You have to consider ETH as a 𝘳𝘦𝘴𝘰𝘶𝘳𝘤𝘦. It is fuel for the blockchain, used to execute various transactions on more than 41M different smart contracts on the network.

This is the two-pronged POV many fail to look at.

(a treat from croissant 1/x…)

This is the two-pronged POV many fail to look at.

(a treat from croissant 1/x…)

I don’t care what the latest news in the market is, what the charts say, or anything else.

Why? It’s all about the supply and demand.

Why? It’s all about the supply and demand.

Ethereum began back in 2015, offering 72M ETH to around 10,000 Bitcoin addresses who participated in the ICO.

These coins have gone through many years of brutal redistribution trading hands.

They are distributed across more than 144.7M recorded wallets.

These coins have gone through many years of brutal redistribution trading hands.

They are distributed across more than 144.7M recorded wallets.

But, did you know that a large majority of ETH hasn’t been moved in months or even years?

The further we go back, the more obvious this gets.

We can see that only 6.5% of the supply has been active in the last 5-7 yrs.

& only ~.3% on average daily.

The further we go back, the more obvious this gets.

We can see that only 6.5% of the supply has been active in the last 5-7 yrs.

& only ~.3% on average daily.

& then there’s also smart contracts, that are currently sucking up ETH at unprecedented levels.

Not only do they require ETH to function, but they often times use ETH as collateral.

This has led to upwards of 28% of ETH being locked in smart contracts (despite a -40% retrace)

Not only do they require ETH to function, but they often times use ETH as collateral.

This has led to upwards of 28% of ETH being locked in smart contracts (despite a -40% retrace)

It’s safe to assume the circulating supply of ETH is much lower than generally expected.

Even more so with EIP-1559.

EIP-1559 introduced a fee burning coins from the already existing ETH in the supply.

It is on pace to burn 3.4M ETH this year.

That’s 2.8% of the whole supply.

Even more so with EIP-1559.

EIP-1559 introduced a fee burning coins from the already existing ETH in the supply.

It is on pace to burn 3.4M ETH this year.

That’s 2.8% of the whole supply.

Then we have to account for stable coins. These change the underlying equation entirely, as their users aren’t always exactly looking to “cash out”

ETH is often used to borrow these tokens in DeFi.

This is probably why stable coins are attracting billions with no end in sight.

ETH is often used to borrow these tokens in DeFi.

This is probably why stable coins are attracting billions with no end in sight.

https://twitter.com/croissanteth/status/1497004291659165696

It is even more interesting when we’re starting to see entire digital economies forming within the ETH ecosystem.

People are already paying millions for virtual real estate…

This will eventually transcend to services, commodities, & things that aren’t exactly “investments.”

People are already paying millions for virtual real estate…

This will eventually transcend to services, commodities, & things that aren’t exactly “investments.”

Then we have the merge.

This an upgrade for Ethereum that will make transaction fees go to stakers on the network rather than miners.

We can estimate daily EVM fees to be ~10K ETH.

That would put ETH staking APR at 6.1% with fees alone. With issuance it puts us around 11% APR.

This an upgrade for Ethereum that will make transaction fees go to stakers on the network rather than miners.

We can estimate daily EVM fees to be ~10K ETH.

That would put ETH staking APR at 6.1% with fees alone. With issuance it puts us around 11% APR.

Along with the increase in staking APY, will come a decrease in total issuance of ETH.

Right now, about 13k ETH are created every day in the form of block rewards.

After the merge, issuance of ETH will immediately drop upwards of 90%.

-> 13K ETH a day in pow to ~1-2K ETH daily

Right now, about 13k ETH are created every day in the form of block rewards.

After the merge, issuance of ETH will immediately drop upwards of 90%.

-> 13K ETH a day in pow to ~1-2K ETH daily

The effects of this should not be underestimated.

For more reference, that is the equivalent of several Bitcoin halving events, happening in the span of months.

At its current rate it will be just 9.5 yrs until ETH is at 100M supply.

This is mind-blowing.

For more reference, that is the equivalent of several Bitcoin halving events, happening in the span of months.

At its current rate it will be just 9.5 yrs until ETH is at 100M supply.

This is mind-blowing.

Another little mentioned fact about the merge is the concept known as a validator queue.

It’s a security mechanism in pos, limiting the amount of validators that can join at any time

Meaning:

->merge

->tx fees go to stakers

->apy shoots up

->ppl rush to stake

->queue fills

->?

It’s a security mechanism in pos, limiting the amount of validators that can join at any time

Meaning:

->merge

->tx fees go to stakers

->apy shoots up

->ppl rush to stake

->queue fills

->?

https://twitter.com/RyanBerckmans/status/1396591150669123585

With these factors taken in hand we can’t forget to consider all the staking derivatives.

This is where most of the magic will happen.

A staking derivative represents staked Ether, with ERC20 tokens that can be traded just like any other token, but usually traded at a premium.

This is where most of the magic will happen.

A staking derivative represents staked Ether, with ERC20 tokens that can be traded just like any other token, but usually traded at a premium.

Staking derivatives introduce an interesting synergy allowing the window for some speculation on the secondary market.

At any moment, stETH should be trading higher than ETH.

If stETH is trading lower, users will simply purchase the stETH instead for dividends at a discount.

At any moment, stETH should be trading higher than ETH.

If stETH is trading lower, users will simply purchase the stETH instead for dividends at a discount.

However, if stETH is trading above current market value of ETH (like it should), users will simply deposit their ETH on Lido (stake it), receive stETH, and sell at a premium.

