How to get URL link on X (Twitter) App

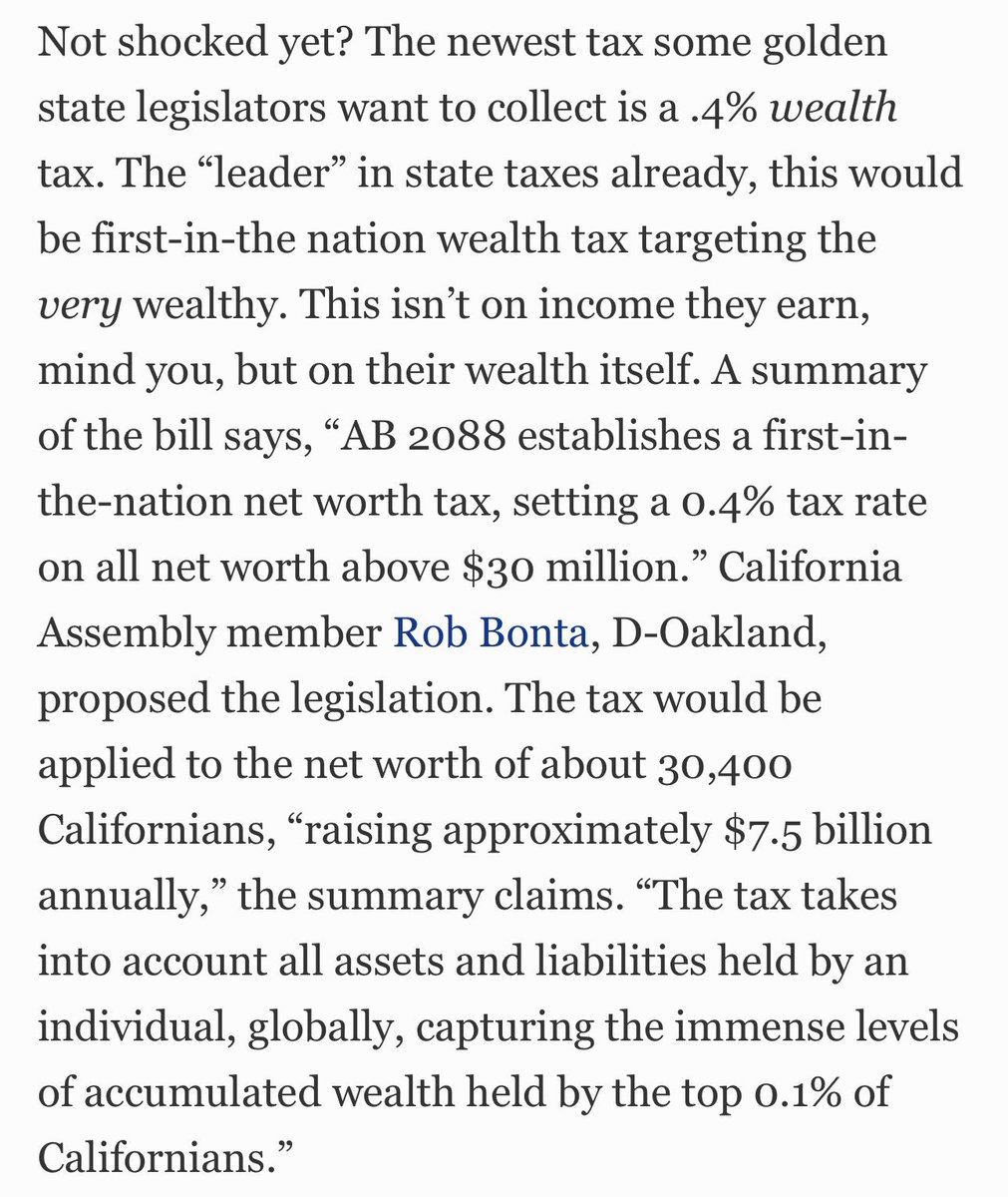

https://twitter.com/wsj/status/2020988601610236266By the way, it’s obvious that the 2026 billionaire wealth seizure will be followed by a millionaire wealth seizure.

