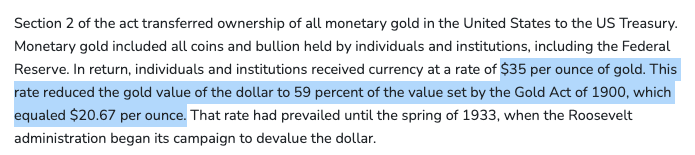

No, gold was defeated by the state. FDR seized the gold of US citizens with Executive Order 6102.

theconversation.com/how-the-us-gov…

theconversation.com/how-the-us-gov…

https://twitter.com/krishnanrohit/status/1501861355464372230

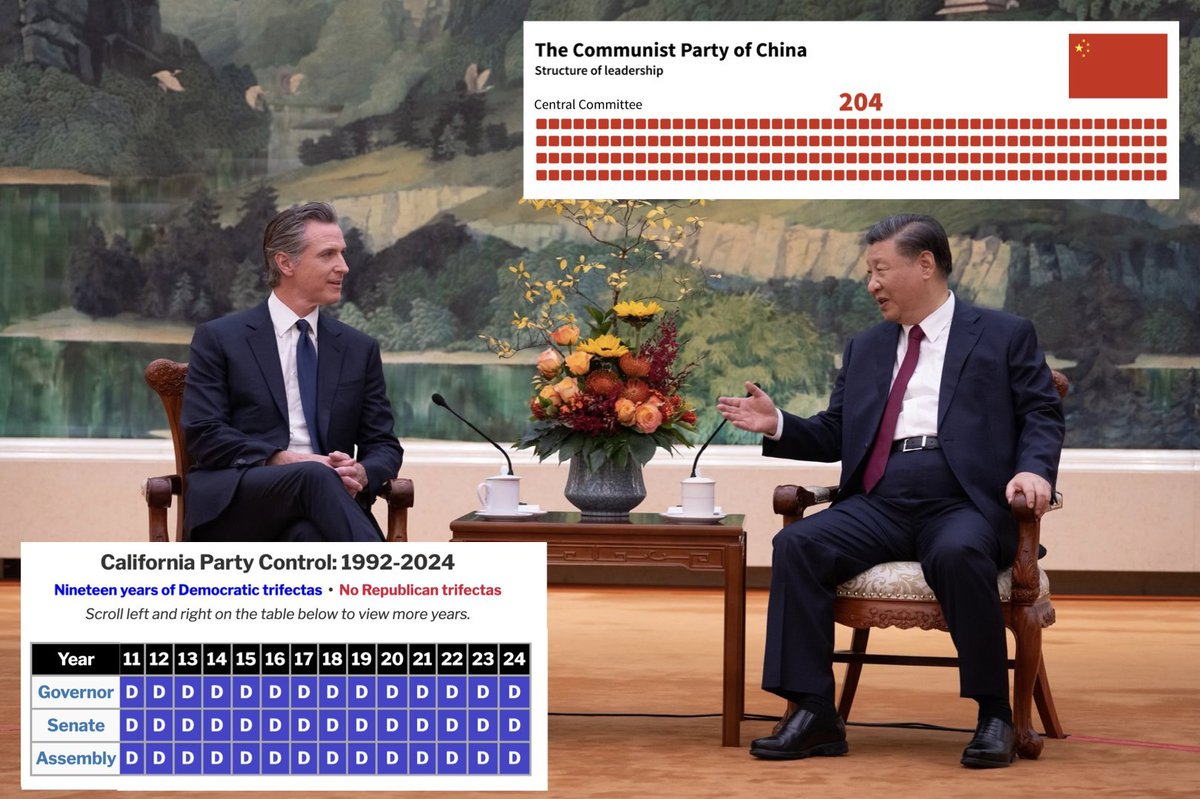

This was just a particularly explicit version of how centralized states expropriated individuals over the 20th century to fund their operations.

Gold was seized at $20.67, then the dollar was devalued so it was $35 per ounce. The state booked the profit.

federalreservehistory.org/essays/gold-re…

Gold was seized at $20.67, then the dollar was devalued so it was $35 per ounce. The state booked the profit.

federalreservehistory.org/essays/gold-re…

Even Krugman admits it: fiat currency is backed by men with guns.

Let's go through some of the conceptual issues here.

"It was too inflexible to allow sufficient policy to be done"

In other words, gold once limited the power of centralized states to seize the assets of citizens for their own purposes, like huge wars.

