I'm logical. And I'm graphs... or something like that? I do this because I love you, and I don't want you to hurt yourself.

So, basically, I'm your dad.

How to get URL link on X (Twitter) App

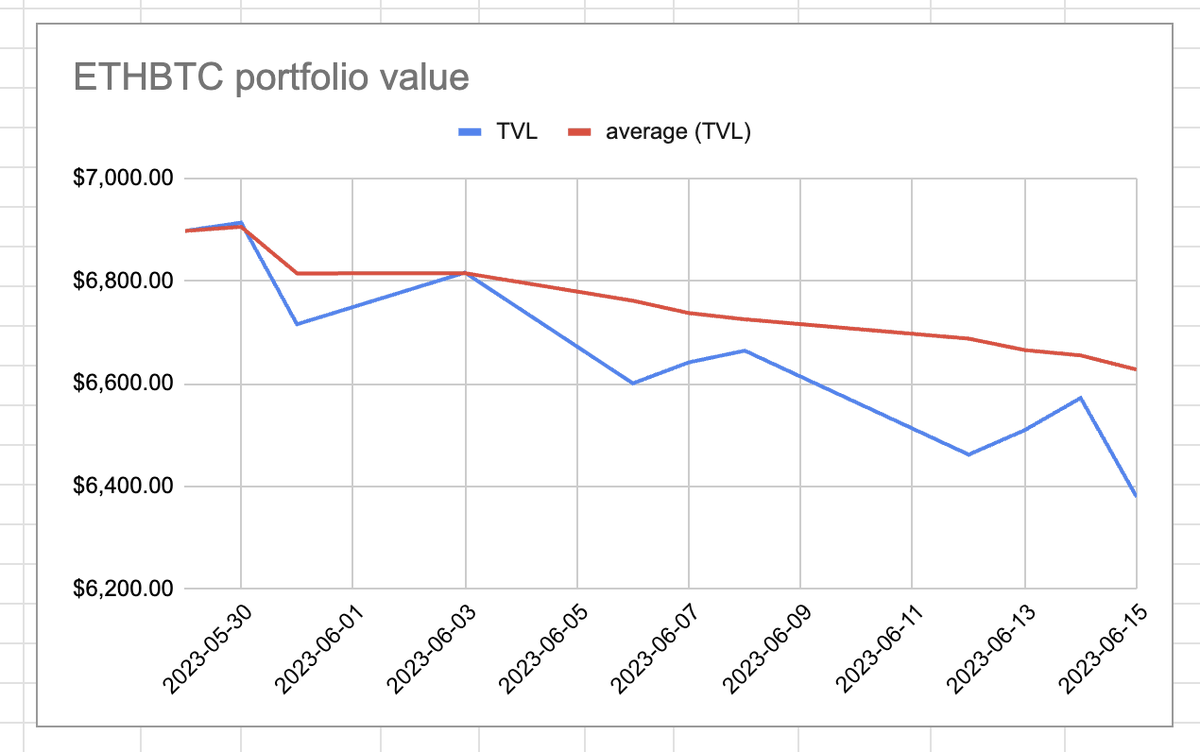

I do the ETHBTC-THANG!: withdrawing $BTC, bridging it to @osmosiszone to swap to $ETH (although I should have checked the @TeamKujira FIN boards, first), then bridging the $ETH back.

I do the ETHBTC-THANG!: withdrawing $BTC, bridging it to @osmosiszone to swap to $ETH (although I should have checked the @TeamKujira FIN boards, first), then bridging the $ETH back.

FIRST! Let's go over the particulars of this arb.

FIRST! Let's go over the particulars of this arb.

WHAT asset will I be buying?

WHAT asset will I be buying?

I also shore-up my $BTC 5xLONG position as it's in immediate danger of liquidation, adding 0.01 $BTC to my 0.03 $BTC 5xLONG.

I also shore-up my $BTC 5xLONG position as it's in immediate danger of liquidation, adding 0.01 $BTC to my 0.03 $BTC 5xLONG.

You see that my SPREADSHEETSZORXEN! sez to close the short at $1,639-per (PT).

You see that my SPREADSHEETSZORXEN! sez to close the short at $1,639-per (PT).