https://x.com/balajis/status/1897175324678553907

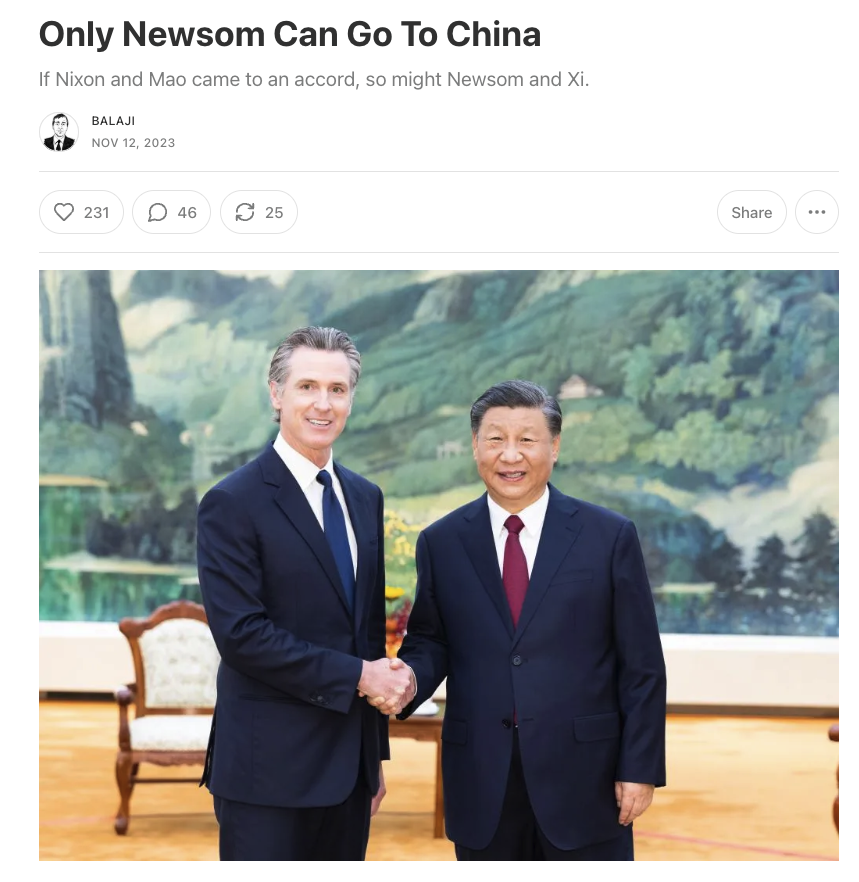

See also this post from 2023.

See also this post from 2023.

https://x.com/balajis/status/1996331329299087523

https://twitter.com/dabit3/status/1975750074748551375To be clear: I'm not talking about sending more tech talent to the US. Instead, I'm talking about backing dark talent around the world.

https://twitter.com/theemissaryco/status/1968189876496703702Naxalites drew their inspiration from Maoism and terrorized India for decades. Now these communists have formally surrendered.

