1/ SiteOne Landscape Supply $SITE Thread

$SITE is a high-quality boring business, very similar to $POOL and other distributors. With shares off -31% from recent highs I wanted to provide a quick walk through of the business. If you like $POOL $WSO $FND etc. you will like $SITE

$SITE is a high-quality boring business, very similar to $POOL and other distributors. With shares off -31% from recent highs I wanted to provide a quick walk through of the business. If you like $POOL $WSO $FND etc. you will like $SITE

2/Intro

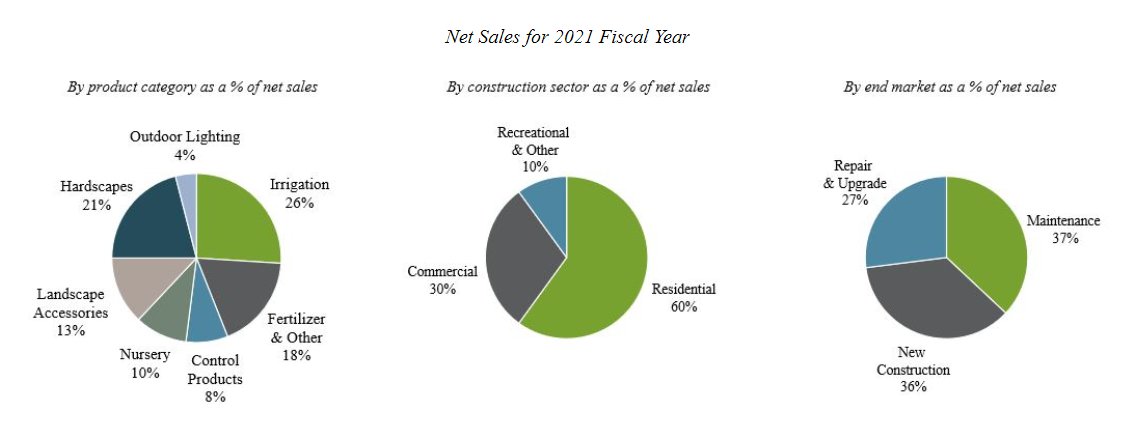

$SITE is the largest and only national scale distributor of landscaping supplies in the US. Sells irrigation, hardscape, nursery, and other items via a 590-branch network in 45 states and 6 CA provinces. Had ’21 revenue of $3.5bln with $415mln in EBITDA (11.9%/sales).

$SITE is the largest and only national scale distributor of landscaping supplies in the US. Sells irrigation, hardscape, nursery, and other items via a 590-branch network in 45 states and 6 CA provinces. Had ’21 revenue of $3.5bln with $415mln in EBITDA (11.9%/sales).

3/Market Share [1]

$SITE operates in the highly fragmented $23bln wholesale landscape supply market. Has ~15% market share with the balance (~85%) primarily held by small/local players. $SITE is 5x larger than its nearest competitor (Ewing) and multiples of the remaining top 8

$SITE operates in the highly fragmented $23bln wholesale landscape supply market. Has ~15% market share with the balance (~85%) primarily held by small/local players. $SITE is 5x larger than its nearest competitor (Ewing) and multiples of the remaining top 8

4/Market Share [2]

Top 8 - Heritage, Harrell’s, Horizon (POOL), BWI, Target Spec, Howard, BFG Supply, Central Turf & Irrigation.

$SITE market share has increased +600bps from 9% in ’15 to 15% in ’21 as $SITE grew topline 16%/yr. 3x faster than industry growth (6%/yr.)

Top 8 - Heritage, Harrell’s, Horizon (POOL), BWI, Target Spec, Howard, BFG Supply, Central Turf & Irrigation.

$SITE market share has increased +600bps from 9% in ’15 to 15% in ’21 as $SITE grew topline 16%/yr. 3x faster than industry growth (6%/yr.)

5/Footprint

$SITE's footprint is in 50% (185) of the 384 US MSA’s. Geared to growth areas, 50% of branches in the south. Expansion potential via (1) new MSA's (2) branch densification (3) MSA product expansion as $SITE only has a full product line in 21% of existing MSA’s

$SITE's footprint is in 50% (185) of the 384 US MSA’s. Geared to growth areas, 50% of branches in the south. Expansion potential via (1) new MSA's (2) branch densification (3) MSA product expansion as $SITE only has a full product line in 21% of existing MSA’s

6/Comp Advantage

Distributor framework. $SITE connects a fragmented base of >5k suppliers of >135k SKUs to a customer base of >280k landscape contractors. Superior economies of scale over local players. Only national operator. #1 market share leader in every product category.

Distributor framework. $SITE connects a fragmented base of >5k suppliers of >135k SKUs to a customer base of >280k landscape contractors. Superior economies of scale over local players. Only national operator. #1 market share leader in every product category.

7/Comp Advantage [2]

$SITE adds value to both sides of the network:

Suppliers – help connect to largest pool of demand, bulk volume purchasing of products with fewer/larger shipments, only national network, quick product launches, sales/marketing support provided by $SITE

$SITE adds value to both sides of the network:

Suppliers – help connect to largest pool of demand, bulk volume purchasing of products with fewer/larger shipments, only national network, quick product launches, sales/marketing support provided by $SITE

8/Comp Advantage [3]

Customers – superior breadth/depth of product, one-stop shopping, better local/regional product availability, cost savings, trade credit offerings, loyalty program sales leads/training

Customers – superior breadth/depth of product, one-stop shopping, better local/regional product availability, cost savings, trade credit offerings, loyalty program sales leads/training

9/M&A

$SITE is an acquisition story and is the leading consolidator in a highly fragmented market. Has acquired 64 co. since ’14 with $1.2bln in sales and 280 branches. National scale and >80 associate scouting team provides it a sourcing advantage and a large M&A pipeline.