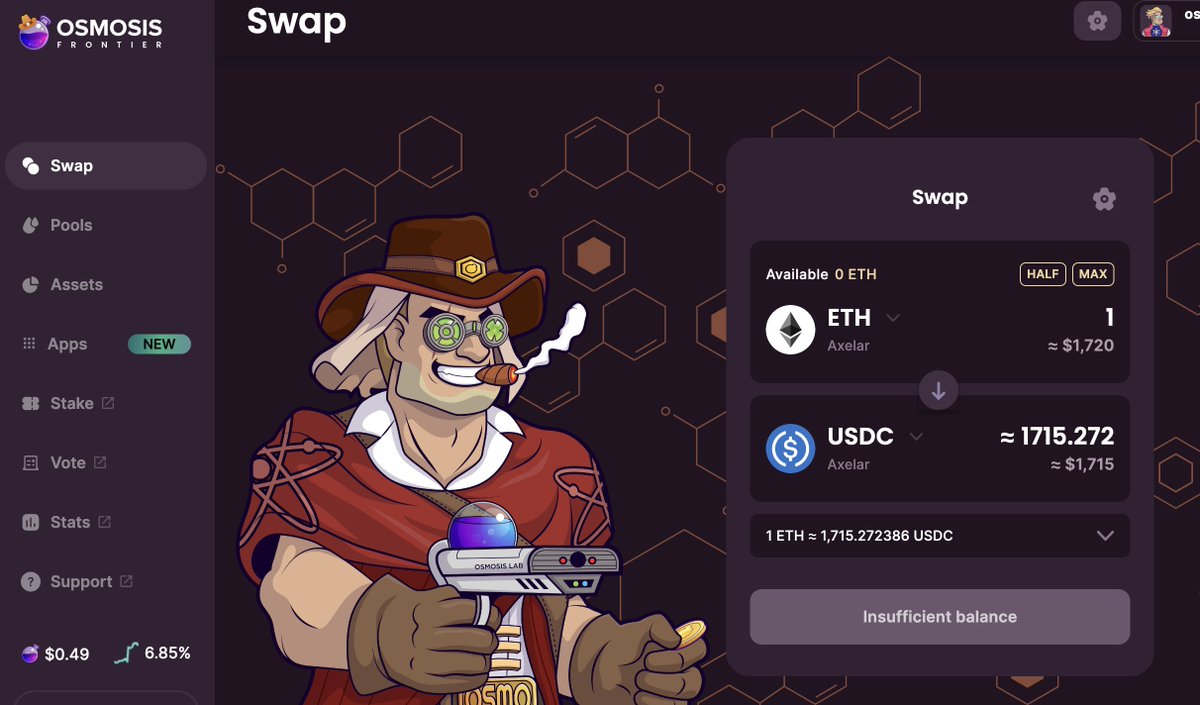

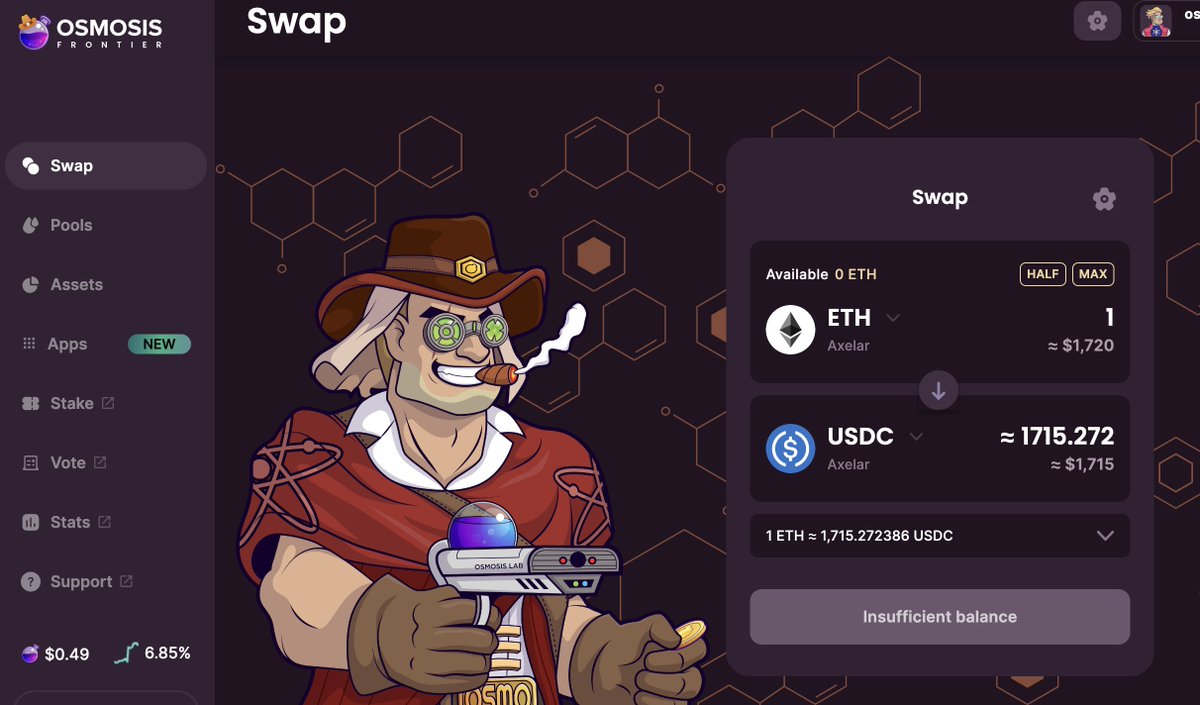

I do the things to swap $BTC to $ETH on @osmosiszone (the best place for me to swap, at present).

I do the things to swap $BTC to $ETH on @osmosiszone (the best place for me to swap, at present).

I sell the 11 $axlUSDC for $USK to buy ... $wETH? For real? That doesn't make sense, right? I just 無-arb'd $wBTC, so why am I buying $wETH with the gains.