This has the potential to lead to unbelievable amounts of ETH being staked.

h/t .@SquishChaos

This has the potential to lead to unbelievable amounts of ETH being staked.

h/t .@SquishChaos

Okay, we’ve talked tons about supply. What about demand?

Well, layer two tech has led way for tens of millions of new users to be onboarded to ETH.

It’s not an imagination anymore, it’s a reality.

Well, layer two tech has led way for tens of millions of new users to be onboarded to ETH.

It’s not an imagination anymore, it’s a reality.

https://twitter.com/croissanteth/status/1488214609664385031

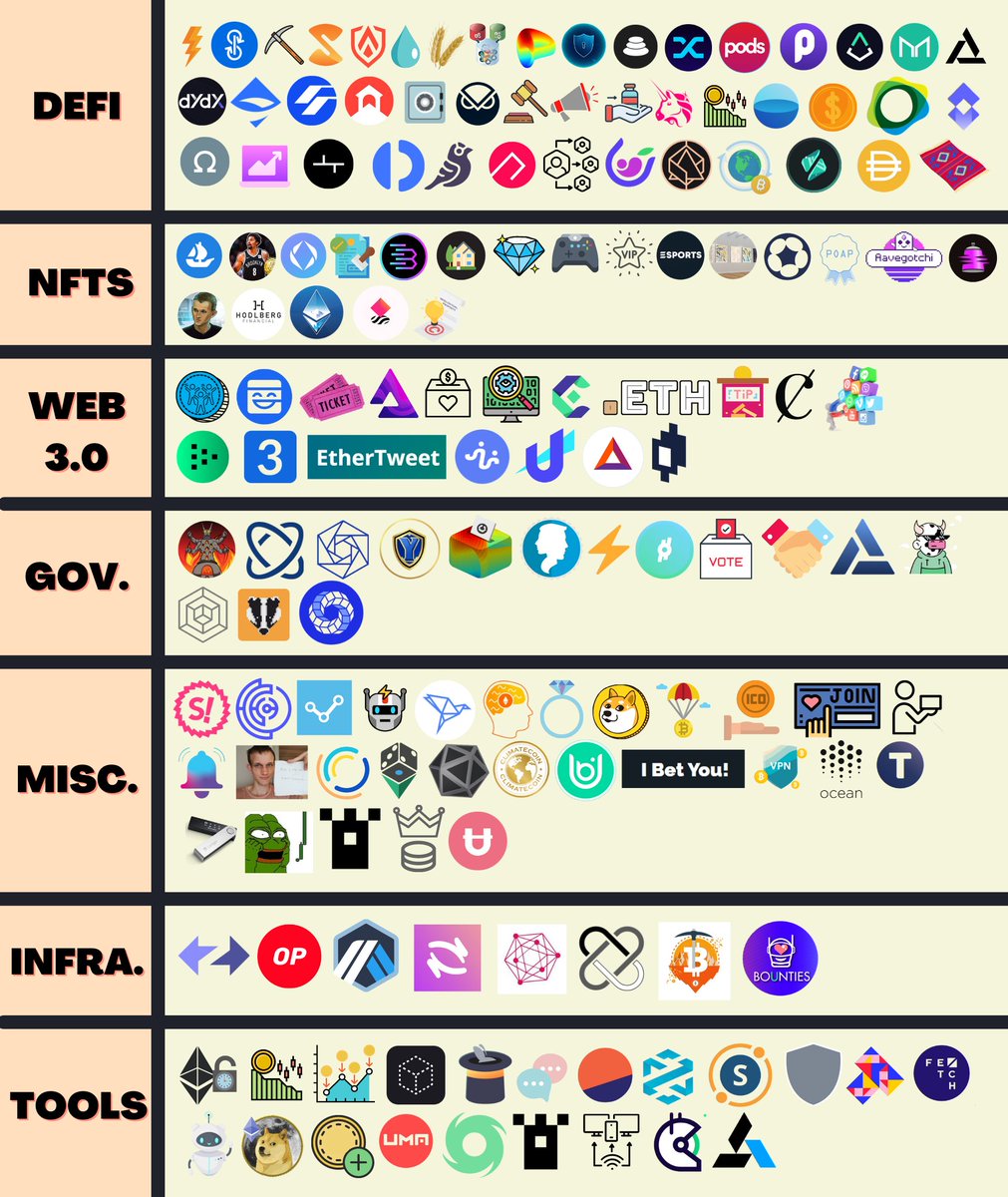

There are now hundreds if not thousands of billion dollar use cases encapsulated inside of the ecosystem.

200,000+ ERC-20 tokens across 13,000 dApps are all powered by Ethereum.

The more users there are on layer two, the cheaper it will be to make txs on mainnet (and so on)

200,000+ ERC-20 tokens across 13,000 dApps are all powered by Ethereum.

The more users there are on layer two, the cheaper it will be to make txs on mainnet (and so on)

All of this is why I believe we are very quickly moving from the mindset of “I buy ETH because it appreciates,” to the mindset of “I buy ETH to do things.”

This will be one of the most important things for ETH to come in the future.

This will be one of the most important things for ETH to come in the future.

Anyways, Ethereum has some very exciting next few months coming up, and no-one can say otherwise.

I hope you all enjoyed this in-depth thread! The croissant has been cooking up some special plans to announce soon… 🥐

I hope you all enjoyed this in-depth thread! The croissant has been cooking up some special plans to announce soon… 🥐

• • •

Missing some Tweet in this thread? You can try to

force a refresh