$SITE is an acquisition story and is the leading consolidator in a highly fragmented market. Has acquired 64 co. since ’14 with $1.2bln in sales and 280 branches. National scale and >80 associate scouting team provides it a sourcing advantage and a large M&A pipeline.

10/M&A [2]

$SITE is acquiring primarily small/local players that it can easily tuck into its existing network. This is a homogenous industry with little difference in core operations between players. M&A is immediately accretive with a repeatable recipe for deriving synergies.

$SITE is acquiring primarily small/local players that it can easily tuck into its existing network. This is a homogenous industry with little difference in core operations between players. M&A is immediately accretive with a repeatable recipe for deriving synergies.

11/M&A Synergies

Purchasing - $SITE can overlay purchasing economies of scale and lower target COGS

Overhead – eliminate duplicate operations in back office/etc.

Branch Network – consolidate branch footprint

Cross Selling - $SITE can bolt on additional product categories sold

Purchasing - $SITE can overlay purchasing economies of scale and lower target COGS

Overhead – eliminate duplicate operations in back office/etc.

Branch Network – consolidate branch footprint

Cross Selling - $SITE can bolt on additional product categories sold

12/M&A Deals

Avg. realized deal size over ’16-’21 was $17-$20mln in sales with 3-5 branches. Deal costs have been slowly increasing from ~0.4x-0.6x P/S in ‘16/’17 to ~0.8x-0.9x P/S in ‘20/’21. Deal multiples compare favorably to $SITE which trades at >2x sales and ~18x EBITDA.

Avg. realized deal size over ’16-’21 was $17-$20mln in sales with 3-5 branches. Deal costs have been slowly increasing from ~0.4x-0.6x P/S in ‘16/’17 to ~0.8x-0.9x P/S in ‘20/’21. Deal multiples compare favorably to $SITE which trades at >2x sales and ~18x EBITDA.

13/Self-Funding

$SITE is capital light, requiring <1%/sales in CAPEX. With $SITE currently producing 7-9% CFO/sales margins, $SITE is FCF generative. Since ’19 $SITE has been able to fully fund M&A via internal CFO. Has capacity for 12-15/deals yr. at est. ’22 CFO/deal size.

$SITE is capital light, requiring <1%/sales in CAPEX. With $SITE currently producing 7-9% CFO/sales margins, $SITE is FCF generative. Since ’19 $SITE has been able to fully fund M&A via internal CFO. Has capacity for 12-15/deals yr. at est. ’22 CFO/deal size.

14/ROIC

$SITE’s business generates attractive 25-30% returns on capital. $SITE printed a ~28% pretax ROIC (23% after tax) in ’21. ROIC has been moving up and to the right as $SITE has increased EBITDA margins +380bps since ’16 (8.1% to 11.9%).

$SITE’s business generates attractive 25-30% returns on capital. $SITE printed a ~28% pretax ROIC (23% after tax) in ’21. ROIC has been moving up and to the right as $SITE has increased EBITDA margins +380bps since ’16 (8.1% to 11.9%).

15/LT Algorithm

Long term $SITE is targeting MSD organic growth (4-6%) with 7-13% M&A growth footing to 15%/yr. (11-19%) revenue growth. Has a long term EBITDA margin goal of 13-15% (’21 11.9%) with 17-18% contribution margins. Equates to around 20%/yr. operating profit growth

Long term $SITE is targeting MSD organic growth (4-6%) with 7-13% M&A growth footing to 15%/yr. (11-19%) revenue growth. Has a long term EBITDA margin goal of 13-15% (’21 11.9%) with 17-18% contribution margins. Equates to around 20%/yr. operating profit growth

16/Mgmt

$SITE is led by Doug Black who has held the CEO seat since $SITE's IPO. Doug used to be CEO of OldCastle Materials where he executed a nearly identical playbook rolling up >100 companies over his tenure. $SITE's head of M&A Scott Salmon is also an OldCastle alumni.

$SITE is led by Doug Black who has held the CEO seat since $SITE's IPO. Doug used to be CEO of OldCastle Materials where he executed a nearly identical playbook rolling up >100 companies over his tenure. $SITE's head of M&A Scott Salmon is also an OldCastle alumni.

17/Valuation

$SITE shares have declined -31% off Nov/’21 highs on both the current Ukraine/Russia conflict and concerns of a slowdown in consumer spending. $SITE now trades at 17.9x NTM/EBITDA (~29x Nov/21) with multiples fully back to levels seen pre-covid in ’18-’19.

$SITE shares have declined -31% off Nov/’21 highs on both the current Ukraine/Russia conflict and concerns of a slowdown in consumer spending. $SITE now trades at 17.9x NTM/EBITDA (~29x Nov/21) with multiples fully back to levels seen pre-covid in ’18-’19.

18/End

Overall, $SITE is a high-quality business with a very similar thesis to $POOL. Higher near-term M&A growth contribution is similar to $POOL's early history back in the 90’s/early 2000’s.

Overall, $SITE is a high-quality business with a very similar thesis to $POOL. Higher near-term M&A growth contribution is similar to $POOL's early history back in the 90’s/early 2000’s.

• • •

Missing some Tweet in this thread? You can try to

force a refresh