I sell the 11 $axlUSDC for $USK to buy ... $wETH? For real? That doesn't make sense, right? I just 無-arb'd $wBTC, so why am I buying $wETH with the gains.

I split the $AVAX-yields three ways.

I split the $AVAX-yields three ways.

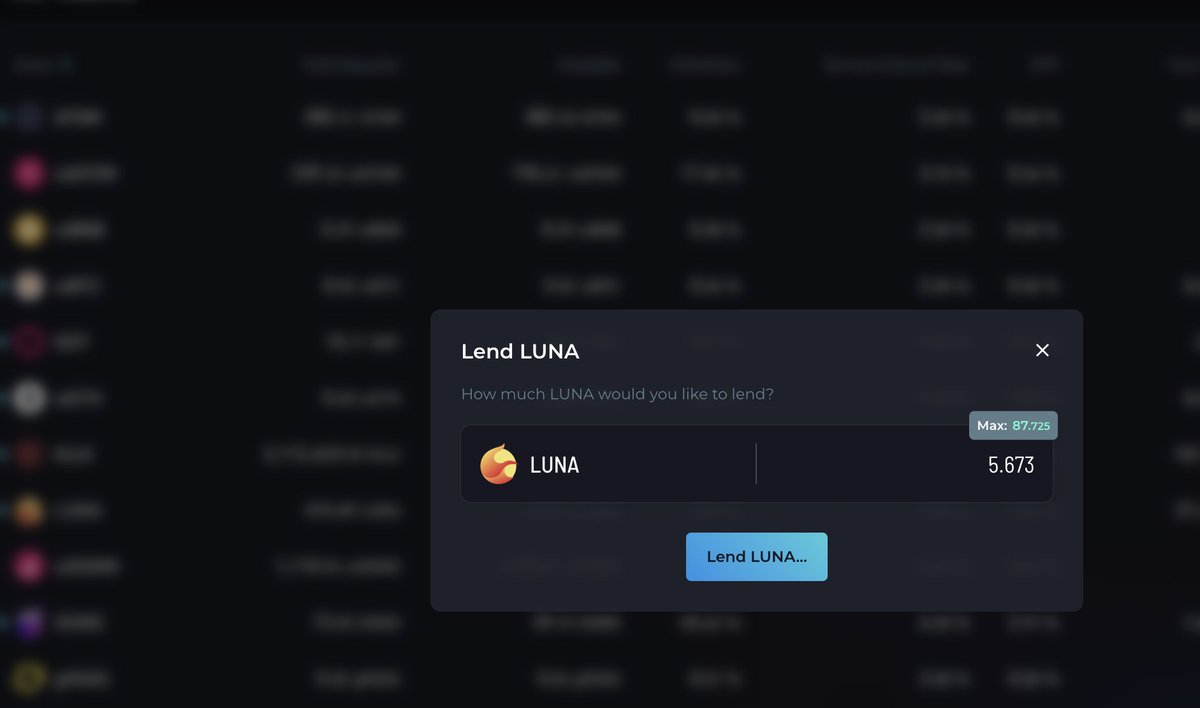

I do note, however, that I don't have a leveraged $FTM long position at this price-point, so I make an entry now.