"It was too inflexible to allow sufficient policy to be done"

In other words, gold once limited the power of centralized states to seize the assets of citizens for their own purposes, like huge wars.

https://twitter.com/krishnanrohit/status/1501861355464372230

"This monograph presents a survey of the crucial link between state power and finance from the ancient era through to the present day. Cicero once said that the true sinew of war was endless streams of money."

press.armywarcollege.edu/monographs/455/

press.armywarcollege.edu/monographs/455/

"Investment in accordance to productive capacity"

Indeed, you want to invest in projects with real cash flows. But you also don't want your money debased via inflation. So the measure of any investment is whether it can outperform simply holding BTC.

Indeed, you want to invest in projects with real cash flows. But you also don't want your money debased via inflation. So the measure of any investment is whether it can outperform simply holding BTC.

https://twitter.com/krishnanrohit/status/1501861355464372230

For years, retail and professional investors alike have benchmarked their returns in BTC terms. That's why coinmarketcap.com makes charts like this easy. You can see whether the no-op of simply holding BTC outcompetes an investment.

Additionally, you can quantify the daily fees paid, which can be plugged into a DCF model just like cash flows, even though these are chains rather than businesses.

This is a different sense in which BTC and other coins actually are "productive assets".

cryptofees.info

This is a different sense in which BTC and other coins actually are "productive assets".

