I am happy to share my first🧵on how I invested with a bag under 10k to achieve growth and minimize fluctuations in the market. The bulk of my strategy relies on $LQDR, @LiquidDriver’s #LQDRv3 on #FTM. This strategy works for me, it is NFA. Let’s dive in (0/10)

2/ I started with 4K in $FTM. Used 1K @spiritswap to deposit into LQDR/FTM LP and deposited on @LiquidDriver for approx 100% APR it may be larger according to the latest alpha:

I harvest the $LQDR monthly (but you can do this daily if you wish)

https://twitter.com/richeybai/status/1474363363274727432?s=21

I harvest the $LQDR monthly (but you can do this daily if you wish)

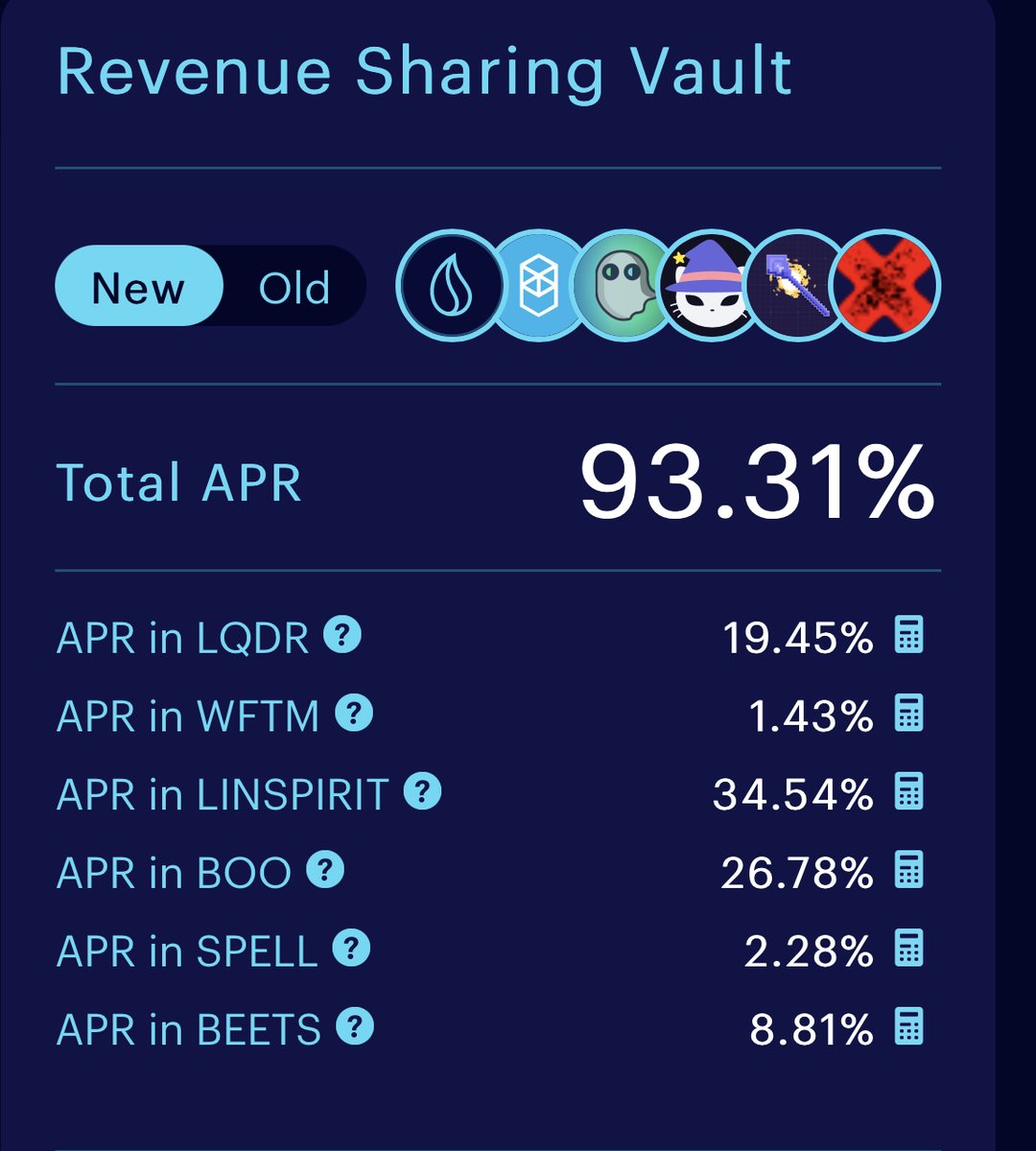

3/ I also bought 1K in $LQDR to lock as $xLQDR for two years. This earns another 90-100% APR from the @LiquidDriver revenue sharing vault (breakdown in screenshot). If you’re weary about locking for two years, a new product #FNFTs will allow you to lock your xLQDR as an NFT… 3/

4/ The #FNFT will allow you to earn the revenue from $xLQDR minus 1% while keeping your position liquid (as it can be sold on NFT markets such as @paintswap).

I also harvest my $xLQDR rewards monthly and compound the all $LQDR earned from farm and xLQDR back into xLQDR.

I also harvest my $xLQDR rewards monthly and compound the all $LQDR earned from farm and xLQDR back into xLQDR.

5/ Earned linspirit is staked on liquiddriver.finance/linspirit to earn $spirit. These rewards are compounded monthly by swapping $spirit to $linspirit using @beethoven_x

Earned $beets are locked as $fbeets and used to earn bribes for #pirateparty votes

Earned $boo is locked as $xboo

Earned $beets are locked as $fbeets and used to earn bribes for #pirateparty votes

Earned $boo is locked as $xboo

6/ Soon $xLQDR vaults will benefit from shadow farms which will bring even more value to $xLQDR holders. Check out the thread from team member @hoemcrypto below for a solid explanation.

https://twitter.com/hoemcrypto/status/1503763617321263122?s=21

7/ To hedge against choppy markets the remainder is farming with stables. My favorite strategy is to supply $MIM on @HundredFinance. I supplied 1k $MIM for $hMIM. The $hMIM is staked on @LiquidDriver for ~10% APR. Reward HND is swapped for liHND and staked on @LiquidDriver.

8/ As you can probably tell from the previous messages my strategy relies heavily on @LiquidDriver. As much as I trust this protocol, I believe it’s still a good idea to hedge even further. I achieve this by going outside the #ftm ecosystem to use @anchor_protocol on #terra.

9/ I bought 1k in $UST using the crypto .com and transferred the funds to a #terra compatible wallet such as #xdefi. I was then able to deposit the UST on anchor for at 19.5% yield.

10/ Next steps, explore:

1. Riskier leverage farming (ie. @ImpermaxFinance)

2.@Onering_Finance to diversify stable yield farming across the #ftm network.

Thank you for reading!

P.S. If you need help with any of the @liquiddriver strategies the discord is great place to start!

1. Riskier leverage farming (ie. @ImpermaxFinance)

2.@Onering_Finance to diversify stable yield farming across the #ftm network.

Thank you for reading!

P.S. If you need help with any of the @liquiddriver strategies the discord is great place to start!

• • •

Missing some Tweet in this thread? You can try to

force a refresh