I do note, however, that I don't have a leveraged $FTM long position at this price-point, so I make an entry now.

The first thing I encounter when I take stock is that @TeamKujira dev team has changed the wallet data-layout on BLUE, causing my ./wallet-parser to puke, ...

The first thing I encounter when I take stock is that @TeamKujira dev team has changed the wallet data-layout on BLUE, causing my ./wallet-parser to puke, ...

I swap the $USDC-gains to $LINK on @beethoven_x, then loop the $LINK on @GeistFinance.

I swap the $USDC-gains to $LINK on @beethoven_x, then loop the $LINK on @GeistFinance.

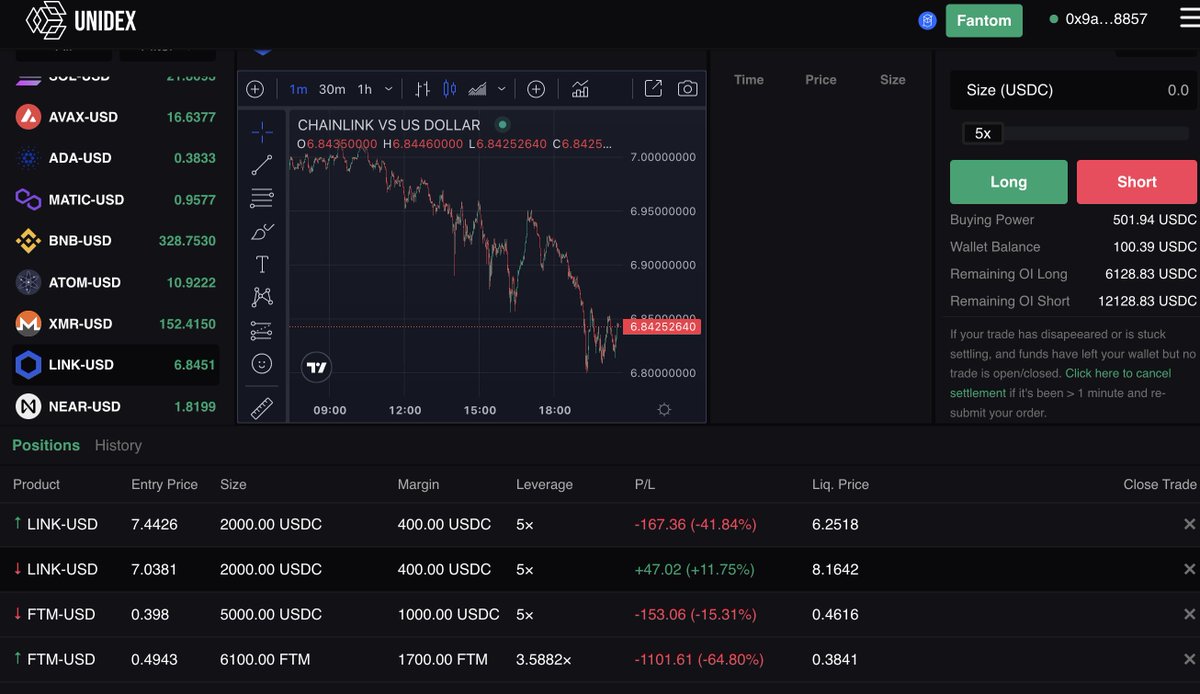

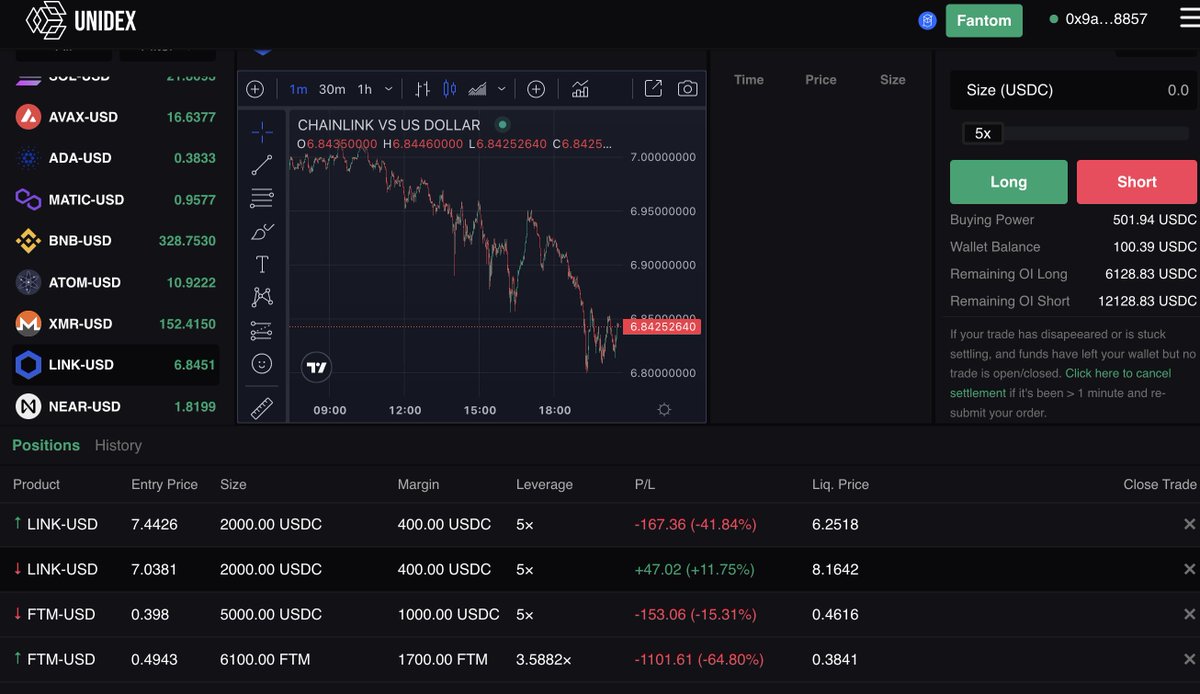

Now, I already have an existing $LINK short at this price-point, but I don't have a long, so I place that order.

Now, I already have an existing $LINK short at this price-point, but I don't have a long, so I place that order.

