🇨🇳SHANGHAI 600000

SHANGHAI PUDONG DEVELOPMENT BANK

Shanghai Pudong Development Bank Co was founded 1992 with the approval of the People’s Bank of China and has been operating since 1993. It is a nationwide joint-stock commercial bank that became listed in 1999 on the Shanghai SE

SHANGHAI PUDONG DEVELOPMENT BANK

Shanghai Pudong Development Bank Co was founded 1992 with the approval of the People’s Bank of China and has been operating since 1993. It is a nationwide joint-stock commercial bank that became listed in 1999 on the Shanghai SE

Principal shareholders: SASAC of China (!) and China Mobile of @CipresMomentum (!)

Equity 660.000 mln RMB

Total liabilities 7.462.000 mln RMB

Marjet Cap 230.000 mln RMB.

This high debt ratio is normal for a bank, and it trades at 0.4 book value.

Total liabilities 7.462.000 mln RMB

Marjet Cap 230.000 mln RMB.

This high debt ratio is normal for a bank, and it trades at 0.4 book value.

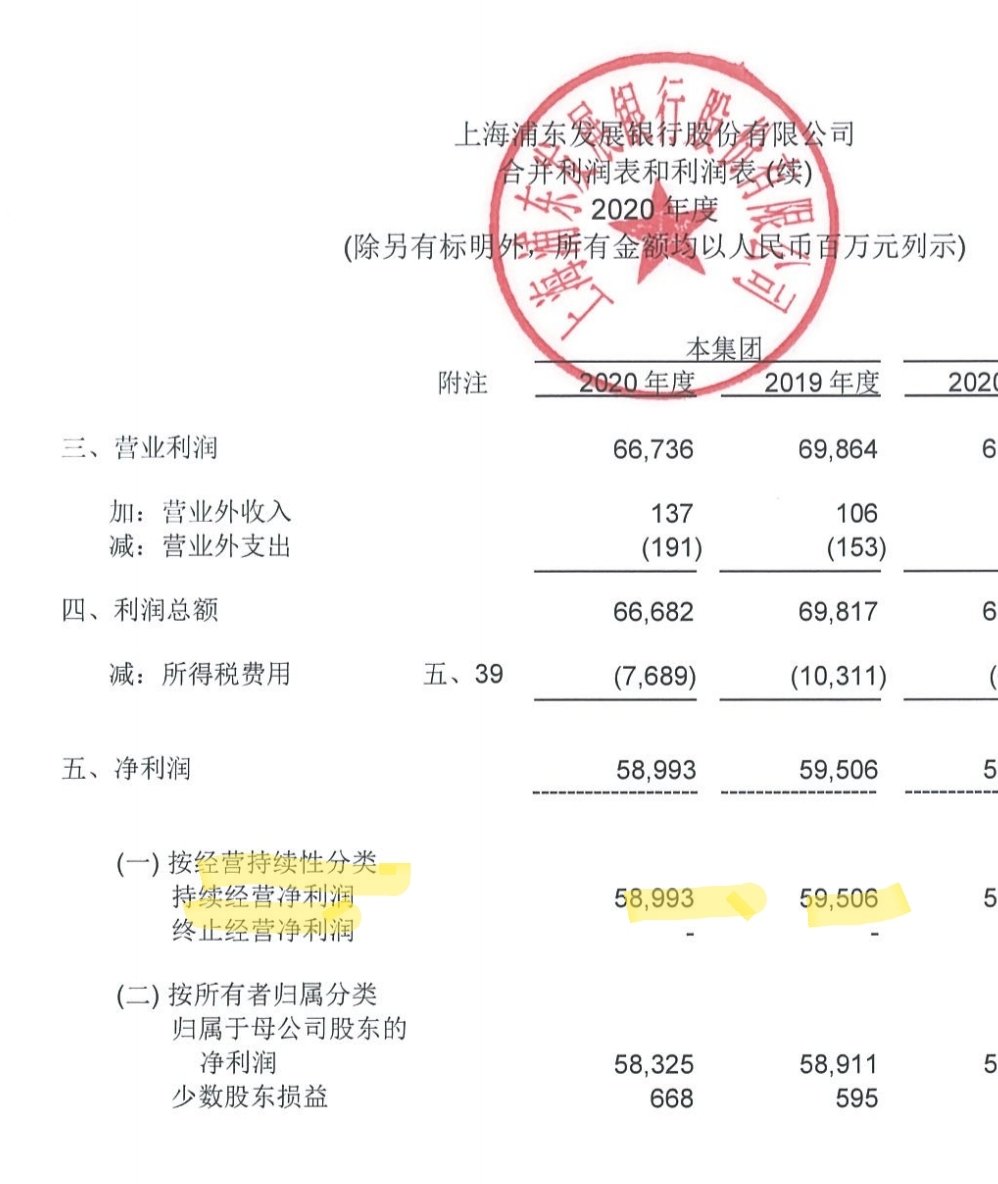

Net profit from continuing operations:

2018: 56.515 mln RMB

2019: 59.506 mln RMB

2020: 58.993 mln RMB

2018: 56.515 mln RMB

2019: 59.506 mln RMB

2020: 58.993 mln RMB

The distribution of dividends is annual and sustained, after a fall in 2017-2018 it returned to a good value in 2019-2020.

As of December 2019, the total share capital of the company was 29.352 mln shares

- The total proposed cash dividend was RMB 17.611 mln (0.6 per share

- Cash dividend ratio in 2019 was 30%

- The total proposed cash dividend was RMB 17.611 mln (0.6 per share

- Cash dividend ratio in 2019 was 30%

As of December 2020, the total share capital of the company's was 29.352 mln shares.

- The total proposed cash dividend is RMB 14.089 mln (0.48 per share).

- Cash dividend ratio in 2020 was 25%

- The total proposed cash dividend is RMB 14.089 mln (0.48 per share).

- Cash dividend ratio in 2020 was 25%

Explanation on the cash dividend ratio of this year is less than 30%: The impact of the new crown epidemic on the world has not been eliminated; PBC and the China Banking and Insurance Regulatory Commission issued the "Measures for the Evaluation of Systemically Important Banks"

From the annual 2020, for the avoidance of doubt: "Last year, we adhere to the leadership of party building, continue to improve the governance level, and consolidate the cornerstone of corporate governance, and achieve positive results".

A recent news:

Shanghai Pudong Development Bank Co. plans to borrow 5 billion yuan by selling three-year bonds to finance real estate project acquisitions, the bank said Jan. 21.

caixinglobal.com/2022-02-18/chi…

Shanghai Pudong Development Bank Co. plans to borrow 5 billion yuan by selling three-year bonds to finance real estate project acquisitions, the bank said Jan. 21.

caixinglobal.com/2022-02-18/chi…

This is just a first approximation, the balances seem quite complete. It seems to be a bank stagnant in growth but with recurring income and a fairly low payout ratio, which can ensure a good dividend performance in the future. Very interesting that it is a Sasac bank.

• • •

Missing some Tweet in this thread? You can try to

force a refresh