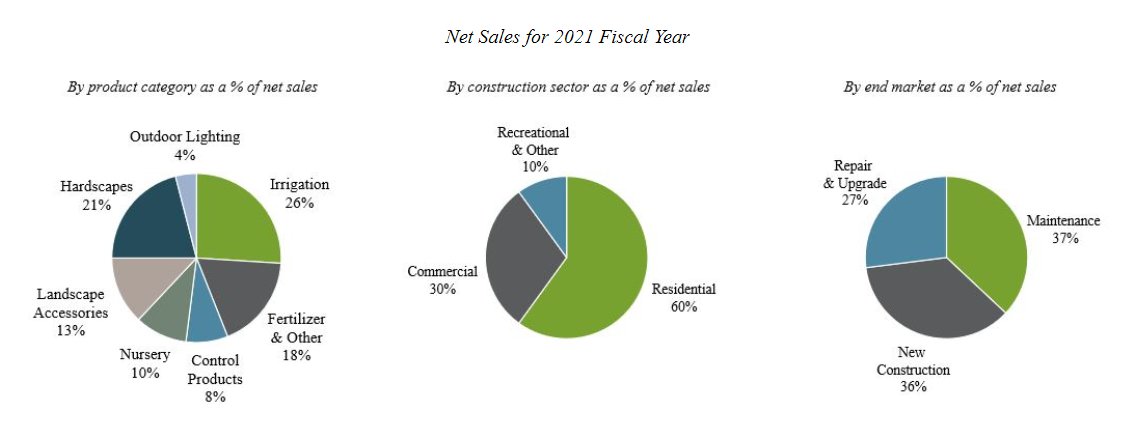

4/#POOL continues to benefit from a large, ageing, and growing (1-3%/yr) installed base of ~5.4mln pools. Each is a vessel of consumption requiring recurring maintenance and upgrade/rehab spend as equiptment (i.e pumps) needs replaced and interior/exterior features need upgraded

5/ $POOL superior economies of scale and value add to both sides of a fragmented market (suppliers ~2,200 buyers ~120,000) continue to allow POOL to outperform small, local players and take market share. POOL is now at ~40% US wholesale market share across all US markets.

6/#POOL saw 7-8% price inflation in '21 and sees 9-10% in '22 vs. LT avg of 1-2%/yr. $POOL can easily pass through price in excess of supplier hikes as material costs are often ~25% of project costs, dwarfed 3-5x by labor. Maintenance items are also mandatory to keep a pool open

7/#POOL discussed recent PE acquisitions, providing its first real competitive headwind as the industry has been absent any large peer. Noted PE is buying existing operators, not adding greenfield capacity. $POOL is competing against new owners of the same locations.

8/ $POOL's recent acquisition of Porpoise Pool grants access to the $3bln DIY market via a franchise model of 265 stores in key states (FL/TX) and a strategic chemical packaging DC which improves $POOL chemical sourcing. Creates supply chain synergies for both $POOL and Porpoise

9/ $POOL reiterated it's LT algorithm for 6-9% organic growth augmented by M&A ('15-'19 +1-2%) and 20-40bps of EBIT leverage. Foots to ~11%/yr. EBIT growth. $POOL usually buys 1-2% of shares back and pays a ~1% dividend yield bringing est. LT TSR to ~14-15%/yr at a flat multiple

10/ overall the $POOL investment thesis appears intact. $POOL shares are down -25% off Nov/'21 highs and now trade at ~19x '22 EBITDA (~31x in Nov/'21) and ~25x EPS (~44x in Nov/'21) with multiples back to pre-covid levels and those not seen since '18-'19.

• • •

Missing some Tweet in this thread? You can try to

force a refresh