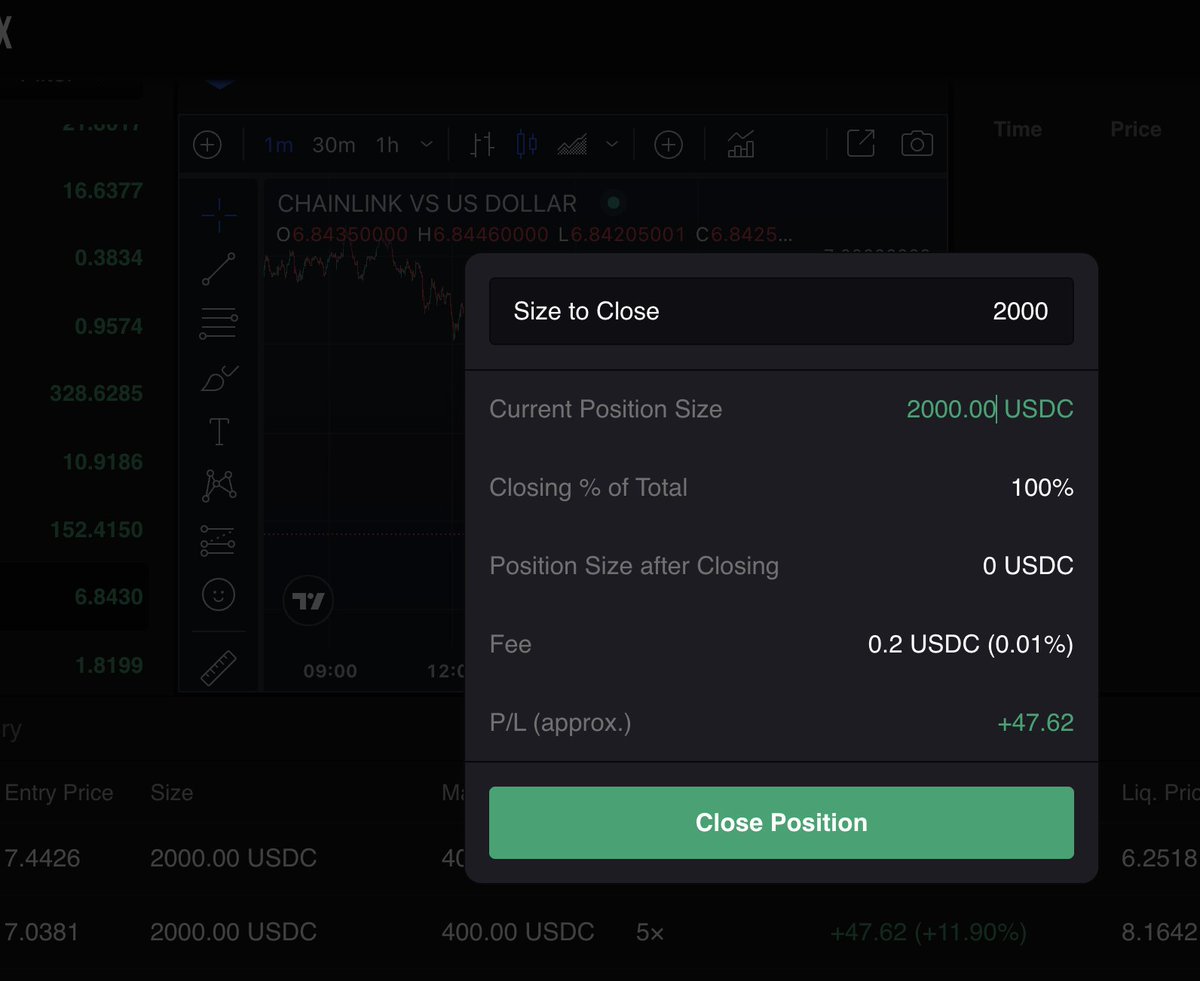

On closing the Ghost 50 $LUNA borrow, I do just that, paying 0.003 $LUNA in interest, which I'm happy to do.

On closing the Ghost 50 $LUNA borrow, I do just that, paying 0.003 $LUNA in interest, which I'm happy to do.

I immediately reopen the $LINK long, because:

I immediately reopen the $LINK long, because:

The next day ...

The next day ...

