Equity Analyst and Investor. Hunting for exceptional businesses. In-depth research available at https://t.co/EYY5FlJWvd.

How to get URL link on X (Twitter) App

Recall - $FND exited Q3 at +17 new stores, and has opened +8 additional stores since

Recall - $FND exited Q3 at +17 new stores, and has opened +8 additional stores since

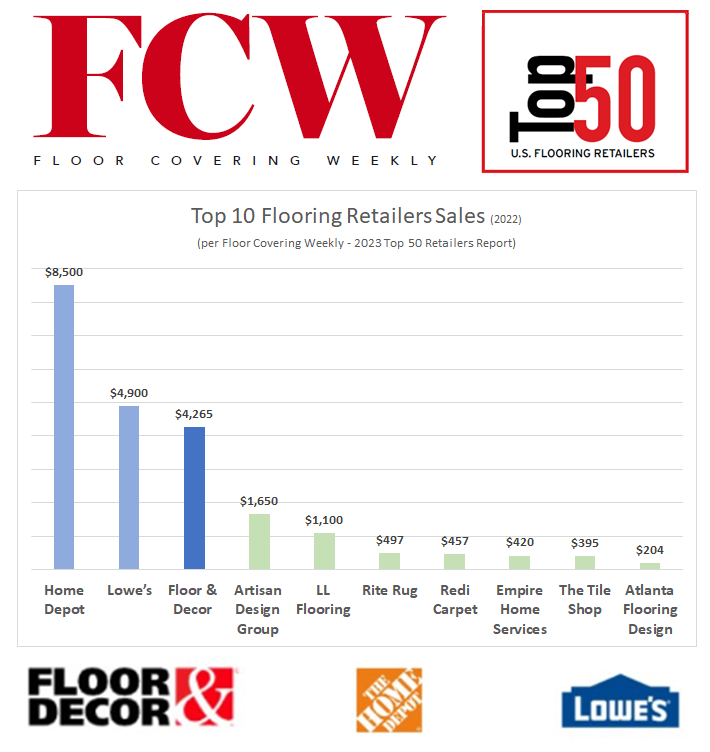

$FND has massively outperformed $HD & $LOW since 2013…

$FND has massively outperformed $HD & $LOW since 2013…

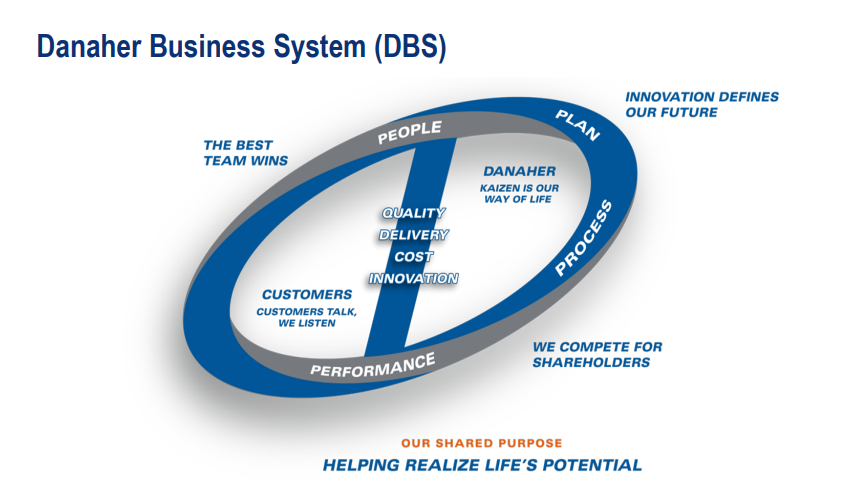

