My latest haul from @DefiKingdoms quests. Time to convert these puppies to $DFKGOLD and from thence to $JEWEL and see how my "Hero self-funding"-project is coming along.

1/ 🧵

1/ 🧵

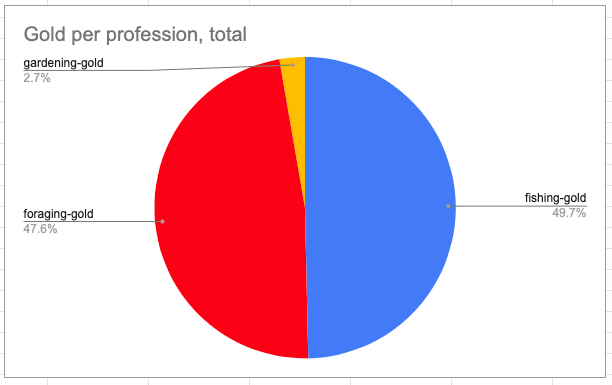

These are the raw data of the trades by profession for 2022-03-11:

Fishing: 43 items, 270 $DFKGOLD, 0.25 $JEWEL

Foraging: 86 items, 686.5 $DFKGOLD, 0.72 $JEWEL

Gardening: 2 items, 20 $DFKGOLD, 0.02 $JEWEL

SWAP 982.5 $DFKGOLD for 1.027 $JEWEL

2/ 🧵

Fishing: 43 items, 270 $DFKGOLD, 0.25 $JEWEL

Foraging: 86 items, 686.5 $DFKGOLD, 0.72 $JEWEL

Gardening: 2 items, 20 $DFKGOLD, 0.02 $JEWEL

SWAP 982.5 $DFKGOLD for 1.027 $JEWEL

2/ 🧵

Let's normalize the results.

1. When we split items by quest, we see an even distribution between foraging and fishing, but

2. Per hero per profession, we see a fisherman makes quite a bit more, per hero, than the other professions.

Interesting. 🤔

4/ 🧵

1. When we split items by quest, we see an even distribution between foraging and fishing, but

2. Per hero per profession, we see a fisherman makes quite a bit more, per hero, than the other professions.

Interesting. 🤔

4/ 🧵

So, does that mean ditch foraging heroes? I don't think so. When crafting items (potions and such) comes into its own, you're going to need the raw materials foraging provides. I'm going to keep foraging, thank you.

But I'll also start buying fishing heroes now, too.

5/ 🧵

But I'll also start buying fishing heroes now, too.

5/ 🧵

"Wen @DefiKingdoms Heroes self-funded, ser?"

Day 3:

Hero cost, adj: 614.377 $JEWEL

items yield, today: 1.027 $JEWEL

items yield, total: 12.72 $JEWEL

remaining: 601.7 $JEWEL

dis eez ... gonna take a while.

G'nite, fam!

6/ 🧵 finis

Day 3:

Hero cost, adj: 614.377 $JEWEL

items yield, today: 1.027 $JEWEL

items yield, total: 12.72 $JEWEL

remaining: 601.7 $JEWEL

dis eez ... gonna take a while.

G'nite, fam!

6/ 🧵 finis

• • •

Missing some Tweet in this thread? You can try to

force a refresh