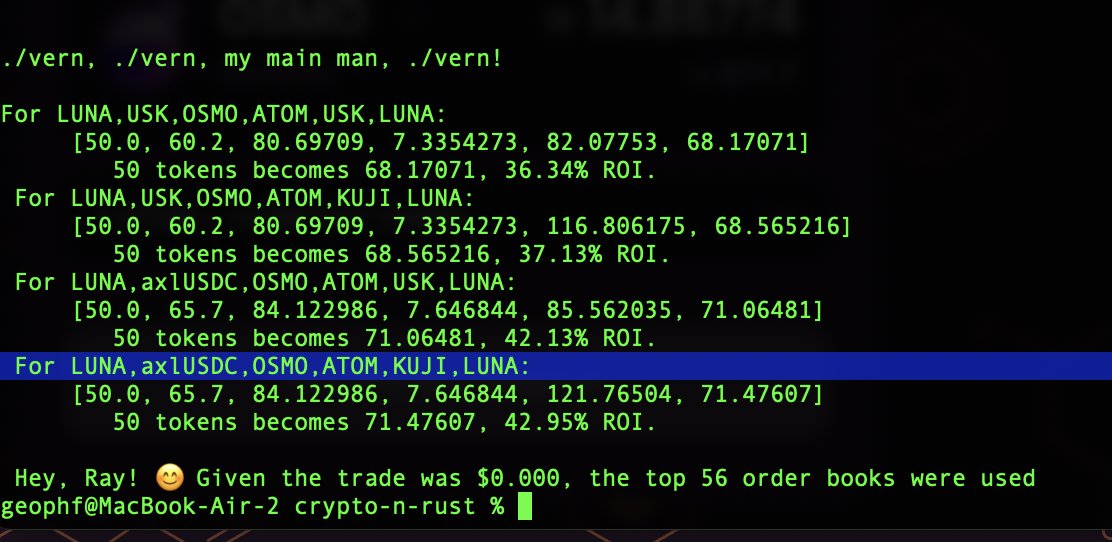

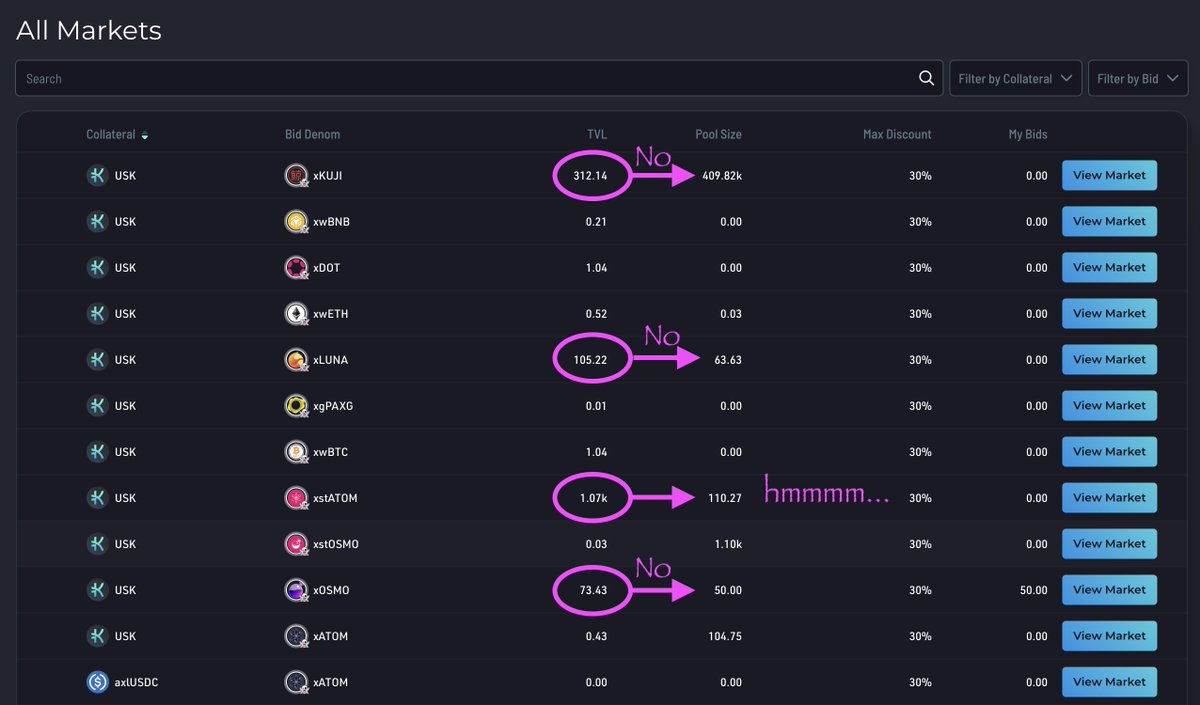

You see from the ORCA marketplace (OT) that there are 4 markets with volume, but three of them are overbid, particularly $xKUJI, so, let's stay away from that one.

You see from the ORCA marketplace (OT) that there are 4 markets with volume, but three of them are overbid, particularly $xKUJI, so, let's stay away from that one.