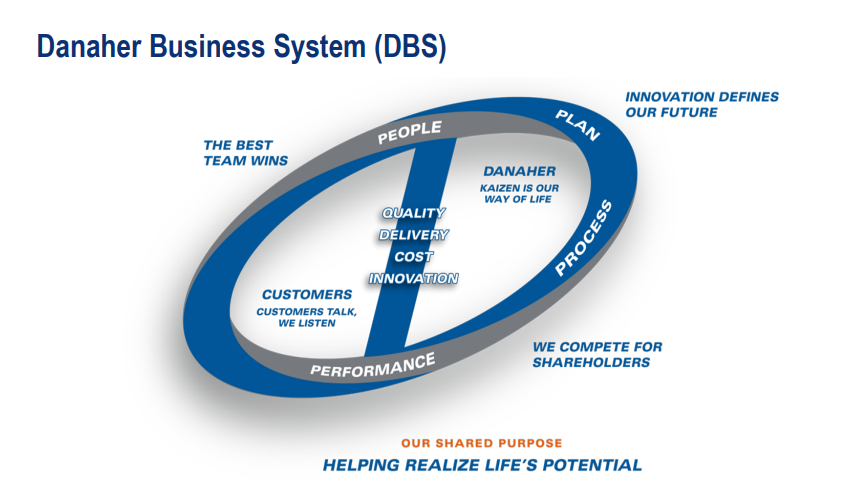

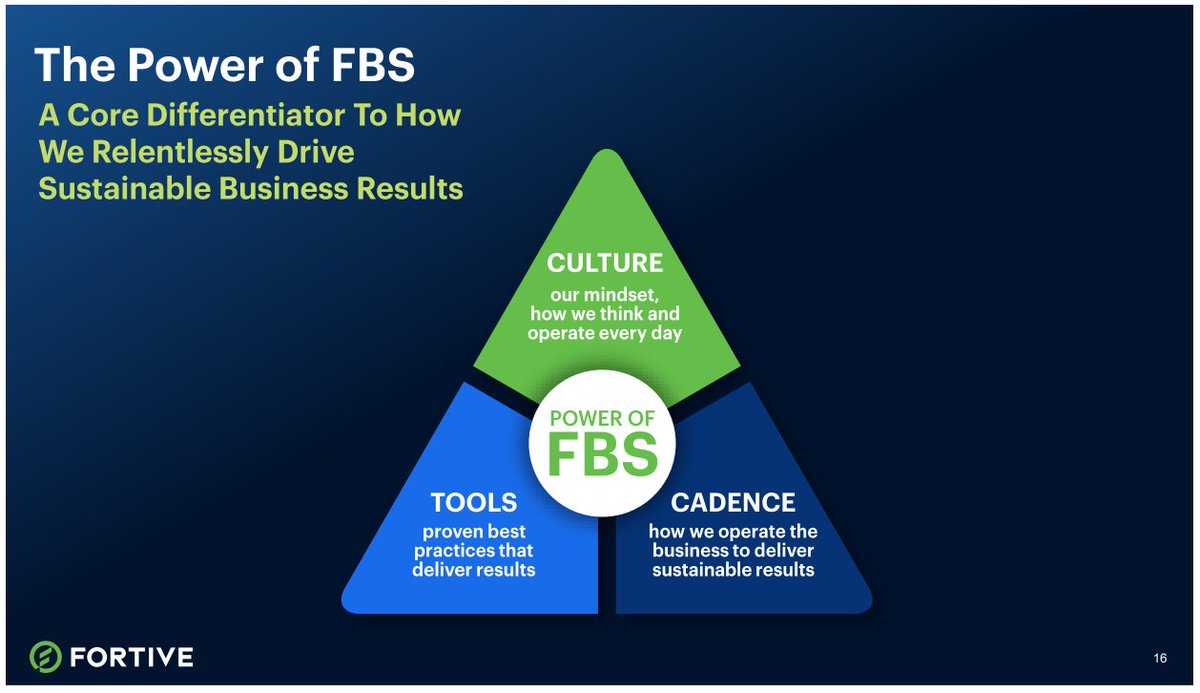

First up is Fortive $FTV

First up is Fortive $FTV

$TREX saw revenues decline just -5% (adj), well ahead of street & prior guidance for a -15-16% (adj) decline

$TREX saw revenues decline just -5% (adj), well ahead of street & prior guidance for a -15-16% (adj) decline

Investors in $FND should keep close tabs on $MHK as it is…

Investors in $FND should keep close tabs on $MHK as it is…

First, the report title is a bit of a misnomer...

First, the report title is a bit of a misnomer...

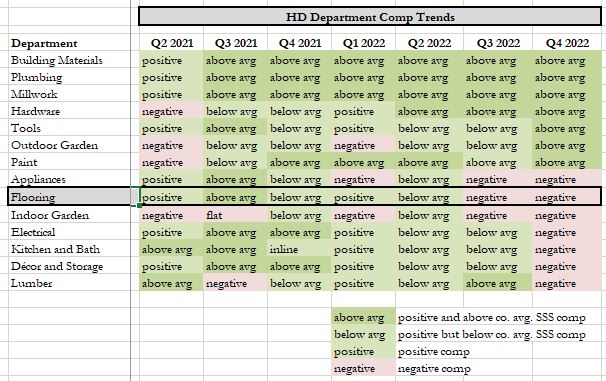

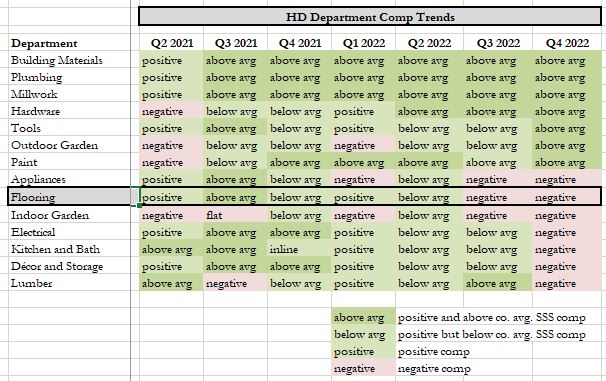

KPI’s like housing starts, home prices, home equity & mortgage rates are seen as classic primary drivers of demand for the industry & names like $HD, $LOW & $FND

KPI’s like housing starts, home prices, home equity & mortgage rates are seen as classic primary drivers of demand for the industry & names like $HD, $LOW & $FND

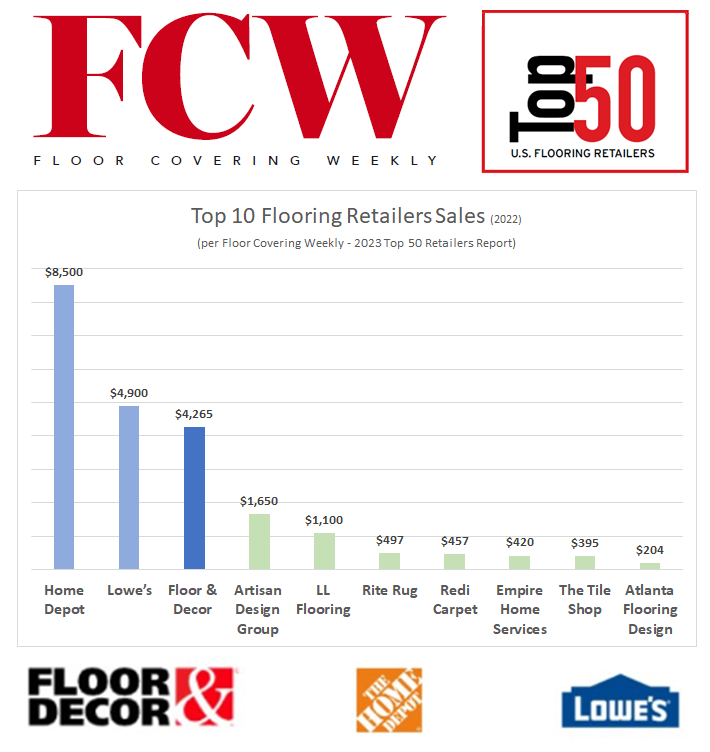

Per $FND's investor day last yr., NYC in particular was an area Spartan really lacked meaningful sales rep coverage