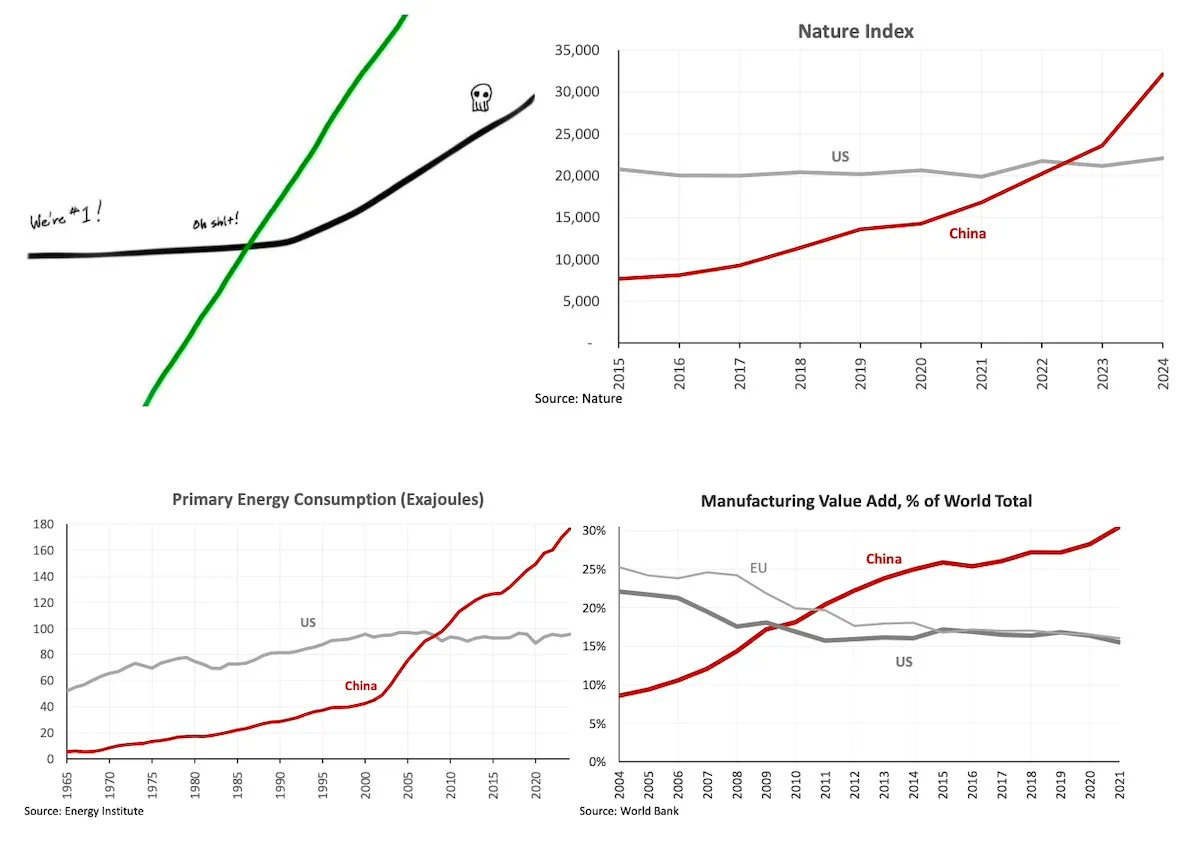

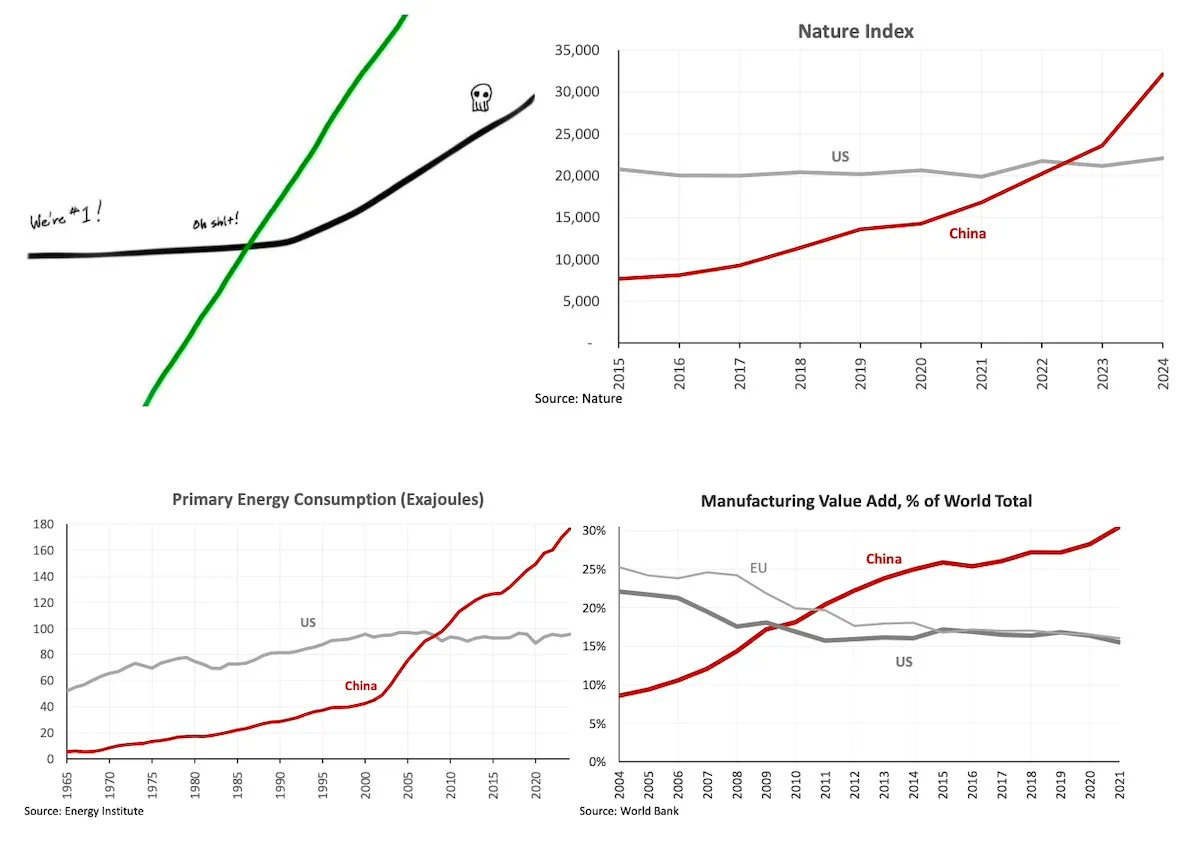

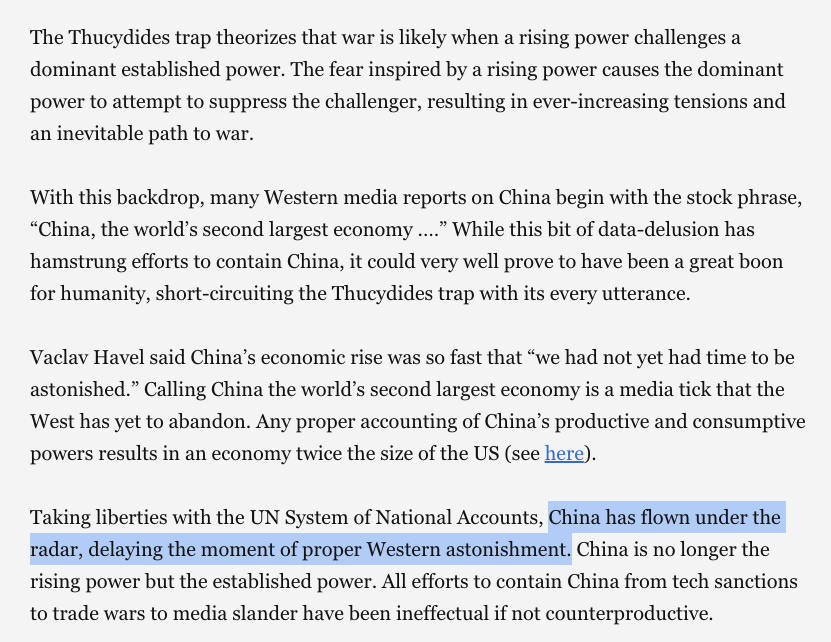

In retrospect, all the China cope over the last decade or so was really just the stealth on the Chinese stealth bomber.

In retrospect, all the China cope over the last decade or so was really just the stealth on the Chinese stealth bomber.