FIRST, let's check up on my DFKGOLD-JEWEL LP experiment.

FIRST, let's check up on my DFKGOLD-JEWEL LP experiment.

Wait for it ...

Wait for it ...

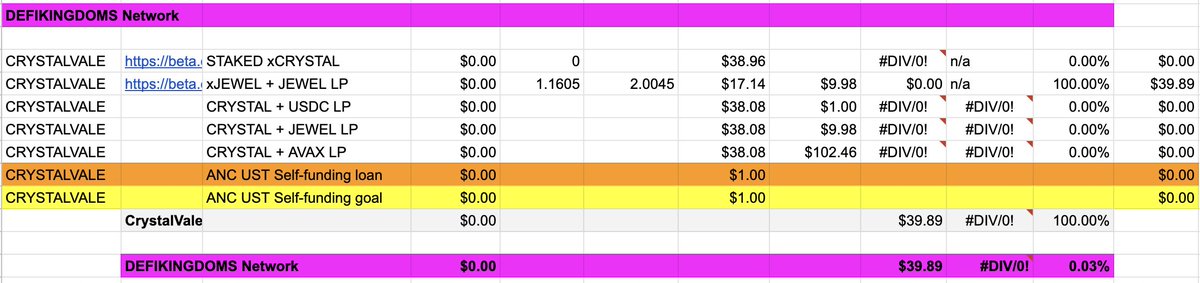

First things first. We MEASURE where we're at. For me, that's establishing CrystalVale as a position in my portfolio.

First things first. We MEASURE where we're at. For me, that's establishing CrystalVale as a position in my portfolio.