Per $FND's investor day last yr., NYC in particular was an area Spartan really lacked meaningful sales rep coverage

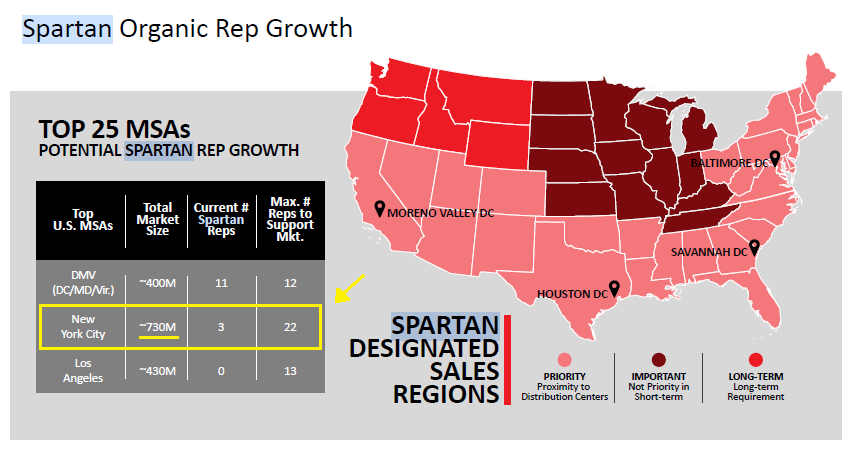

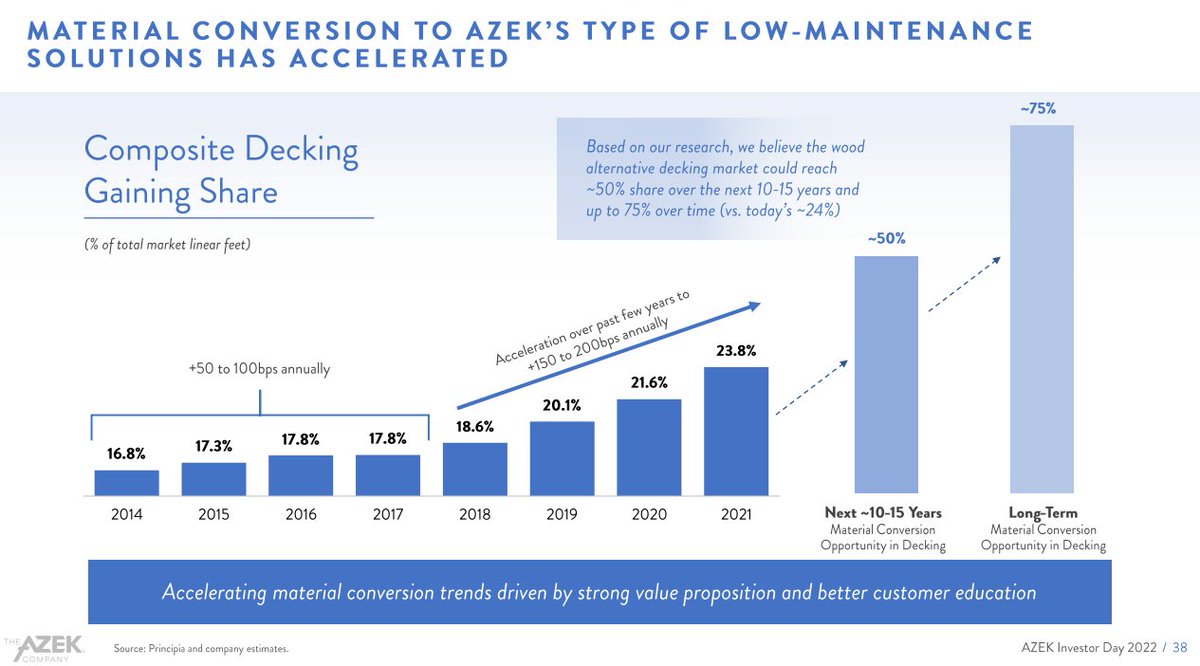

Both $TREX & $AZEK see ~50-75% share possible long term, providing ~2-3x industry upside

Both $TREX & $AZEK see ~50-75% share possible long term, providing ~2-3x industry upside

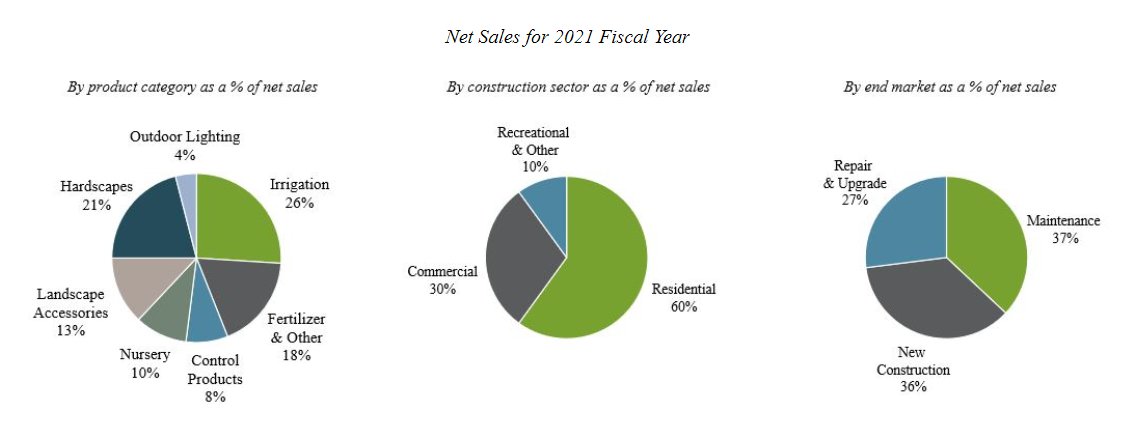

$SITE is unique vs many other distribution businesses in that it faces no other nationally scaled full product line wholesale distributor of landscape supplies

$SITE is unique vs many other distribution businesses in that it faces no other nationally scaled full product line wholesale distributor of landscape supplies

Per industry calls, $FND's largest supplier is Creative Flooring Solutions (CFL Flooring), previously known as China Floors

Per industry calls, $FND's largest supplier is Creative Flooring Solutions (CFL Flooring), previously known as China Floors

$FND revenue up +9.1% (est +8.2%) via a -3.3% comp with +12.4% new store growth. EBITDA up +10.2% (est +7.6%) w/+14bps in leverage (est -8bps) as +15% gross profit growth (est +13%) & +214bps in gm exp (est +175bps) was offset by -210bps deleverage from +17% OPEX growth (ex depr)

$FND revenue up +9.1% (est +8.2%) via a -3.3% comp with +12.4% new store growth. EBITDA up +10.2% (est +7.6%) w/+14bps in leverage (est -8bps) as +15% gross profit growth (est +13%) & +214bps in gm exp (est +175bps) was offset by -210bps deleverage from +17% OPEX growth (ex depr)

2| Results

2| Results

2| Topline

2| Topline

2| Payables

2| Payables

https://twitter.com/EquiCompound/status/1537849475653419008

2| $POOL forward NTM EV/EBITDA now at ~13x, well below Nov/'21 peaks in the ~30x range and below all cyclical troughs back through '17. Have to go back to '14 to get to forward multiples as low as current.

2| $POOL forward NTM EV/EBITDA now at ~13x, well below Nov/'21 peaks in the ~30x range and below all cyclical troughs back through '17. Have to go back to '14 to get to forward multiples as low as current.

2|Topline

2|Topline

2/Intro

2/Intro

2/Results

2/Results

https://twitter.com/EquiCompound/status/1502734216773218312?s=20&t=xJZH4Yc-BwT5-Avxvv3SEQ

2/Retail Conversion Rate

2/Retail Conversion Rate

2/Intro

2/Intro