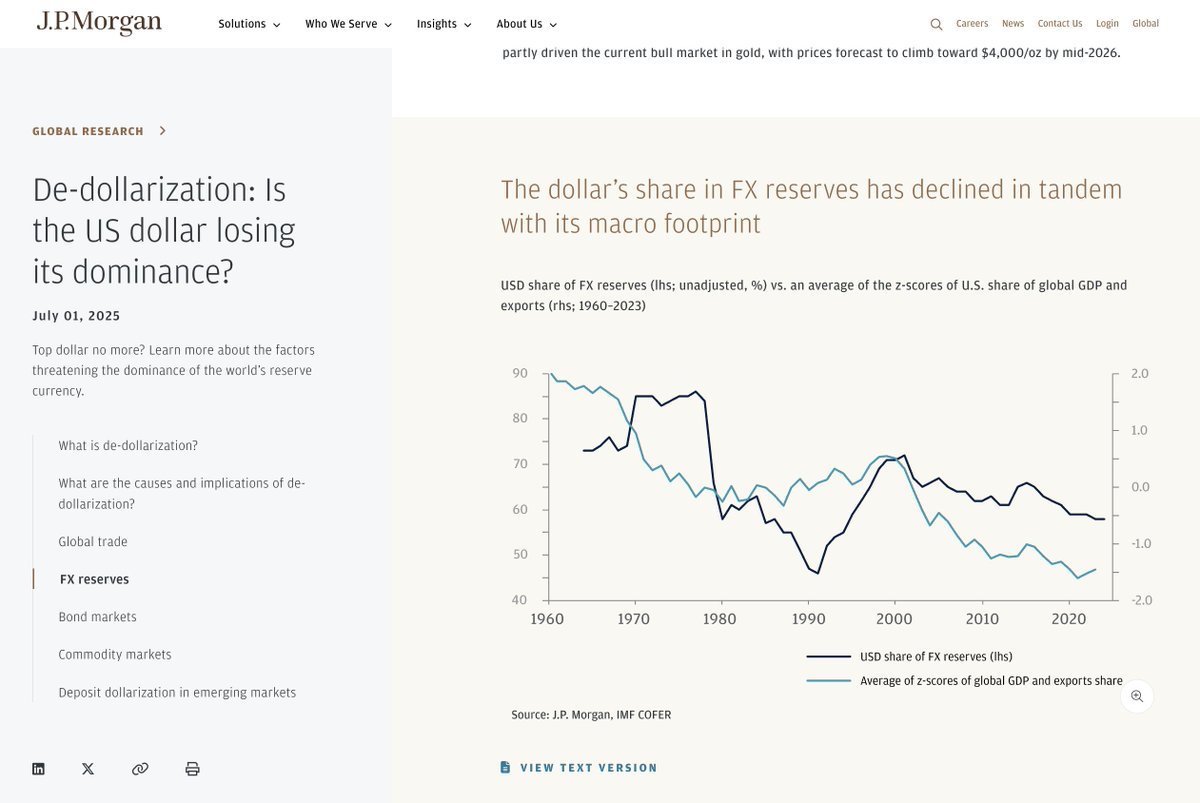

Digital gold is becoming the reserve currency of the individual.

Digital gold is becoming the reserve currency of the individual.https://twitter.com/kobeissiletter/status/1962235795622035767

Just the fact that JPMC is now admitting this is a big step.

Just the fact that JPMC is now admitting this is a big step.

This thread from @dpoddolphinpro has details on the new city limits & vote results. Elon's side won 212-6.

This thread from @dpoddolphinpro has details on the new city limits & vote results. Elon's side won 212-6.https://x.com/dpoddolphinpro/status/1918837843427803526

Ok, say you do.