cryptofees.info

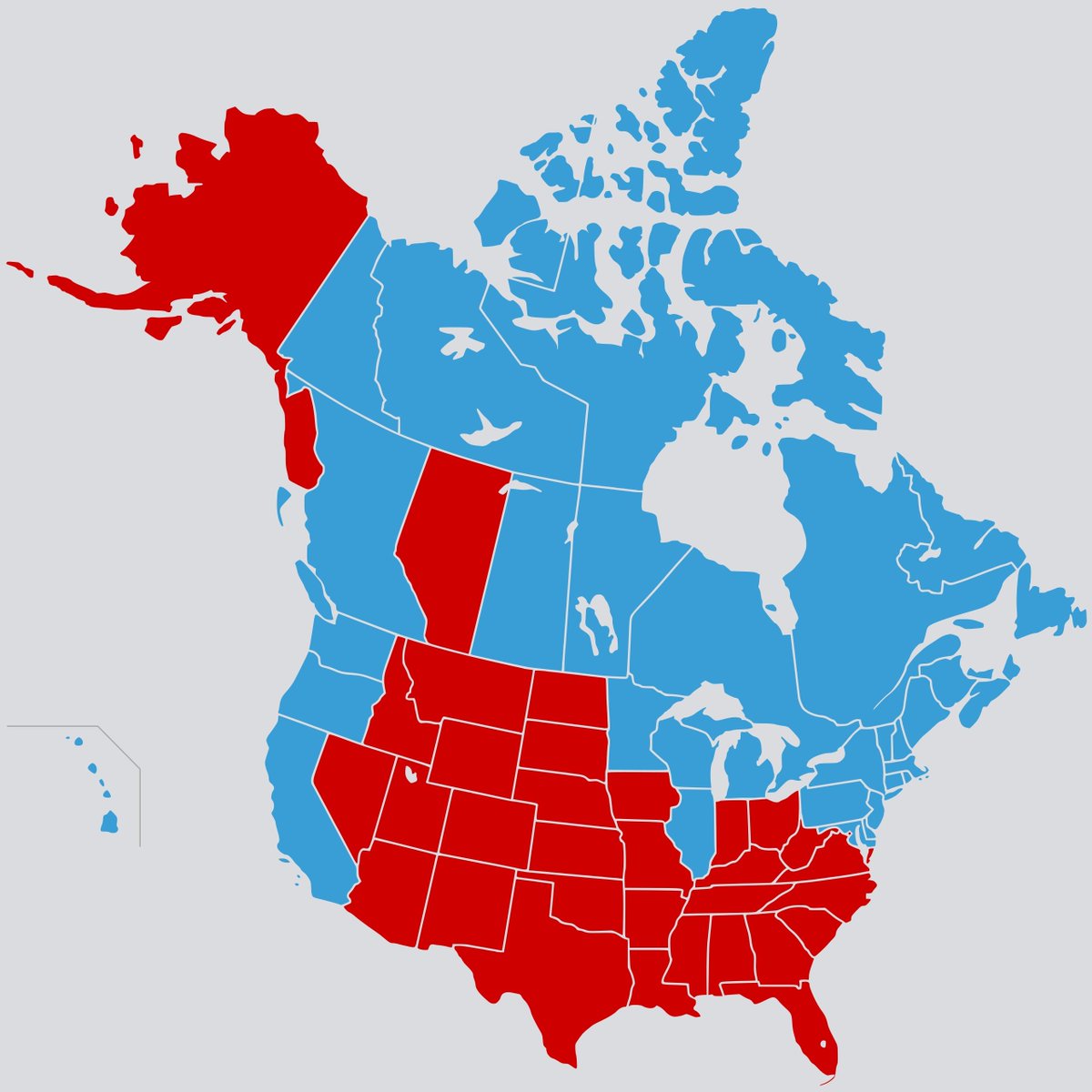

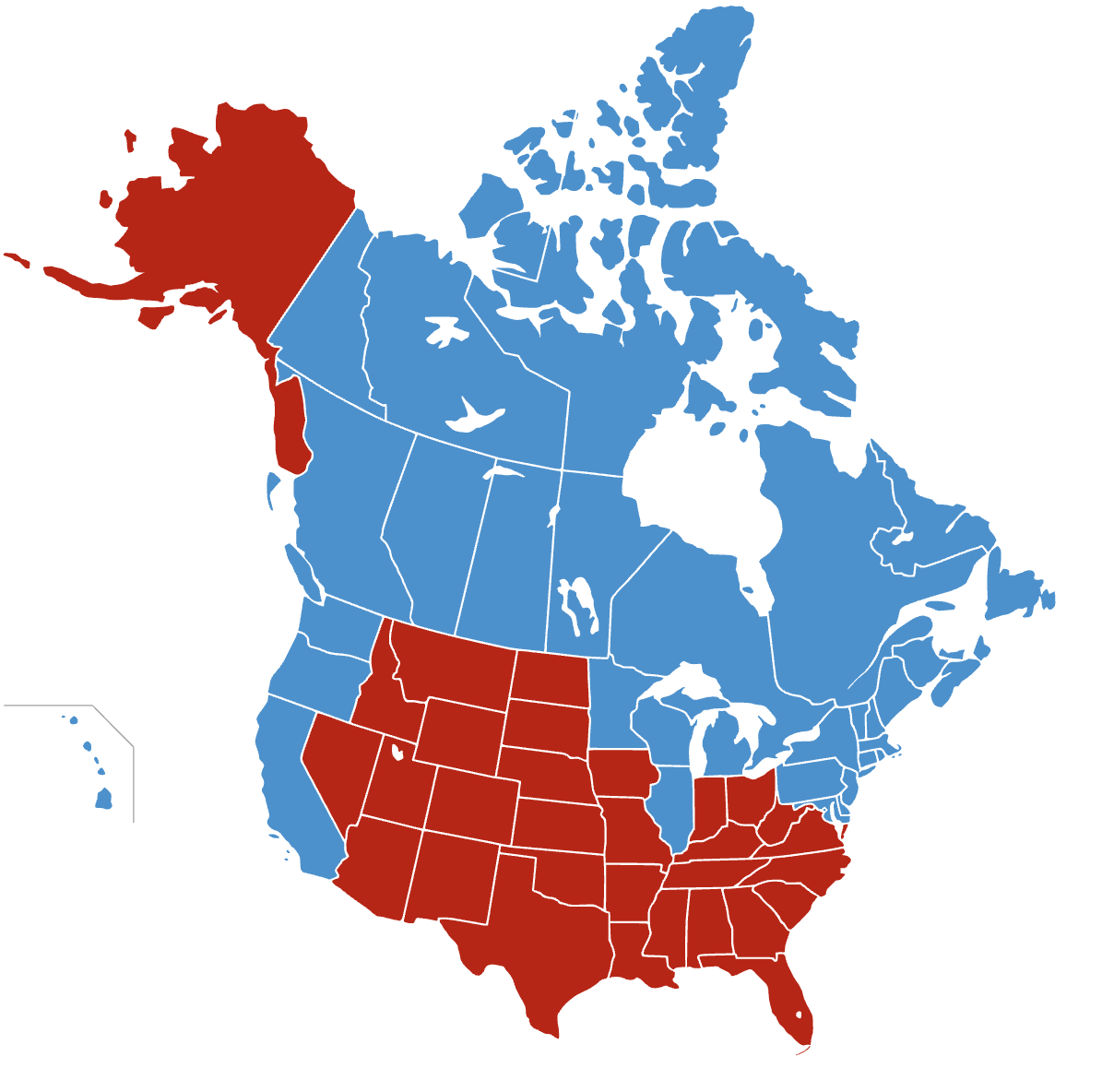

Technologies like mass production & mass media enabled the growth of centralized states till ~1950. The transistor, PC, internet, smartphone, and BTC are now *on balance* decentralizing that power...albeit not without an attempted Counter-Decentralization.

sotonye.substack.com/p/if-einstein-…

sotonye.substack.com/p/if-einstein-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh