If you have some surplus cash that you want to allocate to debt or fixed income funds,

☆ you can consider simple, low cost, debt index funds with a target maturity, giving potential of relatively stable & predictable returns 🎯

1/n🧵

#TargetMaturityFund

#TMF #IndexFunds #ETFs

☆ you can consider simple, low cost, debt index funds with a target maturity, giving potential of relatively stable & predictable returns 🎯

1/n🧵

#TargetMaturityFund

#TMF #IndexFunds #ETFs

2/n

DSP Nifty SDL Plus G - Sec Jun 2028 30:70 Index Fund is one such option you can evaluate

dspim.co/NSDL

DSP Nifty SDL Plus G - Sec Jun 2028 30:70 Index Fund is one such option you can evaluate

dspim.co/NSDL

3/n

What exactly is this fund?

It will be Open-ended target maturity index fund (you can redeem without any lockin)

~ which will mature after about 6 years in June 2028

☆ portfolio will be invested in line with Nifty SDL Plus G-Sec Jun 2028 30:70 Index

dspim.co/NSDL

What exactly is this fund?

It will be Open-ended target maturity index fund (you can redeem without any lockin)

~ which will mature after about 6 years in June 2028

☆ portfolio will be invested in line with Nifty SDL Plus G-Sec Jun 2028 30:70 Index

dspim.co/NSDL

Anything different that this index has?🎯💡

👇

👇

4/n

30% of the portfolio will be in SDLs & a unique Quality Filter shortlists the top 10 States based on their fiscal condition, the lowest Debt/GDP 💡

Mostly we see selection only based on Liquidity so this is a unique feature keeping Safety over Return

dspim.co/NSDLpres

30% of the portfolio will be in SDLs & a unique Quality Filter shortlists the top 10 States based on their fiscal condition, the lowest Debt/GDP 💡

Mostly we see selection only based on Liquidity so this is a unique feature keeping Safety over Return

dspim.co/NSDLpres

5/n

70% portfolio will be in G-Secs

▪︎6Yr spreads between G-Sec & SDL is just ~ 30bps, amongst the lowest ever

> so it could be better to have more investment in G-Secs than SDLs, given the relatively safer risk profiles of G-Secs 📈

dspim.co/NSDL

70% portfolio will be in G-Secs

▪︎6Yr spreads between G-Sec & SDL is just ~ 30bps, amongst the lowest ever

> so it could be better to have more investment in G-Secs than SDLs, given the relatively safer risk profiles of G-Secs 📈

dspim.co/NSDL

6/n

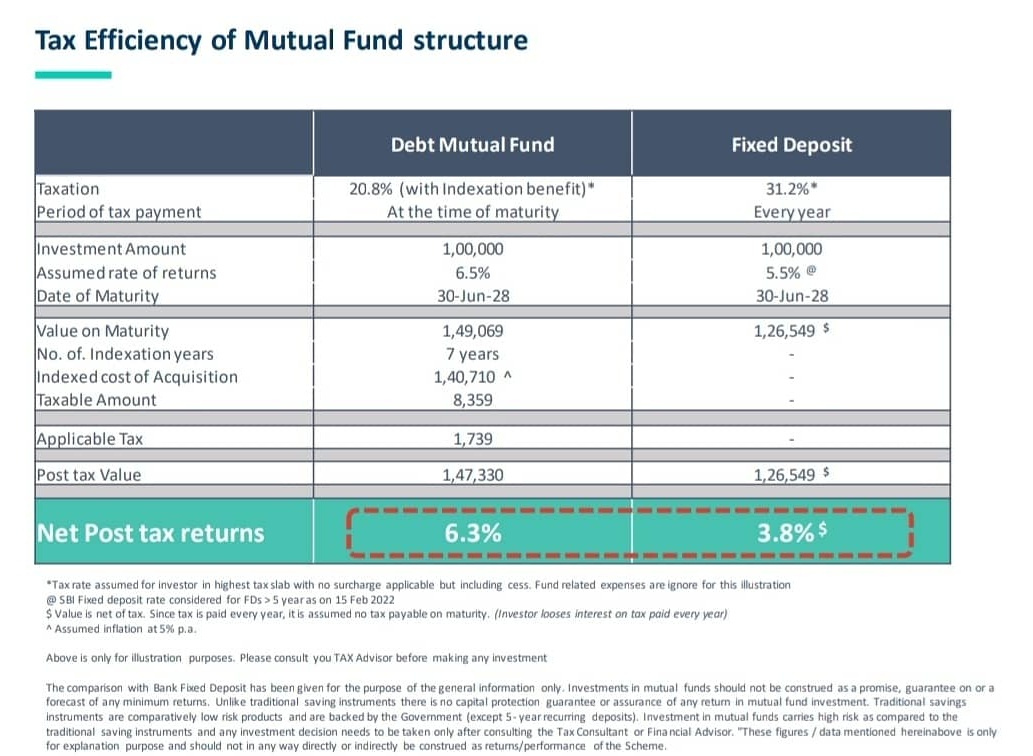

Taxation & indexation benefit?

Like any other debt fund there is a relatively better tax efficiency.

Check out this table below 👇

dspim.co/NSDL

Taxation & indexation benefit?

Like any other debt fund there is a relatively better tax efficiency.

Check out this table below 👇

dspim.co/NSDL

7/n

If you hold for more than 3 Yrs, you can get 1 addnl year of indexation in case you invest before Mar 31, 2022

☆ It is an open ended fund, so you can exit anytime

> but if you remain invested till maturity in 2028, you can get total 7 Yrs indexation

dspim.co/NSDL

If you hold for more than 3 Yrs, you can get 1 addnl year of indexation in case you invest before Mar 31, 2022

☆ It is an open ended fund, so you can exit anytime

> but if you remain invested till maturity in 2028, you can get total 7 Yrs indexation

dspim.co/NSDL

8/8

So what next?

NFO is open till March 17, 2022 - easy online investment at 👩💻👇

dspim.co/NSDL

But..

☆ before that you should check out more details, some useful charts and risk factors

dspim.co/NSDLpres

Do meet your advisor & review your goals periodically.

So what next?

NFO is open till March 17, 2022 - easy online investment at 👩💻👇

dspim.co/NSDL

But..

☆ before that you should check out more details, some useful charts and risk factors

dspim.co/NSDLpres

Do meet your advisor & review your goals periodically.

• • •

Missing some Tweet in this thread? You can try to

force a refresh