Ok, say you do.https://twitter.com/theanon1776/status/1908238644520894556

https://twitter.com/deanwball/status/1900601413148811474

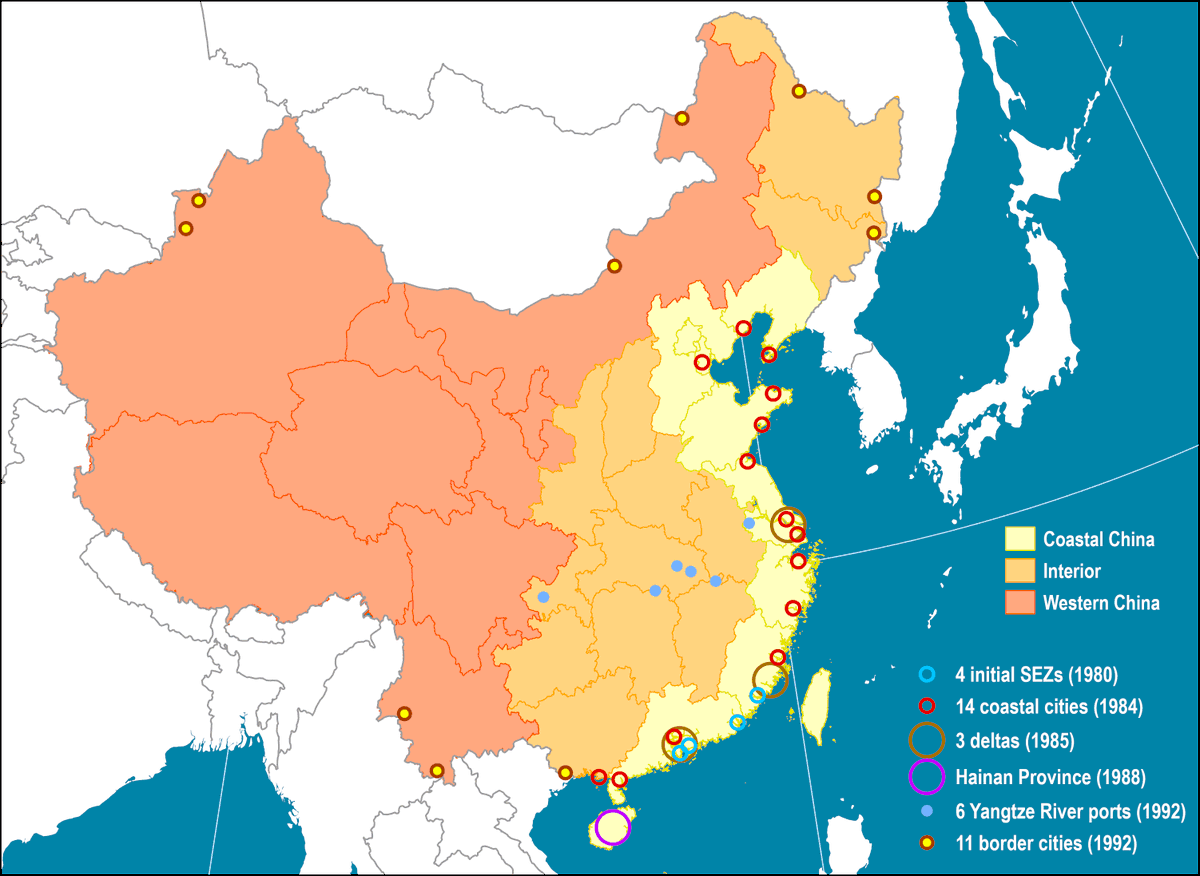

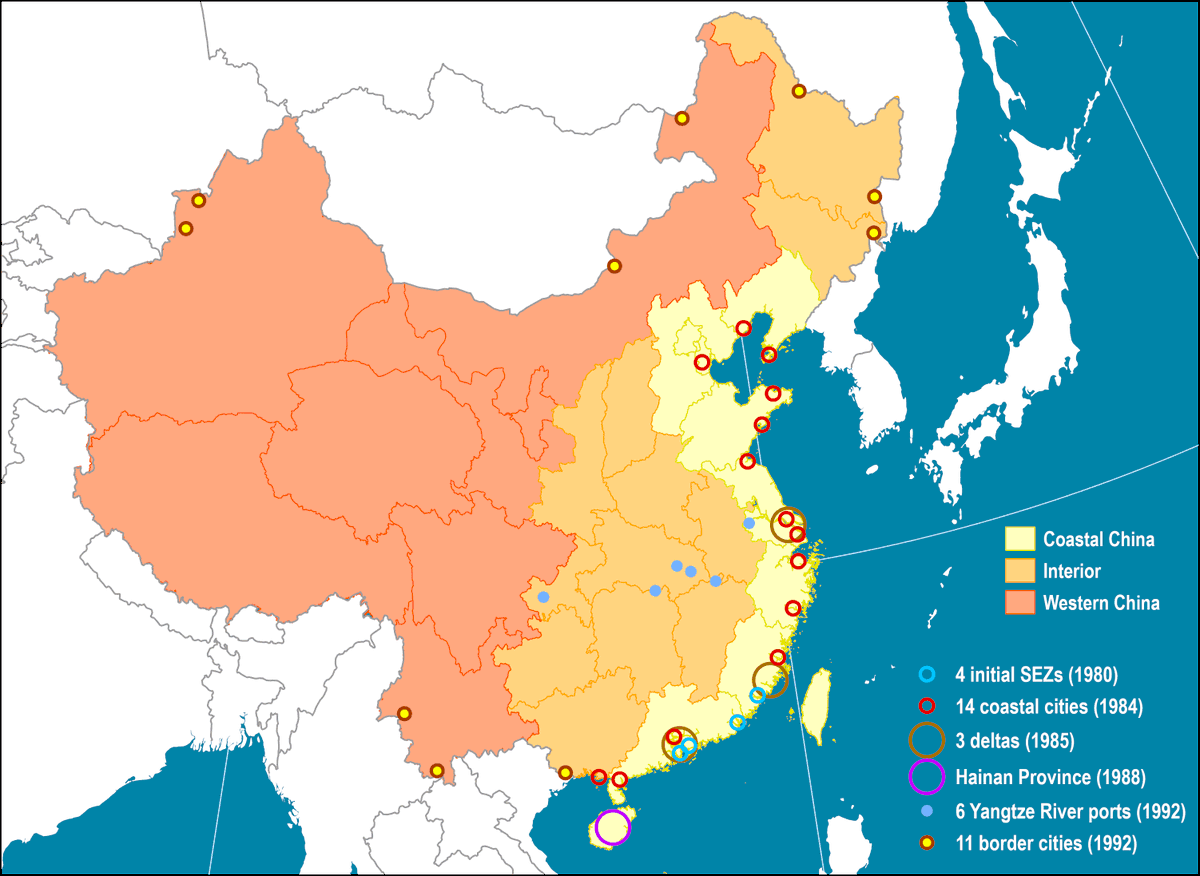

The idea that "Deng refounded China" is obvious yet non-obvious.

The idea that "Deng refounded China" is obvious yet non-obvious.https://x.com/balajis/status/1771899715191460187

Basically, tradeoffs exist.

Basically, tradeoffs exist.https://twitter.com/EricAbbenante/status/1900743275117768788Unfortunately, China is far ahead here too.

https://x.com/ErikGroset/status/1900964107622510797